Overall Equity Capital Markets Commentary

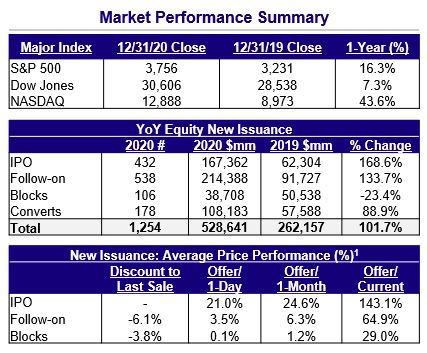

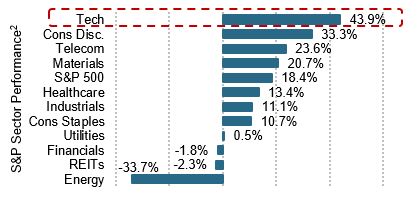

In the early spring of 2020, as the severity of the COVID-19 pandemic became apparent, equity market indices plummeted ~30% and the outlook for the year seemed grim on many, many levels. However, equity markets shrugged off the negative news instead focusing on unprecedented fiscal stimulus and turning their attention to the explosive growth catalyzed by the WFH/WFA environment and focusing their outlook on 2021/2022. By 12/31/2020, equity indices had rebounded with the DOW finishing up 7.3%, the S&P500 up 16.3% and the NASDAQ up a remarkable 43.6%.

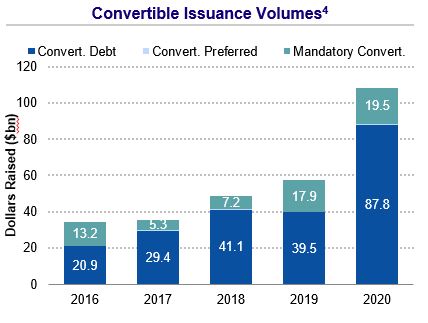

Equity new issue activity exploded to the upside as those companies that were negatively impacted by COVID-19 raised equity to shore up their balance sheets and those that saw their business expand due to the WFH/WFA environment capitalize on enhanced valuations. Over $525bn of equity issuance took place in 2020, more than a 2x increase over 2019’s $262bn raised. IPOs raised $167bn, a 2.5X+ increase over the $62bn raised both in 2019 and 2018. 2020 saw a record number of IPOs raise more than $1bn as 20 companies (ex-SPACs) did so led by TMT companies Snowflake, Airbnb, DoorDash. IPO performance was the best in 20 years as the average IPO performance was up 75%. Convertible issuance raised a record $108bn in proceeds – the first time the $100bn threshold was crossed.

SPACs clearly supplanted the Direct Listing (DL) as the topic du jour during 2020. One year ago we pondered whether the DL would gain traction in 2020 and the answer was…..no. On the other hand, SPACs shattered all records in 2020 as 248 SPACs raised $82.5bn versus 2019’s 59 deals which raised $13.5bn (which broke the previous record set in 2007). SPACs represented 57% by number of deals and 49% by proceeds raised, respectively, of the IPO market in 2020. There were 65+ successful business combinations worth over $85bn.

TMT Specific Commentary

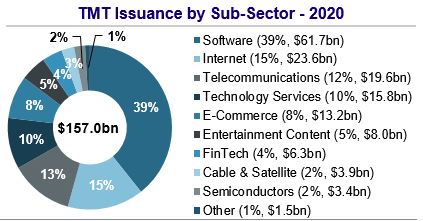

- In 2020, TMT issuers raised $157bn, almost 2X 2019’s proceeds. TMT represented about 30% of total issuance, consistent with 2019, and was the second most active sector (Healthcare was #1 for at least the 5th year in a row).

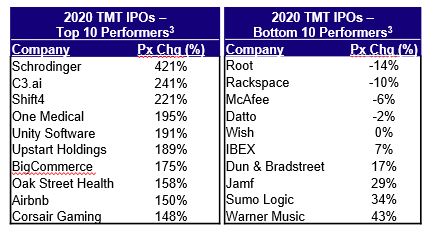

- Twelve TMT companies raised over $1bn at the time of their IPO. Unicorns remained the focus as 73% of TMT companies debuted with over a $1bn valuation, again almost the same as in 2019.

