Mizuho Securities presence

In a drastically changing world where social structures and the economic landscape are in constant flux, we provide sophisticated financial services in collaboration with group companies to address client concerns and business issues.

Our strengths

- Client-driven/client-centric consulting and services

- A professional organization possessing sophisticated expertise and knowledge

- Leveraging the group's collective strength to deliver optimal solutions

- The largest client base in Japan coupled with an industry-leading network of offices

- A global network and significant presence in the growing US market

Retail

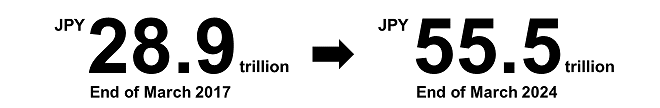

Asset inflows

AUM

Wholesale

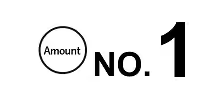

Bond Underwriting

Total Domestic Bonds from Public Offerings (Apr. 1, 2023 – Mar. 31, 2024)

Based on underwriting amount and pricing date basis. Includes samurai bonds, municipal bonds (underwriting only), preferred and securities but excludes treasury bonds and securitization and ST.

Source: Prepared by Mizuho Securities based on data from Capital Eye

Japan SDGs Bonds (Apr. 1, 2023 – Mar. 31, 2024)

Subordinated bonds(Apr. 1, 2023 – Mar. 31, 2024)

IG USD-denominated Corporate Bonds (Americas) (Apr. 1, 2023 – Mar. 31, 2024)

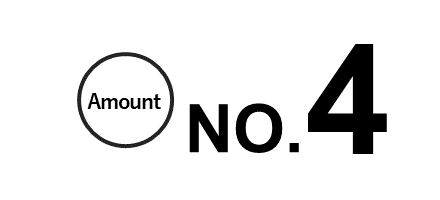

Equity Underwriting

Total Domestic and Cross–border Equities (Apr. 1, 2023– Mar. 31, 2024)

Based on bookrunner and pricing date basis.

Deals including initial public offerings, public offerings, convertible bonds and REITs.

Source: Prepared by Mizuho Securities based on data from LSEG

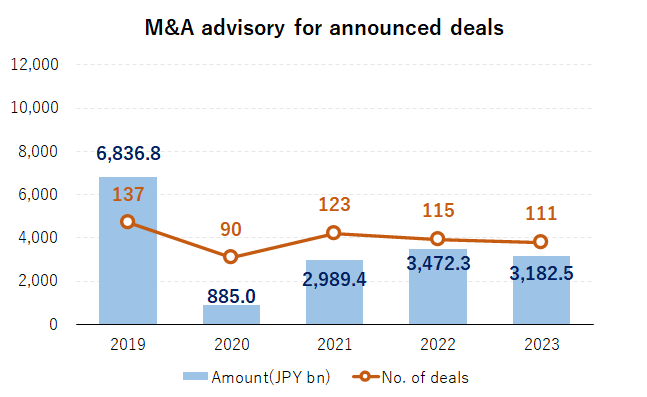

M&A Advisory

M&A Advisory for Announced Deals (Apr. 1, 2023 – Mar. 31, 2024)

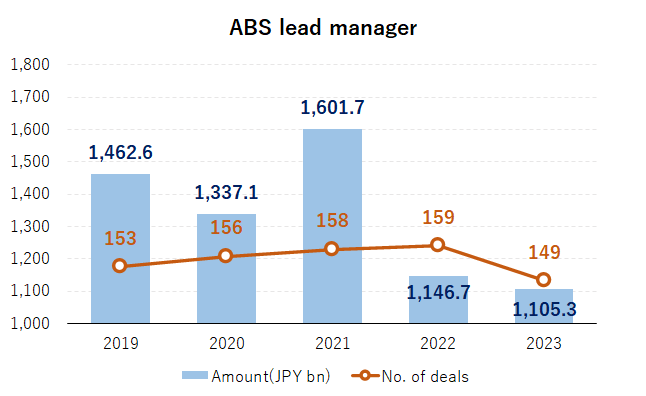

Structured Finance

ABS Lead Manager (Apr. 1, 2023 – Mar. 31, 2024)

