Leveraged Finance

Leveraged finance is a financing arrangement that focuses on the value and future cash flows of an asset. Our leveraged finance team comprises experienced, multinational professionals located in Tokyo, New York, London, Hong Kong and Sydney. Our expertise in providing alternative solutions and navigating complex legal issues helps deliver the best possible outcomes for our clients.

Leveraged Buy–Out

LBO allows financial sponsors to take advantage of the global debt markets to raise funds to purchase a target company or part of its business with limited capital. The future cash flow of the acquired assets can be used to secure the debt. It may use a mixture of multiple ranked debt including senior debt, mezzanine debt and junior debt.

LBO can be applied to other types of financing such as a management buy–out (MBO) and can occur in growth situations, restructuring situations and insolvencies. We lead this market in terms of transaction volume.

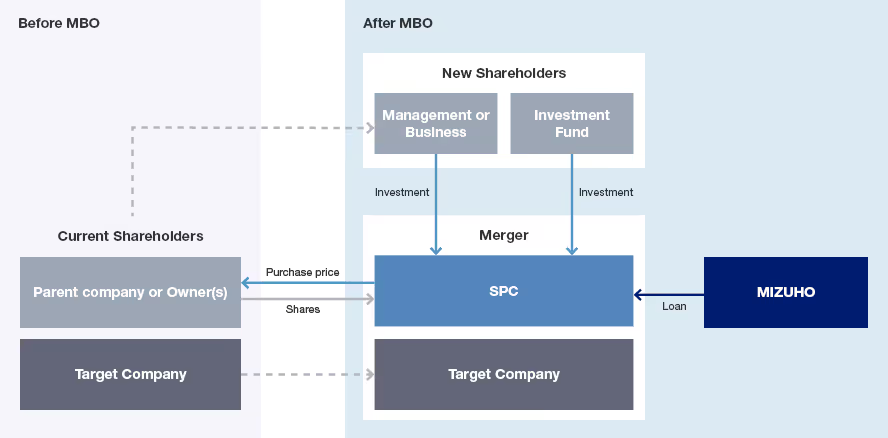

Management Buy–Out

MBO allows the management team of a company to acquire all or part of the shares in the company through a new company established for that purpose.

Structure of a Typical MBO

Mizuho Bank’s Activities

Proposing ways to optimize the business portfolio

- Proposing solutions such as business transfers, taking companies private and “spin–outs.”

Assisting with financing during the LBO/MBO process

- Introducing potential investors and making proposals regarding the structuring of deals and the various procedures to use when executing the transaction.

Offering support for business restructuring and revitalization

- Providing sophisticated financing solutions, including total debt restructuring, borrowing–base financing, and debtor–in–possession (DIP) financing.

Notice

The use of the above products or services is contingent upon the credit assessment in accordance with Mizuho Bank’s prescribed procedures. As part of this assessment, you may be required to submit certain documents.

Fees may be charged for using these products or services. The amount and type differ depending on the details of individual transactions.

Please consult an attorney, accountant, or tax accountant regarding any legal matters, accounting issues, or taxation concerns.

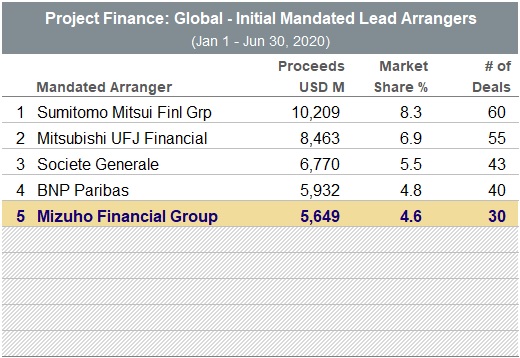

Project Finance

Project finance is a form of syndicated finance designed for long–term infrastructure and industrial projects often involving governments. We play a significant part in funding projects in various industrial sectors, catalyzing public and private partnerships and reducing project risk using a mix of government credits, insurance and private lending.

Global Project Finance

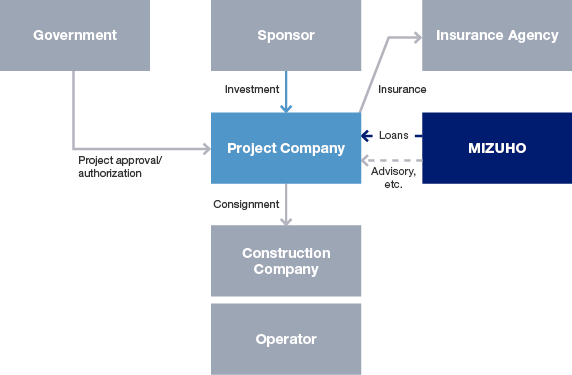

Structure of a Typical Project Financing Arrangement

- The sponsor establishes and invests capital in the project company, which will serve as the borrower.

