Markets & ECM Issuance Commentary

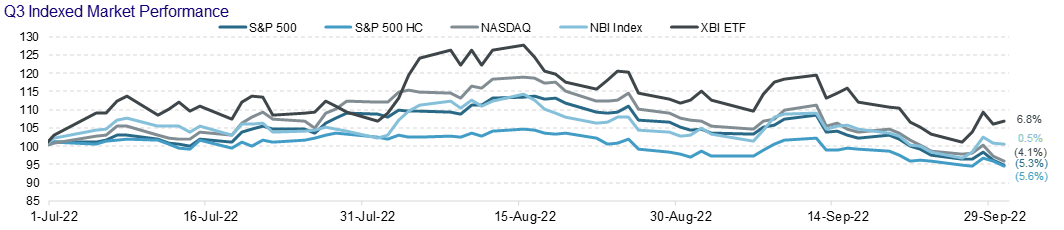

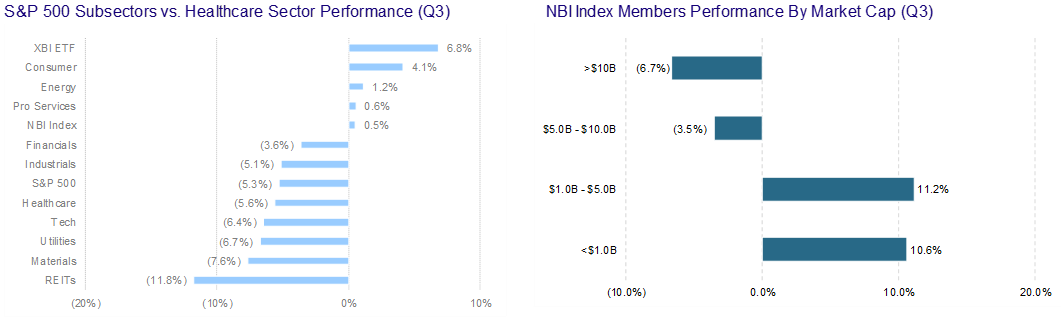

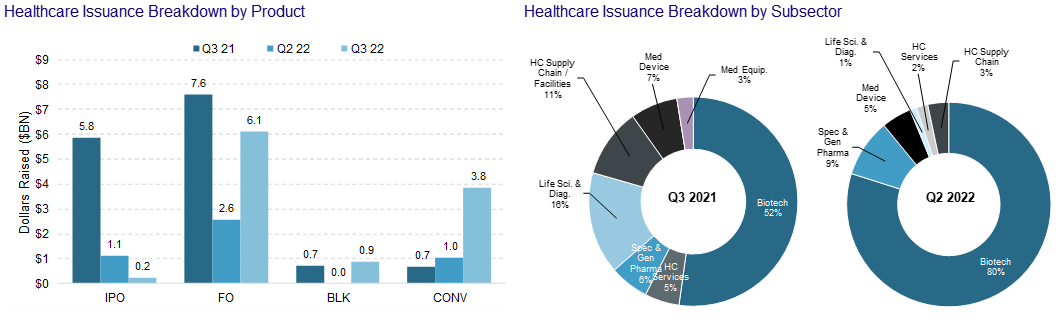

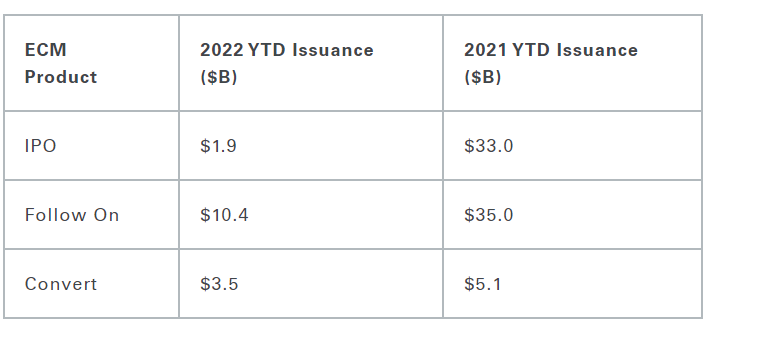

Another quarter comes to a close and, unfortunately, not much has changed. Biotech/Healthcare remains hostage to external macro forces. The volatility and the risk-off sentiment has taken a toll on equity issuance.

