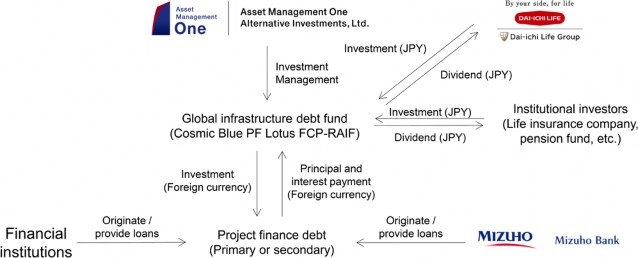

Asset Management One Alternative Investments, Ltd.1 (hereinafter referred to as "AMOAI"; president & CEO: Manabu Ando) and the Dai–ichi Life Insurance Company, Limited (hereinafter referred to as “Dai–ichi Life”; president and representative director: Seiji Inagaki) have announced the joint development of an investment scheme targeted at infrastructure debt. Under this scheme, AMOAI launched the infrastructure debt fund dubbed "Cosmic Blue PF Lotus FCP–RAIF" (hereinafter referred to as the "Fund") on October 26, 2018 with Dai–ichi Life contributing 20 billion yen as the anchor investor. In relation to this scheme, Mizuho Bank, Ltd. (hereinafter referred to as "MHBK"; president & CEO: Koji Fujiwara) also announces the development of a collaborative structure for working with AMOAI.

The Fund is the second infrastructure debt fund managed by AMOAI, as an investment management company, after Cosmic Blue PF Trust Lily, which was launched in July 2016 that received awards recognized internationally2 in March 2018 in the field of infrastructure and private debt investment.

As a vehicle to connect the capital of Japanese investors with the global infrastructure markets, the Fund will offer attractive investment opportunities to investors and will support the financing of the infrastructure industry, which is indispensable for the sustainable growth of countries and local communities invested in. Further, similar to the first fund , the Fund aims to provide long–term stable income to institutional investors such as life insurance companies and pension funds by offering globally diversified portfolio in project finance debt.

Moreover, to further capture attractive investment opportunities, the Fund will expand its investment target from secondary to primary and will be involved in deals from origination. AMOAI plans to increase the Fund's assets under management for infrastructure debt to around 100 billion yen–the top level in the world for infrastructure debt–by having a wide investor base.

AMOAI will continue to provide infrastructure investment opportunities to both Japanese and overseas institutional investors by utilizing Mizuho's extensive knowledge and insight in project finance, combined with the know–how of asset management. AMOAI also aims to increase its presence as an asset manager specializing in infrastructure debt through the launch of the Fund, and will continue to develop new investment products that satisfy the needs of institutional investors.

Dai–ichi Life will aim to further improve investment returns by expanding investment in infrastructure–related debt through the investment in the Fund.

MHBK will continue to aim to satisfy the needs of investors that have an increasing appetite for infrastructure projects by promoting origination and distribution through its collaboration in this Fund, along with continuing to increase its presence in the area of overseas project finance by expanding its engagement in this area.

Scheme (Outline)

| Fund name | Cosmic Blue PF Lotus FCP–RAIF |

|---|---|

| Investment advisory company | Asset Management One Alternative Investments, Ltd. |

| Purpose and target of the investment | Diversified investment in infrastructure projects that have long-term stable cashflow based on offtake agreements, etc.; the target projects are those providing indispensable infrastructure to society, such as electricity, transportation, water supply, sewage systems, and hospitals. |

| Target investment areas | Worldwide |

- 1AMOAI (formerly, Mizuho Global Alternative Investments, Ltd.) became a wholly owned subsidiary of Asset Management One Co., Ltd. (president & CEO: Akira Sugano) jointly funded by Mizuho Financial Group, Inc. and Dai–ichi Life Holdings, Inc. on November 1, 2018.

- 2AMOAI was awarded the Infrastructure Investor Award 2017 – Debt Fundraising of the Year, Global and Private Debt Investor Award 2017 – Infrastructure Debt Manager of the Year, Asia–Pacific by PEI Media Group, a major alternative investment information provider, on March 1, 2018 for managing Cosmic Blue PF Trust Lily. These annual awards are given to corporations that have achieved outstanding performance and results in the areas of infrastructure investment and private debt investment.