- The project company signs contracts with various parties involved in the project.

- The project company signs a loan agreement with the financial institutions, and borrows funds for the completion and operation of the project.

- The project company uses cash flows that are generated from the project to repay the loan.

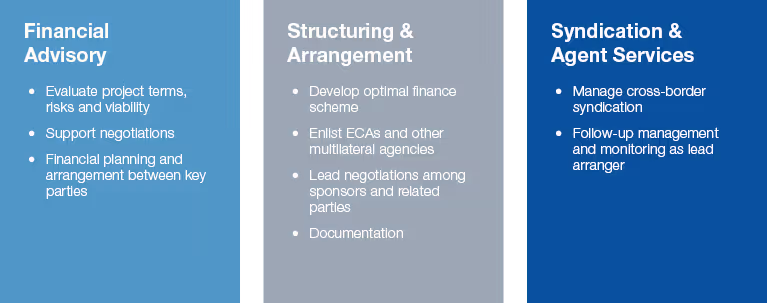

Mizuho Bank’s Roles at Each Stage of Project Finance

Equator Rules

We are a member of the Equator Principles Financial Institutions (EPFI), a group of 40 other major global private and governmental institutions that have established common standards that private financial institutions apply to determine, assess and manage environmental and social risks in project financing. The Equator Principles have been revised, reflecting the experience of the 40 member institutions.

Industry Sectors Covered

- Gas, Gas Pipeline, and LNG

- Oil, Petrochemicals

- Mining, Smelting

- Power Generation, Transmission, and Distribution

- Telecommunications, Information Technology

- Waste Treatment

- Highway, Railway, Port, Water, and Other Infrastructure

Notice

- The use of the above products or services is contingent upon the credit assessment in accordance with Mizuho Bank’s prescribed procedures. As part of this assessment, you may be required to submit certain documents.

- Fees may be charged for using these products or services.

- Please consult an attorney, accountant, or tax accountant regarding any legal matters, accounting issues, or taxation concerns.

Export Credit Agency Finance

An Export Credit Agency (ECA) is an institution that serves as an intermediary between governments and exporters, providing credit insurance or financial guarantees, or both, as part of a financing.

We have credentials and longstanding relationships with many of the major ECAs and with select Multilateral Finance Institutions (MFIs), which also operate to provide risk mitigation. We can provide our expertise to clients when structuring innovative financing solutions. Working alongside exporters and ECAs or MFIs, we can structure financings that mitigate exposure to so–called political risks, thereby facilitating exports to a potentially greater range of countries.

Our global footprint brings together a team of highly experienced professionals who work seamlessly to deliver cutting–edge solutions to clients worldwide. We have a proven track record providing ECA finance for our clients including buyer credits, overseas investment loans, untied loans, natural resource and energy loans.

Notice

- The use of the above products or services is contingent upon the credit assessment in accordance with Mizuho Bank’s prescribed procedures. As part of this assessment, you may be required to submit certain documents.

- Fees may be charged for using these products or services. The amount and type differ depending on the details of individual transactions.

- Please consult an attorney, accountant, tax accountant, or auditing firm regarding any legal matters, accounting issues, or taxation concerns.

Structured Trade Finance

Structured trade finance is a specialized short–term or medium–/long–term (up to 5 years) financing against commodity trade flows. It typically takes the form of pre–payment financing or pre–export financing, structured around the supply chain and commercial terms of customers, and may use export contracts, trade receivables and collection accounts as collateral.

With dedicated offices in London, New York, Singapore, Hong Kong and Tokyo, we have demonstrated our expertise in providing structured trade finance solutions for our clients around the world.

