Mizuho Bank, Ltd. (President & CEO: Masahiko Kato) is pleased to announce the launch of Japan’s first Sustainable Supply Chain Finance (SSCF) (the “Solution”) which is designed to support clients working capital needs and sustainability goals. The launch of SSCF represents Mizuho Bank Ltd.’s ongoing commitment to social responsibility and demonstrates its leadership in arranging Environmental, Social and Governance (ESG) financing in order to advance its broad ESG initiatives.

This Solution is designed to offer medium-sized and small-sized enterprises (the suppliers) with an incentive to adhere to environmental and social guidelines, thereby encouraging them to achieve CO2 emission reduction targets and take environmental and social action throughout the supply chain.

As the trend sustainability accelerates globally, especially the transition to the de-carbonization, the efforts to de-carbonize must also include the entire supply chain.

Recently it has mainly been large companies that have been required not only to control their own CO2 emissions (Scope 1, Scope 2) but also to take environmental and social actions throughout their entire supply chain and to reduce CO2 emissions (Scope 3). For these companies to promote the sustainability throughout the whole supply chain (“Responsible Supply Chain”), they require the cooperation of their medium-sized and small-sized suppliers.

With that said, in reality, many medium-sized and small-sized suppliers may find it difficult to respond to the requests from their large buyers to adhere to their ESG guidelines and this may cause difficulty in funding aspects for the suppliers. In order to support these suppliers and the clients supply chain, Mizuho Bank, Ltd. has developed a new framework of the Supply Chain Finance (the Solution) by offering funding incentives to medium-sized and small-sized enterprises (the suppliers). It aims to support the promotion of environmental and social initiatives such as de-carbonization of the entire supply chain.

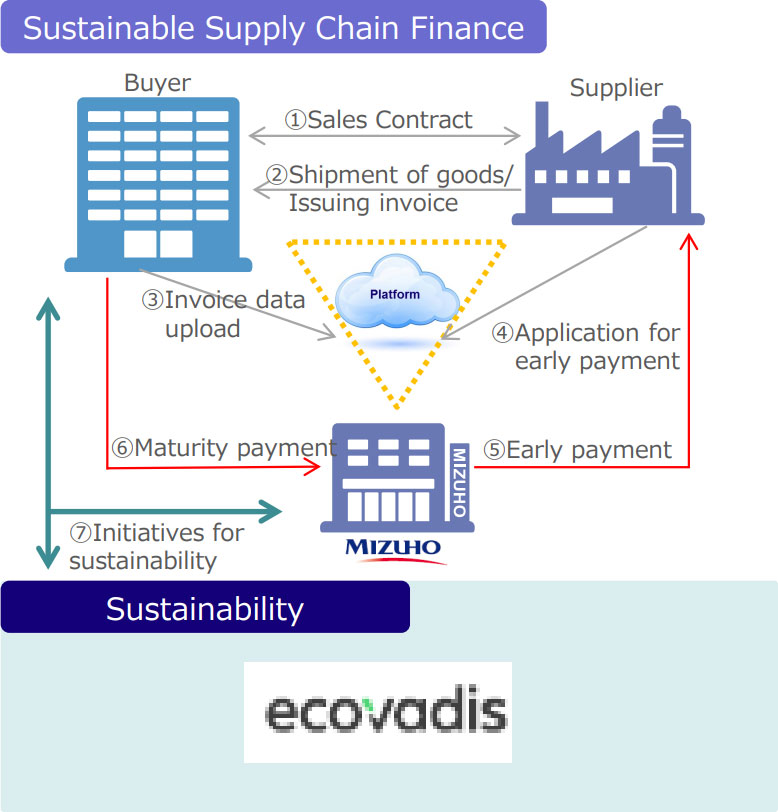

In terms of evaluating whether or not sustainability guidelines have been met, Mizuho Bank, Ltd. will use supplier’s ratings (sustainability performance) (*1) provided by EcoVadis, a French based professional sustainability rating agency, or other appropriate methods which Mizuho Bank, Ltd. deems appropriate. Mizuho Bank, Ltd. will provide financing to the suppliers on a supply chain platform which is globally operated and managed by Mizuho Bank, Ltd.

In order to ensure the effectiveness of the Solution and it’s conformity to the items expected under the international principles, “Sustainability Linked Loan Principles (SLLP) ” (*2), a third-party opinion (SPO) from Rating and Investment Information, Inc. (R&I), an external third-party evaluation organization, has been obtained.

In offering this Product, Mizuho Bank, Ltd. hopes to support both large and small customers in achieving their initiatives in the medium and long term. Mizuho Bank, Ltd. also supports the cooperative relationship between large companies (the buyers) and small and medium-sized enterprises (the suppliers) and contributes to build a stronger, more stable and more sustainable supply chain.

“Mizuho” is strengthening its efforts, “Sustainability Actions”, to realize a sustainable society, such as responding to climate change and transition to a de-carbonized society. Leveraging Mizuho’s knowledge as a comprehensive financial services group, “Mizuho” will contribute to clients desire to improve corporate value and to achieve SDGs(Sustainable Development goals) through Mizuho’s financing and consulting functions, and to actively engage in the development and offer diverse and innovative solutions.

The Solution Overview of Sustainable Supply Chain Finance

| Name | Sustainable Supply Chain Finance (SSCF) |

| Usage of funds | Working capital |

| Term | 1 Year (automatic renewal according to review) |

| Interest rate level | With preferential interest rates in response to improvements in EcoVadis evaluation, etc. (In principle, once a year evaluation: changes according to review) |

| EcoVadis Evaluation Category |

|

| Structure diagram |  |

(As of May 5, 2022)

(*1) EcoVadis evaluation method

1. Certification based assessment, 2. Considering industry type, country and size, 3. Multilateral evaluation based on various sources (NGOs, trade unions, international organizations, local governments, third-party organizations, etc.), 4. Using technology, 5. Evaluation by CSR experts, 6. Traceability and transparency, 7. Based on the 7 principles of continuous improvement efforts, CSR issues of companies are defined and evaluated based on international standards such as the 10 principles of the UN Global Compact, the International Labour Organization (ILO) Agreement, the Global Reporting Initiative (GRI) Standards, ISO 26000, the CERES (CERES) Roadmap, and the United Nations Guiding Principles on Business and Human Rights (Ragey Framework).

(*2) Sustainability linked loan principle

The Principles aim to promote and support environmentally and socially sustainable economic activities and growth. Guidelines developed in 2019 by a working group comprised of major financial institutions players in the syndicated loan market with the goal of maintaining the integrity of sustainability-linked loans and have been continuously updated since then.