Financial Data

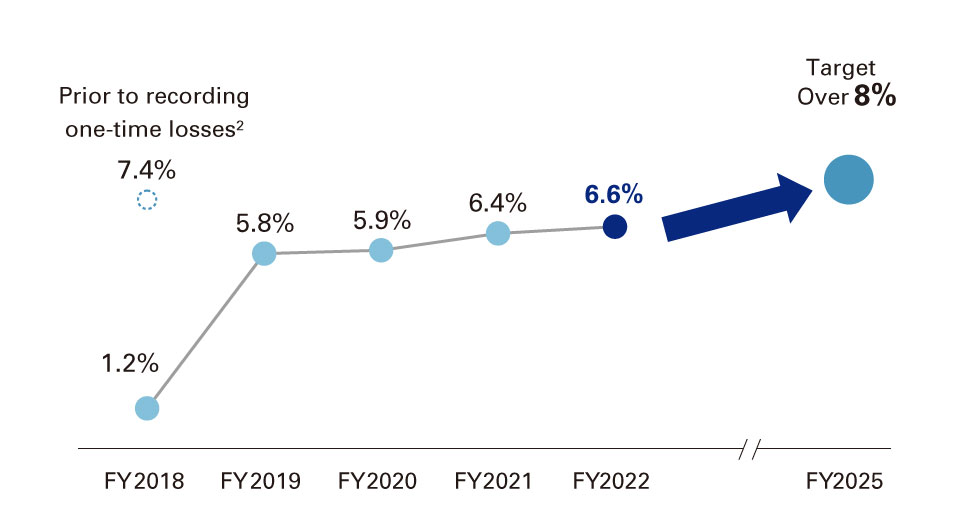

Consolidated ROE1

- Excluding Net Unrealized Gains (Losses) on Other Securities

- Prior to reflecting one-time losses in light of structural reforms

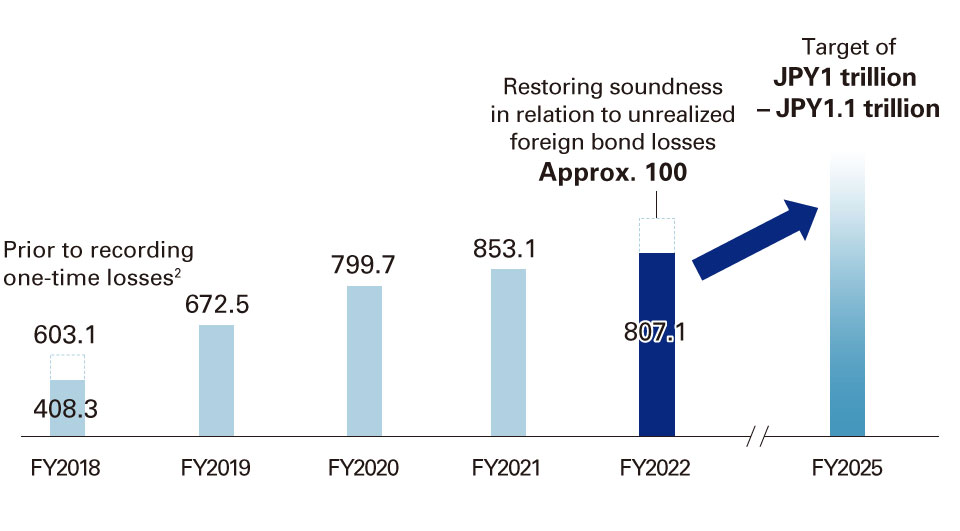

Consolidated Net Business Profits1 (JPY billion)

We recorded consolidated gross profits of JPY2,278.4 billion for fiscal 2022, an increase of JPY25.9 billion from the previous fiscal year. This was mainly due to a steady performance in the customer divisions, especially overseas, although profit declined from realizing losses on foreign bonds in the markets divisions.

General and administrative expenses increased by JPY52.3 billion on a year-on-year basis to JPY1,445.2 billion, mainly due to an increase in expenses as a result of currency fluctuations despite further progress in cost reductions through structural reforms.

As a result, consolidated net business profits decreased by JPY45.9 billion on a year-on-year basis to JPY805.2 billion.

