Shareholders' Meeting

The 23rd Ordinary General Meeting of Shareholders

Date and Time: 10:00 a.m. on Tuesday June 24, 2025 (Doors open at 9:00 a.m.)

Place: Tokyo International Forum (Hall A)

Convocation Notice of the 23rd Ordinary General Meeting of Shareholders (PDF/2,840KB)

Our views on the proxy advisor reports (PDF/126KB)

Our views on the proxy advisor reports (No.2) (PDF/100KB)

Notice of Resolutions of the 23rd Ordinary General Meeting of Shareholders (PDF/320KB)

Filing of Extraordinary Report (PDF/286KB)

Archives regarding Shareholders' Meetings

Archives regarding Shareholders' Meetings

Ordinary General Meeting of Shareholders

The 22nd Ordinary General Meeting of Shareholders (Apr 1, 2023 to Mar 31, 2024)

Convocation Notice of the 22nd Ordinary General Meeting of Shareholders (PDF/3,013KB)

Notice of Resolutions of the 22nd Ordinary General Meeting of Shareholders (PDF/320KB)

Filing of Extraordinary Report (PDF/297KB)

Our views on the proxy advisor reports (PDF/132KB)

The 21st Ordinary General Meeting of Shareholders (Apr 1, 2022 to Mar 31, 2023)

Convocation Notice of the 21st Ordinary General Meeting of Shareholders (PDF/2,936KB)

Notice of Resolutions of the 21st Ordinary General Meeting of Shareholders (PDF/26KB)

Filing of Extraordinary Report (PDF/98KB)

The 20th Ordinary General Meeting of Shareholders (Apr 1, 2021 to Mar 31, 2022)

Convocation Notice of the 20th Ordinary General Meeting of Shareholders (PDF/2,788KB)

Notice of Resolutions of the 20h Ordinary General Meeting of Shareholders (PDF/100KB)

Filing of Extraordinary Report (PDF/97KB)

Our views on the ISS and Glass Lewis reports (PDF/151KB)

The 19th Ordinary General Meeting of Shareholders (Apr 1, 2020 to Mar 31, 2021)

Convocation Notice of the 19th Ordinary General Meeting of Shareholders (PDF/1,506KB)

Notice of Resolutions of the 19th Ordinary General Meeting of Shareholders (PDF/323KB)

Filing of Extraordinary Report (PDF/285KB)

The 18h Ordinary General Meeting of Shareholders (Apr 1, 2019 to Mar 31, 2020)

Convocation Notice of the 18th Ordinary General Meeting of Shareholders (PDF/1,192KB)

Notice of Resolutions of the 18th Ordinary General Meeting of Shareholders (PDF/30KB)

Filing of Extraordinary Report (PDF/140KB)

Amendment Report for Extraordinary Report (PDF/293KB)

June 10, 2020 Proposal 5 at the 18th Ordinary General Meeting of Shareholders (PDF/311KB)

The 17th Ordinary General Meeting of Shareholders (Apr 1, 2018 to Mar 31, 2019)

Convocation Notice of the 17th Ordinary General Meeting of Shareholders (PDF/4,001KB)

Notice of Resolutions of the 17th Ordinary General Meeting of Shareholders (PDF/11KB)

Filing of Extraordinary Report (PDF/14KB)

Reports for Shareholders

Shareholders' meeting

Convocation Notice of the 23rd Ordinary General Meeting of Shareholders (PDF/2,840KB)

Interim period report to our shareholders

24th interim period report to our shareholders (PDF/881KB)

Archives regarding materials for shareholders

Convocation Notice of the 22nd Ordinary General Meeting of Shareholders (PDF/2,898KB)

Convocation Notice of the 21st Ordinary General Meeting of Shareholders (PDF/2,936KB)

Convocation Notice of the 20th Ordinary General Meeting of Shareholders (PDF/2,788KB)

22nd interim period report to our shareholders (PDF/3,287KB)

21st interim period report to our shareholders (PDF/3,134KB)

20th interim period report to our shareholders (PDF/1,007KB)