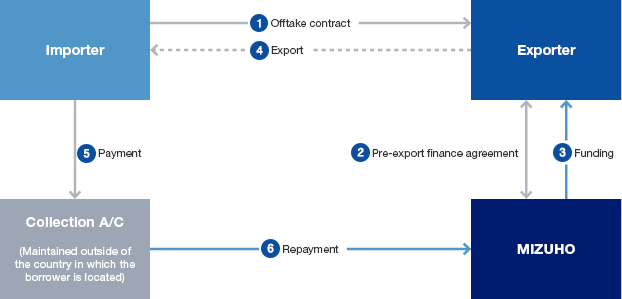

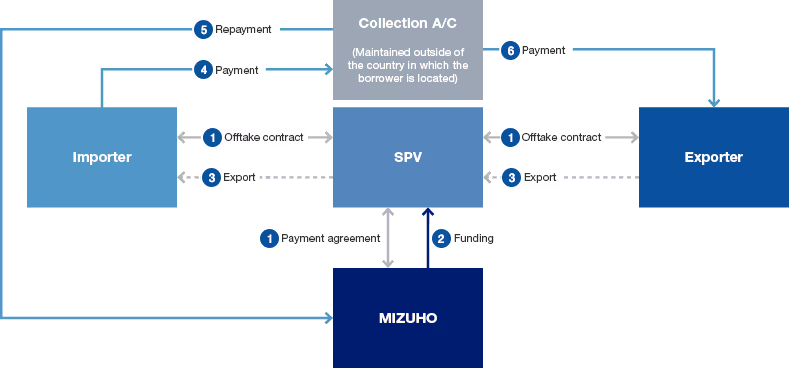

Structure of a Typical Structured Trade Finance Arrangement

Example of Pre–Export Finance

Example of Pre–Payment Finance

Notice

- The use of the above products or services is contingent upon the credit assessment in accordance with Mizuho Bank’s prescribed procedures. As part of this assessment, you may be required to submit certain documents.

- Fees may be charged for using these products or services.

- Please consult an attorney, accountant, or tax accountant regarding any legal matters, accounting issues, or taxation concerns.

Real Estate Finance

Real estate finance can be used by property owners to optimize their balance sheets, as well as by REITs and other real estate businesses to acquire properties efficiently.

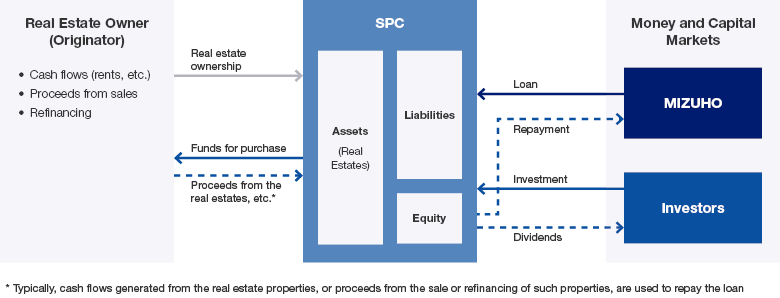

Real estate securitization refers to the process whereby income generated from real estate properties, and the value of the properties themselves, are used as collateral to secure a loan that is then used by a special purpose company (SPC) to purchase the properties.

We design financing proposals to meet the our clients’ specific needs based on the analysis of such factors as the property type, location, purchase price, occupancy rate, and related income versus expenditures.

Typical Structure of a Real Estate Securitization Arrangement

- The real estate owner (customer) agrees to sell their real estate to the SPC.

- The SPC obtains funds for the purchase in the form of a non–recourse loan and investment capital.

- The SPC pays the purchase price to the real estate owner (customer).

- The SPC uses the cash flows generated from the purchased properties to repay the loan and pay dividends to investors.

Addressing Other Business Needs

The securitization financial model helps real estate owners diversify financing methods and optimize their balance sheet. It could also be used by REITs, etc., to acquire real estate properties.

For those who need to consolidate or relocate their business centers, we provide simulations and cost estimates involved in such an action and suggest plans for effective alternatives. We also advise and provide optimal solutions for any real estate–related issues that may arise in the course of business development.

Notice

- The use of the above products or services is contingent upon the credit assessment in accordance with Mizuho Bank’s prescribed procedures. As part of this assessment, you may be required to submit certain documents.

- Fees may be charged for using these products or services. The amount and type differ depending on the details of individual transactions.

- Please consult an attorney, accountant, tax accountant, or auditing firm regarding any legal matters, accounting issues, or taxation concerns.

Securitization

Securitization is a way of raising funds by selling receivables, which are then turned into asset–backed loan and securities. This method of financing brings various benefits such as diversification of funding sources and improvement of cash flow.

