Environmental business initiatives

Promoting environmental friendliness in society as a whole through our business activities

It is essential for companies to ensure due consideration for the environment as they engage in their regular business activities, including addressing climate change, and encouraging recycling and the conservation of biodiversity. For many years we have been actively involved in financing projects that generate renewable energy in Japan and around the world, as well as the support of environmental and energy–related policy.

In recent years, in light of increasing interest in ESG topics we leverage our expertise as a global financial services group to provide financial products, services, and consulting to support the environmental initiatives of our clients.

Green finance

Investment and loans related to the Bank of Japan Climate Response Financing Operations

Supporting the issuance of GSS+ bonds

Support for renewable energy financing

Environment–related projects

Finance for environmentally conscious companies

Green Loans

Mizuho Eco Finance

Transition finance

Environment–related loans to individual customers

Investment and loans related to the Bank of Japan Climate Response Financing Operations

Mizuho Bank and Mizuho Trust & Banking have been selected as financial institutions to receive financing under the Bank of Japan's Climate Response Financing Operations*. We have notified the Bank of Japan of the following financing activities under the operation.

* Financing operations to support responses to climate change

Mizuho Bank Report on "Disclosure of Targeted Investments and Loans" in Climate Response Financing Operations (in Japanese only) (PDF/272KB)

Mizuho Trust & Banking Report on "Disclosure of Targeted Investments and Loans" in Climate Response Financing Operations (in Japanese only) (PDF/162KB)

Supporting the issuance of GSS+ bonds

Mizuho Securities is contributing to the expansion of the sustainable finance market by strengthening the support system for the issuing GSS+ bonds*2 through its Sustainability Promotion Department, providing sustainable finance including GSS+ bonds structuring support, developing sustainability stories for customers, and collecting Sustainability-related information.

Our track records:

・No. 1 domestic GSS+ bonds underwriting volume for six consecutive years since FY2019*3

・No. 1 domestic GSS+ bonds structuring agent for five consecutive years since FY2020*3

・The Environmental Finance's Sustainable Debt Awards 2025: Lead manager of the year, transition bonds, Lead manager of the year, green bonds – local authority/municipality, and Lead manager of the year, social bonds – corporate

・The ESG Finance Awards Japan from the Ministry of Environment for five consecutive years

・The Sustainable Finance House of the Year from REFINITIV DealWatch Awards 2024 for five consecutive years

*2 Including Green, Social, Sustainability, Sustainability-linked, and Transition bonds.

*3 Based on information from LSEG and Capital Eye, compiled by Mizuho Securities (excluding in-house bonds and securitization). Based on the pricing date.

Mizuho's initiatives related to sustainable finance

Mizuho Securities' sustainable business/finance (Sustainable BX Partner)

Support for renewable energy financing

Leveraging its accumulated know–how in project finance, Mizuho Bank is proactively providing financing for such renewable energy projects as those involving solar power, geothermal, and wind power generation. Regarding large–scale development projects, Mizuho Bank is working to ensure due consideration for the environment and society in accordance with the Equator Principles.

Mizuho Bank's financing for renewable energy projects

Mizuho has been leading the listed infrastructure fund market to assist the sound scaling-up of renewable energy. Since listed infrastructure funds invest in assets including power-generating facilities using renewable energy sources, they are also attracting attention as destinations for ESG investment. On the back of their characteristics as pure players, many listed infrastructure funds have recently developed an equity financing framework, obtaining certification as "green equity" by third-party rating agencies with reference to the Green Bond principles. We have been providing our full support for the listing and new equity issues of numerous infrastructure funds, including the listing of the very first fund on the Tokyo Stock Exchange's Infrastructure Fund Market in June 2016, when Mizuho Securities acted as the sole listing lead manager, Mizuho Trust & Banking served as an administrator of the investors' registry, and Mizuho Bank led the arranging of financing.

Since 2019, Mizuho Securities has been involved in all IPOs and new equity issues by the listed infrastructure funds as listing lead manager. Indeed, the total amount underwritten by Mizuho Securities in FY2022 and 2023 amounted to JPY 42.2 billion, accounting for 82.1% of the JPY 51.4 billion in issuances for the entire market. We also serve as secretariat to the Listed Infrastructure Fund Council, established by the five existing listed infrastructure funds in March 2023 with the objective of facilitating the expansion and development of listed infrastructure funds, and sound development of the market. Thus, Mizuho Securities has been substantially contributing to the promotion of decarbonization by helping expand and develop listed infrastructure funds that work to turn renewable energy into a permanent power source through disciplined arrangements and operation by leveraging private capital.

