Takeaways from the ICR Conference 2023

Mizuho was excited to be back at the ICR Conference in Orlando, FL where we met with many of our corporate and sponsor clients across the consumer and retail industries landscape. With over 2,900 attendees and 250 presenting companies (public and private), ICR was back in full swing.

Amidst the uncertain macro backdrop, conversations ensued around the probability and severity of a 2023 recession, the related impact on various Consumer & Retail sub-sectors, and the implications for C&R deal making and capital raising. While some caution was in the air, sponsors and well-capitalized corporates remain eager to put capital to work (selectively) behind organic and inorganic growth opportunities.

Recession fears and the step change in interest rates has shifted investor sentiment towards C&R companies exhibiting “growth with defense” in the form of pricing power and visible profitability. A key topic on the Consumer M&A Panel was the impact of the rate reset and disruptions in financing markets pressuring “LBO math” for financial sponsors and leveraged corporate acquirors. Relative outperformance and still-full valuations for defensive Consumer companies creates both opportunities and challenges for M&A and capital markets activity in the sector. However, signs of green shoots are emerging. Rounds of commodity-driven price increases have largely run their course, spotlighting winners and laggards from a demand elasticity standpoint (and resulting in “cleaner” EBITDA adjustments for sellers). Easing commodity inflation coupled with normalizing supply chains and inventory levels have facilitated a more constructive backdrop.

Our team shares some topline takeaways here:

State of the Consumer and Economizing

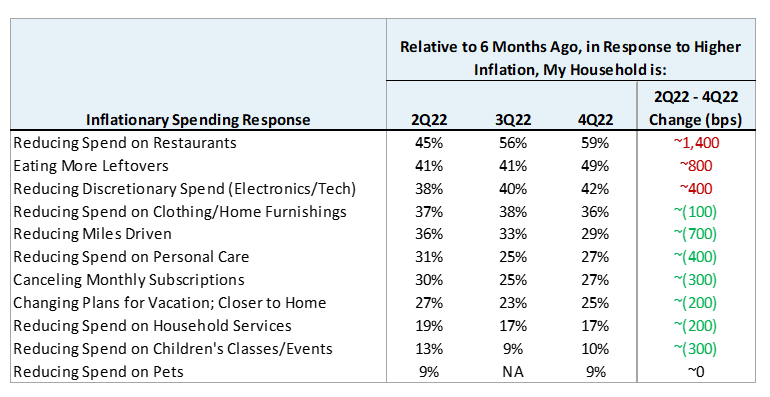

While employment metrics remain strong, the consumer is increasingly facing more uses than sources of cash. Signs of constraint emerged in Q4 around consumer discretionary spending and preferences, as evidenced in the below data gleaned from a Mizuho Equity research survey. In response to inflation, consumers are tightening their belts with discretionary restaurant, food and electronics spending. Notably, respondents indicated they were less willing to cut back on car miles driven, personal care or household and child services relative to other sacrifices.

Source: MSUSA Research, Mizuho 2023 Food and Healthy Living Outlook, January 6, 2023 (File Link)

Despite the building consumer pressures, CPG companies were largely successful in implementing price increases throughout 2022, though not without some demand elasticity offset. Unsurprisingly, private label food sales gained share in 2022, reversing 2021 losses. While price gaps between branded and private label food narrowed somewhat in the last three quarters of 2022, store brands are expected to continue their positive trajectory as consumer trade down accelerates. Many differentiated “challenger” brands have succeeded in appealing to adventurous Gen X and Millennial consumers – others face headwinds as higher price points need to be justified with clear value propositions, marketing budgets are under pressure, and some categories are susceptible to fad risk. Value oriented sub-sectors, such as discount retailers, scaled general merchandisers and QSRs are also likely to continue gaining share.

Market Outlook: M&A, Equity and Debt Financing

From an equity market standpoint, strong performing companies are beginning to dust off previously filed S-1s and starting to write new ones, with large corporate carve-outs likely to be among the first to test the IPO market in late Q1 or Q2 2023. While the IPO market for unprofitable, high-growth companies is largely closed for the foreseeable future, broader expectations are for a more open and constructive IPO market for quality companies in the second half of 2023. We also expect convertible debt to continue to be popular for public companies, in particular investment grade issuers, with elevated interest rates and more favorable accounting treatment creating an optimal environment for corporates.

From an M&A perspective, the rising cost of capital will continue to position well-capitalized strategic acquirers advantageously, with large corporates able and willing to pay outsized multiples for high conviction ideas and disruptive concepts. A bid / ask spread between buyers and sellers persisted in 2022 and resulted in some postponed or stalled sell-side auctions. Significant EBITDA adjustments due to price increases and commodity volatility also hampered underwriting confidence and overall activity. With these adjustments cycling through and some tempering of seller valuation expectations, bid /ask spreads are expected to narrow and consumer M&A activity levels should recover. A pickup in some closely followed Consumer transactions towards year-end provides some evidence of this. Separately, activism has been a factor in the sector and could catalyze more take-private activity, particularly in Retail where multiples have generally compressed and stock prices remain challenged.

Regardless, thawing in the financing markets is an important pre-condition to a broader recovery in M&A, particularly for Consumer & Retail focused financial sponsors. Bank loans and direct lenders have filled some of the acquisition financing void created by the lack of institutional debt market liquidity. Sponsors have increasingly turned to creative, bespoke structures to close transactions – in some cases incorporating seller financing, back leverage or over-equitized capital structures. Additionally, alternative asset managers with special situations funds are also seeking to provide subordinated capital. This pattern is likely to continue through early 2023 as private equity investors seek to put significant dry powder to work in the Consumer sector.

In sum, 2023 promises to be another dynamic year in Consumer & Retail as the market continues to evolve!