HC Equity Capital Markets Commentary

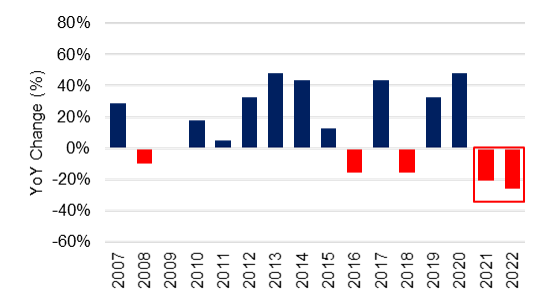

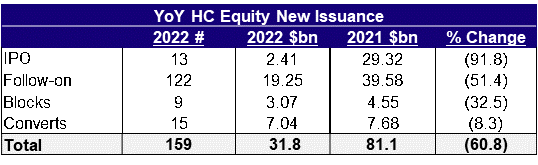

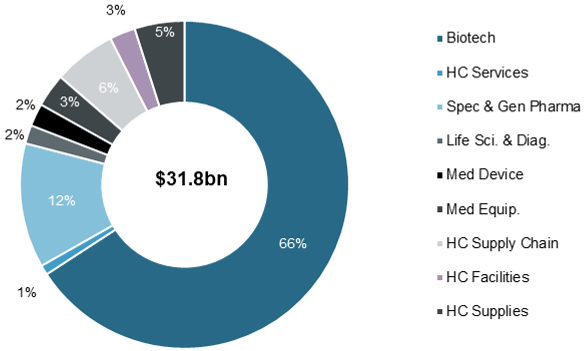

Macro headwinds took their toll on the healthcare sector in 2022 resulting in significantly reduced Equity Capital Markets activity. Hawkish central banks all over the world continue to tighten the liquidity spigot. Their war on inflation saw equity markets taking shrapnel. The S&P is ~20% lower than where it was a year ago. The XBI ETF (Biotech) is ~26% lower than its 2021 closing level. Most private companies chose to remain private leading IPO issuance to drop from $29BN last year to $2.4BN this year. Follow on activity was cut in half –dropping from ~$40BN to $19BN.Most of the follow-on activity was catalyst driven and confidentially de-risked via wall cross. Convertible issuance remained flat year over year at $7BN.

HC IPOs & Follow-ons

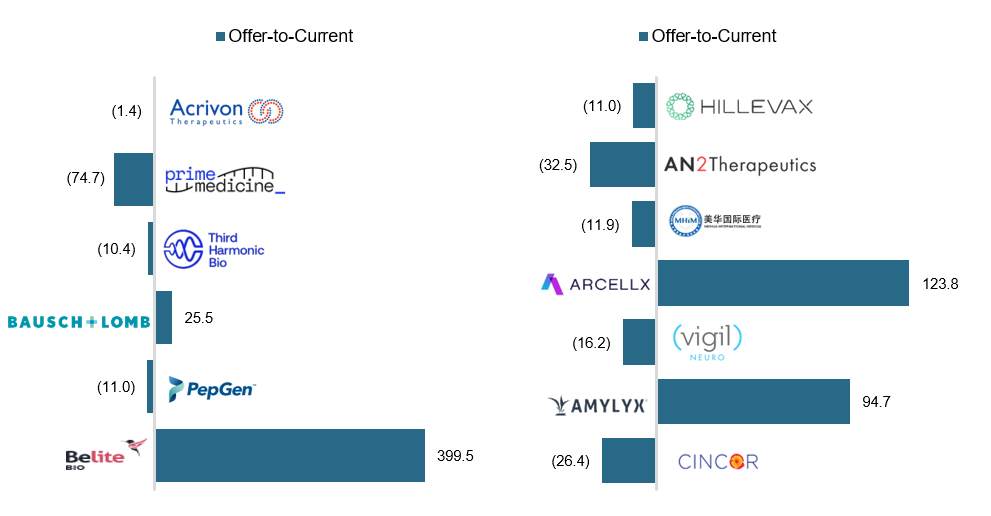

There were only a handful of IPOS in 2022 and they were supported by a handful of existing investors. The IPO class of ’22 experienced extreme volatility. They were up 93% in Q2 of this year only to drop 75% in Q3.Investors that have maintained their positions to date are up about 6%.