- Includes Net Gains (Losses) related to ETFs (Mizuho Bank and Mizuho Trust & Banking) and Net Gains (Losses) on Operating Investment Securities (Mizuho Securities consolidated)

- Prior to reflecting one-time losses recorded in light of structural reforms

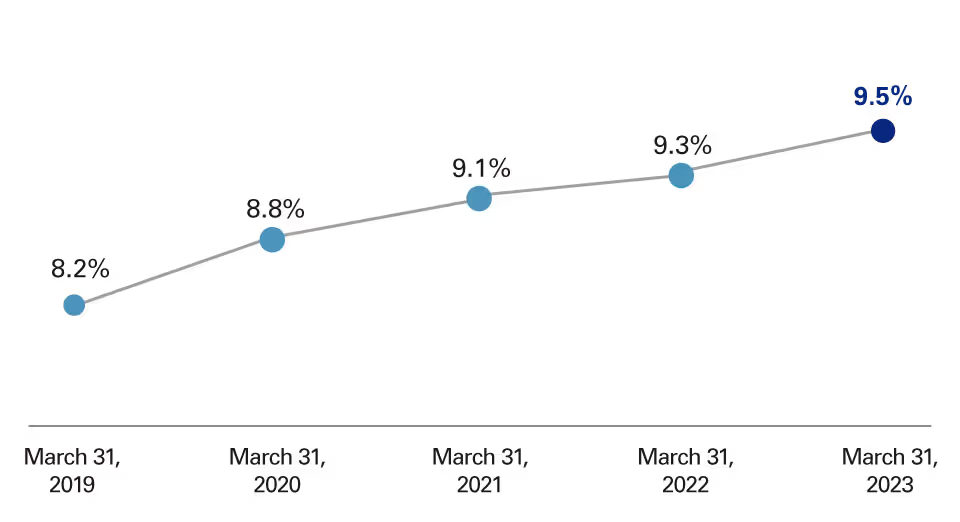

Common Equity Tier 1 (CET1) Capital Ratio*

* Basel III finalization fully effective basis, excluding Net Unrealized Gains (Losses) on Other Securities

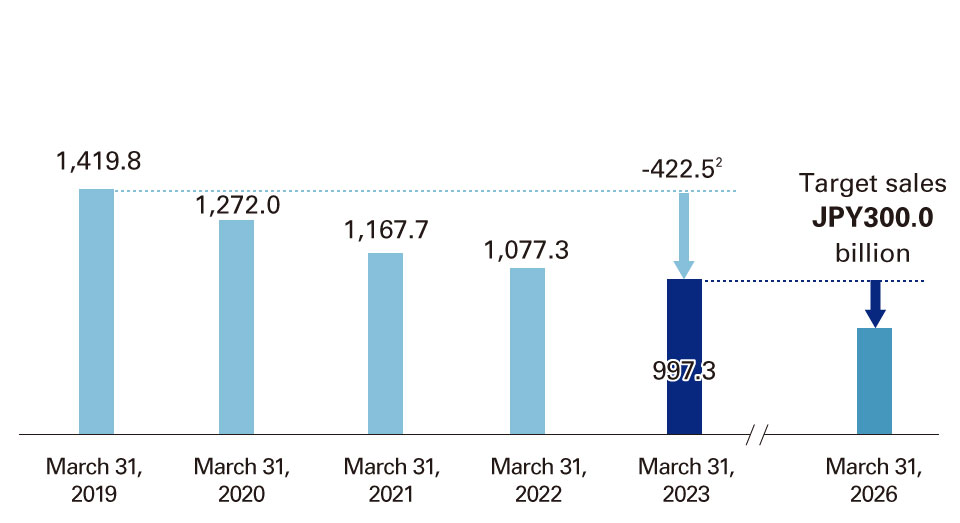

Cross-shareholdings1 (JPY billion)

