Overall Equity Capital Markets Commentary

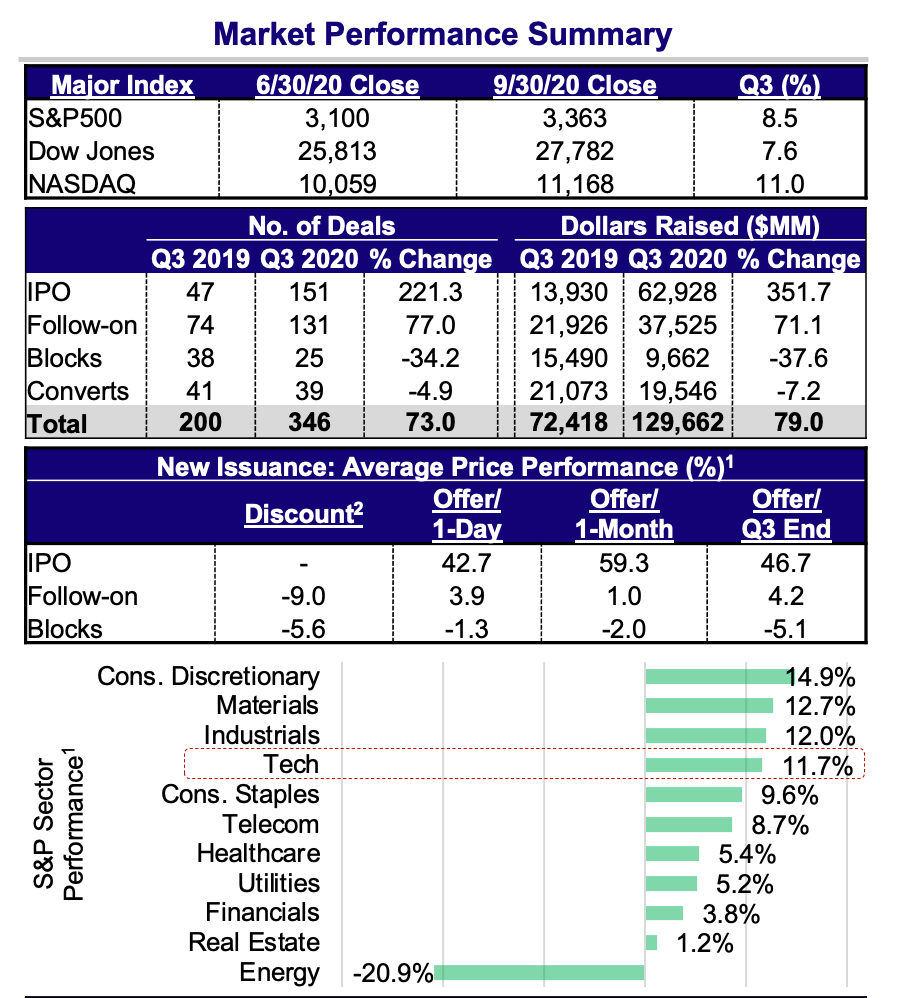

Equity markets continued their rally after the record setting performance in Q2 with each of the three major indices up between 7%-11%. As of September 30 YTD, the S&P500 was up 4.1%, the NASDAQ up 24% and the DOW down 2.6%.

While Q2 was dominated by follow-on offerings and convertible issuance, IPOs were the highlight of Q3:

- Q3 saw total equity issuance of $129 billion which brought the YTD total to ~$360 billion as of 9/30/2020. That amount is now ~$100 billion – or 38% – more than total issuance for all of 2019 and exceeds the full-year record of $350 billion set in 2000.

- Overall, Q3 equity issuance was down 31% from Q2 but up 79% compared to Q3 2019

- The IPO market was awe-inspiring in the amount of capital raised, with 151 deals raising $63 billion. This represented a 153% increase over Q2 2020 and a 352% increase over Q3 2019. Typically, annual IPO proceeds are $50 billion to $75 billion, but that level was accomplished in Q3 2020 alone.