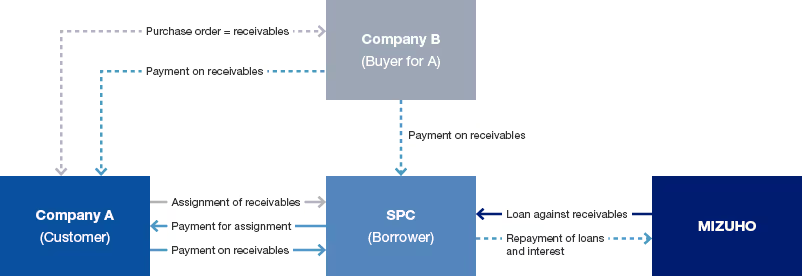

Structure of a Typical Securitization Arrangement

(asset–backed loan)

- The customer sells its receivables to the SPC on a true–sale basis along with necessary perfection.

- The SPC obtains loans from the bank in order to purchase the receivables.

- The SPC makes the payment to the customer as the proceeds for purchasing the receivables.

- The customer’s buyer makes the payment regarding the receivables directly to the SPC on the due date. (The customer may be required to collect the payment from the buyer and deliver it to the SPC.)

- The SPC applies such payment/collection from the customer to repay the loan.

Notice

- The use of the above products or services is contingent upon the credit assessment in accordance with Mizuho Bank’s prescribed procedures. As part of this assessment, you may be required to submit certain documents.

- Fees may be charged for using these products or services.

- Please consult an attorney, accountant, or tax accountant regarding any legal matters, accounting issues, or taxation concerns.

Ship Finance

Ship financing is an arrangement that uses vessel charter fees as the principal source of repayment, while various forms of collateral structured around shipbuilding and charter agreements are assigned to mitigate credit risk. We leverage our wealth of experience and proven track record in this area to help clients obtain long–term funding to purchase vessels, both new and used.

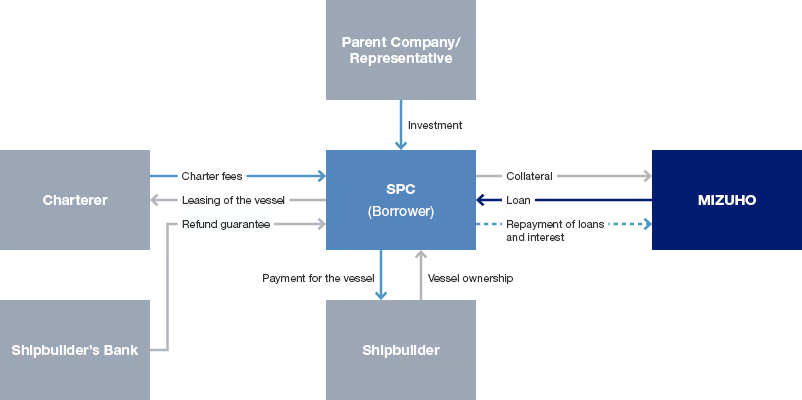

Structure of a Typical Ship Financing Arrangement

- Parent company/representative invests in a special purpose company (SPC) established outside Japan to serve as a borrower.

- The SPC borrows funds for the purchase of the vessel, assigning various forms of collateral including the mortgage, shipbuilding contract (or purchase agreement, including refund guarantee), hull insurance receivables and the charter fee receivables (or charter contract).

- The SPC uses the funds obtained to pay for the vessel, and takes its possession from the shipbuilder.

- The SPC leases the vessel to a charterer and receives charter fees in return.

- The SPC uses the charter fees received to repay the loan.

- Terms and conditions will be determined on a case by case basis.

Lending Terms and Conditions

Eligible vessels

Cargo–carrying vessels including bulk carriers and container ships, chemical tankers, product tankers, pure car carriers, LPG tankers, and woodchip carriers.

Loan amount

The amount of the loan will be based on a comprehensive determination of the profitability of the transaction, and will not exceed the price of acquiring the vessel.

Loan period

The loan period will be for the duration of the charter contract, including the construction period. A repayment schedule will be set in order to ensure that the actual repayment period will be within the legally–defined depreciation period (e.g., full payout in 15 years for a newly–built bulk carrier).

Notice

- Loans are subject to examination of factors such as market price of the relevant vessel and transaction profitability. Please contact Mizuho for details.

- Please note that fees may be charged to use these products or services. The amount and type differ depending on the details of individual transactions. Please contact Mizuho for more information.