Source – Ipreo

We will note that converts held up better than other items on the ECM menu. In our opinion, this stems from the fact that issuers like the idea of issuing equity at higher levels – achieved by the conversion premium. We also believe that issuers enjoy selling volatility at these elevated levels. Finally, investors still have appetite for converts despite the back up in yields. A lot of convert paper has or is maturing…convert funds are keen to reinvest maturing proceeds. Shameless commercial – Mizuho is off the charts at pricing, distributing and trading convertible bonds.

The general themes remain the same:

- IPOs continue to rely upon the support of existing investors

- Follow-ons are largely catalyst driven

- Follow-ons are largely wall crossed

- Follow-ons also rely upon existing holders making pre-funded warrants the flavor of the day

- Registered Directs and PIPEs have become far more common place

Some of the highlights of the quarter:

- ALNY - lots of eyes (and dollars) on APOLLO-B data in ATTR amyloido-sis

- MRNA – shorts were caught off sides by their earnings print and the size of their buyback.

- Some M&A – PFE deploying some Covid bucks for GBT.

- BIIB and its development partner Eisai …+ve Phase III trial results for their potential blockbuster new treatment for the Alzheimer’s disease.

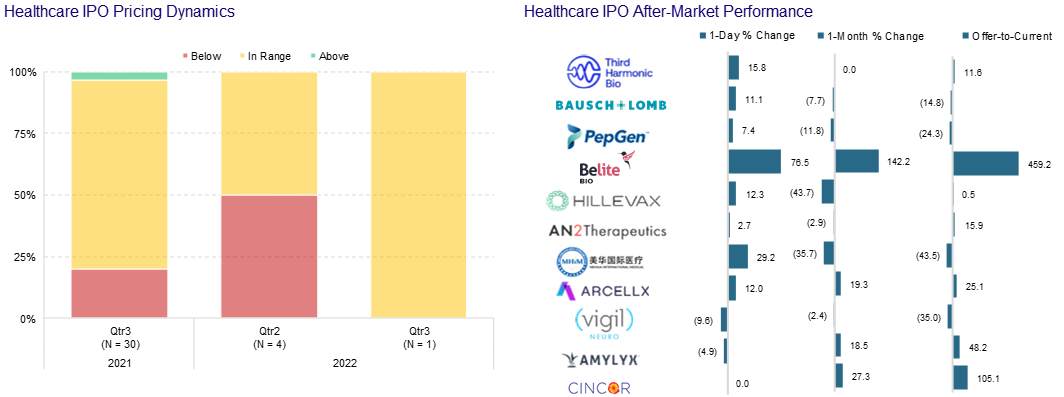

IPO Recap:

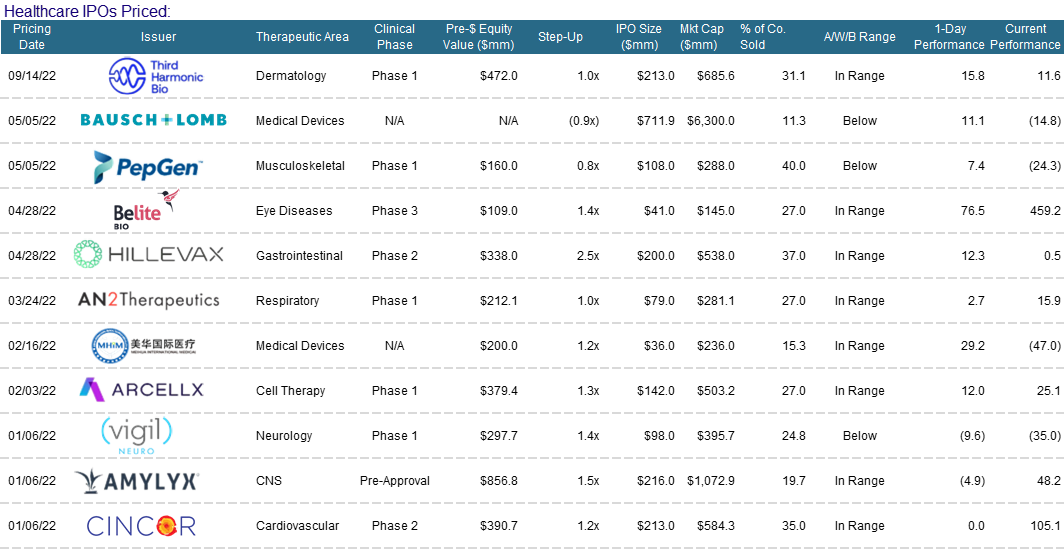

One in a row this quarter! Third Harmonic Bio (THRD) took in ~$213m pricing their IPO at $17...a skosh above their $16.83 B round from last year. THRD rallied out of gate and settled in to the $18 level. Seriously – no complaints in this tape. Third plans to use the IPO proceeds to fund Phase Ib trials for its treatment for itching caused by hives and other types of allergic reactions. They were founded by Atlas Ventures and they are backed by Orbimed and General Atlantic.

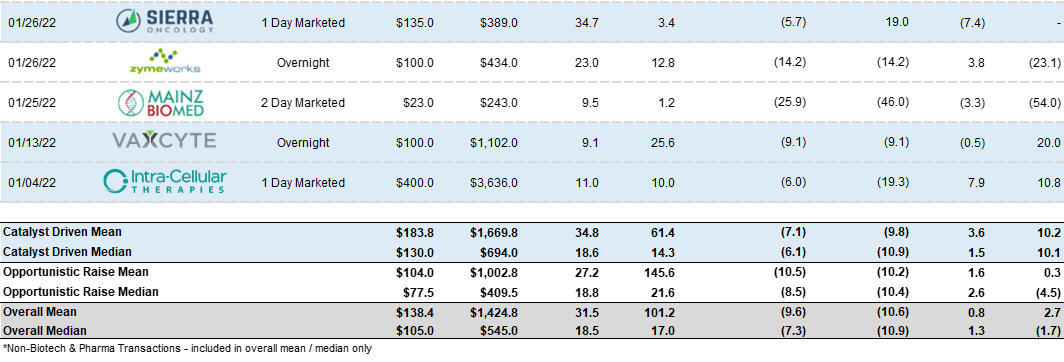

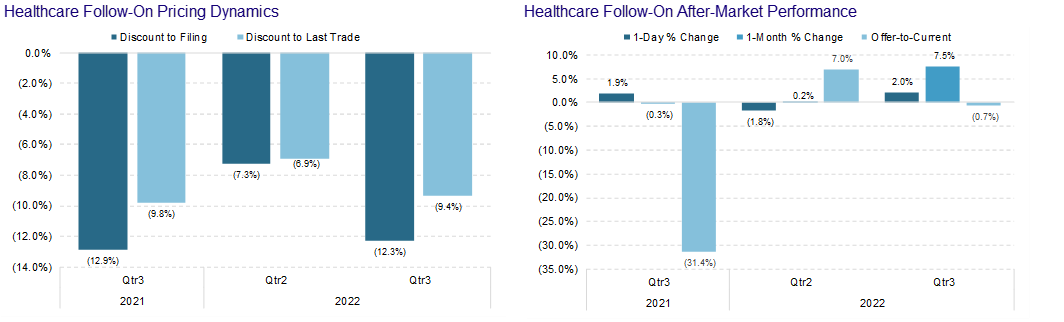

Follow-On Recap:

Despite the carnage - we saw 40 follow-on transactions in the 3rd quarter. Activity was characterized by higher incidence of registered directs and PIPEs. I will highlight a subset as the themes listed above have not changed from the 2nd quarter.