- SPACs! 82 SPAC IPOs priced in Q3 raising $30 billion. This was a 300% increase over the amount raised in Q2, which was the previous record! For the first time, SPAC IPO issuance is on par with “regular way” IPO issuance.

- Both follow-on issuance and convertible issuance fell dramatically in Q3 versus Q2, down 60% and 65%, respectively. However, compared to Q3 2019, follow-on issuance was up 71% while convertible issuance was down just 7%. The spike in Q2 was directly tied to “emergency financings” as the COVID-19 pandemic took hold.

- The average IPO performance for Q3 (ex-SPACs) was 43% on day-1 and 47% from offer to September 30 – remarkably similar to Q2’s performance.

Mizuho Highlights

Mizuho served as a Bookrunner or Co-Manager on 23 equity and equity-linked offerings in Q3 which raised $15.3 billion.

- Mizuho was a Bookrunner on 16 of the 23 transactions.

Notable deals included:

- Bookrunner on Snowflake’s $3.9 billion initial public offering

- Bookrunner on Jamf’s $538 million initial public offering

- Bookrunner on Sabre’s $288 million follow-on and $345 million mandatory convertible

- Bookrunner on the $600 million E.Merge SPAC IPO and the $345 million Burgundy Technology SPAC IPO

- Mizuho currently has 13 bookrun mandates which expect to raise proceeds of ~$5 billion

TMT Specific Commentary

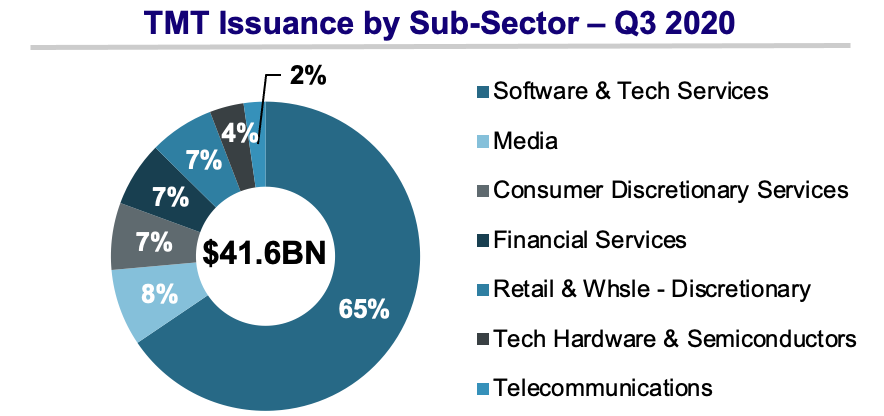

In Q3 TMT issuers raised a robust $42 billion, down from $60 billion in Q2 but still better than a 5x increase over Q1’s $8 billion. TMT issuance accounted for 32% of total issuance across all sectors (TMT was also 32% in Q2).