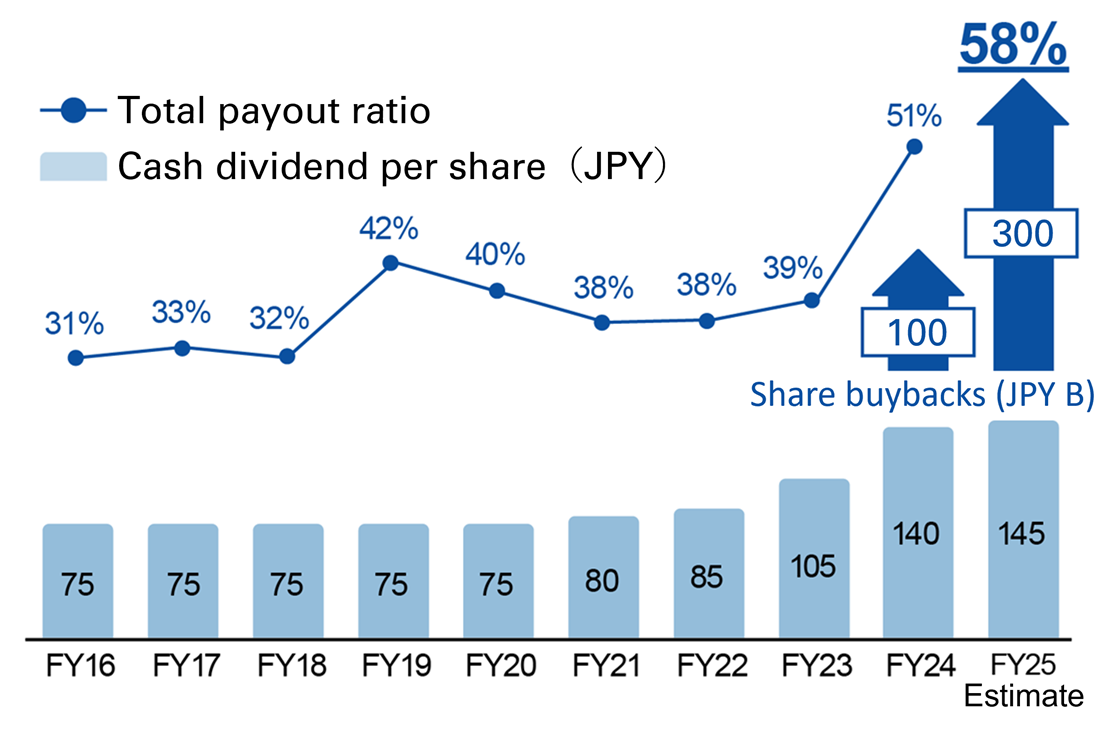

Return & Capital Management

Capital Management and Shareholder Return Policy

We have been pursuing the optimal balance between capital adequacy, growth investment and enhancement of shareholder return, and we set forth our shareholder return policy of keeping progressive increase of dividends per share, while executing flexible and intermittent share buybacks. In addition, we will increase dividends per share by approximately JPY5.0 each fiscal year, based on the steady growth of our stable earnings base. We will decide share buybacks, based on our business results, capital adequacy, our stock price and the opportunities for growth investment, using the total payout ratio of 50% or more as a guide.

Dividend Information

Forecast of annual Cash Dividend per Share for FY25 is JPY 145.00, an increase of JPY 5.00 compared to FY24. This will be the fifth consecutive year to increase dividends, backed by solid growth of stable earnings foundation. This remains unchanged from our initial forecast announced in May 2025. Additionally, share buybacks were resolved up to a maximum of JPY 100 billion on May 15, 2025, and up to a maximum of JPY 200 billion on November 14, 2025, bringing the total for FY25 to JPY 300 billion.

For FY25 plan, please refer to page 14.

Summary of Financial Results for the Second Quarter of FY2025 (PDF/1,059KB)

Interim cash dividend payment commencement date for the fiscal year ending March 2026: Friday, December 5, 2025.

* Shareholders who have opted to receive dividends via bank account or securities account deposit will receive them on the payment commencement date. Shareholders who receive dividends by Dividend Receipts, may not receive them until after the payment commencement date in the case of delay in postal mail delivery. There is no such potential delay when receiving dividends via bank account or securities account deposit, and therefore we recommend this method of receipt. To change the method by which you receive dividends, please follow the instructions provided under the Contact List.

Shareholder Return

ADR Information

What is ADR?

ADRs are securities issued for the purpose of trading in the U.S. in place of the underlying stock of foreign companies. As ADRs are registered with the SEC as U.S. securities, they are traded, settled and held in custody in substantively the same manner as the stocks of U.S. companies. ADR is an acronym for American Depositary Receipts.

Outline of Mizuho Financial Group's ADR

- Type of ADR Program: Sponsored Level 2 Program (*)

- Conversion Ratio : 5 ADRs = 1 Underlying Share (Underlying Share : Mizuho Financial Group's common stock)

- U.S. Security Code (CUSIP): 60687Y109

- NYSE Ticker Symbol: MFG

- Depositary bank: The Bank of New York Mellon

- Local custodian bank: Mizuho Bank, Ltd.

