Overall Equity Capital Markets Commentary

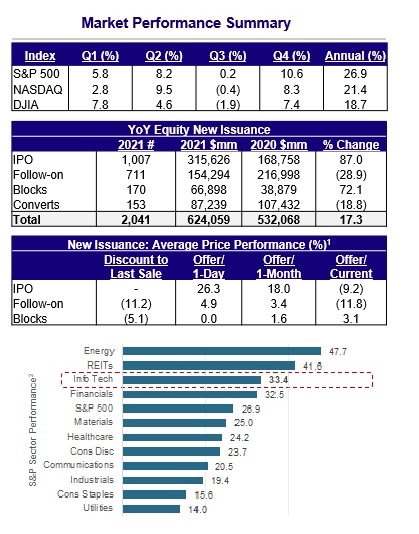

Due to unprecedented monetary support and pent up consumer demand, the equity markets experienced strong returns in 1H21. The low interest rate environment boded well for all three major equity indices. However, as inflation and supply chain shortages increased, investor confidence started to wane. As investors entered 2H21, the spread of the new omicron variant and the possibility of three rate hikes in 2022, caused volatility levels to spike and a minor pullback in the market from all-time highs. Even with a resurgence in COVID cases, the markets still closed the year near all-time highs as the S&P 500 was up 26.9%, the Nasdaq was up 21.4% and the Dow was up 18.7%.

With favorable market conditions, the equity new issuance market built upon its momentum in 2020, and once again, produced a record year. Over $620bn of equity issuance took place in 2021, more than a 15% increase over the previous record in 2020 and almost a 2.5x increase from 2019. IPOs raised an astonishing ~$316bn, a 1.9x increase over the ~$169bn raised in 2020 and 5.0x increase from 2019. 2021 saw a record number of IPOs raise more than $1bn as 29 companies (ex-SPACs) did so led by TMT companies Coupang, GlobalFoundries and Nu Holdings. Relative to last year, IPO performance was drastically different as companies often enjoyed a first day price increase, but on average, then found their stock price trading below the IPO price. Convertible issuance did not surpass last year’s record year, but generated proceeds exceeding $85bn – the second best year in terms of issuance

It was hard to imagine that SPACs could have an encore performance to last year, but 2021 did just that and more. The SPAC market saw 612 SPACs raise over $160bn in proceeds versus the previous record of 248 SPACs that raised $82.5bn in 2020. SPACs represented ~64% by number of deals and ~52% by proceeds raised, respectively, of the IPO market in 2021. In addition, there were 204 successful business combinations worth over $460bn.

TMT Specific Commentary

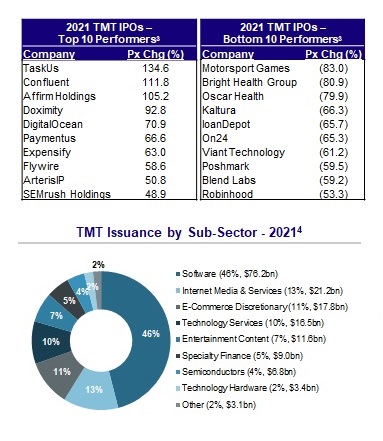

- In 2021, TMT issuers raised just over $165bn, almost 10% more than 2020’s proceeds. TMT represented 1/3 of total issuance, consistent with 2020, and dethroned Healthcare for the most active sector in the market (Healthcare was previously #1 for at least 5 years in a row)

- 18 TMT companies raised over $1bn at the time of their IPO – six more than 2020. Unicorns remained the focus as 82% of TMT companies debuted with over a $1bn valuation, an increase from 2020

- Software once again dominated the TMT new issue landscape as the subsector accounted for almost $76bn, or 46% of total TMT issuance in 2021

- Similar to the broader IPO market, 2021 TMT IPOs enjoyed a positive first day price performance, but as of year-end, the mean price performance was -5.5%. Several companies found their stocks trading well below the offer price. Notable underperformers included WaterDrop (-88.5%), Oscar Health (-79.9%), Robinhood (-53.3%) and Marqeta (-36.4%)

- Valuations remained very robust in 2021 and numerous software companies traded at between 20x-30x forward revenues. The market continues to look forward to justify these multiples buttressed by the high margins (particular for subscription revenue models) and high growth rates (30%-40%)

