Compliance with international financial regulations

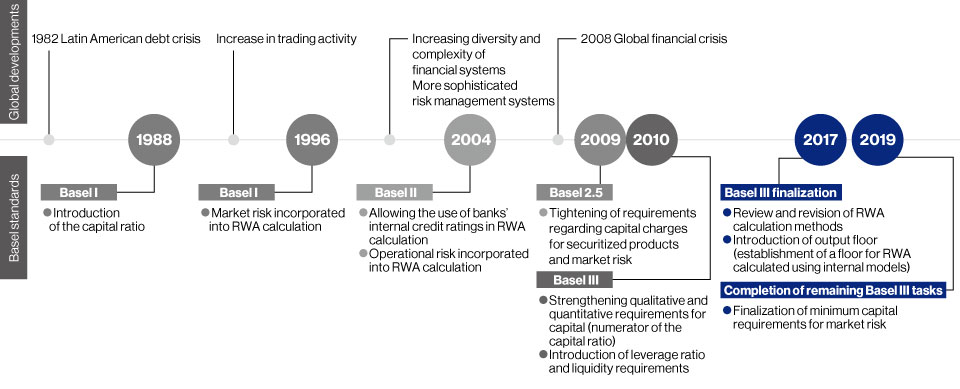

The Basel standards, a unified international regulatory framework for ensuring the soundness of banking institutions, were first created in 1988 (now referred to as Basel I). As the financial services industry and world affairs have developed, steps have been taken to steadily enhance this framework. Formulated in 2010, Basel III is a framework that tightened capital requirements along with introducing liquidity requirements to address issues that came to light in the 2008 global financial crisis. Regulatory reforms following the financial crisis were largely completed in 2017 (Basel III finalization) with reforms aimed at reducing discrepancies among banks regarding the calculation of risk-weighted assets (RWA, which is the denominator of the capital ratio).

.

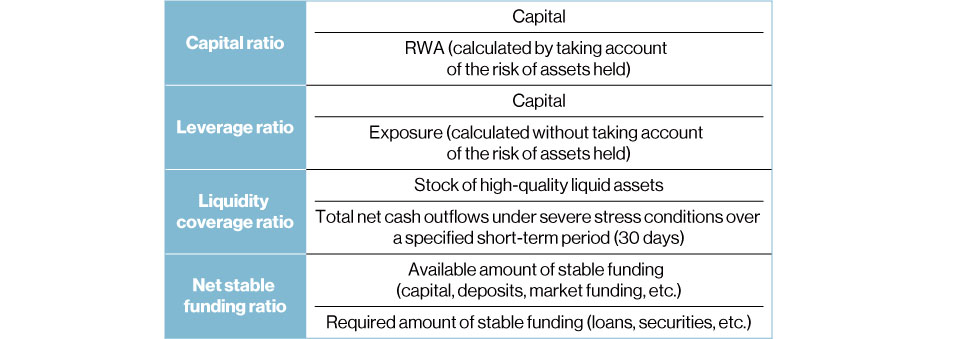

Principal requirements under Basel III and state of compliance

As a Global Systemically Important Bank (G-SIB), Mizuho Financial Group must meet some regulatory standards at a higher level. We maintain full compliance with all the requirements in the standards and, going forward, we will steadily accumulate capital and control our balance sheet to ensure that we can satisfy any new requirements that are introduced.

International financial regulations going forward

With the completion of the post-global financial crisis regulatory reforms, the Financial Stability Board and the Basel Committee on Banking Supervision, which are responsible for developing international financial regulatory standards, are turning their attention to new areas. Specifically, they have shifted their focus from developing new regulatory standards to consistent implementation of regulations in individual countries and evaluating the impact of regulatory reforms (e.g., are they having the intended effect without compromising regulatory resilience). Recently, responding to the banking turmoil of 2023, the Basel Committee on Banking Supervision reaffirmed their expectation of implementing all aspects of the Basel III framework in full, consistently, and as soon as possible.

In addition, the environment that financial institutions operate in has reached a critical turning point, including rapidly accelerating digitalization and increasing societal interest in sustainability. There is growing attention to, and international discussion about, the opportunities and risks presented to banks and financial systems by the various impacts of climate change and the popularization of digital assets. For example, various international bodies and local regulatory authorities, foremost among them the Financial Stability Board and the Basel Committee on Banking Supervision, have been looking into responses to risks related to digital assets and climaterelated financial risk.

To address these various risks, we will work closely with government, academia, and industry, while also holding proactive internal discussions.