Marubeni Corporation (hereinafter, “Marubeni”; President & CEO: Fumiya Kokubu), Mizuho Bank, Ltd. (hereinafter, “Mizuho”; President & CEO: Koji Fujiwara), and Asset Management One Co., Ltd. (hereinafter, “AM–One”; President & CEO: Akira Sugano) have reached an agreement regarding the establishment of a fund specialized for equity investment in overseas infrastructure assets, as well as a managing company for the fund, targeting institutional investors both in Japan and abroad.

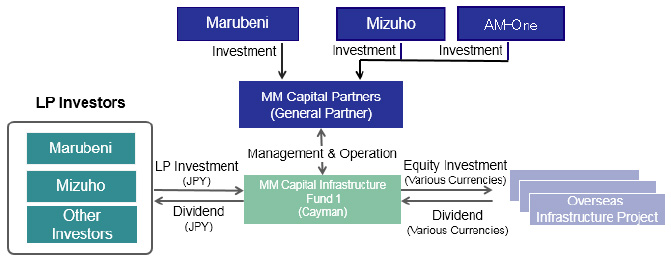

Three companies all contribute to establish MM Capital Partners Corporation (hereinafter, “MMCP”; President & CEO: Tomohide Goto) as the management company for the “MM Capital Infrastructure Fund 1” (hereinafter, “the Fund”), with the objectives to make equity investments in private–sector led overseas infrastructure assets and build a portfolio of assets. MMCP will be responsible for management and operation of the Fund.

The Fund will make investments within the transportation infrastructure sector and energy infrastructure sector, and will focus on assets that have already been operational and is generating a steady cash flow (brown–field), particularly located within member countries of the Organization for Economic Co–operation and Development (OECD). With this strategy, the fund will aim to mitigate risk factors like country risk and project risk, maintain income gain during the term, and provide long–term and stable investment opportunities to institutional investors like financial institutions and pension funds. Marubeni and Mizuho will invest in the Fund, and going forward the goal is to broadly invite number of investors to expand the capital managed by the Fund to ¥50 billion.

Marubeni, while expecting to create synergies in the Fund and utilizing its vast experience in overseas infrastructure investment, intend to contribute to the development and expansion of infrastructure world–wide by proactively engaging in overseas infrastructure investment projects, including development type project (green–field).

Mizuho will, through organization and management of the Fund, strengthen equity investment and other infrastructure business related initiatives, and further improve their presence in related fields and industries.

Finally, amidst growing interest and needs from clients to invest in alternative assets, including institutional investors, Am–One will strengthen their management capability of alternative assets by participating in the management for a fund which conducts investments in overseas infrastructure assets.

Organizational Outline

- *LP Investment: Limited Partnership Investment

| Name | MM Capital Infrastructure Fund I, L.P. (Cayman Islands Limited Partnership) |

|---|---|

| Operation & Management Company | MM Capital Partners Corporation |

| Main Business | Equity investments in overseas infrastructure (transportation and energy) assets. Specifically within the Organization for Economic Co–operation and Development. |

| Name | MM Capital Partners Corporation (Headquarters: Chuo Ward, Tokyo) |

|---|---|

| Representative | President & CEO: Tomohide Goto |

| Shareholders | Marubeni (90%), Mizuho (5%), and AM–One (5%) |

| Main Business |

Management and Operation of MM Capital Infrastructure Fund I, L.P. |