- Acquisition cost basis

- Of which, -JPY383.8 billion from sales

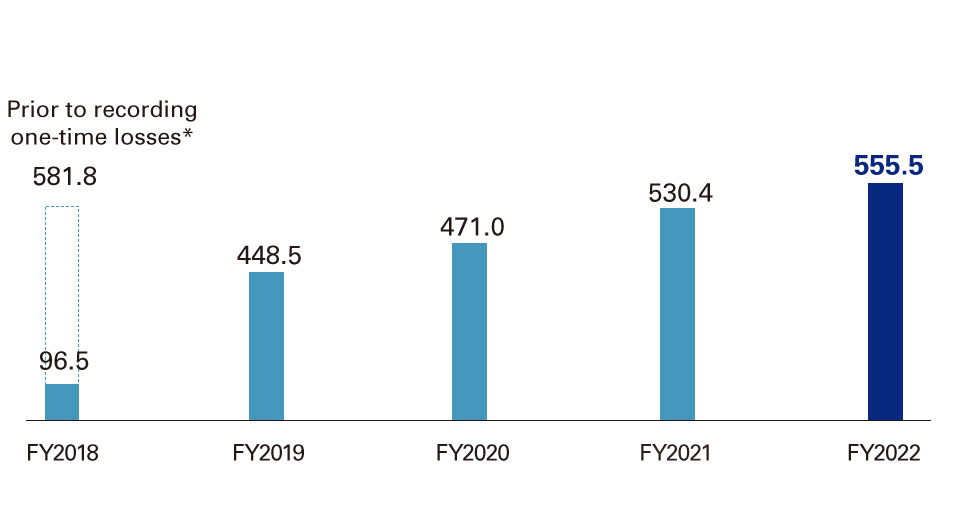

Net Income Attributable to Mizuho Financial Group (JPY billion)

Credit-related costs decreased by JPY145.8 billion on a year-on-year basis to JPY89.3 billion, mainly due to the elimination of a large provision for reserves relating to certain clients recorded in the previous fiscal year.

Net gains (losses) related to stocks increased by JPY130.3 billion on a year-on-year basis to net gains of JPY86.4 billion, mainly due to the elimination of losses on the cancellation of bear funds intended to fix in place unrealized gains on stocks recorded in the previous fiscal year in addition to steady progress in the sale of cross-holding stocks.

As a result, ordinary profits increased by JPY229.7 billion on a year-on-year basis to JPY789.6 billion.

Extraordinary gains (losses) decreased by JPY54.6 billion on a year-on-year basis resulting in net losses of JPY10.6 billion, mainly due to the elimination of a large amount of gains on cancellation of an employee retirement benefit trust recorded in the previous fiscal year.

Income taxes increased by JPY158.1 billion on a year-on-year basis to JPY218.8 billion, partly due to the elimination of the impact of the tax effect of capital optimization of Mizuho Securities as part of financial structure reforms in the previous fiscal year.

As a result, profit attributable to owners of parent increased by JPY25.0 billion on a year-on-year basis to JPY555.5 billion.

* Prior to reflecting one-time losses recorded in light of structural reforms

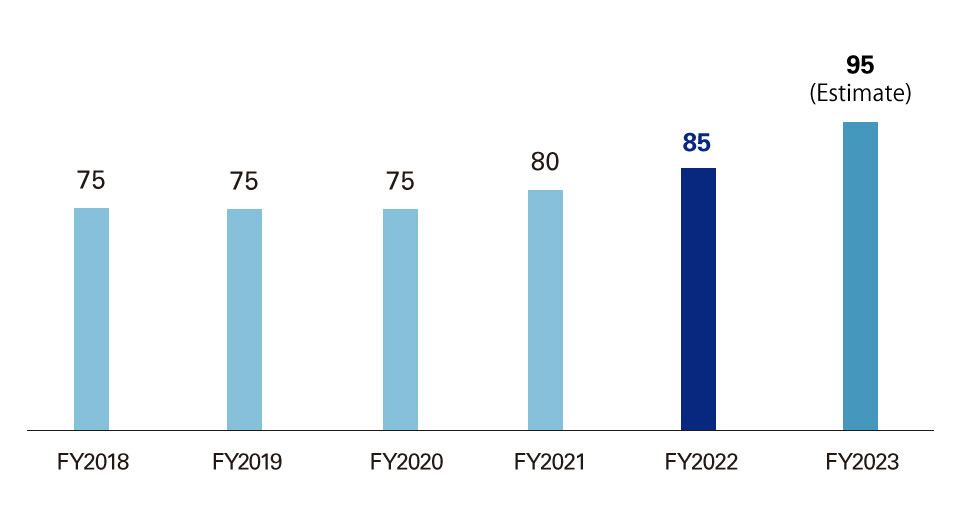

Cash dividend per share* (JPY)

