Corporate Governance System

Corporate Governance Policy

Mizuho Financial Group's corporate governance policy.

Rules and Reports, etc.

Rules and Report, etc. shown below:

Corporate Governance Policy

Mizuho's Corporate Identity, which is composed of Corporate Philosophy, Purpose and The Mizuho Values, serves as the concept that forms the basis of all activities conducted by Mizuho Financial Group.

Under the "Mizuho's Corporate Identity," MHFG forms basic management policies and strategies for its entire group and has each company in our group work together and promote such group strategy. We aim to fulfill our social role and mission by giving due regard to creating value for diverse stakeholders and realizing improved corporate value through continuous and stable corporate growth and contributing to internal and external economic and industrial development and prosperity of society.

MHFG, as a holding company, plays an active role in the management of our group and takes on a planning function with respect to strategies and policies of our group and a controlling function with respect to each company of our group as part of its business management, and establishes a corporate governance system consisting with the Board of Directors at its core, which operates for the benefit of the shareholders, and ensures that self–discipline and accountability of management of our group is fully functioning.

Basic policy regarding its corporate governance system

MHFG has adopted a Company with Three Committees in order to realize the basic policy regarding its corporate governance system.

(1) Secure the effectiveness of corporate governance by ensuring the separation of supervision and management and making supervision of the management such as the execution of duties, etc., by executive officers the primary focus of the Board of Directors.

(2) Make it possible for the management to make swift and flexible decisions and realize expeditious corporate management by the Board of Directors' delegating decisions on business execution to executive officers.

(3) Utilize committees, etc., comprising mainly of outside directors who are independent from the management of Mizuho, and secure transparency and fairness in decision–making processes and the effective supervision of the management.

(4) In the course of designing the organizations, etc., comprising the corporate governance system that realizes matters set out in items 1 through 3, the Company is to actively adopt operations and practices that are recommended at a global level regarding corporate governance as well as compliance with Japanese and foreign laws and regulations as a financial group expanding across the globe.

For your reference, MHFG puts on its website "Corporate Governance Guidelines," which set out the fundamental perspectives regarding corporate governance in Mizuho, and the framework of the corporate governance system and the roles, composition, and operation policies of the Board of Directors, Executive Officers, Nominating Committee, Compensation Committee, and Audit Committee in MHFG as a Company with Three Committees.

The Corporate Governance Report, which sets out the status of MHFG's corporate governance system, has been submitted to the Tokyo Stock Exchange, and it is also put up on the websites of both the Tokyo Stock Exchange and MHFG.

(Related Principle of Corporate Governance Code)

Principle 2.1, Principle 3.1 i), Principle 3.1 ii), General Principle 4

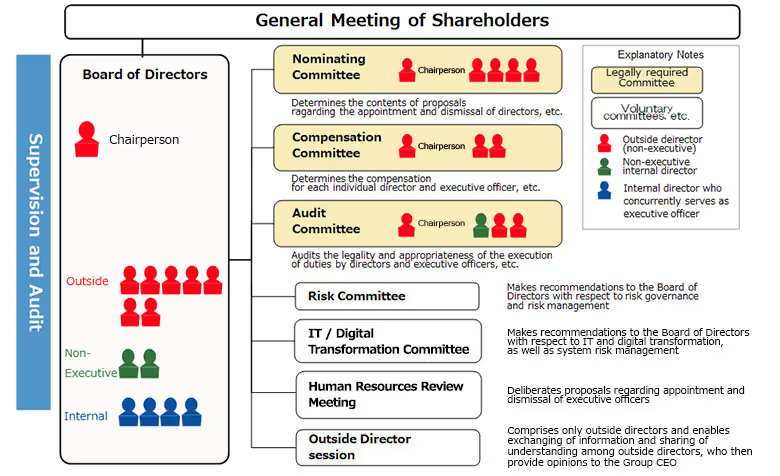

Corporate Governance Structure

Mizuho Financial Group ("MHFG") has adopted a Company with Three Committees in order to realize the basic policy regarding its corporate governance system.

Overview of MHFG's corporate governance structure is shown below.

Regarding the fundamental perspectives, framework and governing policies of MHFG's corporate governance system (Board of Directors, Directors, Nominating Committee, Compensation Committee, Audit Committee, voluntary committee, etc., Mizuho's group governance, and its advisor system), MHFG has established the "Corporate Governance Guidelines" as high–level regulations superseded only by the Articles of Incorporation.

Related Principle of Corporate Governance Code

Principle 3.1 ii)

Supervision

Execution

Internal Audit Group

Accounting Auditor

Advisors System

Relation with Stakeholders

Appropriate Corporate Disclosure

MHFG's Corporate Governance Structure

Supervision

The Board of Directors and Directors

Role of the Board of Directors and Directors

Role of the Board of Directors

- The main roles of the Board of Directors are making decisions on business execution such as that basic management policy, which are matters to be determined solely by the Board of Directors under laws and regulations, and supervising the execution of duties by directors and executive officers.

- In order to fulfill the roles mentioned above, the Board of Directors shall appropriately establish and supervise the operation of the internal control systems (regarding matters such as risk management, compliance, and internal auditing) and risk governance systems of Mizuho.

- The Board of Directors shall, in principle, delegate to the President & CEO, who is the chief executive officer of Mizuho (Group CEO), decisions on business execution excluding matters to be determined solely by the Board of Directors under laws and regulations, for the purpose of realizing quick and flexible decision–making and expeditious corporate management and strengthening the supervision of executive officers, etc. by the Board of Directors.

Role of Directors

- Each director shall supervise decision–making by the Board of Directors and the execution of duties by other directors and executive officers and execute the duties of the Committees by receiving reports and explanations from the Group CEO and other executive officers or other directors, etc. and asking questions or giving instructions or directions whenever necessary as members of the Board of Directors or appointed members of Committees.

- In addition to taking charge of the duties above as directors, it is expected that outside directors will conduct deliberations and make decisions in the course of making decisions on business execution such as basic management policy and supervising directors and executive officers particularly from the perspective of whether it is possible to realize continuous growth and social contributions by Mizuho from the standpoint of shareholders and other outside stakeholders.

Related Principle of Corporate Governance Code

General Principle 4, Principle 4.1, Supplementary Principles 4.1.1, Principle 4.2, Supplementary Principles 4.3.4, Principle 4.6, Principle 4.7

Composition of the Board of Directors

- The Board of Directors shall not have more than fifteen (15) directors, which is the number of directors prescribed under the Articles of Incorporation. In light of the role of the Board of Directors to supervise the management, non–executive directors (outside directors and internal directors who do not concurrently serve as executive officers, managing directors, employees, or executive directors of MHFG or any subsidiary of MHFG) shall comprise a majority of the directors in the Board of Directors, while at least six (6) directors shall be outside directors (to fulfill the "Independence Standards of Outside Directors (PDF/229KB)").

Number of the board members

14

Percentage of Non–Executive Directors

71% (10 out of 14)

Percentage of Outside Directors

57% (8 out of 14)

Chairperson

Takashi Tsukioka (Outside Director (to fulfill the "Independence Standards of Outside Directors"))

* Percentage of female directors: 14.3% / Average tenure: 2.3 years / Average age: 64.5 years

Related Principle of Corporate Governance Code

Principle 4.6, Principle 4.8

Composition of the Board of Directors

Skill matrix of the Board of Directors (Reason for appointment)

Appointment and Dismissal of Directors

- MHFG adopts a Company with Three Committees structure, therefore the Nominating Committee of MHFG determines the contents of proposals regarding the appointment and dismissal of directors of MHFG to be submitted to the general meeting of shareholders.

- Each candidate to be appointed as a director must satisfy the following requirements("Common Requirements").

- The candidate possesses high integrity and deep insight, is highly ethical, and is committed to compliance with laws and regulations.

- The candidate can be expected to apply his or her extensive experience and knowledge in contributing to the continuous and stable corporate growth and improved corporate value of Mizuho.

- The candidate can be expected to contribute to the decision-making function and supervisory function of the Board of Directors.

- The candidate can ensure the time to invest sufficient time for performing his or her duties as a director.

- The candidate satisfies the qualification requirements for directors under laws and regulations.

- Each candidate to be appointed as an outside director must satisfy the following requirements as well as the requirements set out in the preceding paragraph in order to fully exert his or her supervisory function.