Results of environment–related finance

Results as lead arranger for project finance in the renewable energy division (PDF/3,928KB)

Environment-related projects

Offering loans that fund initiatives aimed at preventing global warming and promoting energy saving and that qualify for interest subsidies

Mizuho Bank provides loans that qualify for various interest subsidy programs. These include the Japanese Ministry of the Environment’s Interest Subsidies for Promoting Reduction of Environmental Risk and Interest Subsidies for Financing Environmental Risk Research. Other such subsidies are also provided under the Subsidies for Promoting the Introduction of Specified Equipment for Improving Efficiency of Energy Usage program of the Agency for Natural Resources and Energy under Japan’s Ministry of Economy, Trade and Industry. These programs provide interest subsidies from the national government and other sources for environmentally conscious capital investment loans meeting certain requirements. Eligible loans include capital investment in facilities that prevent global warming, energy conservation, and other investments that have environmental protection objectives, including research on the environmental impact of projects. In addition, when providing finance for projects under the Interest Subsidies for Financing Environment Risk Research program, Mizuho Bank conducts environmental risk due diligence.

Mizuho Bank offers loans qualifying for similar interest subsidy programs from Japan’s Ministry of the Environment and from the Agency for Natural Resources and Energy under Japan’s Ministry of Economy, Trade and Industry, thus helping companies that are taking initiatives to prevent global warming and promote energy conservation.

Green loans

Uses of green loans are limited to business activities that show due regard for the environment. As the flow of funds into environmental, social, and governance (ESG) investments has expanded, in March 31, 2018, the Loan Market Association and the Asia–Pacific Loan Market Association jointly prepared and issued their Green Loan Principles, which are the rules for making loans and specify that the funds must be used in environment–related fields.

On August 24, 2018, Mizuho Bank signed its first green loan contract based on these principles. Going forward, Mizuho will also provide proactive support for companies that are responding to ESG issues through the provision of green loans.

Mizuho signs Green Loan Agreement

Mizuho Eco Finance

To promote the shift to a low–carbon society alongside our clients, in June 2019 Mizuho Bank and Mizuho Research & Technologies launched Mizuho Eco Finance (Mizuho Environmentally Conscious Finance). This service evaluates the climate change initiatives of clients, allowing us to provide further support via financing and consulting to companies who are actively engaged in combating climate change.

Using an environmental assessment model developed by Mizuho Research & Technologies and featuring a globally accepted environmental verification and evaluation program, Mizuho Bank will provide financing to clients who meet a certain minimum score, and through monitoring by Mizuho Research & Technologies, we will provide strategic advice to clients to improve and maintain their scores.

Announcing the launch of Mizuho Eco Finance

Transition finance

We are particularly strengthening our transition finance initiatives to support the transition of clients in sectors with high levels of carbon emissions. Transition finance is a financing method* that aims to support the initiatives of clients considering climate change measures for greenhouse gas reduction in line with a long-term strategy toward a low-carbon society

*From the “Basic Guidelines on Climate Transition Finance” released by Japan's Financial Services Agency, Ministry of Economy, Trade and Industry, and Ministry of the Environment

Mizuho Securities acts as a lead manager and structuring agent for a number of transition bonds, and conducts seminars and other initiatives to expand the transition finance market.

- Head of Sustainability Promotion Department at Mizuho Securities, spoke at the seminar titled “Standardization of Intervention-based GHG Accounting/Avoided Emissions in Industry & Finance“ at the COP29 Japan Pavilion.

- Head of Sustainability Promotion Department at Mizuho Securities, participated in a panel discussion titled “Transition Finance: market development and standards” at the 8th Annual ICMA & JSDA Conference: Enabling Sustainable Society / Economy-Wide Transition through Sustainable Bonds.

Mizuho's Track Records of Underwriting /Arranging Sustainable Finance

Environment–related loans to individual customers

To support individuals' environmental protection efforts, Mizuho Bank offers loans with lower interest rates that are available to customers who want to remodel their existing home, or build or purchase a new home that is more environmentally friendly, such as by employing solar power generation or all–electric systems.

Natural Disaster Support Loans

In cooperation with Sompo Japan Insurance, Mizuho Bank has begun offering housing loans with built–in relief for disaster–affected customers in the event of an earthquake, disaster resulting from a torrential rainstorm, or other natural disaster, through which eligible customers have part of their scheduled payments or loan debt reduced. This housing loan product addresses risks that are not fully covered by conventional insurance, and by partially reducing scheduled payments or loan debt in the event of a natural disaster, can reduce the strain on household finances, specifically the burden of housing loan repayment.