- Software dominated the TMT new issue landscape as the sub-sector accounted for almost $62bn, or 39%, of total TMT issuance in 2020.

- Unlike last year, when notable companies such as Uber, Lyft and Peloton seriously underperformed, 2020’s TMT IPOs turned in a robust average return of over 70%. First-day outperformers included Big Commerce (201%), nCino (196%), Agora (153%), C3.ai (120%) and Snowflake (112%).

- Valuations remained very robust in 2020 and numerous software companies traded at between 20x-30x forward revenues. The market continues to look forward to justify these multiples buttressed by the high margins (particular for subscription revenue models) and high growth rates (30%-40%).

Convertible Market Commentary

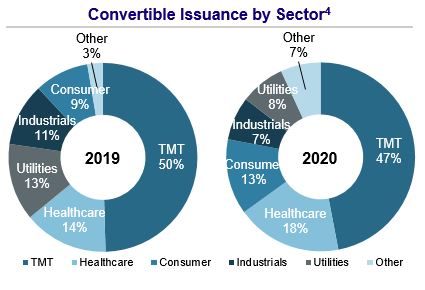

- As noted, convertible new issuance set a record in 2020 as issuance cracked the $100bn mark for the first time. TMT issuers accounted for close to 50% of the total volume.

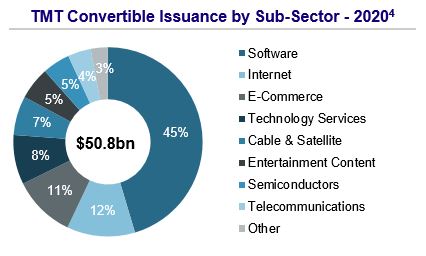

- Once again, software was the dominate subsector representing 45% of TMT issuance and 21% of all convertible issuance.

- Terms remained extremely attractive: 70 TMT issuers raised convertible proceeds at average terms of 0.75% coupon and up 32.5% on a 5 year note. The use of the call-spread remained high as 57% of all TMT issuers utilized the structure to raise the conversion premium to 75%-100%.

- In the 2019 TMT YIR we predicted that 2020 would be “an excellent year for companies to tap this capital pool” and we are confident in saying that 2021 will be equally appealing.

Themes and Thoughts

- The New Administration – From our 2019 YIR: “We are in uncharted territory as we enter an election year with an impeached President seeking re-election.” WOW. The election process turned out to be even wilder and more unsettling than we could have ever anticipated – and the events of January 6th only punctuated that. Now, as President-elect Biden announces his cabinet, his 100-day plan and we await another impeachment trial, it is fair to say much will be impacted by these events.

- SPACs – With 53 SPACs raising $14bn+ by January 15, 2021 – a furious pace – it seems clear that SPACs will continue to be a focus in 2021. It is also likely that this will be the first year that SPAC IPO issuance will exceed regular IPO issuance. We predict that the SPAC party will continue for another 12-18 months as only when we see the success rate of class of 2020 will we really know if this can continue. If the success rate of SPACs closing business combinations remains extremely high (~90%), then it will keep going. If the class of 2020 stumbles it will chill future new issuance.

- COVID-19 – Numerous vaccines have shown high degrees of efficacy and we all await the opportunity to receive the vaccination. But, whether this happens in Q1/Q2, or 3-6 months later, can have a significant impact on the economy, equity markets and consequently, the new issue market.

Mizuho Highlights

Mizuho served as a Bookrunner on 44 equity deals in 2020 – a breakout year and equivalent to almost the last four years combined. In total, we helped raise over $75bn for our clients by participating in 78 equity or equity-linked transactions.

- Bookrunner on largest IPO – Snowflake

- Bookrunner on 2nd largest IPO – Airbnb

- Bookrunner on largest Follow-on – T-Mobile

- Bookrunner on largest Mandatory Exchangeable – SoftBank/T-Mobile

- Bookrunner on largest Exchangeable – Liberty/Live Nation

- Bookrunner on three TMT SPACs raising over $1.3 billion