- The candidate has the ability to get an overview and understanding of the overall management of Mizuho, the ability to grasp essential issues and risks, and the ability to appropriately interview management and express opinions to and persuade management, etc.

- It is recognized that the candidate is independent from management of Mizuho in light of the Independence Standards of Outside Directors (PDF/397KB).

- Each candidate to be appointed as a director who concurrently serves as an executive officer, such as the Group CEO, must be a person who satisfies Common Requirements in the above and who is familiar with financial businesses and regulations and Mizuho's business model and has the ability to appropriately perform the business management of the Mizuho Group.

- The Nomination Committee selects candidates for directors to ensure that the Board of Directors as a whole possesses the necessary skills to exercise appropriate supervisory functions, including extensive experience and knowledge in the areas of management, risk management and internal control, finance and accounting, finance, human resources and organization, IT and digital, sustainability, and global fields.

- If there are objective and reasonable grounds for determining that a director has become significantly unqualified in light of the requirements set out in the each paragraph, and it is determined that the execution of duties as a director cannot be delegated to that director, then the Nominating Committee shall consider submitting a proposal regarding the dismissal of the director to the general meeting of shareholders.

- With regard to the status of concurrent offices of directors and the reason of appointment of directors, MHFG provides such information on reference materials of the "convocation notice of the ordinary general meeting of shareholders".

Related Principle of Corporate Governance Code

Principle 3.1 iv), Principle 3.1 v), Principle 4.9, Principle 4.11, Supplementary Principles 4.11.1, Supplementary Principles 4.11.2

Director Training

- Our company's directors continuously gather information and enhance their knowledge regarding the business environment and the status of our Group's operations to fulfill their roles and enable the Board of Directors to exercise its supervisory functions. We consistently provide our directors with opportunities to acquire and improve the knowledge necessary to fulfill their expected roles and responsibilities.

- Upon their appointment, we offer opportunities for directors to acquire the necessary knowledge to fulfill their roles and responsibilities, including information on the Companies Act, related laws and regulations, and corporate governance. After their appointment, we continue to provide opportunities tailored to each director as needed. Additionally, for outside directors, we offer various opportunities for information gathering and communication, such as input sessions outside the Board of Directors, exchanges of opinions with officers and employees, and on-site inspections, to deepen their understanding of our Group's business, finances, organization, and business realities.

- The training policy for directors is described in "Corporate Governance Guidelines."

Overview of main initiatives

- "Opportunities to acquire and improve knowledge" in relation to risk management, which directors should be aware of

- "Opportunities to acquire and improve knowledge" to deepen understanding of Mizuho

Related Principle of Corporate Governance Code

Principle 4.14, Supplementary Principles 4.14.1, Supplementary Principles 4.14.2

Operation of the Board of Directors

- The Chairperson of the Board of Directors shall, in principle, be an outside director in light of the role of the Board of Directors to supervise management. Mr. Takashi Tsukioka currently has been the Chairperson of the Board of Directors since June 2025.

- The Board of Directors may, whenever necessary, have executive officers, managing directors and employees of the Company, directors, corporate auditors, executive officers, managing directors and employees of any subsidiary, etc. of the Company, and outside experts, etc. attend meetings of the Board of Directors and request reports or opinions by those people.

- The resolution of the Board of Directors requires the attendance of more than half of the directors who can participate in the decision-making, and is carried out with their majority consent.

- The Board of Directors has delegated decision–making, in principle, to the President & Group CEO for items other than those legally specified as matters to be determined solely by the Board of Directors. The Chairperson of the Board of Directors plays a central role in narrowing down the agendas to enable concentration on truly necessary proposals and, regarding proposals associated with core management issues, the Board of Directors promotes comprehensive discussions of essential points in a free and vigorous manner with the inclusion of high–quality opinions and suggestions from outside directors.

- To ensure the effective and smooth operation of the Board of Directors and each of the Nominating Committee, Compensation Committee and Audit Committee, the Company has established dedicated organizations (Corporate Secretariat and Audit Committee Office) that carries out businesses related to the secretariat of the meeting bodies (such as organizing interested departments related to proposals and explanatory materials, prior explanations to outside directors, and other businesses related to supporting the Chairperson of the Board of Directors and each director). In addition, the Company establishes a position of Deputy Chairperson (Non–Executive Director) in cases where Chairperson is an outside director and where Deputy Chairperson is needed to support the outside director Chairperson.

- The Board of Directors held 13 meetings in the fiscal year ended March 31, 2025. In particular, the Board discussed the current status of and issues regarding business plans and key strategies, status of the initiatives for sustainability, digital transformation, corporate culture transformation, and stable business operations. The average attendance rate was 99%.

Related Principle of Corporate Governance Code

General Principle 4, Principle 4.1, Principle 4.12, Supplementary Principle 4.12.1, Principle 4.13, Supplementary Principle 4.13.1, Supplementary Principle 4.13.2, Supplementary Principle 4.13.3

Evaluating the effectiveness of the Board of Directors

- The Board of Directors shall perform an analysis and evaluation of the effectiveness of the Board of Directors as a whole each year and shall disclose a summary of the results. The Company shall have a third–party evaluation organization perform an evaluation at least once every three years for such self–evaluation.

- The operational policies of the evaluation of the effectiveness of the Board of Directors are stated in Article 9 Paragraph 4 of the "Corporate Governance Guidelines".

- For the summary of the results of the effectiveness evaluation for the fiscal year 2024, please refer to "Corporate Governance Report" [Supplementary Principle 4.11.3].

Nominating Committee

Chairperson

Yoshimitsu Kobayashi

Committee members

Takashi Tsukioka

Kotaro Ohno

Hiromichi Shinohara

Takakazu Uchida

Outside Directors

Roles of the Nominating Committee

- The Nominating Committee comprises mainly outside directors who are sufficiently independent from the management of Mizuho and the role of the Nominating Committee is ensuring objectivity and transparency in the appointment of directors.

- The Nominating Committee executes matters below.

- Determining the contents of proposals regarding the appointment and dismissal of directors of MHFG to be submitted to the general meeting of shareholders

- Exercising the approval rights in MHFG with respect to the appointment and dismissal of directors of each of the Three Core Companies

- Exercising the approval rights in MHFG with respect to the appointment and removal of representative directors and the appointment and removal of directors with special titles of the Three Core Companies

Composition of the Nominating Committee

- The Nominating Committee shall comprise no less than three (3) members. In principle, all members of the Nominating Committee shall be appointed from among the outside directors (or at least Non–Executive Directors). The Chairperson of the Nominating Committee shall be an outside director.

- All members of the Nominating Committee, including the Chairperson, are currently outside directors.

Operation of the Nominating Committee

- Regarding appointment of MHFG's directors, the Three Core Companies' directors and other related matters, The Nominating Committee has its members directly gain an understanding of personnel in connection with candidates to be appointed as directors by attending each type of meeting of members of the Nominating Committee and conducting interviews with management personnel, and operates in light of factors such as the results of evaluations by outside assessment bodies as necessary.

- The Nominating Committee may, whenever necessary, have the Group CEO or other directors, executive officers, managing directors and employees other than members of the Nominating Committee (including directors, corporate auditors, managing directors and employees of the Three Core Companies) and outside experts, etc. attend meetings of the Nominating Committee and request reports and opinions by those people.

- The Nominating Committee held 10 meetings in the fiscal year ended March 31, 2025. The Committee discussed the composition of the Board of Directors of MHFG and the Three Core Companies, aiming to enhance the overall governance of the group, and director nomination and appointment. The average attendance rate was 100%

Related Principle of Corporate Governance Code

Principle 3.1 iv), Supplementary Principle 4.1.3, Principle 4.3, Principle 4.10, Supplementary Principle 4.13.2

Compensation Committee

Chairperson

Takakazu Uchida

Committee members

Yumiko Noda

Yuki Ikuno

Outside Directors

Role of the Compensation Committee

- The Compensation Committee comprises mainly outside directors who are sufficiently independent from the management of Mizuho and the role of the Compensation Committee is to ensure objectivity and transparency in director and executive officer compensation.

- The Compensation Committee executes matters below.

