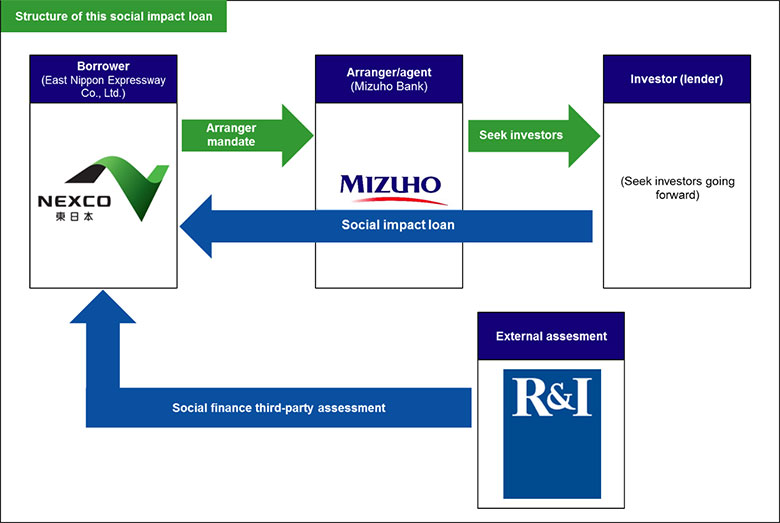

Mizuho Bank, Ltd. (President & CEO: Koji Fujiwara) has received the mandate as arranger for a syndicated social impact loan to raise capital for East Nippon Expressway Co., Ltd. (“NEXCO East”). This is the first social impact loan for which Mizuho Bank will act as an arranger.

Social impact loans are loans aimed at raising capital for businesses which are seeking to provide solutions to social issues. NEXCO East has created a social finance framework aligned with the International Capital Market Association's Social Bond Principles1 and is the first expressway operator to receive a third–party assessment regarding social finance2 from Rating and Investment Information, Inc. (“R&I”), what is referred to as the R&I Social Bond Opinion.

In its expressway business, NEXCO East is proactively contributing to society from the perspective of local community revitalization, disaster preparedness, promotion of traffic safety, and environmental conservation.

Mizuho Bank is actively pursuing sustainability initiatives and are pleased to syndicate a social impact loan as a means of supporting NEXCO East's efforts to address social issues.

At Mizuho, we are working to further incorporate sustainability initiatives into our strategy and strengthen our group–wide framework for promoting sustainability. We will draw on our insight as a financial services group to proactively provide a wide range of solutions, including providing capital raising support to businesses that are contributing to the achievement of the SDGs.

Overview

Borrower: East Nippon Expressway Co., Ltd.

Planned amount: 30 billion yen

Planned contract date: July 23, 2019

Planned effective date: July 25, 2019

Structure: See below

Structure of the loan

1: Social Bond Principles

Announced in June 2017 by the International Capital Market Association (ICMA), the Social Bond Principles promote integrity in the development of the social bond market by providing voluntary process guidelines.

2: Social finance

Social finance refers to any debt financing, including bonds or loans, where the capital raised will be used to address social issues (social impact).