PIPES/Registered Directs:

Cancer-focused small molecule specialist Syros Pharmaceuticals raised $130m from a PIPE financing alongside its merger with Tyme Technologies. Syros agreed to sell 138.1m shares/pre-funded warrants at 94 cents each and the same number of warrants with an exercise price of $1.04. Syros shares had closed at 87 cents. The premium placement allows Syros to raise > 20% of market cap. Had they executed the PIPE at a discount to the current market price, they would have been confined by that limitation on raise as a percentage of market cap. Flagship Pioneering, Avidity Partners, Bain Capital Life Sciences, Invus and Cowen Healthcare Investments were among the new and existing holders that participated in the PIPE.

AlloVir (ALVR) took matters into their own hands. AlloVir is an issuer focused on immuno-compromised individuals, including patients that have undergone organ transplants. It raised $126.6m from a registered direct offering (RDO) that provides it with enough money to fund development into 2024. The proceeds will fund registration trials. Gilead signed on as a new investor, adding strategic fo-shizzle to the funding.

Ventyx (VTYX) Biosciences was 2021’s second-best performing IPO - up nearly 130%. They took the unusual step of raising capital via a $176.6m PIPE rather than a marketed follow-on. This avoided the need to market for two days – a requirement that goes hand in hand with being an unseasoned issuer (less than 1 year as a public company). They priced the PIPE at a 10% discount to last sale. The PIPE was led by new investors Redmile Group and Boxer Capital. The company recently updated investors on its ongoing Phase II trial for the treatment of ulcerative colitis. Ventyx is planning to launch two separate Phase II trials for psoriasis and Crohn’s disease.

Allakos (ALLK) was able to secure $150m from a registered direct offering (RDO) despite a less than stellar Phase III trial for a gastrointestinal drug. They used a backward-looking mechanism to set the price – selling 9.9m shares at $5.02 or the trailing five-day VWAP. Allakos last publicly sold stock via a $250m follow-on offering at $82.00 in October 2020. That’s right…from $82 to $5.02. They had once traded above $110.00 - less than a year ago.

X4 Pharmaceuticals (XFOR) raised $55m from the sale of shares and warrants to institutional investors via a PIPE. They issued 50.9m X4 shares (or pre-funded warrants) at $1.095 plus warrants to buy the same number of shares. X4’s market cap prior to the offering stood at just $30m amid concern it was running out of cash ahead of the expected Q4 release of top-line Phase III data for its treatment for the rare immunodeficiency disorder, WHIM Syndrome. Again – this transaction required anchor investments from existing investors including Bain Capital Life Sciences, OrbiMed and AXA Investment Managers.

Regular Way Follow-ons:

Pliant Therapeutics (PLRX) ripped higher (+159%) after posting stellar results from a clinical trial of its lung disease drug. On the back of this pop, the company was able to launch a $150m offering that was ultimately upsized to $200m. Given the strength of the results and the stock’s rally, Pliant was in a position to execute their capital raise without a wall cross (rare!). Some new investors did show up for this transaction – but it is important to note – that the new players only showed up after some element of de-risking – a sign of the times. The discount to last sale was only about 8%...a small concession to make given the meteoric rally.

Bellus Health (BLU) secured $153m from an overnight stock sale to fund an upcoming Phase III trial of its chronic coughing drug. Unlike Pliant, they launched their transaction as covered via wall cross. They priced the trade at $9.25 but the stock could not hold the level…retreating to $8.95. It has since recovered. The new financing added to $234m of cash at March 31, an amount that was supposedly sufficient to fund it through 2024.

Cancer drug developer, Revolution Medicines (RVMD) raised an upsized $230m from an overnight stock sale but paid a heavy price for the new capital. They placed 11.5m shares at $20.00, the bottom of the $20–$21 range marketed overnight and an 18.6% discount to the $24.58 last sale. The transaction was launched at $200m – fully covered via wall cross. This seems to be another transaction that leaned heavily upon existing investors. Revolution recently reported early results from a Phase Ib trial of a lung cancer drug it is developing in collaboration with Amgen.

Verve Therapeutics (VERV) raised an upsized $225m from a stock sale last that was marketed on an overnight basis. They launched their transaction simultaneous to announcing a collaboration with Vertex Pharmaceuticals on a liver disease drug. Again – this transaction was launched as covered via CMPO. It was initially launched as a $200m offering. While Verve priced with a 25% file to offer discount – the stock was up 150% prior to the offering.