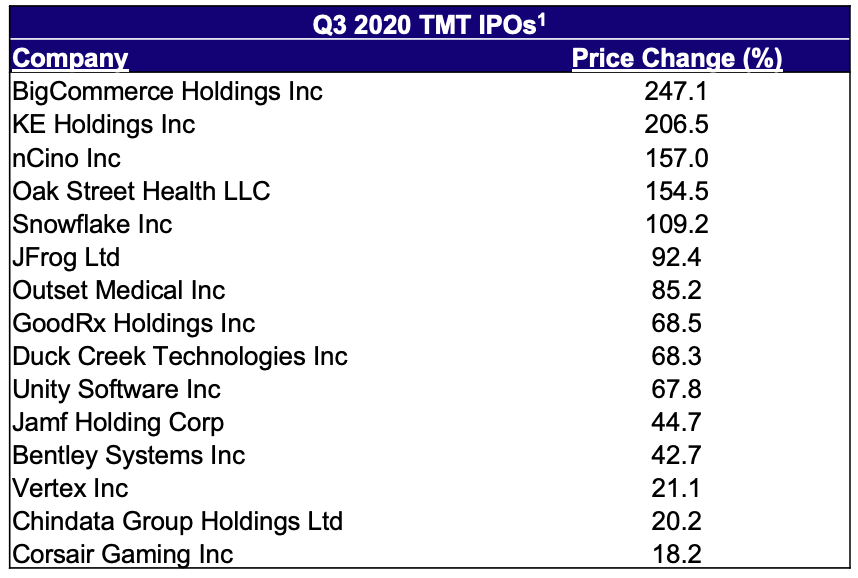

Snowflake’s $3.36 billion IPO was the largest IPO of Q3. Its 111% first day performance and 109% performance as of September 30 place it in the top-10 for all IPOs in Q3.

Other notable TMT IPOs in Q3 were Unity Software ($1.5 billion), GoodRX ($1.3 billion), and Rackspace ($704 billion).

Software represented 65% of TMT issuance in Q3 with $22.2 billion raised.