* For sponsored ADRs, the company issuing the underlying stock enters into a deposit agreement with a specific depositary bank, and ADRs are issued by the depositary bank once the issuer, depositary bank and investor rights and obligations have been clarified. In contrast, unsponsored ADRs are issued by the depositary bank based on investor demand without any involvement by the company issuing the underlying stock. Sponsored ADR Programs are divided into Levels 1, 2 or 3 depending on whether the issuance or sale of new stock is involved and the level of disclosure the company is obligated to provide. Under a Level 2 program, ADRs may be issued and listed on U.S. stock exchanges without being accompanied by the issuance or sale of new stock, and the issuer of the underlying stock is required to disclose information in a similar manner as U.S. listed companies.

ADR Price Information

Details of Mizuho Financial Group's ADR price, daily and weekly chart.

General Information

Fiscal Year –End

Mar 31

Ordinary General Meeting of Shareholders

Late Jun

Share unit

100 shares

Record Dates for Determination of Dividends

Mar 31 and Sep 30 (Interim dividends)

Record Date

The date for the Ordinary General Meeting of Shareholders: Mar 31

In other cases as deemed necessary, we will set the record date and give advance notice.

Method of Public Notices

Electronic public notices; provided, however, that in the case where an electronic public notice is impracticable due to an accident or any other unavoidable reason, the same public notice of the Company may be given in the Nihon Keizai Shimbun.

Stock Exchange Listings

Prime Market of the Tokyo Stock Exchange

New York Stock Exchange*

*We listed our ADRs (American Depositary Receipts) on the New York Stock Exchange

Domestic Stock Exchange Securities Code

8411

Shareholder special benefit plans

As of today, we do not offer a shareholder special benefit plan.

Contact List

Shareholder special benefit plans

Shareholder special benefit plans

Various procedures (e.g. change of address, change of method for receiving dividends, etc.)

Request for purchase or additional purchase of shares constituting less than one unit

Please contact your securities company or other financial institution

Stock Transfer Agency Department Mizuho Trust & Banking Co., Ltd.2–8–4 Izumi, Suginami–ku, Tokyo, Japan 168–8507

Website:https://www.mizuho-tb.co.jp/daikou/index.html (Japanese Text Only)

Tel: 0120–288–324 (toll–free within Japan only)

Hours: 9:00 am to 5:00 pm (Tokyo local time), except Saturdays, Sundays and national holidays.

Request for uncollected dividends

Issuance of payment statements, etc.

Handling Office of Stock Procedure

Shareholder Register Manager

3–3, Marunouchi 1–chome, Chiyoda–ku, Tokyo

Mizuho Trust & Banking Co., Ltd.

Handling Office

3–3, Marunouchi 1–chome, Chiyoda–ku, Tokyo

Stock Transfer Agency Department of the Head Office of Mizuho Trust & Banking Co., Ltd.

Analyst Coverage

Equity Analysts

Firms (in alphabetical order)

Equity Analyst

BofA Securities Japan Co., Ltd.

Shinichiro Nakamura

Daiwa Securities Co. Ltd.

Ken Matsuda

Goldman Sachs Japan Co., Ltd.

Makoto Kuroda

J.P. Morgan Securities Japan Co., Ltd.

Takahiro Yano

Morgan Stanley MUFG Securities Co., Ltd.

Mia Nagasaka

Nomura Securities Co., Ltd.

Ken Takamiya

Okasan Securities Co., Ltd.

Shinichi Tamura

SBI SECURITIES Co., Ltd.

Toyoki Sameshima

SMBC Nikko Securities Inc.

Masahiko Sato

Credit Analysts

Firms (in alphabetical order)

Credit Analyst

SMBC Nikko Securities Inc.

Muneharu Hashimoto

Note: Please note that any opinions, predictions or recommendations regarding Mizuho Financial Group, Inc. made by the analysts listed above are theirs alone and do not represent our opinions, predictions or recommendations. Mizuho Financial Group, Inc. does not by its reference above guarantee nor support those analysts' opinions, predictions or recommendations.

Creditor Information

The purpose of the Site is to facilitate fair and timely disclosure of information to Mizuho Group stockholders, investors and customers, as well as providing a broad range of information, including press releases. Information contained in the Site may include "important information" as defined by the Financial Instruments and Exchange Law. If a person receives such information by viewing the Site within twelve hours after the release of such information to the media and such person later conducts any sale, purchase or other transactions designated under the Financial Instruments and Exchange Law in respect of stocks or other securities or instruments issued by Mizuho Group, such transactions may be deemed to violate the Financial Instruments and Exchange Law. Visitors to the Site who are residents of countries other than Japan may be subject to similar restrictions under the laws of their country of residence, and MHFG expects that such visitors will utilize the information contained in the Site in compliance with such restrictions.