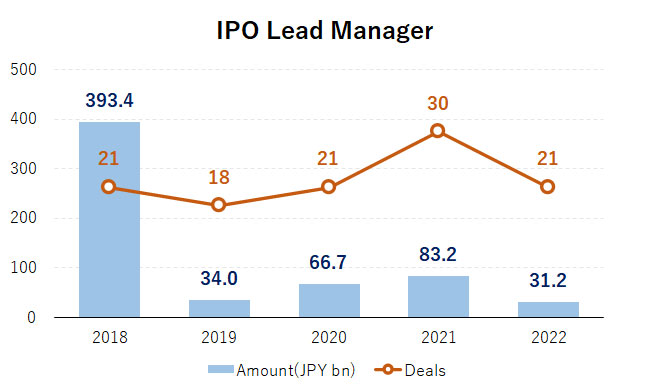

IPO Lead Manager

Based on Capital Eye data. Bookrunner base.REITs and global offerings excluded.

Awards & Rankings

Awards

Award

(Publication)

Award details

Date

BEST DEALS OF 2024

(CAPIAL EYE)

<Corporate Bond>

BEST DEALS OF 2024

- Sony Group series 42 Unsecured Bonds

- Sony Group series 43 Unsecured Bonds

<Municipal Bond>

BEST DEALS OF 2024

- Aichi Prefecture Bond FY 2024 series 8

Special Award

- Nagasaki Prefecture Regular Redemption Bond FY 2024 series 4

<Foreign Bond>

BEST DEAL OF 2024

- Dai-ichi Life Insurance Subordinated Dollar Bond

Special Award 2024

- East Japan Railway Company EUR Bonds

- East Japan Railway Company GBP Bonds

<Newly Listed Stocks>

BEST DEAL OF 2024

- Tokyo Metro

<Publicly Listed Stocks Offering/Sale>

BEST DEAL OF 2024

- Honda Motor Co., Ltd.

<Investment Corporation Investment Units Issuance/Sale>

BEST DEAL OF 2024

- Invincible Investment Corporation

April

2025

DealWatch Awards 2024

(LSEG)

<Bond>

Bond House of the Year

- Mizuho Securities(5th consecutive year)

Bond of the Year

- SUMITOMO CHEMICAL COMPANY series 3 Subordinated Bonds

Innovative Debt Deal of the Year

- Japan Investment Adviser series 2 Unsecured Straight Bonds

<Local Government Bond>

Local Government Bond of the Year

- Joint Local Government Green Bond

<Cross-border Bond>

Cross-border Bond House of the Year

- Mizuho Securities(3nd consecutive year)

Offshore Bond of the Year

- Rakuten Group US Dollar-denominated Undated Subordinated NC5 Fixed Rate Reset Notes(Mizuho International)

Cross-border Yen Bond of the Year

- ROMANIA Japanese Yen Bonds First Series (2024) (Green bonds)

- ROMANIA Japanese Yen Bonds Second Series (2024) (Green bonds)

- ROMANIA Japanese Yen Bonds Third Series (2024) (Green bonds)

<Sustainable Finance>

Sustainable Finance House of the Year

- Mizuho Securities(5th consecutive year)

<Equity>

Equity-linked Product of the Year

- Kasumigaseki Capital Zero Coupon Convertible Bonds due 2029

(Mizuho International)

J-REIT Deal of the Year

- Invincible Investment Corporation

Innovative Equity Deal of the Year

- Astroscale Holdings

March

2025

Deals of the Year 2024

(J-Money)

<Equity>

Best IPO

- KOKUSAI ELECTRIC

Best Equity Follow-on

- Honda Motor Co., Ltd.

<Bond>

Best Yen Bond Deal

- SoftBank Group

Best International Bond Deal

- East Japan Railway Company

March

2025

Analyst Rankings

Publication

Award

Category

Date

Extel

Extel’s 32nd annual

Japan Research Team survey

Ranking Voted #1"

This content was originally published by Extel on February 11, 2025 (EST) and is reproduced with their permission."