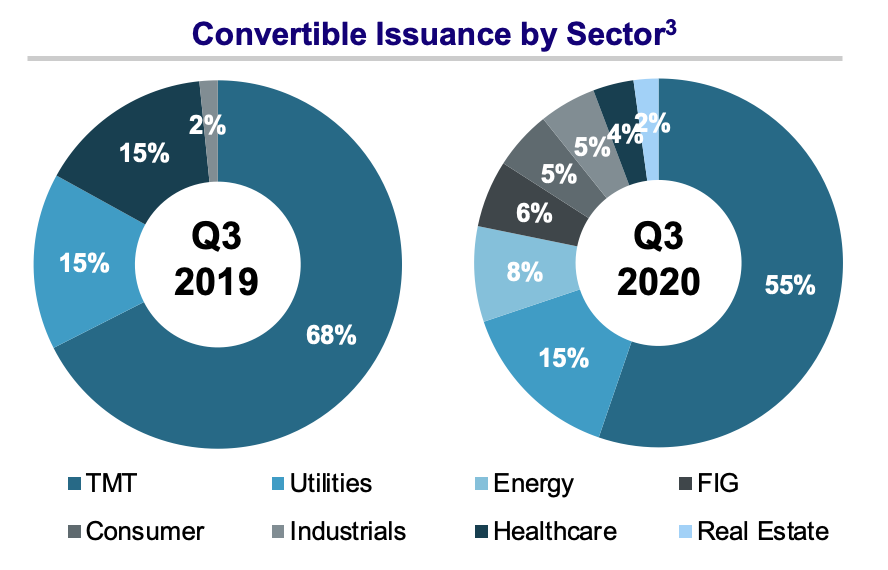

Convertible Market Commentary

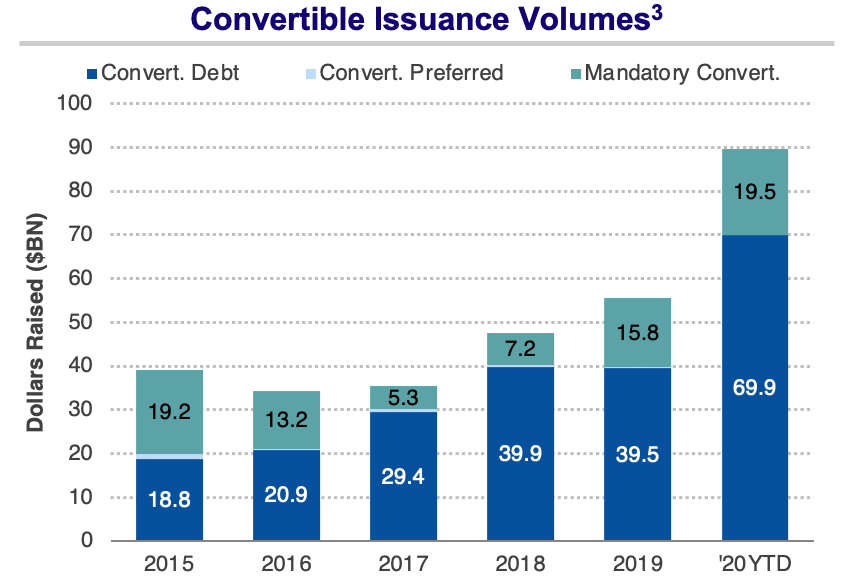

As of the end of Q3, 156 convertibles had priced to raise just over $91 billion. This is a record for issuance over nine months and only $7 billion shy of 2007’s annual record of $98.2 billion – which should be exceeded in short order.

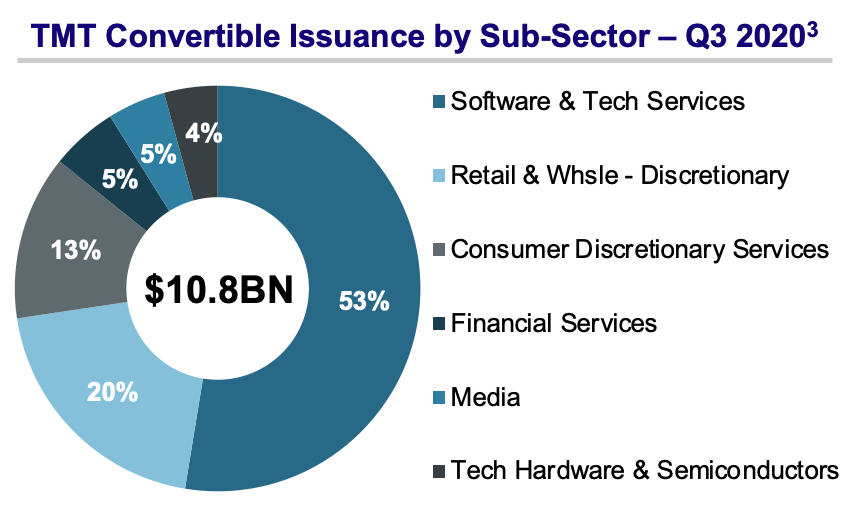

Terms remained extremely attractive: There were 39 convertibles issued in Q3 of which 20 were broadly TMT. Median terms were 1.25% coupon, up 32.5% on a 5-year note.

Four issuers raised over $1 billion. Three of the seven largest convertibles in Q3 were mandatories.

Q3 TMT highlights include: Chegg ($1 billion), Shopify ($920 million), RingCentral ($650 million), Etsy ($650 million), LendingTree ($575 million), Medallia ($575 million) and Wix ($575 million).

The use of derivative structures to increase the conversion premium to either 75% or 100% remained popular as over ~50% of issuers utilized such a structure.

Themes and Thoughts – More of the Same!

COVID-19: WFH continues to be extremely effective for most professional services. Unfortunately, many in the retail industry continue to face restrictions that have materially hurt their businesses. Hot spots continue to flare up in different parts of the country, including in the White House. However, multiple vaccines and treatments are underway which, if proven effective, will undoubtedly fuel further advancements in the markets.

The Election: “It’s the economy stupid.” With unemployment still running relatively high and discussions of a “K” recovery, polls appear to show Biden widening his lead in both the popular vote and in swing states. As we know, the polls got it wrong in 2016 but with less than four weeks until the election the markets seem to be more comfortable with a potential Biden victory.

The “Alt” IPO: The impact of SPACs cannot be understated. With 130 SPACs raising over $50 billion in 2020 YTD they have become a clear alternative for companies considering an IPO. The Direct Listing has also returned as both Palantir and Asana completed DLs on September 29. Slack (2019) and Spotify (2018) are the only other two companies to recently complete DLs.