Rating Information

(Updated on May 17, 2024, no changes since then)

S&P

Moody's

Fitch

Bond Information

[Mizuho Financial Group]

Mizuho Financial Group is filing Shelf Registration Statement.

- For the details of subordinated notes, please refer to Capital Ratio Information.

[Mizuho Bank]

Mizuho Bank is filing Shelf Registration Statement.

- For the details of foreign currency senior notes and subordinated notes, please refer to About Mizuho Bank's Foreign Currency Senior Notes and Capital Ratio Information.

[Mizuho Trust & Banking]

- For the details of subordinated notes, please refer to Capital Ratio Information.

*1 Japanese Text Only

*2 This PDF is presented by Mizuho Financial Group or Mizuho Bank and transformed by EDINET

(provided by Financial Services Agency)

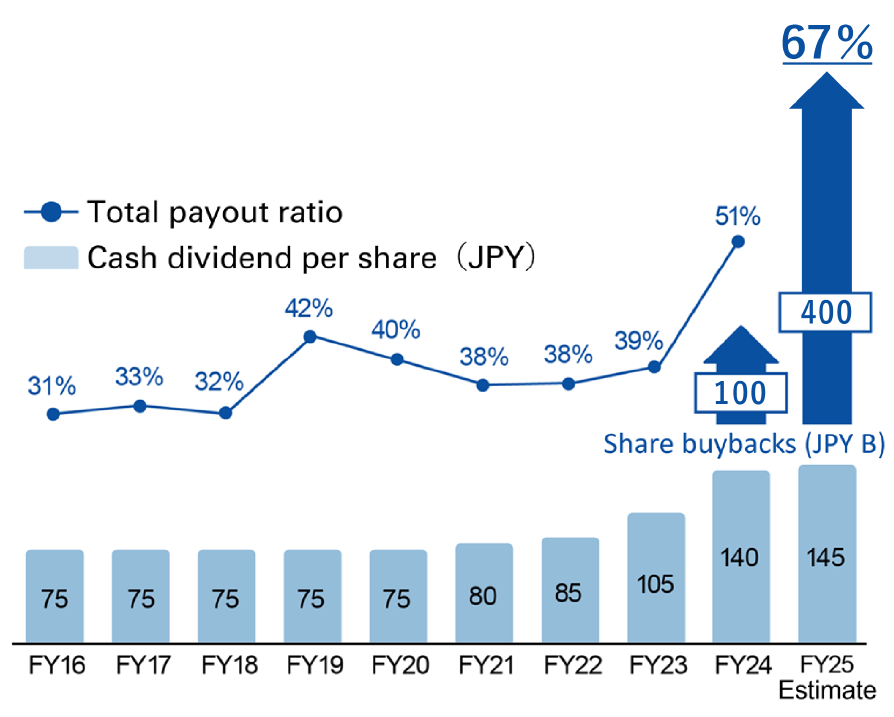

Capital Management, Shareholder Return Policy and Dividend Information

Capital Management and Shareholder Return Policy

We have been pursuing the optimal balance between capital adequacy, growth investment and enhancement of shareholder return, and we set forth our shareholder return policy of keeping progressive increase of dividends per share, while executing flexible and intermittent share buybacks. In addition, we will increase dividends per share by approximately JPY5.0 each fiscal year, based on the steady growth of our stable earnings base. We will decide share buybacks, based on our business results, capital adequacy, our stock price and the opportunities for growth investment, using the total payout ratio of 50% or more as a guide.

Dividend Information

Forecast of annual Cash Dividend per Share for FY25 is JPY 145.00, an increase of JPY 5.00 compared to FY24. This will be the fifth consecutive year to increase dividends, backed by solid growth of stable earnings foundation. This remains unchanged from our initial forecast announced in May 2025. Additionally, share buybacks were resolved up to a maximum of JPY 100 billion on May 15, 2025, up to a maximum of JPY 200 billion on November 14, 2025, and up to a maximum of JPY 100 billion on February 2, 2026, bringing the total for FY25 to JPY 400 billion. All shares purchased are to be cancelled.

For FY25 shareholder return forecast, please refer to page 13 of Summary of Financial Results for the Third Quarter of FY2025 (PDF/699KB).

Interim cash dividend payment commencement date for the fiscal year ending March 2026: Friday, December 5, 2025.

* Shareholders who have opted to receive dividends via bank account or securities account deposit will receive them on the payment commencement date. Shareholders who receive dividends by Dividend Receipts, may not receive them until after the payment commencement date in the case of delay in postal mail delivery. There is no such potential delay when receiving dividends via bank account or securities account deposit, and therefore we recommend this method of receipt. To change the method by which you receive dividends, please follow the instructions provided under the Contact List.