- Determining the basic policy and compensation system for directors and executive officers, and managing directors of MHFG

- Determining the compensation for each individual director and executive officer of MHFG

- Exercising approval rights in MHFG for the basic policy and compensation system for directors and executive officers of the Three Core Companies.

- Exercising approval rights in MHFG for compensation for each individual director of the Three Core Companies

Composition of the Compensation Committee

- The Compensation Committee shall comprise no less than three(3) members. In principle, all members of the Compensation Committee shall be appointed from among the outside directors (or at least Non–Executive Directors). The Chairperson of the Compensation Committee shall be an outside director.

- All members of the Compensation Committee, including the Chairperson, are currently outside directors.

Operation of the Compensation Committee

- The basic policy of compensation for directors, executive officers, and managing directors contains compliance with domestic and overseas regulations and guidelines, etc. pertaining to compensation for directors, executive officers, and managing directors and the realization of the compensation system corresponding to the role and responsibility to be carried out by directors, executive officers, and managing directors in light of factors such as the medium– to long–term results of the Company, examples of other companies in the same industry as well as economic and social circumstances.

- The Compensation Committee may, whenever necessary, have the Group CEO or other directors, executive officers, managing directors and employees other than members of the Compensation Committee (including directors, corporate auditors, managing directors and employees of the Three Core Companies) and outside experts, etc. attend meetings of the Compensation Committee and request reports and opinions by those people.

- The Compensation Committee held 7 meetings in the fiscal year ended March 31, 2025. The Committee discussed on the determination of individual compensation for directors and executive officers, the evaluation of incentive compensation for fiscal 2023, verification and review of our group’s executive compensation system in light of our group's management environment and domestic and international economic trends, and the verification and review of compensation levels in light of market research and other factors. The average attendance rate was 100%.

Mizuho Financial Group Basic Policy for Executive Compensation (PDF/305KB)

Related Principle of Corporate Governance Code

Principle 3.1 iii), Principle 4.2, Supplementary Principle 4.2.1, Supplementary Principle 4.13.2

Audit Committee

Chairperson

Kotaro Ohno

Takakazu Uchida

Committee members

Takakazu Uchida

Masahiko Tezuka

Hisaaki Hirama

Outside Director

Outside Director

Internal Non–Executive Director

Role of the Audit Committee

- The Audit Committee shall audit the legality and appropriateness of the execution of duties by directors and executive officers.

- When conducting audits, the Audit Committee shall, whenever necessary, gather information based on its right to collect reports and investigate business property.

Related Principle of Corporate Governance Code

Principle 4.4

Composition of the Audit Committee and Appointment of Members

- The Audit Committee shall comprise no less than three (3) members who are Non–Executive Directors, and the majority of those members shall be outside directors.

- Given that as a financial institution, it is essential for the Company to ensure the effectiveness of the activities of the Audit Committee, and that it is necessary for the Audit Committee to gather information through internal directors who are familiar with financial businesses and regulations, share information among the Audit Committee, and to have sufficient coordination with internal control departments, the Company shall in principle appoint one or two Non–Executive Directors who are internal directors as full–time members of the Audit Committee. As for the members of the Audit Committee other than the full–time members of the Audit Committee, the Company shall appoint outside directors.

- MHFG listed its American Depositary Receipts on the NYSE, therefore the members of the Audit Committee shall meet independence requirements under the U.S. securities laws and regulations as may from time to time be applicable to the Company. Further, at least one member of the Audit Committee shall be a "financial expert" as defined under U.S. law.

- The Chairperson of the Audit Committee is currently outside director.

Related Principle of Corporate Governance Code

Supplementary Principle 4.4.1, Principle 4.11

Operation of the Audit Committee

- The Audit Committee shall play a role in the supervisory function of the Board of Directors and shall audit the execution of duties by the directors and the executive officers.

- The Audit Committee shall monitor and inspect the establishment and management of the internal control system of MHFG and its subsidiaries.

- The Audit Committee shall monitor and inspect the condition of the execution of duties with respect to corporate management of subsidiaries, etc. by executive officers.

- The Audit Committee determines the contents of proposals regarding the appointment, dismissal and non–reappointment of accounting auditors to be submitted to the general meeting of shareholders.

- The Audit Committee adopts resolutions regarding the approval of the basic policy for internal audits, the basic internal audit plan, as well as the Internal Audit Group's budget, the entrustment and remuneration of the Group CAE, and the assignment of the General Manager of the Internal Audit Group.

- The Audit Committee shall execute its duties through effective coordination with internal control departments, etc. based on the establishment and management of an internal control system in MHFG and its subsidiaries.

- The Audit Committee may, whenever necessary, have directors, executive officers, managing directors and employees of the Company and directors, corporate auditors, managing directors and employees of subsidiaries, etc. of the Company other than members of the Audit Committee, accounting auditors, and outside experts, etc. attend meetings of the Audit Committee and request reports and opinions by those people.

- The Audit Committee held 18 meetings in the fiscal year ended March 31, 2025. In particular, the Committee confirmed the effectiveness of the Structure for Ensuring Appropriate Conduct of Operations (internal control system) and provided relevant opinions. Moreover, the Committee monitored the progress of key strategies in the executive departments, recognition of issues, and efforts to strengthen internal management systems with priority. The average attendance rate was 100%.

Related Principle of Corporate Governance Code

Principle 4.13, Supplementary Principle 4.13.1, Supplementary Principle 4.13.2, Supplementary Principle 4.13.3

MHFG has established committees and other organizations on a voluntary basis in addition to the above legally–required three committees as set forth.

Risk Committee

Chairperson

Hisaaki Hirama

Internal Non–Executive Director

Committee members

Yumiko Noda

Yuki Ikuno

Rintaro Tamaki

Hiroshi Naka

Outside Director

Outside Director

External Expert

External Expert

- The Risk Committee, as an advisory body to the Board of Directors, shall make recommendations to the Board of Directors regarding supervision and decisions relating to risk governance and supervision of matters such as the status of risk management.

- The Risk Committee shall, in principle, comprise no less than three (3) members who shall be Non–Executive Directors or outside experts.

- The Risk Committee held 7 meetings in the fiscal year ended March 31, 2025. In particular, the Committee discussed the selection of top risks, the operational status of the risk appetite framework, the status of comprehensive risk management, the status of sustainability initiatives and business and risk awareness in overseas regions. The average attendance rate was 97%.

Related Principle of Corporate Governance Code

Principle 4.10

IT / Digital Transformation Committee

Chairperson

Hiromichi Shinohara

Outside Director

Committee members

Masahiko Tezuka

Hisaaki Hirama

Masatsugu Shimono

Keiji Kojima

Outside Director

Internal Non-Executive Director

External Expert

External Expert

- The IT / Digital Transformation Committee, as an advisory body to the Board of Directors, shall make recommendations to the Board of Directors regarding supervision and decisions related to IT and digital transformation and supervision of the status of IT risk management.

- The IT / Digital Transformation Committee shall, in principle, comprise no less than three (3) members who shall be Non-Executive Directors or outside experts.

- The IT / Digital Transformation Committee held 6 meetings in the fiscal year ended March 31, 2025. In particular, the Committee discussed the status of the initiatives for IT and digital transformation, the status of the initiatives for stable business operations, and IT risk management and cybersecurity risk management. The average attendance rate was 100%.

Related Principle of Corporate Governance Code

Principle 4.10

Human Resources Review Meeting

- The Human Resources Review Meeting shall deliberate over plans for the appointment and dismissal of, and commissioning of MHFG's executive officers as defined in the Companies Act and plans for the appointment and removal of MHFG's executive officers as defined in the Companies Act with special titles, such plans to be decided upon by the Board of Directors.

- The Human Resources Review Meeting shall comprise the members of the Nominating Committee and the Group CEO in order to ensure transparency and fairness in the appointment of executive officers and specialist officers.

- The Human Resources Review Meeting held 4 times in the fiscal year ended March 31, 2025. In particular, the Meeting discussed the succession of key executives, and personnel changes for executive line officers in the fiscal year ending March 31, 2026. The average attendance rate was 100%.

Related Principle of Corporate Governance Code

Principle 3.1 iv), Principle 4.3, Supplementary Principle 4.1.3, Supplementary Principle 4.3.1, Supplementary Principle 4.3.2, Supplementary Principle 4.3.3, Principle 4.10

Outside Director Session

- The Outside Director Session shall be to exchange information and share understanding among only the outside directors and to provide objective and candid opinions to the management based on the outside directors' perspectives as outsiders as necessary.

