Trends in High-End Photoresists: Strategic Direction for Japan to Remain Strong

Mizuho Industry ResearchOctober 2023

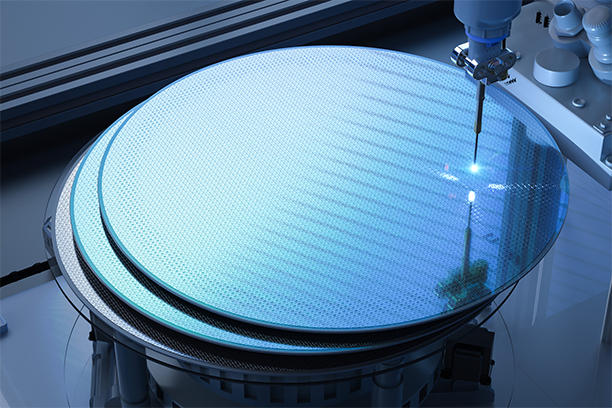

Technical progress in the semiconductor industry continues unabated, and the competition to develop next-generation technologies is intensifying. Japanese manufacturers hold a large share of the market for photoresists, which play a key role in miniaturization, one of the themes in semiconductor technological development.

This paper provides an overview of the technological challenges facing photoresists and the R&D trends for cutting-edge products, and then examines the strategic directions for Japanese photoresist manufacturers to remain strong in the future, as well as the ideal form of policies to support semiconductor material manufacturers.

Key Highlights

- A photoresist is a circuit-forming material used in the photolithography process of semiconductor fabrication. Although Japanese photoresist manufacturers were latecomers to the market, they have been able to survive the competition by leveraging their superior technological capabilities. Historically, the miniaturization of front-end processes has been achieved by evolving exposure light sources to shorter wavelengths, but EUV lithography, which uses light with an extremely short wavelength of 13.5 nm, has been in practical use since 2019. Photoresists have been developed and improved in response to the evolution of exposure light sources.

- Resolution, line width roughness, and sensitivity are the primary criteria for evaluating photoresist performance, but there are trade-offs in the relationship between them. While it is considered to be extremely difficult to improve these trade-offs, various types of cutting-edge photoresists, such as PAG bound-CAR and Wet/Dry-MOR, are being developed as photoresists that can be used for semiconductor miniaturization that will evolve to 2 nm and 1.X nm in the future. Although PAG bound-CAR is a type of photoresist that is familiar to semiconductor fabricators and is attracting significant attention, the dispersion inhomogeneity of PAG polymers remains unresolved. Wet/Dry-MOR is considered to be superior to PAG bound-CAR in terms of resolution and in other aspects, but has issues such as the need to develop peripheral materials and equipment. Each type has its advantages and disadvantages, and at this point, it is unclear which type will become the de facto standard.

- In order for Japanese photoresist manufacturers to maintain their high technological capabilities and competitiveness and to continue leading the industry, they must assess areas to focus on and formulate appropriate strategies. One direction would be to allocate profits earned in the middle- to high-end areas, where each company's strengths can be leveraged. There are four specific strategies: (1) assess China as a market, (2) domestic coordination, (3) alliances, and (4) supply chain diversification. As for the environment surrounding the industry changes, there is the possibility that policy support will become essential. We hope that Japanese photoresist manufacturers will remain strong going forward through each company's continued R&D efforts and appropriate policy support.