Convertible Market Commentary

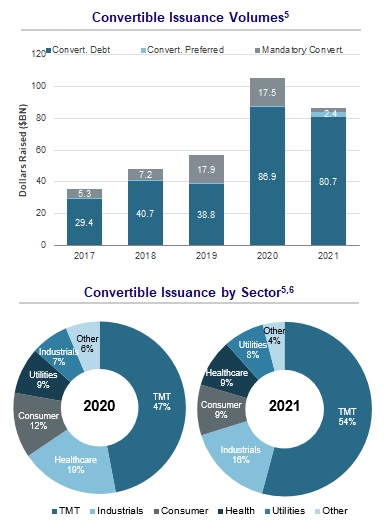

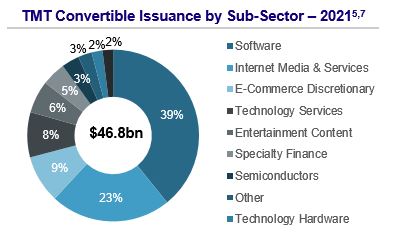

- Although the convertible issuance in 2021 did not meet last year’s record output, it still generated over $85bn of issuance, which resulted in the second most active year for the convertible market. Once again, software was the dominant subsector representing 39% of TMT issuance and 21% of all convertible issuance

- Terms remained extremely attractive: 65 TMT issuers raised convertible proceeds at average terms of 0.75% coupon and up 42.5% on a 5 year note. The use of the call-spread remained high as 51% of all TMT issuers utilized the structure to raise the conversion premium to 75%-100%

- In the 2020 TMT YIR, we predicted that 2021 would be as “equally appealing” as 2020. In fact, 2021 saw higher conversion premiums realized and similar coupons while overall TMT issuance was down slightly. A rising interest rate environment should continue to make the convertible market an attractive product for issuers

Themes and Thoughts

- Expected Rate Hikes in 2022 – The major macro headwinds heading into 2022 for the U.S. economy are the continued inflationary pressures and supply chain shortages that have had a ripple effect in almost every sector. Based on minutes from the December FOMC meeting, 12 members of the Fed expect at least three rate hikes in 2022. The combination of that many rate hikes and a reduction in the Fed’s tapering program should generate an uptick in volatility and dislocations in 2022

- SPACs – With a record 600+ SPACs generating over $160bn in proceeds, 2021 exceeded last year’s total as we had predicted in our 2020 YIR. It is very unlikely we see a repeat of 1Q21 in the first quarter of 2022. As terms have become more investor friendly, we would expect the overall SPAC issuance in 2022 to considerably moderate. With 78 SPACs from 2020 still seeking business combinations along with another 496 from 2021, it will be interesting to see if there are enough IPO-ready companies willing to go public. At the same time, price performance for these newly merged companies in 2021 has been challenging as the average return was -14.5% - slightly worse than the -9.2% average return for traditional IPOs

- Resurgence of COVID-19 – A surge in COVID cases around the world negatively affected investor sentiment heading into the holiday season resulting in a pullback in the equity markets. As scientists obtain more data on the new variant, the world will reassess different measures on how to combat this ever evolving disease

- Geopolitical Unrest – Clearly, the active conflict in Ukraine has created great uncertainty and increased volatility in all markets. This will dampen equity issuance until there is comfort that the conflict will not expand into broader Europe and/or it becomes apparent a resolution is on the horizon. A protracted conflict, measured in months, and of increasing intensity, will likely cause greater disruption.

Mizuho Highlights

Mizuho served as a Bookrunner on 52 equity deals in 2021 – surpassing our record in 2020 during which we were a Bookrunner on 44 equity deals. In total, we helped raise over $67bn for our clients by participating in 68 equity or equity-linked transactions

- Bookrunner on largest IPO – Rivian

- Bookrunner on 2nd largest IPO – Coupang

- Bookrunner on 2nd largest FinTech IPO – Robinhood

- Bookrunner on 2nd largest Software IPO - UiPath

- Bookrunner on Convertible w/ largest Convert Prem. – Expedia

- Bookrunner on 11 SPACs (8 TMT focused) raising over $2.6bn

Source: Dealogic, Bloomberg

1. Performance metrics are for all U.S. listed IPOs in 2021 excluding SPACs; Deal size > $25mm

2. S&P sector performance from 12/31/20 to 12/31/21

3. Top/Bottom performers include U.S. companies only

4. “Other” includes: Cable & Satellite, Publishing & Broadcasting, Advertising & Marketing, and Telecommunications; Deal size > $25mm

5. Calculated off dollars raised; Deal Size > $25mm

6. “Other” includes: Real Estate, FIG, & Energy

7. “Other” includes: Telecommunications, Advertising & Marketing, and Electrical Equipment