For more than two decades, ICR has gathered top public and private management teams, investment bankers, analysts and private equity professionals to connect and discuss outlooks and trends in the Consumer & Retail (C&R) sectors.

A pervasive sentiment at this year’s conference held in Orlando, and attended by more than two hundred specialty retail, restaurant, food & beverage, e-commerce, beauty, and lifestyle companies, was tempered optimism for a resilient consumer and stabilizing economic backdrop. University of Michigan’s flagship Consumer Sentiment Index is now slightly above 2022 readings but still hovering around depressed levels of 1981. While we are on the subject of the Wolverine State, we took in Michigan’s College Football Championship with other conference attendees per the annual tradition; Michigan’s emphatic win generated a lot of positive sentiment in its own right. Too bad the outlook for finicky consumers is less definitive.

Optimism, caution and competing consumer data

For the U.S. consumer, the blitz of interest rate hikes that helped cool inflation have not yet demonstrated the full impact hoped for by the Fed. Labor market tightness and wage inflation remain a pressure point both for the Fed and for labor intensive businesses present at ICR, including restaurant operators. There is a push and pull with the data. While the December CPI numbers show the Fed has further to go before it hits its 2% inflation target, signs of an increasingly cautious consumer also abound including upticks in private label consumption and other signs of broader spending discipline. Higher-earning consumers are expected to be more cautious with their spending and are pulling away from credit card use, according to a January survey by Mizuho Securities Research. Food and other staple prices are stabilizing, but the “experience economy” is still elevated, as evidenced in recent CPI data, which clocked low inflation on goods but higher inflation for services. And U.S. retail sales data from December were overall stronger-than-expected, led by department store spending.

Early-year optimistic consumer sentiment is driven by factors such as cheaper gas, slowing inflation, a stock market rally, and a strong labor market which the Fed will be tracking in the economic data. The impact of Fed policy on the outstanding $17 trillion in consumer debt, as credit card rates remain near a record high, remains a wildcard. Any sign of revitalized consumer strength could delay the timeline for a rate cut. Other unknowns remain, including the upcoming 2024 Presidential election and potential further geopolitical escalations.

The profit improvement imperative

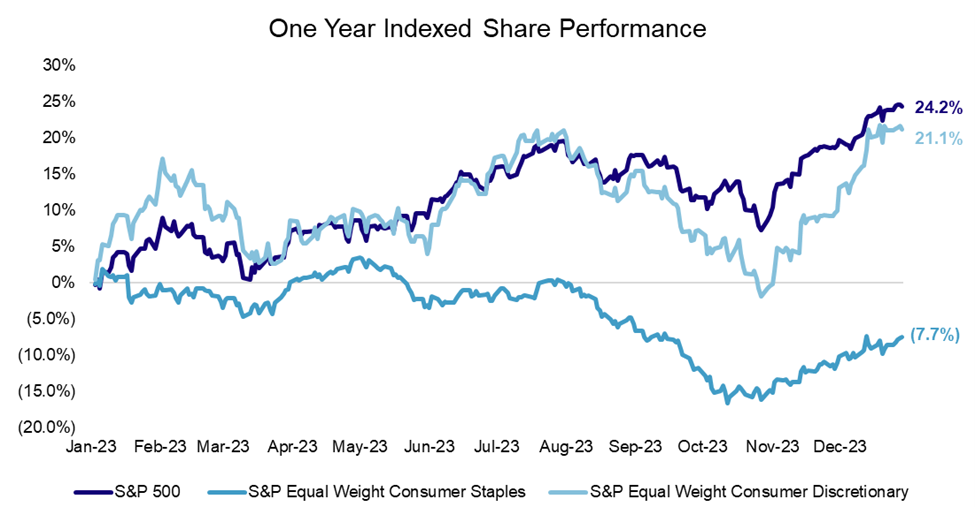

It’s “déjà vu all over again” as the sector remains focused on supply chain efficiency and SKU rationalization to enhance profitability. Discretionary spending has held up reasonably well despite a more cautious consumer, and, according to a McKinsey analysis, is expected to be largely unchanged over the next three months. As the chart below demonstrates, consumer discretionary equities tracked the broader market and significantly outperformed staples last year.

.

Consumer Discretionary vs. Consumer Staples

Source: FactSet/Mizuho

Facing a potentially more conservative consumer and tepid top-line growth, many of these lagging consumer companies are using cost initiatives to boost earnings and offset inflation until it further cools. Producer prices fell in December indicating that manufacturers may be able to begin eventually passing on lower costs to consumers. In the meantime, price wars between brand owners and retailers have escalated as strikingly highlighted by European grocery chain Carrefour’s standoff with Pepsi over the last round of price increases.

What’s more, the challenges of reaching and connecting consumers in a differentiated way requires a great deal of organizational flexibility in addition to technological investment. Enhanced omnichannel capabilities remain a strategic imperative in certain sub-sectors, and new, more profitable DTC-centered business models were showcased at the conference. Companies are doubling down to enhance supply chains and drive product accessibility through the digital channel. Consumer products and retail companies are attempting to de-risk their supply chains through diversifying networks and friendshoring, according to tech and consulting firm Capgemini. Predictably, a lot of ICR presenting companies referenced the use of artificial intelligence tools to promote operational and marketing efficiencies, though implementation clearly remains a work in process.

What does this mean for C&R deal activity?

M&A discipline and scrutiny remain high but growing board room confidence, stronger balance sheets and the search for growth portend a better deal environment in 2024. We expect that sharpening portfolio focus and enhancing top-line growth will continue to be key drivers of corporate deal activity in most consumer sectors, whereas retail sectors may see some opportunistic M&A as weaker, sub-scale players struggle with the pullback in discretionary spending. Pressure on sponsors to monetize long-held investments is growing as the capital markets environment and M&A pipeline improve to start the year.

We have seen that recent performance of C&R sector IPOs has been mixed. Even with that, there was growing dialogue at ICR around a building pipeline of companies evaluating or prepping for a public debut. Competitively differentiated C&R businesses with proven profitability and growth attributes have scarcity value and an attractive “growth with defense” positioning for IPO investors.

To sum it up, it is still a wait-and-see kind of game but if Michigan can pull off a national championship after a long dry spell, then maybe that’s a metaphor to support our (cautious) optimism for resurgent C&R sector activity and value creation in 2024.