February 2025

Nikkei Veritas

37th Annual Survey on Most Popular Equity Analyst

(Overall Company Ranking) of Nikkei Veritas

Overall Company Ranking Voted #3

Source:Nikkei Veritas, February 23, 2025 issue

February 2025

Nikkei Veritas

Nikkei Veritas 30th Annual Survey on Most Popular Bond/Forex Analyst/Economist by company/group

Overall Company Ranking Voted #3

Source:Nikkei Veritas, March 27, 2025 issue

March 2025

FY2023

FY2023

FY2022

FY2022

Diversity, Equity & Inclusion

Diversity, equity and inclusion initiatives

Mizuho Financial Group adopted Mizuho's Commitment to Diversity, Equity & Inclusion(PDF/167KB) to foster growth and promote the active involvement of all members of Mizuho's diverse workforce. Along with this, the Priority measures in commitment to Diversity, Equity & Inclusion in Japan(PDF/453KB) were formulated, introducing group-wide diversity, equity and inclusion initiatives. (See our group initiatives here.) Likewise, we at Mizuho Securities aim to create new corporate value through the continual development of innovative financial products, and the transformation of services and business systems by proactively adopting diverse perspectives and ideas of individual employees as we carry out daily operations and decision-making processes.

Diversity promotion at Mizuho Securities

Mizuho Securities continuously strives to facilitate initiatives for promoting diversity, equity and inclusion on a group–wide basis. The Group established a Diversity, Equity & Inclusion Promotion Committee chaired by the Group CPO (Chief People Officer) and composed of department heads in charge of business promotion in each division. Through the committee, we are striving to accelerate the promotion of diversity, equity and inclusion as appropriate for each division's particular situation.

Mizuho Securities is also dedicated to support employee-initiated activities for promoting diversity, equity and inclusion and we regard them as our important measures.

About 25 people in total are appointed to serve a dual-hat role as promotion representatives in the D&I Office of the Human Resources Dept. to develop and implement diversity, equity and inclusion activities using their knowledge acquired through work to answer the needs of each division/group.

In addition, Mizuho Securities is developing various promotional activities based on duties at each workplace, by appointing the person in charge of DEI promotion at each department/branch office.

Promoting active involvement of diverse talent

- At Mizuho Securities, we strive to support the work–life balance of employees caring for children and other family members.

- We have set numerical targets to further promote female employee representation. We organize training for female employees, providing support at each career stage to provide opportunities to further their careers and empower them to realize their full potential and serve in leadership positions.

- In addition, the entire Mizuho group supports wide–ranging employee–initiated networking activities, including LGBT + ally activities, efforts to promote the active participation of women, globalization efforts, and initiatives to leverage technology to create value.

- Click here to see our group initiatives to promote the employment and advancement of diverse talent.

Numerical Targets

Mizuho conducts training programs to prepare female employees for managerial positions.

Main Activities

Promotion of female employee

- Implementation of career education and support for female employees

- Implementation of various support in career development operations

- Promoting networking activities among female employees

Enhancement of work–life balance

Enhancement of multi-national and cultural diversity

- Enhancement of cultural diversity

Enhancement of balancing work and family

- Enhancement of childcare and nursing care related systems

- Providing follow up support for female employees to attend seminars for childcare leave etc.

- Providing support for employees after childcare leave

- Promoting networking activities among working mothers

Sharing information/changes in the consciousness

- Opening diversity forum on intra-ne

- Introducing examples and roll-models

- Sharing information and hold guidance on diversity

- Starting management training program of spreading diversity mind

Corporate Overview

Head Office Locations

Otemachi and Marunouchi

Addresses and Access by Public Transportation

Otemachi First Square(Corporate Headquarters)

Address

Otemachi First Square

1–5–1, Otemachi, Chiyoda–ku,

Tokyo 100-0004

THE OTEMACHI TOWER

Address

Otemachi Tower

1–5–5, Otemachi, Chiyoda–ku,

Tokyo 100–8176

Mizuho Marunouchi Tower

Address

Mizuho Marunouchi Tower

1-3-3, Marunouchi, Chiyoda-ku,

Tokyo 100-8241

Corporate History

Leadership

Members of the Board of Directors

* indicates directors expected to concurrently serve as executive officers.