* Reflects the effect of the reverse stock split conducted in October 2020

Non-financial Data

Environment and climate change related

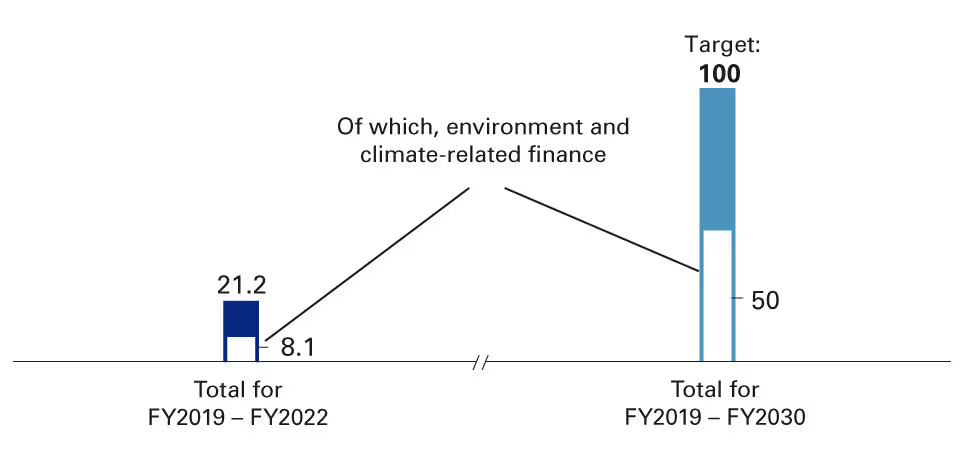

Sustainable finance Environment and climate-related finance (JPY trillion)

Scope 1 and 2 (GHG emissions across the seven group companies1) (ktCO2e)

In relation to Scope 2, progress was made on switching to renewable energy in FY2022.

- Mizuho Financial Group, Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, Mizuho Research & Technologies2, Asset Management One, and Mizuho Americas (data up to FY2021 are for eight group companies including the former Mizuho Private Wealth Management3).

- Data up to FY2020 combines figures for the former Mizuho Information & Research Institute and former Mizuho Research Institute.

- Company liquidated on March 23, 2022; functions taken over by Mizuho Bank.

Scope 3 (GHG emissions from financing and investment)

Medium-term targets were set for the following three sectors in FY2022 toward achieving net zero GHG emissions (Scope 3) in 2050.

Sector

Target

FY2021 result

Electric power

FY2030

138-232 kgCO2e/MWh

353kgCO2e/MWh

Oil and gas

Scope 1 and 2

FY2030 4.2gCO2e/MJ

6.5gCO2e/MJ

Oil and gas

Scope 3

-12 to -29% (compared to FY2019)

43.2MtCO2e

(-29%)

Thermal coal mining

FY2030 OECD countries: Zero balance

FY2040 Non-OECD countries: Zero balance

1.7MtCO2e

Outstanding credit balance for coal-fired power plants based on our Environmental and Social Management Policy for Financing and Investment Activity

Target

FY2022 result

FY2030: Reduce the FY2019 amount by 50%

FY2040: Zero

21.4% reduction

(JPY235.5 billion)

Exposure to high-risk areas in transition risk sectors

Target

FY2022 result

Reduce over the medium to long term

JPY1.6 trillion

Human capital related

Engagement score1

Target

FY2022 result

FY2025 65%

51%

Inclusion score1

Target

FY2022 result

FY2025 65%

55%

Percentage of management positions outside Japan filled by employees hired outside Japan2

