Overall Equity Capital Markets Commentary

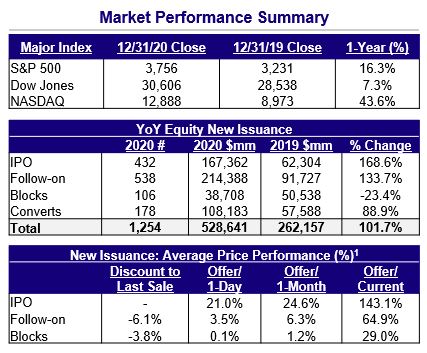

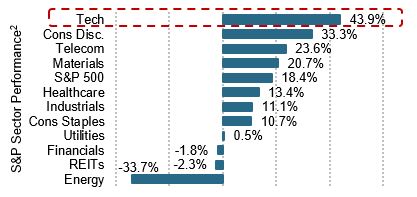

In the early spring of 2020, as the severity of the COVID-19 pandemic became apparent, equity market indices plummeted ~30% and the outlook for the year seemed grim on many, many levels. However, equity markets shrugged off the negative news instead focusing on unprecedented fiscal stimulus and turning their attention to the explosive growth catalyzed by the WFH/WFA environment and focusing their outlook on 2021/2022. By 12/31/2020, equity indices had rebounded with the DOW finishing up 7.3%, the S&P500 up 16.3% and the NASDAQ up a remarkable 43.6%.

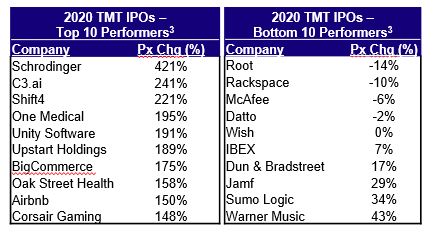

Equity new issue activity exploded to the upside as those companies that were negatively impacted by COVID-19 raised equity to shore up their balance sheets and those that saw their business expand due to the WFH/WFA environment capitalize on enhanced valuations. Over $525bn of equity issuance took place in 2020, more than a 2x increase over 2019’s $262bn raised. IPOs raised $167bn, a 2.5X+ increase over the $62bn raised both in 2019 and 2018. 2020 saw a record number of IPOs raise more than $1bn as 20 companies (ex-SPACs) did so led by TMT companies Snowflake, Airbnb, DoorDash. IPO performance was the best in 20 years as the average IPO performance was up 75%. Convertible issuance raised a record $108bn in proceeds – the first time the $100bn threshold was crossed.

SPACs clearly supplanted the Direct Listing (DL) as the topic du jour during 2020. One year ago we pondered whether the DL would gain traction in 2020 and the answer was…..no. On the other hand, SPACs shattered all records in 2020 as 248 SPACs raised $82.5bn versus 2019’s 59 deals which raised $13.5bn (which broke the previous record set in 2007). SPACs represented 57% by number of deals and 49% by proceeds raised, respectively, of the IPO market in 2020. There were 65+ successful business combinations worth over $85bn.