- The Outside Director Session held 3 meetings in the fiscal year ended March 31, 2025. In particular, outside directors exchanged opinions each time with the outside directors of the Three Core Companies on permeation of corporate identity, transformation of corporate culture, customer-oriented business conduct and internal audit control systems and global governance. The average attendance rate was 100%.

Related Principle of Corporate Governance Code

Supplementary Principle 4.8.1, Supplementary Principle 4.8.2, Principle 4.10, Principle 4.11, Supplementary Principle 4.11.3

Execution

Executive Officers

Roles of executive officers

- Executive officers of MHFG take charge making decisions on business execution delegated by a resolution of the Board of Directors and implementing the business execution of MHFG.

Appointment and Dismissal of Executive Officers

- In the course of appointing executive officers, the Board of Directors shall appoint the Group CEO and, in principle, can select from among the heads of in-house companies and units, and the Group CxOs, taking into account deliberations by the Human Resources Review Meeting and based on the policy that it is necessary to appoint as executive officers people who make decisions on business execution delegated by the Board of Directors as managers of the Company, who assume a comprehensive role of business execution, and who satisfy the following requirements.

- The candidate possesses high integrity and deep insight, is highly ethical, and is committed to compliance with laws and regulations.

- The candidate has the ability to execute his or her duties based on his or her extensive experience and knowledge as well as a superior business sense and can be expected to contribute to the continuous and stable corporate growth and improved corporate value of Mizuho.

- The candidate satisfies the qualification requirements for executive officers under laws and regulations.

- If there are objective and reasonable grounds for determining that an executive officer has become significantly unqualified in light of the requirements set out in the above paragraph, and it is determined that the execution of duties as an executive officer cannot be delegated to that executive officer, then the Board of Directors shall consider dismissing the executive officer, taking into account deliberations by the Human Resources Review Committee.

- With regard to the status of concurrent offices of executive officers and the reason of appointment of executive officers, MHFG provides such information on reference materials of the "convocation notice of the ordinary general meeting of shareholders".

Operation by Executive Officers

- The President & CEO shall oversee the business of the Company as the Group CEO. The Executive Management Committee was established to serve as an advisory body for the President & CEO and discusses important matters concerning the execution of business operations as necessary.

Succession Planning

The Group CEO shall invest sufficient time and resources in developing candidates for successors to the Group CEO and other executive officers and shall report to the Nominating Committee and the Human Resources Review Meeting at least once a year on the status of the development and operation of plans for such successors.

Related Principle of Corporate Governance Code

Principle 3.1 iv), v), Supplementary Principles 4.1.3, Principle 4.3, Supplementary Principles 4.3.1, 4.3.2, 4.3.3

Internal Audit Group

Internal Audit Group

- Under the supervision of the Board of Directors and the Audit Committee, the Internal Audit Group is independent from the departments it audits. The Internal Audit Group conducts internal audits of MHFG in accordance with the basic policy and the basic audit plan determined by the Board of Directors and the Audit Committee, and monitors and manages the status of internal audit operations at our major group companies in a centralized manner by verifying the internal audits and internal control systems of each company based on reports submitted by major group companies on the results of internal audits and the status of follow-up on problems identified.

- Based on the basic policy for internal audits, the Group CAE manages matters related to the planning and operation of internal audits, and reports to the Board of Directors, etc. on the status of the operations, regularly and as needed. Specifically, the Group CAE reports functionally to the Board of Directors and the Audit Committee on important matters related to internal audits. In addition, the Group CAE reports on the progress and results of individual audits and plans to the Audit Committee, and responds to requests for investigations as needed, or follows specific instructions.

- Also, as the person in charge of internal audit, the Group CAE reports administratively on the status of internal audits operation management to the Group CEO directly or through the Internal Audit Committee.

Accounting Auditor

- The Audit Committee establishes standards for proper evaluation of the accounting auditors, and maintains the procedures regarding the appointment and dismissal of the accounting auditors of MHFG according to the standard.

- MHFG endeavors to give the accounting auditors adequate time to ensure high quality audits, ensure the accounting auditors have the chance to interview senior management, including the CEO and the CFO, and ensure coordination between the Audit Committee, including outside directors, and the Internal Audit Group.

Related Principle of Corporate Governance Code

Principle 3.2, Supplementary Principle 3.2.1, Supplementary Principle 3.2.2

Advisors system

- The Company does not have a consultant (sodanyaku) system, but there are some cases where former representative directors and presidents, etc., are appointed as senior advisors.

- Advisors shall participate in the activities of economic associations and social contribution programs and the like in order to fulfill the social responsibilities and contribute to the development of the Company and the Mizuho Group. Advisors shall not participate in the management of the Company or the Mizuho Group.

- Outside directors are involved in the appointment and removal of and compensation for advisors, and the advisors system in general.

- For other details, refer to "Corporate Governance Guidelines" and "Corporate Governance Report".

Relation with Stakeholders

"The Mizuho Code of Conduct,” which is standards for implementing "Mizuho's Corporate Identity," stipulates Mizuho’s Basic Stance to serve as infrastructure for the economy and society and our stance towards our stakeholders (our customers, the economy and society, and our employees).

Related Principle of Corporate Governance Code

General Principle 1, General Principle 2, Principle 2.1, Principle 2.2, Supplementary Principle 2.2.1, Principle 4.5

Relation with Shareholders

Relation with Shareholders

Mizuho is committed to an open form of management that emphasizes proactive communication with shareholders and investors.

To earn the satisfaction and trust of its Shareholders, Mizuho will make every effort to improve general meetings of shareholders.

Shareholders and the general meeting of shareholders

- In light of shareholders being the primary starting point for corporate governance discipline, MHFG takes following measures to fully secure shareholder rights and appropriate exercise of their rights at general meeting of shareholders.

- MHFG provides accurate information through the "convocation notice of the ordinary general meeting of shareholders" to shareholders as necessary in order to facilitate appropriate decision–making at general shareholder meetings.

- MHFG strives to send the "convocation notice of the ordinary general meeting of shareholders" early enough to give shareholders sufficient time to consider the agenda. In addition, information included in the "convocation notice of the ordinary general meeting of shareholders" should be disclosed by TDnet or on its website.

- MHFG sets the date of its general meeting of shareholders to avoid dates on which many other companies conduct their general meetings.

- Other than via attending general meetings of shareholders, MHFG provides for voting via mail and voting via the internet. In addition, institutional investors can vote by electronic voting platform.

- When MHFG recognizes that a considerable number of votes have been cast against a proposal by the company and the proposal was approved, MHFG will analyze the reasons behind opposing votes and why many shareholders opposed, and consider the need for shareholder dialogue and other measures.

- MHFG gives adequate consideration to the exercise of shareholder rights, which includes recognizing the rights of minority shareholders.

- Where institutional investors hold shares under the street name, and wish in advance to exercise their right to vote in a general meeting of shareholders in place of the trust bank, MHFG deals with them in accordance with laws and regulations and Articles of Incorporation.

Related Principle of Corporate Governance Code

General Principle 1, Principle 1.1, Supplementary Principle 1.1.1, Supplementary Principle 1.1.3, Principle 1.2, Supplementary Principle 1.2.1, Supplementary Principle 1.2.2, Supplementary Principle 1.2.3, Supplementary Principle 1.2.4, Supplementary Principle 1.2.5

Dialogue with Shareholders

- Mizuho places one of the highest management priorities on continuing to disclose information to shareholders and investors in a fair, timely and appropriate manner, in order that they may form proper judgments and appraisals of the group. The Board of Directors resolved to establish the "Disclosure Policy," which summarizes basic principles regarding disclosure including investor relation activities for promoting constructive dialogue with shareholders and framework of disclosure controls and procedures, and MHFG has published it.

- Investor Relations Division handles IR activities, and Group Chief Financial Officer manages as managing executive officer.

- MHFG holds regular IR meetings for individual investors, institutional investors and overseas investors, and publishes IR materials on its website.Investor Relations Activities

IR Events

IR Presentations - IR activities for individual investorsAs part of our mission to provide the fullest possible disclosure to individual investors, MHFG provides on its web page the information of our management strategy, financial results, financial condition and capital management, in addition to audio streaming and archives of the internet conferences and IR meetings mentioned above.