Target

FY2022 result

83%

84%

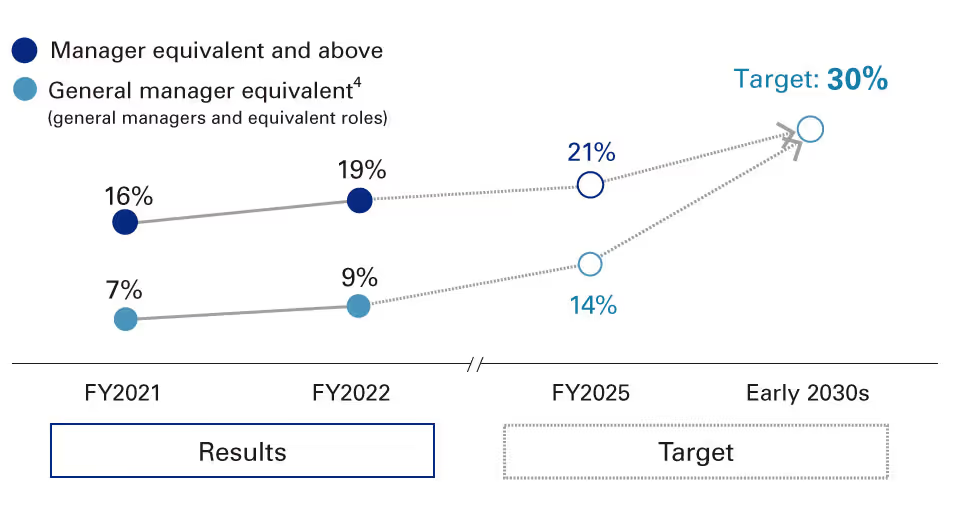

Percentage of management positions filled by women3

- Based on the positive response rate (selection of 4 or 5 on a scale from 1 to 5) for four Staff Survey questions related to engagement and inclusion.

- Total of Mizuho Bank, Mizuho Trust & Banking, and Mizuho Securities

- Japan (Total of Mizuho Financial Group, Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, and Mizuho Research & Technologies)

- In FY2023, we revised the standards for calculation to align with the medium-term business plan. FY2021 and 2022 result reflect the new standards.

Non-financial Data (appendix)

Corporate governance

Directors

June 2019

June 2020

June 2021

June 2022

June 2023

Number of directors

14

13

13

12

14

Percentage of outside directors

43%

46%

46%

50%

57%

Percentage of director positions filled by women

14%

8%

8%

8%

14%

Average attendance rate for Board of Directors meetings*

100%

100%

100%

100%

-

Nominating Committee

Compensation Committee

Audit Committee

Percentage of outside directors (June 2023)

100%

100%

13

* Fiscal year basis

Human capital

Employees1

FY2018

FY2019

FY2020

FY2021

FY2022

Total number of employees3

58,727

56,225

54,055

51,056

49,068

Employees in Japan

52,607

50,244

48,253

45,667

44,008

Employees hired outside Japan

4,867

4,917

4,728

4,449

4,207

Employees dispatched to our offices from other organizations, and similar.

1,253

1,064

1,074

940

853

Average employee age4

39

40

40

40

40

Average employee length of service4

14

14

15

15

16

Training

FY2018

FY2019

FY2020

FY2021

FY2022

Total number of participants5

/

/

/

/

1,956,513

Training organized by Human Resources Group

48,868

158,448

227,101

354,846

Training hours

/

/

/

/

1,689,113

Training organized by Human Resources Group

1,253

1,064

1,074

940

652,048

Engagement

FY2018

FY2019

FY2020

FY2021

FY2022

Engagement score6

/

/

/

/

51%

Diversity, Equity & Inclusion / Well-being

FY2018

FY2019

FY2020

FY2021

FY2022

Percentage of employees who are female1, 7

57%

57%

57%

57%

57%

Percentage of management positions filled by women

General manager equivalent

5%

5%

6%

7%

9%

Percentage of management positions filled by women

General manager and manager equivalent

14%

15%

16%

16%

19%

Percentage of eligible male employees who take childcare leave9

100%

93%

98%

97%

104%

Percentage of management positions outside Japan filled by employees hired outside Japan10

44%

64%

64%

66%

84%

Inclusion score6

/

/

/

/

55%

Percentage of paid annual leave taken by employees11

75%

77%

70%

76%

78%

- As of March 31. Mizuho Financial Group (including employees seconded to Mizuho Securities), Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, and Mizuho Research & Technologies.2

- Data up to FY2020 reflects figures for the former Mizuho Information & Research Institute.

- Definition and breakdown have been updated. The figures have been recalculated retroactively based on the new definition.

- Figures are for employees in Japan only, excluding temporary and contract employees.

- In Japan (aggregate for Mizuho Financial Group, Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, and Mizuho Research & Technologies). Up until FY2021, the scope for training was training organized by the Human Resources Group, but this has been changed as of FY2022 to training organized by all departments, the Human Resources Group included.

- Based on the positive response rate (selection of 4 or 5 on a scale from 1 to 5) for four Staff Survey questions related to engagement and inclusion.

- Figures are for employees in Japan only.

- From FY2022, target, scope, and base date have been changed in conjunction with revision of the medium-term business plan. As of March 31. In Japan, Mizuho Financial Group (including employees seconded to Mizuho Securities), Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, and Mizuho Research & Technologies.2 Figures for FY2021 and FY2022 are based on the new criteria.