- Balance (as at the end of FY2024): 139.3 billion JPY

Research and Consulting Services

In the area of environmental issues, Mizuho has developed channels with specialist institutions at home and overseas, and works to gather expert knowledge and the latest information. Making the most of this plentiful accumulated knowledge, it offers companies management advice and consulting on environmental problems.

Mizuho Research & Technologies has long been involved in contract research and consulting related to the environment and energy in partnership with government agencies, related research institutes and cutting–edge environmental companies. The company has compiled an extensive track record and a wealth of expertise and information in various areas, including environment and energy technology evaluation and CO2 emissions clarification. Leveraging this experience, MHIR helps customers deal with issues related to the environment and develop corporate and business strategies that take the environment into account. In addition, drawing on its network and expertise, Mizuho is working to create frameworks that will promote environmental consciousness.

Consulting on Environmental Management

Consulting and Policy Support for Environmental, Energy, and Natural Resource Matters

Mizuho Research & Technologies Environmental and Energy Solutions (Japanese text only)

Consulting on decarbonization management

With the commitment of the international community to limit the rise in the average global temperature to below 2˚C under the Paris Agreement, and the acceleration of the movement to realize the pathway to 1.5˚C, the ability of a company to respond to business risks and opportunities that arise from climate change is beginning to affect how companies are evaluated.

In their management strategies, companies are expected to reduce lifecycle CO2 emissions from their products and services, and to develop products, services and technologies that contribute to the reduction of CO2 in society. Depending on the industry, companies are required to transition their business portfolios while working to acquire business opportunities. Due to the globalization and growing complexity of corporate activities, companies must be aware not only of the necessity of decarbonizing their own consolidated group, but also that of suppliers and customers in their value chains.

In light of this, proactive companies are setting scenarios of what the future might look like for their business, identifying and evaluating all potential business risks and opportunities as a basis for establishing transition plans aligned with their management strategy. The requirement to develop a transition plan, encompassing a target for CO2 reduction, as well as capital deployment for concrete measures and investment plans to reach the target, means that companies are now being held accountable for the viability and feasibility of their decarbonization management. By incorporating climate risks and opportunities into the management strategy, they are expected to realize business growth and CO2 reduction, thereby communicating the evolving nature of their business and their own sustainability as a going concern.

Primarily by leveraging the strengths of Mizuho Research & Technologies, which has expertise in climate action, Mizuho provides a range of solutions, from information services to consulting, for creating and implementing a decarbonization strategy that is completely in step with the overall management strategy.

Environmental business matching

Mizuho Bank has established a solution network to support customer environmental management and provides business matching to introduce customers to the most suitable environmental management partners.

Business matching pairs Mizuho Bank customers with companies with consulting capabilities or that possess environmental and energy solutions (in compliance with the Scope 1, 2, and 3 standards of the GHG Protocol). Specifically, we introduce companies with abilities to visualize CO2 emissions, support TCFD/CDP measures, assist in strategy and plan creation, provide products and services related to reducing CO2 emissions, and assist in introducing renewable energy equipment, such as solar and small wind power generators. Our business matching activities effectively help companies in all aspects of environmental management.

In addition, Mizuho Bank participates in the Local Partnership for Energy Efficiency, launched by the Agency for Natural Resources and Energy to build a system for helping local SMEs to save energy, with the aim of supporting clients’ efforts to improve energy efficiency.

Consulting and policy support for environmental, energy, and natural resource matters

Consulting on greenhouse gas reductions

Companies are making reducing greenhouse gas emissions a management priority and are formulating concrete reduction plans to contribute to realizing a low-carbon society.

At Mizuho, we use our extensive expertise to provide comprehensive consulting services to clients seeking ways to develop businesses with reduced greenhouse gas emissions, including support for clients using carbon credits and clients, primarily governmental agencies, researching ways to reduce emissions. Our services are specialized in providing information about promising projects around the world, project assessments including quantitative evaluations, financial feasibility studies, and risk assessments for projects aimed at reducing greenhouse gas emissions and energy consumption, as well as assistance with procedural matters related to governmental policies and initiatives in the host country.

Support for carbon credits

Companies around the world are facing increased demands to adopt low-carbon technologies, and carbon credits1 earned for reducing greenhouse gas emissions are an effective tool for companies to meet greenhouse gas emission reduction targets.

Mizuho has been involved with carbon credits from very early on and has accumulated the vast knowledge and expertise necessary to conduct quantitative evaluations. Via collaboration among Mizuho group companies, we provide total support for greenhouse gas reduction, from identification of projects that generate carbon credits and preliminary surveys for project feasibility studies to quantitative assessments of greenhouse gas emissions once a project is underway. Also, since 2010, we have been focusing on the Joint Crediting Mechanism (JCM)2 as a new framework under the government's post-Kyoto mechanisms. Using our wealth of experience and know-how, we are now supporting the utilization of JCM in companies' business development outside Japan and the Japanese government's efforts to develop JCM.