With a view to expanding and improving further its two–way communication with investors centering on individual investors, MHFG runs an "IR contact page," which receives a broad range of questions and comments about IR, on the website. - Internal cooperation for dialogue with shareholders and investors

At MHFG, contents of securities reports, business reports, etc., are discussed at the Disclosure Committee, a business policy committee, which consists of the Group CGO, Group CFO, Group CRO, Group CHRO, Group CPO, Group CIO, Group CPrO, Group CCO, Group CSO, Group CSuO, Group CCuO and Group CAE in order to reflect the various perspectives of each group upon disclosure to shareholders and investors.

In addition, through IR Division's participation in various business policy committees, internal information is shared in order to promote constructive dialogues with shareholders. - Feedback to the management from IR activities

Shareholder views and concerns learned through IR activities are timely and appropriately reported to the management. - Establishment and implementation of Disclosure Controls and Procedures

MHFG endeavors to establish, implement and continuously improve its Disclosure Controls and Procedures to comply with applicable domestic and international laws and regulations as well as stock exchange rules and to implement fair, timely and appropriate corporate disclosure.

In addition, Mizuho respects various disclosure principles including fair disclosure. Accordingly, at individual calls, private meetings or conferences hosted or attended by representatives of Mizuho, Mizuho appropriately controls insider information by limiting carefully our explanations to matters already disclosed and facts commonly known.

Related Principle of Corporate Governance Code

General Principle 5, Principle 5.1, Supplementary Principle 5.1.1, Supplementary Principle 5.1.2, Principle 5.2

Basic Strategy for Capital Policy

- Mizuho have been pursuing the optimum balance between capital adequacy, growth investment and enhancement of shareholder return.Capital Management, Shareholder Return Policy and Dividend Information

IR Presentations

Related Principle of Corporate Governance Code

Principle 1.3

Policy Regarding Cross–holdings of Shares

MHFG has published the "Policy Regarding Cross–holdings of Shares" on its website. Policy Regarding Mizuho Financial Group's Cross–shareholdings of Other Listed Companies

Related Principle of Corporate Governance Code

Principle 1.4

Implementation of anti–takeover measures

MHFG doesn't implement anti–takeover measures.

Related Principle of Corporate Governance Code

Principle 1.5

Related Party Transactions

When MHFG engages in transactions with its directors or major shareholders (i.e., related–party transactions), in order to ensure that such transactions do not harm the interests of the Company or the common interests of its shareholders, MHFG has established the following system:

- MHFG has established internal regulations to prohibit conflicts of interest conduct, bribery of shareholders in relation to exercise of their rights, and favors to shareholders, and to disseminate and ensure compliance with an arm's-length relationship in related-party transactions. The Board of Directors, Audit Committee, Executive Management Committee, the President & Group CEO and Business Policy Committee receive reports and perform monitoring, with respect to the status of compliance, etc., periodically and as necessary.

- When directors or executive officers engage in transactions in the line of business of MHFG or transactions that have conflicts of interest, MHFG has expressly provided in the "Regulations of the Board of Directors," which was established as a result of a resolution of the Board of Directors, that such transactions are matters subject to approval by the Board of Directors, which are monitored at the Board of Directors through approval of or report on each actual transaction and audited at the Audit Committee pursuant to the "Audit Policies of the Audit Committee."

- When directors or executive officers engage in transactions in the line of business of MHFG or transactions that have conflicts of interest and the Board of Directors approves the matters, the legal risk division of MHFG conducts legal review. Additionally, the legal risk division also conducts legal review, as necessary, on matters concerning transactions between MHFG and its group company.

Related Principle of Corporate Governance Code

Principle 1.7, Principle 4.3, Principle 4.7

Relation with Stakeholders Other Than Shareholders

Measures against Sustainability Issues, Including Social and Environmental Matters

At Mizuho, we take an integrated view on sustainability and business strategy. We have designated materiality areas based on the expectations of society (the expectations of stakeholders for social impact to be made by the Mizuho group) and their importance for Mizuho (medium- to long-term impact on our corporate value and compatibility with Mizuho's strategies and business areas). Through our materiality-related initiatives, we will contribute to environmental conservation and the sustainable development and prosperity of the economy, industry, and society both in Japan and around the world. Also, we will engage in management practices that take into consideration value creation for various stakeholders and will work to enhance our corporate value through the sustainable and steady growth of the Mizuho group.

MHFG has published the initiatives for Sustainability on its website.

Related Principle of Corporate Governance Code

Principle 2.3, Supplementary Principle 2.3.1, Supplementary Principle 3.1.3, Supplementary Principle 4.2.2

Diversity

The Mizuho group firmly believes that, as stated in the People Philosophy, "the personal development of individual employees contributes to the stable and sustainable growth of the group as a whole". As such, Mizuho encourages employees who differ in terms of gender, country of origin, cultural background, and values to understand, respect, and inspire each other. Mizuho respects a workplace culture that embraces diversity and is committed to fostering growth and empowering employees. For more information, please refer to the Human capital management section on Mizuho's website.

Related Principle of Corporate Governance Code

Principle 2.4, Supplementary Principle 2.4.1

Whistleblowing System

- MHFG maintains a compliance hotline where employees, etc., may report when they find any problems concerning compliance, such as violation of laws.

- MHFG has established the Internal Controls and Audit Hotline, a system designed for obtaining concerns regarding questionable accounting or auditing matters from in and outside the company.

- Structure to ensure that persons who report are not treated disadvantageously due to such report has been set forth in the "Basic Policy of Compliance."

- Issues such as the handling of reports to a compliance hotline are reported to the Compliance Committee and the Board of Directors regularly, and is supervised by the Board of Directors. In addition, content of reports are reported to members of the Audit Committee.

- The Audit Committee supervises and verifies whether the whistle–blowing system is functioning effectively and whether the structure to provide the necessary information to the Audit Committee is established, and utilizes the information provided in its auditing duties.

Related Principle of Corporate Governance Code

Principle 2.5, Supplementary Principle 2.5.1

Appropriate Corporate Disclosure

MHFG published "Disclosure Policy," which states "we place one of the highest management priorities on continuing to disclose information to our customers, shareholders and investors both in and outside Japan in a fair, timely and appropriate manner, in order that they may form proper judgments and appraisals of the group."

This Integrated Report includes financial information as well as non-financial information on such subjects as ESG. The report presents information on Mizuho's efforts related to strategies, governance, and other subjects along with information on how those activities are leading to the creation of value for our customers, society, Mizuho over the short, medium, and longterms. It was edited with the intention of providing stakeholders with concise and clear explanations in a story–like form.

MHFG has also published "the new medium-term business plan" on its website.

Related Principle of Corporate Governance Code

General Principle 3, Principle 3.1, Supplementary Principle 3.1.1, Supplementary Principle 3.1.2

(As of July 4, 2025)

Reason for appointment as outside directors

Outside directors and reason for their appointment

Policy Regarding Mizuho Financial Group's Cross–shareholdings of Other Listed Companies

Mizuho Financial Group and our Three Core Companies* have established and published a Policy Regarding Cross–shareholdings of Other Listed Companies and Standards Regarding the Exercise of Voting Rights Associated with Cross–shareholdings.

* "Three Core Companies" refers to Mizuho Bank, Ltd., Mizuho Trust & Banking Co., Ltd. and Mizuho Securities Co., Ltd.

Policy Regarding Mizuho Financial Group's Cross–shareholdings of Other Listed Companies

- As a basic policy, unless we consider these holdings to be meaningful, Mizuho Financial Group and the Three Core Companies will not hold the shares of other companies as cross–shareholdings. This reflects factors including the changes in the environment surrounding Japan's Corporate Governance Code and the potential impact on our financial position associated with stock market volatility risk.

- We consider cross–shareholdings to be meaningful if they contribute to the maintenance and improvement of the corporate value of issuers and the Mizuho group based on their growth potential, outlook, or revitalization perspectives or as a result of studies on present and future economic feasibility and profitability.

- We will regularly and continually examine whether shares held as cross–holdings are meaningful, and we will dispose of holdings determined to be deficient in meaning with due regard to the impact on the market and other matters. Through dialogue with the issuing companies, we will also reduce even those holdings we consider to be meaningful.

