Overall Software Sector Commentary

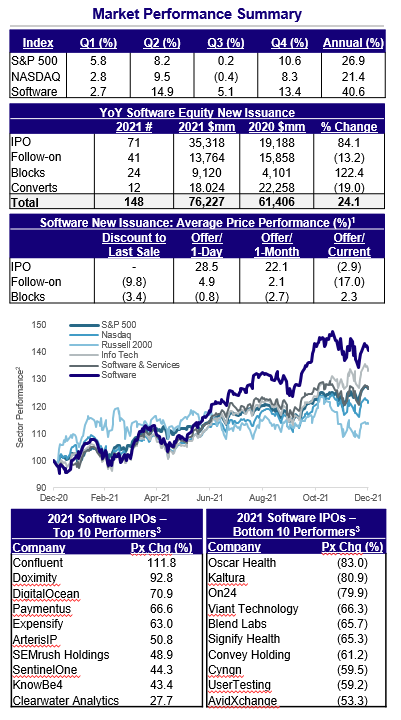

Even as a global pandemic has terrorized the global economy for almost two years, the Software sector has remained one of the best performing sectors during this time-frame. Benefitting from a low interest rate environment as well as a vast amount of businesses going through digital transformation (i.e. Work from Anywhere), software companies have taken advantage of the cheap liquidity in the issuance market as well as higher investor demand/valuations. Over the past two years, the S&P 500 Software Index has posted a ~102% increase. To put that into perspective, the S&P 500 has only increased ~48% while the Nasdaq has increased ~71% over the same time-frame. The growth in the sector has bolstered returns in the space – resulting in these companies entering the public market at all-time high valuations.

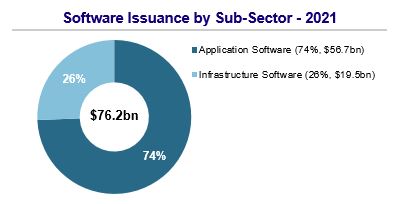

With a favorable market backdrop, software new issuance built upon the sector’s record year in 2020 by raising just over $76bn in 2021. Overall, issuance in 2021 increased almost 25% from 2020 and had a ~2.5x increase relative to 2019. Software IPOs raised an incredible $35bn, which accounted for ~11% of all IPO proceeds (~24% of all IPO proceeds ex-SPACs) and ~52% of TMT IPO proceeds. In 2021,13 TMT companies (ex-SPACs) raised over $1bn in their IPO - led by software companies Qualtrics, UiPath, & SentinelOne. Software IPO performance experienced positive gains on its first day and month of trading, and in contrast to the overall issuance market, their stock price, on average, traded closer to their initial offering price. Software Convertible issuance did not surpass last year’s levels, but software companies still tapped the market to generate over $15bn in proceeds.

Traditional IPOs were not the only route software companies explored to go public in 2021. Amplitude and Squarespace both went public via Direct Listings. As of 12/31, Amplitude posted a ~53% increase, while Squarespace was down ~41% - both relative to their reference price. SPACs were another popular vehicle for software companies as there were 20+ business combinations with a combined EV of $66bn.

Software Issuance Highlights

- In 2021, Software issuers raised just over $76bn, ~25% more than 2020’s proceeds. Software represented ~12% of total issuance, consistent with 2020, and dominated the TMT issuance as the sub-sector accounted for ~46% of total TMT issuance

- Six software companies raised over $1bn at the time of their IPO – two more than 2020. None of these issuers surpassed Snowflake’s IPO of ~$3.9bn. Unicorns remained the focus as 90% of software companies debuted with over a $1bn valuation, an increase from 2020

- Similar to both the overall and TMT IPO issuers, 2021 software issuers enjoyed a positive first day price performance; however, by year-end, the mean price performance was -2.9%. Nevertheless, slightly higher than both overall and TMT issuers. Several companies found their stocks trading well above their offer price. Notable outperformers included Global-e Online (153.6%), Confluent (111.8%), Monday.com (99.2%), and Expensify (63.0%)

- Valuations remained very robust in 2021 and numerous software companies traded between 20x-30x forward revenues. The market continues to look forward to justify these multiples buttressed by the high margins (particularly for subscription revenue models) and high growth rates (30%-40%)

Software Convertible Market Commentary

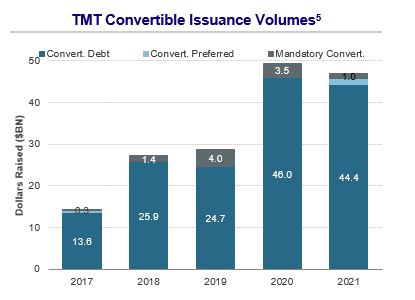

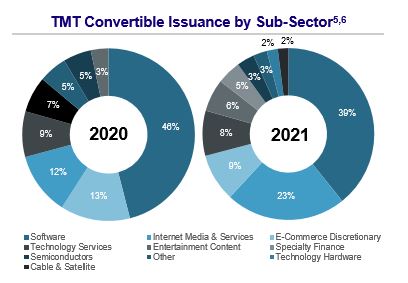

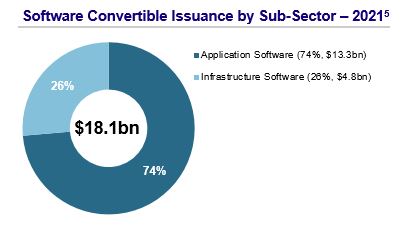

- Although TMT convertible issuance in 2021 did not meet last year’s record output, it still generated over $45bn of issuance resulting in the sector’s second most active year. Once again, software was the dominant subsector representing 39% of TMT issuance and 21% of all convertible issuance

- Terms remained extremely attractive: 27 software issuers raised convertible proceeds at average terms of 0.75% coupon and up 45% on a 5 year note. The use of the call-spread remained high as ~70% of all software issuers utilized the structure to raise the conversion premium to 75%-100%

- Although software companies decreased their convertible issuance from 2020, a rising interest rate environment should continue to make the convertible bond an attractive product

Key Trends Benefiting the Software Industry

Digital Transformation – Due to COVID-19, businesses have re-prioritized their digital transformation initiatives. Systems that have a more flexible operating structure have been adopted to increase productivity and security. At the same time, digital transformation enables organizations to provide significantly improved and personalized customer experiences which drives higher engagement and retention levels

Work from Anywhere – As employees work remotely, demand for cloud-based collaboration solutions has increased. As a result, collaboration also becomes more global using cloud solutions, which expands companies’ market opportunities overseas

Data and Analytics – Companies are continuing to improve efficiency and leverage their proprietary data as a strategic asset. Big data software is designed to handle large data sets to provide valuable intelligence in real-time

DevOps – Encompasses a wide and growing range of software tools that enable developers to engage with their production application and automate many of the more common tasks. This ensures code updates can be rolled out to live production environments with limited downtime

Next-gen Security – Cybersecurity has become increasingly important due to the rise in “Work From Anywhere” environments, ongoing adoption of cloud-based technologies, and growing sophistications of cyberattacks

Customer Data Platforms – The loss of third-party cookies, reduced user tracking, and enhanced consumer privacy regulation is driving companies away from third-party data and towards first- and second-party data managed by Customer Data Platforms

Significant M&A Activity – In 2021, there were 17 large ($1bn+) M&A transactions (Ex-SPACs) totaling more than $102bn in volume. This was a significant increase from 2020 as more companies continue to diversify their product suite in this ever evolving economy