Executive Officers

Global Investment Banking Division

Global Markets Division

Retail & Business Banking Division

Research & Consulting Unit

Corporate

* Operating officers are listed only if they hold a position at a certain level or higher.

(As of October 27 ,2025)

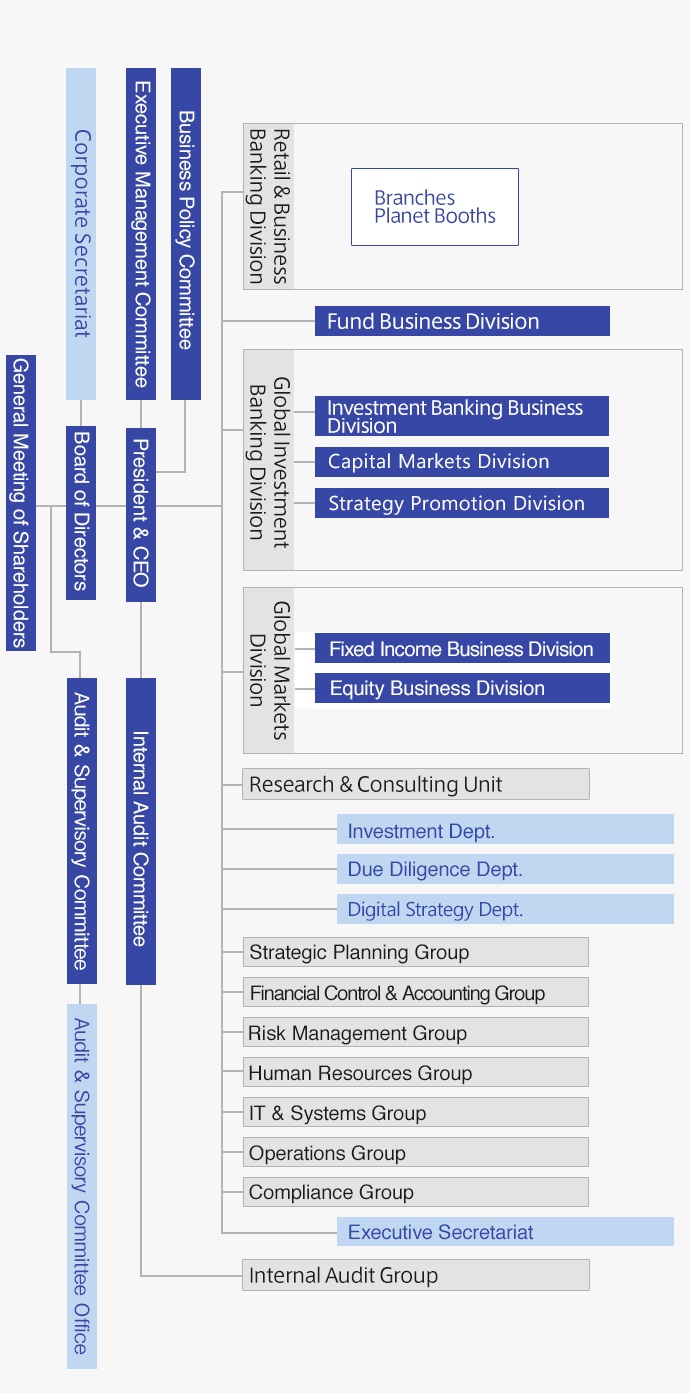

Organizational Structure

(as of September 30,2025)

Network and Affiliates in Japan

Network in Japan

Leveraging our retail branch network and wholesale offices in Japan, we cater to the investment banking and asset management needs of individuals and institutions.