Standards Regarding the Exercise of Voting Rights Associated with Cross–shareholdings

- Mizuho Financial Group and the Three Core Companies will exercise voting rights after comprehensive consideration of whether an issuing company has established effective corporate governance and is making appropriate decisions to improve its corporate value over the medium to long term. We will also consider any impact to our own corporate value. Further, if we are unable to agree on proposals made by issuing companies, we may consider disposing of our share holdings.

- We will consider specific proposals through dialogue with the issuing companies and studies conducted by our own specialized departments. In particular, when proposals such as those listed below could affect corporate value or shareholder interests, we will decide on the exercise of voting rights after comprehensive consideration of the purposes of the proposals and the issuing company's approach to improving corporate value.

- Proposals to re–elect directors and auditors, grant retirement benefits, pay bonuses and increase compensation amounts when an issuing company has posted a loss or paid no dividends for a certain period of time, or a corporate scandal has occurred.

- Proposals to re–elect representative directors when profit on capital is going through a long–term slump, when after convening a general meeting of shareholders a company has less than the required number of independent directors or no female directors, or when a company holds excessive cross–shareholdings.

- Proposals to appropriate retained earnings when there are ongoing low dividend distributions or when such proposals, if resolved, may adversely affect financial soundness.

- Proposals to adopt or continue anti–takeover measures.

- Proposals for reorganization such as through a merger.

- Proposals for capital strategies, including issuing new shares.

- Proposals to grant stock options to dilute overall shares.

- Proposals to change articles of incorporation that may impact shareholder value.

- Proposals based on shareholder proposals.

Process for assessing whether cross–shareholding is meaningful

Taking into account our Policy Regarding Mizuho Financial Group's Cross–shareholdings of Other Listed Companies, we assess whether cross–shareholding is meaningful using the process outlined below.

- We will continue to hold the shares of clients if those shares meet certain profitability standards based on a quantitative assessment. However, in light of factors including the changes in the environment surrounding Japan's Corporate Governance Code and the potential impact on our financial position associated with stock market volatility risk, we are working to reduce our cross–shareholdings through dialogue with our clients.

- For those shares that also fall short of profitability standards based on a comprehensive assessment, we will draw on our relationship of trust with the client in order to engage with them in constructive dialogue. If improvements in profitability can be made as a result, we will continue to hold the shares, but if improvement is not possible, we will negotiate with the client regarding the sale of the shares.

- We periodically confirm the status of negotiations for the sale of cross–shareholdings, client efforts to improve profitability, and other matters. Additionally, once per year at a meeting of the Board of Directors, we conduct an assessment of whether it is meaningful to maintain shares of each of the domestically listed stocks that we are holding.

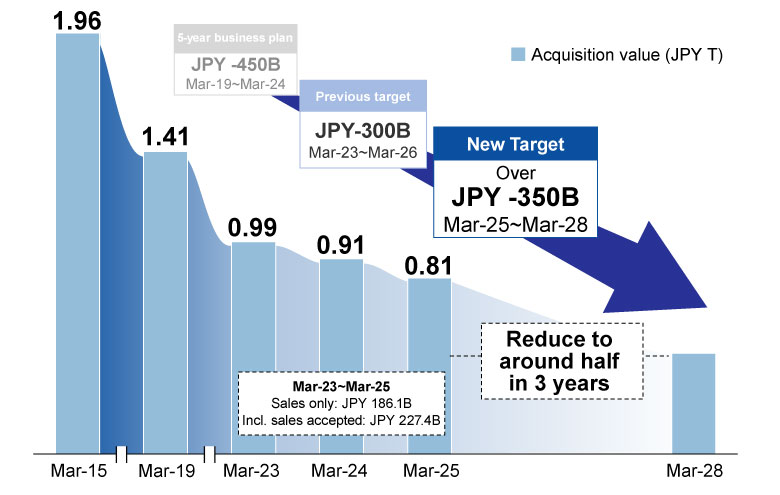

- In our assessment of cross-shareholdings as of the end of March 2024, of domestically listed stocks that we are holding (JPY 916.9 billion in total on a consolidated acquisition cost basis as of the end of March 2024), around 30% did not meet the standards for continued holding.

- The results of the assessment may vary based on our business relationship with the client, the market environment, and other factors at the time of assessment, but we will continue to work steadily to reduce our cross–shareholdings.

- Note that we also conduct a similar assessment for deemed holdings of shares.

Reduction of cross–shareholdings

- The sales performance for FY2023–2024 was JPY 186.1 billion, reflecting steady progress.

- To achieve the reduction target over JPY 350 billion for FY2025–2027, we will continue to engage in careful negotiations with our clients through dialogue.

- Regarding deemed holdings of shares, the projected reduction for FY2025–2027 is JPY 200.0 billion.

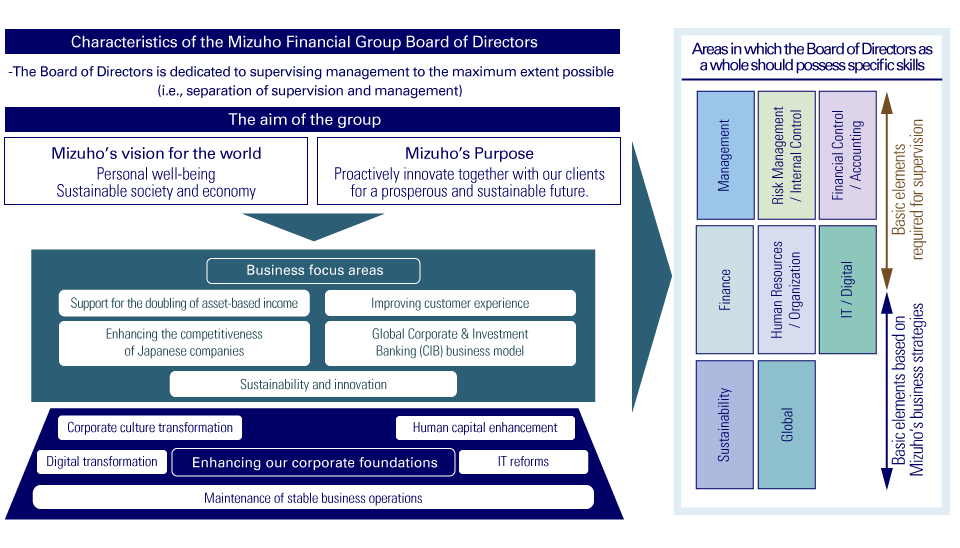

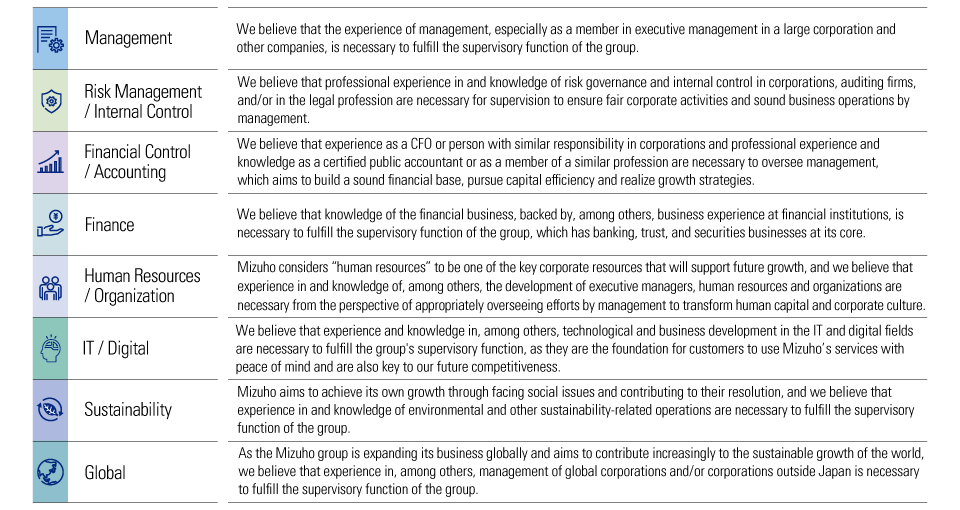

Composition and skills of the Board of Directors

Skills that the Board of Directors should possess as a whole

In light of the recent revision of the group's Corporate Identity and the review and formulation of a new medium-term business plan that takes into account the direction for growth we will pursue over the long term, Mizuho Financial Group has clarified the areas in which the Board of Directors as a whole should possess specific skills in order to ensure speedy corporate management and appropriate supervisory functions toward realization of the plan. Specifically, the group has selected the eight skill areas of "Management," "Risk Management / Internal Control," "Financial Control / Accounting," "Finance," "Human Resources / Organization," "IT / Digital," "Sustainability," and "Global."

