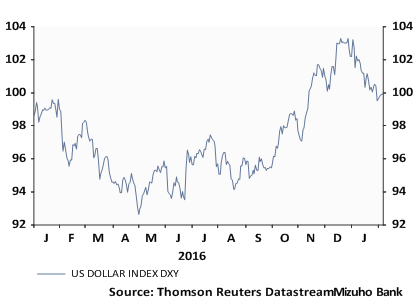

The USD has experienced a period of consolidation since the beginning of the year with the DXY index losing nearly 3% of its value. However, yields managed to maintain higher levels despite some softening in January. The break in performance between the USD and treasury yields begs the question; will the dollar strengthen to catch up to yields or are yields set to move lower going forward?

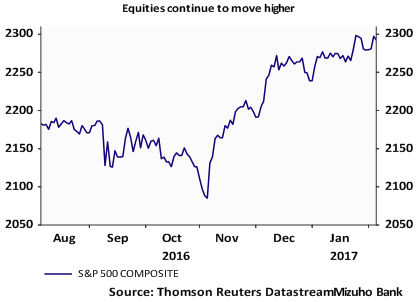

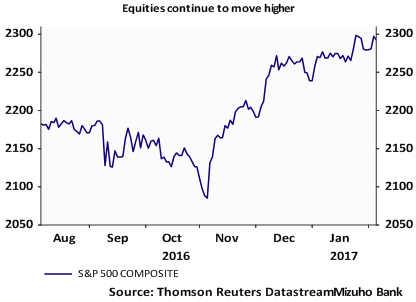

Our bet is for the USD to remain supported despite rising market discomfort with the Trump reflation trade. The new administration’s focus on the social aspects of President Trump’s agenda was met with less enthusiasm by investors who were looking for policies on tax reform and fiscal stimulus. There have been steps taken by the new administration that were supportive for business such as reviving the Dakota and Keystone pipelines as well as talk of cutting bank regulation. Those factors, along with good earnings releases, saw US equity prices surge higher.

|

|

We believe that the expectations built around an overhaul of the US tax code as well as the passage of a large stimulus package are bound to be met with disappointment. Re-writing the tax code is a large undertaking in and out of itself, and attempting that with clear divergences between the proposal put forth by Paul Ryan last year and the ideas that President Trump has floated around lead us to believe that very little progress will be made in that regard. That said, there is a consensus within the GOP that the US corporate tax rate is too high and a proposal to cut it can be easily passed through the legislative process in Congress. However, this is a far cry from tax reform and can undermine USD strength.

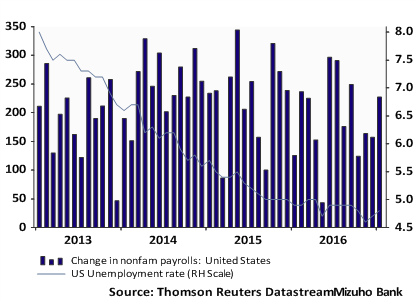

The US economy continues to perform at better rates. Labor markets are arguably tight, and the manufacturing sector continues to expand. Consumer confidence is at historically high levels which will be supportive of consumption going forward. Business investment spending is already seeing signs of a pick up as seen in the Durable Goods Orders. The better economic performance in the US provides enough of a case for the Fed to raise rates at least twice this year. This will drive yields in the US higher and will underpin USD strength against other majors where the central banks - including the European Central Bank, the Bank of Japan, the Bank of Canada and the Bank of England - are likely to stand pat.

|

|

The USD’s path going forward is likely to remain choppy given uncertainty surrounding policy steps in the coming weeks. We are entering a period of volatility in currency markets where we could expect to see broad based dollar strength followed by periods of consolidation. We anticipate that the USD will trade at the top of the range with the bias remaining for a stronger USD. So far the dollar index has been supported at the 99.815 level (100 day moving average), and we see the top of the range at the January 3rd high of 103.8. We believe that for the USD to break above the 103 level in a meaningful way, we would have to see either concrete policy efforts from the Trump administration on tax cuts or fiscal stimulus or a signal by the Fed that another rate hike is coming soon.

This article is not a research report under the legal requirements in any country or jurisdiction and is not intended to provide information upon which to base a decision to enter into a financial transaction. It has been prepared for institutional clients, sophisticated investors and market professionals only, and is limited to commentary on economic, political, or market conditions on the basis of publicly available information.