- Due to revisions to relevant laws, FY2022 results have been calculated using legally defined rules (percentages of employees who take childcare leave), while FY2021 results have been calculated using Mizuho's own methods. In Japan, Mizuho Financial Group (including employees seconded to Mizuho Securities), Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, and Mizuho Research & Technologies.2

- Figures up to FY2018 are for Mizuho Bank only. Figures for FY2019 and later are the aggregates for Mizuho Bank, Mizuho Trust & Banking, and Mizuho Securities. Criteria for management positions changed as of FY2022.

- Figures up to FY2021 are the total of Mizuho Financial Group, Mizuho Bank, Mizuho Trust & Banking, and Mizuho Securities. Mizuho Research & Technologies added as of FY2022.2

Environment

- These data items include all the facilities of seven group companies: Mizuho Financial Group, Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, Mizuho Research & Technologies3, Asset Management One, and Mizuho Americas (data up to FY2021 are for eight group companies including the former Mizuho Private Wealth Management4. Our FY2022 performance, consolidated subsidiaries included, was 128 ktCO2e (provisional figure).

- The FY2022 figure is provisional.

- Data up to FY2020 combines figures for the former Mizuho Information & Research Institute and former Mizuho Research Institute.

- Company liquidated on March 23, 2022; functions taken over by Mizuho Bank.

- These data items include all the facilities of six group companies: Mizuho Financial Group, Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, Mizuho Research & Technologies3, and Asset Management One (data up to FY2021 are for seven companies including the former Mizuho Private Wealth Management4).

- Direct and indirect energy consumption converted to megawatt hours.

Sustainable finance and environment and climate-related finance

FY2019

FY2020

FY2021

FY2022

Sustainable finance (JPY trillion) (of which, environment and climate-related finance)

2.4

(1.1)

4.7

(1.5)

6.0

(2.0)

8.1

(3.5)*

* Of which, Mizuho Bank accounts for JPY2.6 trillion and Mizuho Trust & Banking accounts for JPY26.1 billion.

Earnings Outlook

- Consolidated Net Business Profits of JPY 1.07T, Net Profits Attributable to FG of JPY 750.0B

- Aiming for early accomplishment of Medium-term business plan's final year targets (FY25) of Net Business Profits JPY 1-1.1T and Consolidated ROE 8%

Plan for FY 2024 (As of May 15, 2024)

Earnings Plan

Consolidated

(JPY B)

FY 2023

FY 2024

FY 2024

Results

Plan

YoY

Consolidated Net Business Profits1

1,005.8

1,070.0

+64.2

Credit-related Costs

-106.3

-100.0

+6.3

Net Gains (Losses) related to Stocks2

54.7

80.0

+25.3

Ordinary Profits

914.0

1,050.0

+136.0

Net Income Attributable to FG

678.9

750.0

+71.1

2 Banks

(JPY B)

FY 2023

FY 2024

FY 2024

Results

Plan

YoY

Net Business Profits1

650.8

720.0

+69.2

Credit-related Costs

-97.1

-95.0

+2.1

Net Gains (Losses) related to Stocks2

38.2

80.0

+41.8

Ordinary Profits

584.7

715.0

+130.3

Net Income Attributable to FG

401.6

495.0

+93.4

Shareholder return

Cash dividend per share

FY 2023

FY 2024

FY 2024

Results

Plan

YoY

Interim

JPY 50.00

JPY 57.50

+JPY 7.50

Fiscal Year-end

JPY 55.00

JPY 57.50

+JPY 2.50

Annual

JPY 105.00

JPY 115.00

+JPY 10.00

[Assumed financial indicators] 10Y JGB Yield 1.20%. Nikkei 225, JPY 35,150. USD/JPY 135

- Incl. Net Gains (Losses) related to ETFs and others(Consolidated and 2 Banks).

- Excl. Net Gains (Losses) related to ETFs and others(Consolidated and 2 Banks).

This presentation contains statements that constitute forward–looking statements including estimates, forecasts, targets and plans. These statements reflect our current views with respect to future events and are subject to risks, uncertainties and assumptions. Such forward–looking statements do not represent any guarantee of future performance by management and actual results may materially differ.

Further information regarding factors that could affect our financial condition and results of operations is included in our most recent Form 20–F and our report on Form 6–K.

Gross Profits by Segment

FY2022

* Including items which should be eliminated as internal transactions between subsidiaries on a consolidated basis