Follow-ons came with a 10% file to offer discount on average. On the surface, this may not seem so Draconian but it is important to keep in mind the pull back in valuation and the fact that the majority of the issuance came concurrent with very positive catalysts. Importantly, these transactions have created alpha for investors. Participants in these offerings were ~6.5% richer if they held their positions for 30 days post issuance.

HC Convertibles

Broadly, Convertibles started the year slow, but saw a flurry of issuance towards year-end as the equity-linked product started to become a cheaper financing option relative to raising straight debt and issuers capitalized on the elevated volatility of their stock price.

Of the $7BN issued from the healthcare space in 2022, 2 of the notable convertible transactions came from Sarepta and Alnylamin what were akin to refinancing trades utilizing the product to take out more expensive forms of debt and in the case of Sarepta, repurchasing an existing convertible that was in-the-money. Cytokinetics also tapped the market to refinance its existing convertible that was deeply in-the-money, putting a larger convertible in place with a higher conversion price and lower coupon.

We expect to see a significant uptick in CB issuance in 2023 given the broader interest rate backdrop. Additionally, as most issuers are not enamored with their current valuation and many would welcome the opportunity to issue equity at a premium to current levels. The utilization of a capped call will allow issuers to push their effective conversion premium even higher.

Market Performance Summary

HC IPO Performance –Offer to Current

HC Issuance by Sub-Sector -2022

2022 Themes and Thoughts

So, what were some of the important lessons in 2022?

Discipline has been lacking amongst the biotech investing community for years. We are paying the price for that excess now.

Issuers need to be prepared and flexible. We are not expecting a check mark recovery in 2023.2022 has shown us that issuers need to be prepared to exploit positive catalysts. Wall crosses are the new “orange”.

Privates should try to remain private for now. It is easier to pivot as a private if your lead R&D asset fails. This is not possible as a public issuer right now in this environment.

With the above in mind, investors should embrace platform plays now. Why? Circling back to the pivot comment above, you need to have something to pivot to. A single asset company has no fallback if the asset fails…and, truthfully, failure happens more often than not. This is important as the aforementioned sentiment deviates from bulk of the investor dialogue that we have. In this distressed tape, most investors want biotechs to focus all their capital and attention on a single lead asset. This is understandable when considering the capital drought that we are experiencing. However, the platform argument makes a huge amount of sense when one looks at the stats related to drug approval and success.

2023 Expectations

What can we expect in 2023?

As mentioned above, we see nothing cathartic in the calendar flip on Jan 1.We will still be facing central bank and macro headwinds.

The term “baby shelf” sounds innocuous…even joyful. It is anything but. Many biotech issuers may have to come to terms with this issue. If their public float is less than $75mm, they will only be able to issue 1/3 of their float in a registered offering. This may lead to some “rip the band aid” offerings prior to being categorized as a “baby shelf” issuer. It may also lead several companies to simply take a knee.

Light at the end of the tunnel!

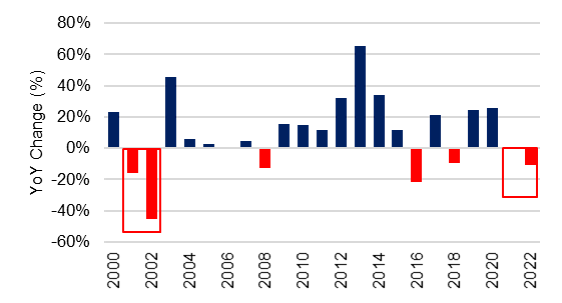

- Biotech has never seen (3) consecutive years of negative returns. We have been in the shed for (2) now and enough is enough!

- This is the second most significant air pocket ever experienced in biotech. Only the bursting of the genomics bubble in 2001 left more bodies on the battlefield. The carnage has resulted in much more reasonable valuations. Biotech NTM EV/Sales multiples are at 5-7x…well below the 9-14x multiple we experienced in 2015.

- Investors are getting very excited about progress in Alzheimer’s and obesity. These are massive TAMs and alpha generated here will likely spill into other therapeutic categories within biotech.

- We will ultimately get to terminal short term rates. Mizuho sees fed funds topping at 5.5%.

- Drug pricing regulation should not be as relevant a concern with a divided government.

- M&A. Large cap has a great deal of fire power and current valuations represent an opportunity to take in fresh IP.

NBI Historical Performance

XBI Historical Performance