Chinese biotech - Legend Biotech (LEGN) - took a full day to market a $250m (at launch) follow-on offering. Legend had pre-announced Q2 sales for its CAR-T multiple myeloma drug of $24m - a positive launch. While the transaction represented a small percentage of mkt cap, the issuer still opted for a wall cross. Legend will use some of the proceeds of the upsized offering (upsized to $350m) to bring manufacturing in-house next year. While the deal represented limited dilution, the stock did pull back about 14% during the marketing window.

Lexicon Pharmaceuticals (LXRX), posted a $75m overnight raise (upsized to $85m) - continuing the trend of data-dependent financings. Invus Group, the New York PE/VC firm, exercised preemptive rights on the raise - allowing the firm to retain its current 50.5% ownership. Invus has been committed to Lexicon for over 10 years. The offer price came toward the bottom of the $2.45–$2.60 range marketed overnight and a steep 23.5% discount to the $3.27 last sale price. Lexicon cleared a key regulatory hurdle when the FDA accepted a new drug application (NDA) for its heart failure drug.

On the back of the approval of their new plaque psoriasis drug, Arcutis Biotherapeutics (ARQT) raised $150m from an overnight stock sale to fund the drug’s commercial launch. The stock was offered in a range of $19.50–$21.00, the bottom of the range in line with the previous close and a 7.6% premium at the top end. This seemed bold, but it is only fair to acknowledge that ARQT pulled back 22% while the offering was confidentially marketed. The transaction was ultimately priced at $20 and traded up in the aftermarket. It has since pulled back with the tape. Mizuho is proud to have acted as a Lead Manager in this transaction!

Poseida (PSTX) priced $70m of equity (upsized from $50m at launch – covered via wall cross) at $3.50/share…a 22% discount to the previous close. The discount may seem steep but is in keeping with the stock’s Herculean rally post announcing their collaboration with Roche.

CinCor Pharma (CINC) used positive Phase II trial results showing double-digit reductions in blood pressure in patients with uncontrolled hypertension as a launching pad for the biotech’s first public stock sale since its Nasdaq IPO in January. They put in the mandatory two days of public marketing on 6m CinCor shares/pre-funded warrants. CINC had rallied 49% on the data. Pre-funded warrants expose the heavy support expected from existing investors. They priced their deal at $30 – a 14% file to offer discount. Not bad considering the rally mentioned above and the fact that they were able to upsize to 7.5m shares.

Mirum Pharmaceuticals (MIRM) raised ~ $80m of new funding from an overnight stock sale after hitting a new 52-week high earlier this week. The offering was confidentially marketed and priced at the low end of the marketing range ($23 - $24) off a $27.49 close…a 16% file to offer discount. The biotech is cashing in on its post-Q2 gains to expand development of its drug Livmari, an FDA approved treatment for severe itching caused by a systemic liver disease.

Staying with the theme of issuance on the back of positive data - UK-based Verona Pharma (VRNA) pounced on positive Phase III trial results for a potential blockbuster lung disease drug. They priced 10m ADS at $10.50/share – up from the $10.03 previous close. The stock has already popped almost 60% on the trial results. Verona’s drug is a potential treatment for chronic obstructive pulmonary disease (COPD).

Karuna Therapeutics (KRTX) launched a $600m follow on offering (upsized to $750m) capitalizing on positive Phase III trial results for its schizophrenia drug. Karuna ripped up 72% post the results. Management said that it plans to apply for FDA approval by the middle of next year. In addition to schizophrenia, Karuna is running clinical trials of the same drug in patients with bipolar disorder, Alzheimer's disease and other neuropsychiatric disorders.