Basic approach to selection of skills

Main reasons for selecting each skill and approach to main experience and knowledge deemed necessary

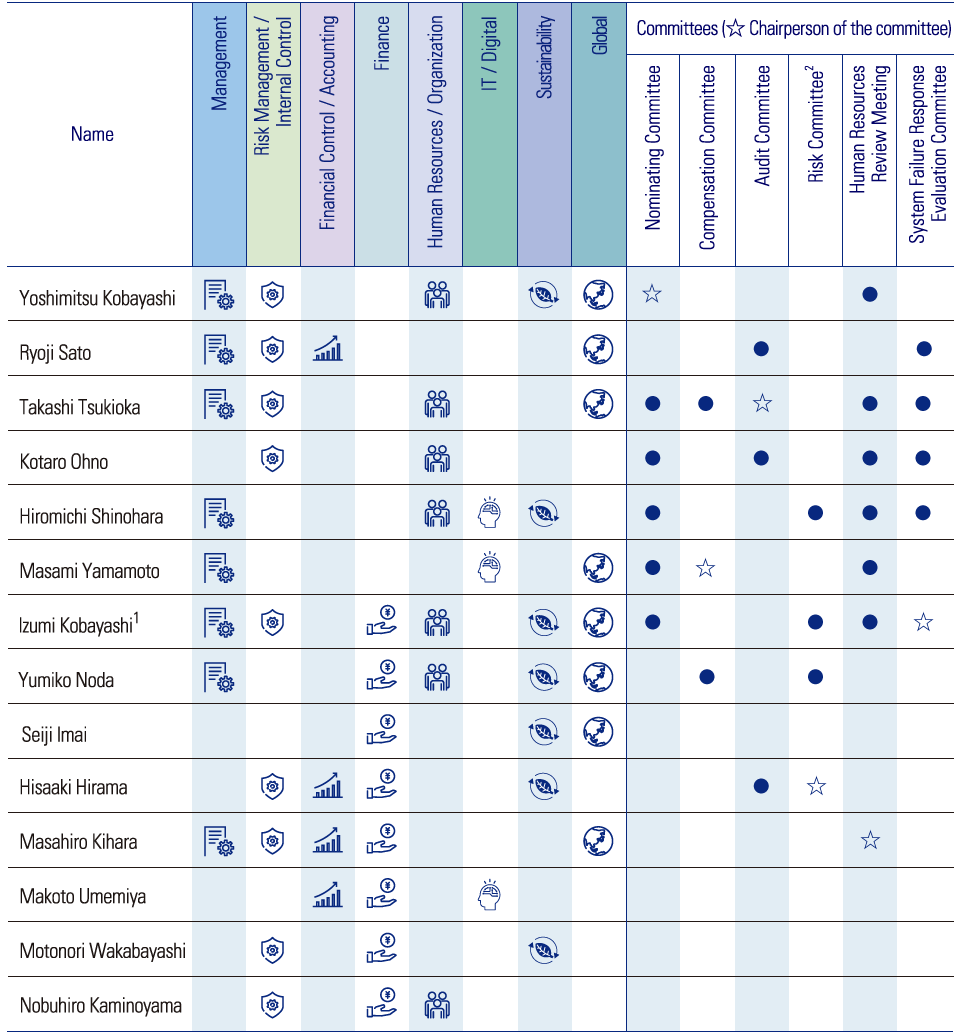

Skill Matrix of the Board of Directors

The table below lists the particular core skill areas that each director possesses in relation to the skills that the Board of Directors as a whole should possess, and with which Mizuho Financial Group believes the Board of Directors as a whole has the necessary skills. We also believe that each committee is equipped with the necessary skills based on their respective roles, including securing the knowledge of outside committee members at the meetings of voluntary committees.

Notes:

- Chairperson of the Board of Directors

- The following two outside experts serve on the committee:

Rintaro Tamaki (President, Japan Center for International Finance)

Hiroshi Naka (Professor, the University of Tokyo Institute for Future Initiatives)

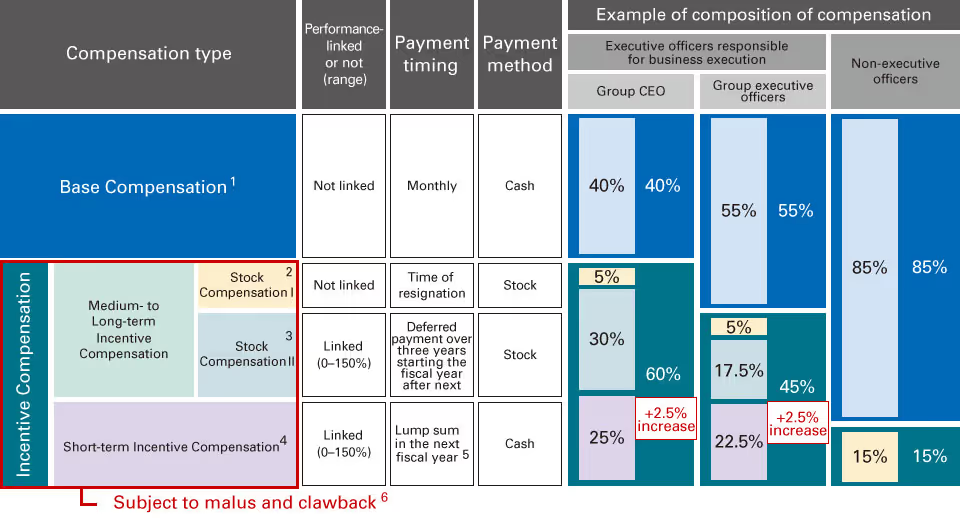

Compensation for executive officers

Basic policy1

Our executive compensation system is designed to achieve the following objectives and approaches pursuant to the basic policy on management under the Mizuho Financial Group's Corporate Identity.

- The full text of the "Basic Policy for Executive Compensation" is posted on the Mizuho Financial Group's website.

https://www.mizuhogroup.com/who-we-are/governance?tab=rules-and-reports-etc#basic

Compensation system

- Payment will be made monthly in cash in accordance with the roles and responsibilities of each of the Officers.

- Payment in accordance with the roles and responsibilities of each of the Officers as an incentive to increase corporate value over the medium to long term and for other purposes.

- Payment in accordance with level of achievement of financial indicators emphasized by the Mizuho Financial Group and evaluation of indicators related to stakeholders as an incentive to increase corporate value over the medium to long term and for other purposes.

- Payment in accordance with level of achievement of financial indicators emphasized by the Mizuho Financial Group and the evaluation of individual performance as an incentive for fiscal year performance to increase corporate value.

- Deferred payment over three years starting the fiscal year after next for payments above a certain amount.

- A system has been adopted that enables malus (forfeiture of compensation remaining unpaid) and clawback (request for return of compensation) by resolution of the Compensation Committee depending on the performance of the group or the individual.