1. Carbon credit: A mechanism for reducing greenhouse gas emissions in accordance with international guidelines and using the resulting offsets to comply with targets. Emissions trading involves countries and companies buying and selling carbon credits.

2. Joint Crediting Mechanism (JCM): A mechanism under which CO2 emissions reductions achieved through the adoption of Japanese low-carbon technologies and products are recognized as reductions in Japan's CO2 emissions, on the basis of bilateral agreements. With the adoption of this system, Japan will be able to secure emissions credits through the sale of Japanese technologies and products, as opposed to the existing system in which Japan purchases emissions credits from sources outside Japan.

JCM:Joint Crediting Mechanism

Greenhouse gas reduction survey support

Mizuho supports research, primarily by governmental agencies, aimed at reducing greenhouse gases.

* Currently Mizuho Research & Technologies

Consulting on energy and resources

Based on our cutting–edge research and wealth of knowledge and expertise, in the field of energy and resources, Mizuho Research & Technologies provides information and consulting services on energy issues and energy-related industries.

In the field of renewable energy, for example, we perform a broad area of work ranging from studies of policies inside and outside Japan to the preparation of project plans, all for the purpose of promoting the optimal usage of solar power, biomass, wind power, and other energy sources. Also, in the field of hydrogen energy, carbon dioxide capture and storage (CCS), and energy efficiency, we use the results of R&D performed by research institutes throughout the world to evaluate technologies for practical application.

Mizuho Research & Technologies also performs studies of new energy technology markets across the globe, develops commercialization plans with special attention paid to regulatory trends, and offers a wide variety of other types of support aimed at turning cutting–edge energy technology into concrete businesses.

Support for environmental and energy policies

With the rising awareness of environmental issues worldwide, consideration of environmental factors is required not only of corporations but also individuals, municipalities, and many other tiers of society. To establish a system to effectively promote environmental activities throughout society based on Japan's targets, and to achieve the targets in international agreements, various policies to address environmental problems are under discussion.

Mizuho Research & Technologies provides government agencies with a wide range of support for environmental and energy policies, including the collection and analysis of basic data, investigations, and research, as well as support for the formulation of policies.

Investment products

Sales, development and management of environment–related funds

When investments are made, there is growing interest not just in the outlook for profitability and growth but also in environmental, social, and corporate governance (ESG) activities of investee companies.

At Asset Management One (the former Mizuho Investment Advisory and the former DIAM), its activities are under way to develop, arrange, and manage investment products that incorporate the ESG perspective, and environment–related funds as well.

Environment–related funds managed by Asset Management One (As of Mar 29, 2024)

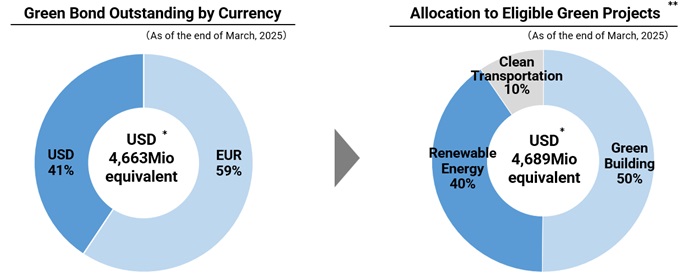

Green Bond

Green bonds are bonds in which the proceeds are used solely for the purpose of providing finance for environment–friendly projects (hereinafter "Green Projects") such as renewable energy and energy-saving business, etc. Mizuho Financial Group (hereinafter "MHFG") issues green bond to promote green finance.

Green Bond Framework

Mizuho's green bond is issued and managed based on its formulated green bond framework (hereinafter "Framework"), which is in line with the Green Bond Principles 2021 published by the International Capital Market Association. We have obtained an independent Second-Party Opinion with respect to this Framework.

Issue Record

* The exchange rate as of the end of March, 2025

**Criteria of Eligible Green Project is different by each Framework.

All information contained in this website prepared by MHFG has been prepared for informational purposes only and is not a solicitation of any offer to buy or sell any security or other financial instrument. Investing in securities involves risks, and, when you invest in securities, there is always the potential of losing all or a portion of your invested money. Prior to your making investment decisions based on the information contained in this website, please carefully consider the details of the relevant green bond, and confirm that such investment is in line with your financial situation and purposes. At the same time, please consult your expert advisors as necessary.These materials may contain forward–looking statements, and there can be no guarantee that these statements will be realized.