In more of an opportunistic raise, Cerevel Therapeutics (CERE), a direct competitor to Karuna and a former SPAC looked to capitalize on their symbiotic rally with KRTX. They launched $500m from a two-part offering of common stock and five-year convertible debt to help fund clinical trials of their own schizophrenia drug. The equity and CB are both sized at $250m, the latter was marketed at a 2.75%–3.25% coupon and 27.5%–32.5% conversion premium. Cerevel, which merged with SPAC Arya Sciences Acquistion II two years ago, closed at $41.42, up 4% thanks to the correlation with Karuna. The CB was upsized to $300m and the coupon priced through the tight side of the range at 2.5% while the premium was 27.5% - the tights. The common priced at $35…a 15.5% discount to last sale but still a great outcome when considering the rally that CERE enjoyed.

Not everyone can make it through the wire. Rani Therapeutics (RANI) shares cratered in mid-August after the oral biologics specialist attempted to bring a $50m marketed stock sale that piggybacked on an earlier confidential marketing effort. Rani had announced positive Phase I trial results for its osteoporosis drug. Rani shares plunged 25.9% to $8.23 leading them to cancel the offering.

Viridian Therapeutics (VRDN) launched a $175m offering – only to upsize to $225m. The shares had a 49% surge following the release of Phase I/II data on its drug to treat thyroid eye disease (TED). The shares rose another 14.75% to $25.25 post the offering.

Unity Biotechnology (UBX) was able to raise 55% of their market cap after posting exceptional data for the DME – Diabetic Macular Edema – platform. They raised $45m after launching a $25m base deal – a significant upsize on the back of very strong demand. They did have to offer a fairly robust discount (28%) along with 100% warrant coverage. When considering the raise relative to market cap and the fact that they now have capital into 2024 – the ends justify the means. Mizuho was an active book runner on this transaction.

Akero Therapeutics (AKRO), a developer of NASH drugs, launched a $175m follow on offering after surging 136.8% on Phase II trial. The message from the syndicate was that there was heavy reverse on this trade. Akero is using the money to fund an expanded Phase III trial.

Revance Therapeutics (RVNC) raised an upsized $200m (initial launch was $150) from its overnight stock sale albeit, at a healthy discount. They sold 8m new shares at $25.00, the low end of the $25.00–$26.00 range and a steep discount to the $28.09 last sale. Demand was pre-confirmed via a wall cross. We heard that 65% of the offering was placed with 10 institutions. Revance used the catalyst of The FDA clearing their anti-wrinkle drug.

Edgewise Therapeutics (EWTX) opted to upsize their follow-on stock sale despite a steep decline while the transaction was marketed. The offering was priced at last sale ($10.32), which is misleading given the stocks 25% file to offer discount. It also hurts that this is the company’s first financing since its IPO priced at $16.00 last year. They will use the transaction proceeds to fund a Phase II trial for their drug to treat Duchenne muscular dystrophy. Edgewise’s DMD drug is an oral alternative to Sarepta’s DMD gene therapy treatment.

Rhythm Pharmaceuticals (RYTM) took in $100m from an overnight stock sale to help ramp up global sales of its newly approved obesity drug. They were marketing a fixed-size offering at $25–$26, up to a stiff 19% discount to the closing price. This too was a wall crossed trade. The stock did jump 24% while the cross was going on.

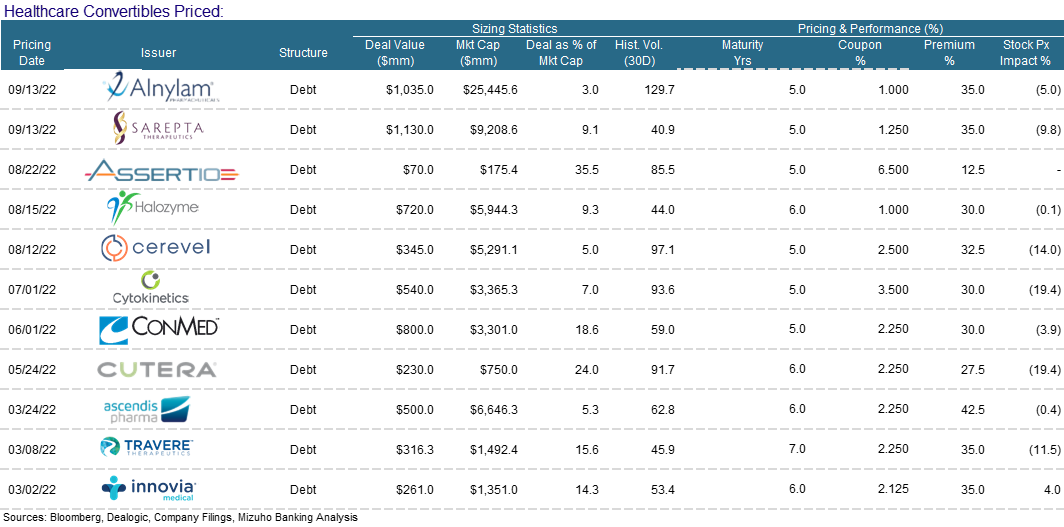

Convertibles:

Alnylam Pharmaceuticals (ALNY) termed out floating-rate bank debt with a new $900m five-year CB, significantly reducing its borrowing costs. They marketed the CB for one day today at a coupon and conversion premium of 1.25%–1.75% and 30%–35%. They priced the bonds at a 1% coupon, through the aggressive end of 1.25%–1.75% coupon talk. They were also able to secure a 35% conversion premium, the high end of 30%–35% talk.

Similarly - Sarepta Therapeutics (SRPT) launched a $1bn five-year CB to help cut bank debt and repurchase an existing in-the-money CB. The transaction was marketed at a coupon and conversion premium of 1.25%–1.75% and 32.5%–37.5% respectively. Like Alnylam, Sarepta, is using the money to repay and terminate a $550m term loan on which it pays 8.5% annually and it is also buying a capped call. Sarepta managed to raise $980m (or $1bn in total) despite a difficult tape. They scored the tights on the coupon - 1.25% and 35% conversion premium – mids.

Halozyme (HALO) secured $625m (upsized from $500m) from the sale of new CB to complete a recapitalization. They bought back both stock and existing convertible bonds, fully repaid a term loan and they still had some extra bling to repurchase more stock in the open market. The transaction priced at a 1% coupon and 30% conversion premium, toward the aggressive ends of the 1%–1.5% 27.5%–32.5% price talk. Mizuho was proud to be a co-manager on this transaction.

Alternative Capital and Belt Tightening:

Royalty Pharma (RPRX) can fund its $1.3bn purchase of drug royalties from Theravance/Innoviva with cash. They are clearly generating enough bling to grow their portfolio organically. This comes on the heels of Royalty Pharma’s purchase late last month of a drug royalty from Blueprint Medicines for $175m, a portion of a $1.25bn royalty/credit facility financing package the cancer-focused drug developer signed with Royalty Pharma and Sixth Street Capital. Non-equity solutions are growing part of the solution set for cash strapped biotechs.

CytomX (CTMX) announced a restructuring and pipeline reprioritization (press release, 8-K) that should extend the cash runway into 2025 from 2024. Extending runway and prioritizing pipeline assets are positive, particularly in light of the current environment.

Fulcrum Therapeutics (FULC) raised $75m from a stock sale to help fund clinical trials of its two most promising drugs. They priced 9.6m shares at $7.82, a zero discount to the previous closing price. In an effort to preserve capital, Fulcrum is channeling its resources into a Phase III treatment for a rare type of muscular dystrophy and a Phase Ib treatment for sickle cell disease (SCD) at the expense of its broader preclinical pipeline. Fulcrum plans to lay off 25% of its staff.

M&A:

Pfizer Inc announced the acquisition of Global Blood Therapeutics Inc for USD 4,618.23M. The transaction was announced on 08/08/2022 and is expected to be completed by 12/31/2022.

Frazier Healthcare’s SPAC - Frazier LifeSciences Acquisition - reached an agreement in late-July to merge with Dutch biotech NewAmsterdam Pharma. The financing is coming at the end of the SPAC’s life and is designed to fund the company into 2026. Frazier secured $235m of new PIPE funding, including new money being invested by Frazier itself as well as commitments from Bain Capital Life Sciences, RA Capital and GMT Capital. Redemptions may still represent and issue. Frazier LifeSciences’ shares closed at $9.91, suggesting IPO investors are likely to redeem rather than help fund the merger.