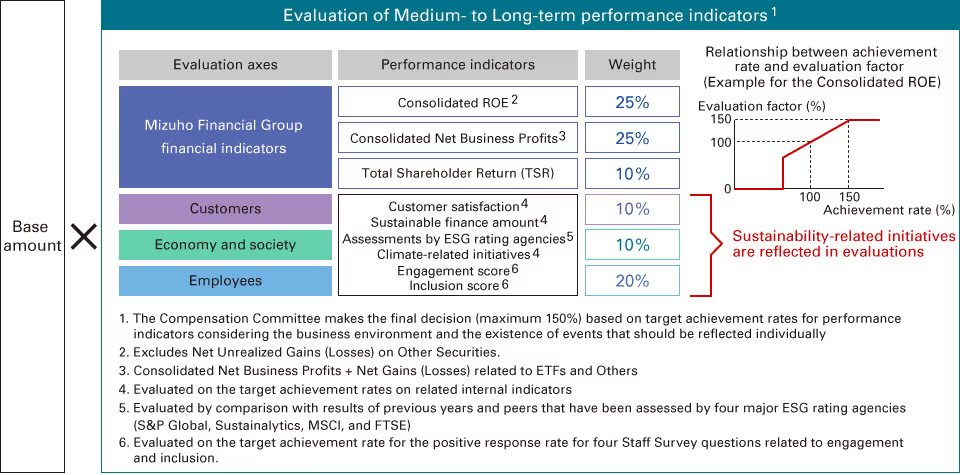

Performance evaluation indicators for performance-linked compensation

Medium- to Long-term Incentive Compensation (Stock Compensation II)

Short-term Incentive Compensation1

- The evaluation factor for the short-term performance indicators and individual evaluation is capped at 150%

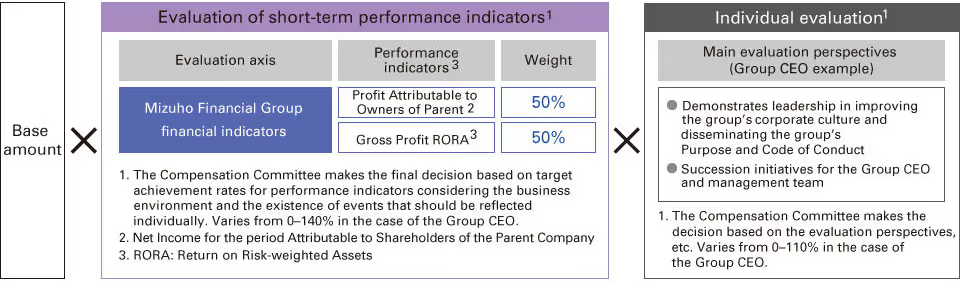

Compensation Governance

Individual compensation determination process

The Compensation Committee shall determine the executive compensation system including the compensation system taking into account the Basic Policy for Executive Compensation. In addition, in order to ensure fairness and objectivity concerning the compensation for each officer, the Compensation Committee shall determine the compensation for each individual director and executive officer of Mizuho Financial Group as defined in the Companies Act and approve the compensation of each individual director of the Three Core Companies (Mizuho Bank, Mizuho Trust & Banking, and Mizuho Securities).

Individual compensation determination process diagram

Appropriateness of compensation level and composition

We conduct a market survey each year with other companies in the same industry and similar-scale corporate groups as the peer group, and examine the appropriateness of the compensation level and composition.

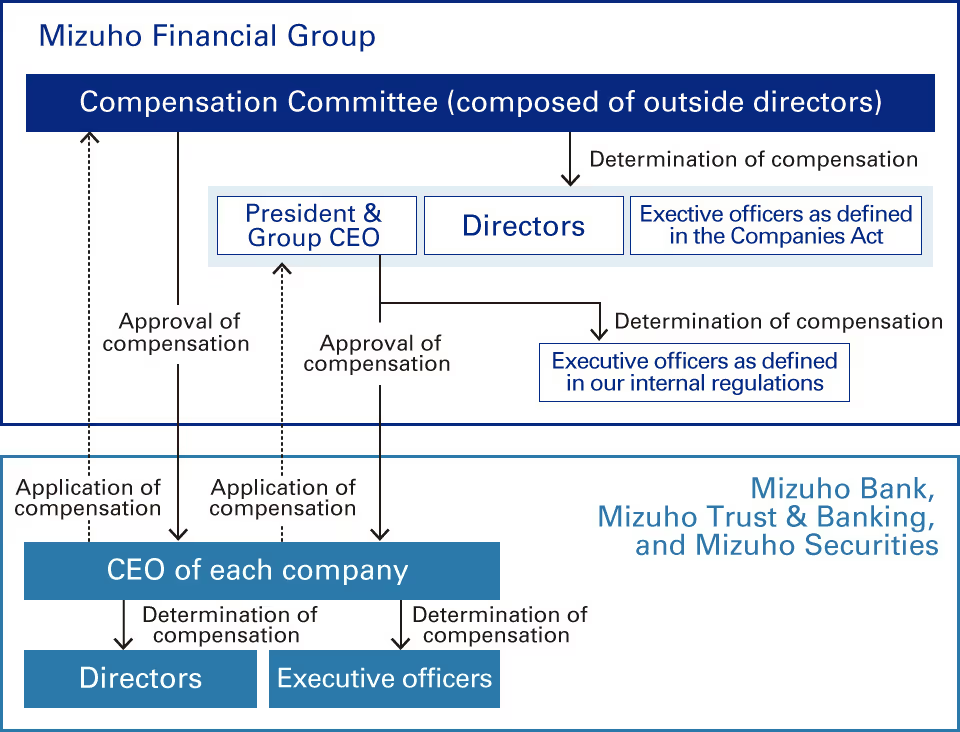

Amounts of compensation

Aggregate amounts of compensation paid to directors and executive officers as defined in the Companies Act

Shown below are the compensations of the directors and executive officers as defined in the Companies Act.

The aggregate compensation paid to directors who concurrently serve as executive officers as defined in the Companies Act is included in the below table as those of "Executive officers as defined in the Companies Act."

Notes:

- The amounts are indicated in units of one million yen and the numbers of shares are indicated in units of one thousand. Fractions are rounded down.

- The number of directors in the "Fixed compensation" column for the Compensation for fiscal year 2022 includes one director who retired on June 21, 2022. The number of executive officers for the Compensation for fiscal year 2021 includes one executive officer who resigned on November 26, 2021, one executive officer who resigned on January 17, 2022, one executive officer who was dismissed (*) on February 1, 2022 and two executive officers who resigned on April 1, 2022.

(*Due to health reasons, the original plan (resignation on April 1, 2022) was moved forward.) - With respect to Stock Compensation I for fiscal year 2022, the amounts given are obtained by multiplying the stock ownership points, granted by the Compensation Committee of Mizuho Financial Group in July 2022 for fiscal year 2022 based on the functions and responsibilities of each of the Officers (one (1) point translates into one (1) share of common stock of Mizuho Financial Group), by the book value of Mizuho Financial Group stock (JPY 1,607.087 per share). Stock Compensation I is not linked to the performance of the group and shall be paid at the time of resignation.

- The other compensation for fiscal year 2022 includes condolence money premiums and other premium subsidies (group life insurance premiums paid by the group to the Officers as the insured party).

- The target and result of key indicators related to the corporate performance linked compensation and others (variable compensation) for fiscal year 2021 are as follows:

- With respect to the Performance Payments, the amounts stated were decided by the Compensation Committee of Mizuho Financial Group in July 2022 as the Performance Payments for fiscal year 2021.

- With respect to the Stock Compensation II, the amounts given are obtained by multiplying the stock ownership points, granted by the Compensation Committee of Mizuho Financial Group in July 2022 for fiscal year 2021 based on the functions and responsibilities and performance of each of the Officers, by the book value of Mizuho Financial Group stock (JPY 1,607.087 per share). Stock Compensation II for fiscal year 2021 is expected to be paid as deferred payments over three years from fiscal year 2023.

- With respect to the other compensation for fiscal year 2021, the amount of fixed compensation paid in deferral is stated. The fixed compensation paid in deferral is a system whereby the decision to pay a portion of the fixed compensation is deferred and can be reduced or forfeited in accordance with the performance of Mizuho Financial Group and other factors.

- Because the amount of the corporate performance linked compensation and others (variable compensation) to be paid with respect to fiscal year 2022 has not yet been determined at present, the aggregate compensation above does not include the amount of corporate performance linked compensation and others (variable compensation); however, the necessary reserve is recorded for accounting purposes.

- Since the Compensation Committee determines the executive compensation system, including the compensation system, taking into account the Basic Policy for Executive Compensation, we believe that the details of individual compensation for directors and executive officers as defined in the Companies Act are in line with the Basic Policy for Executive Compensation.

*For information on the compensation system related to the above results, please refer to the following.

Rules and Report, etc. (Corporate Governance)

Articles of Incorporation

Articles of Incorporation (PDF/221KB)Corporate Governance Guidelines

Corporate Governance Guidelines (PDF/296KB)The Corporate Governance Guidelines (the "Guidelines") set out the fundamental perspectives regarding corporate governance in Mizuho, and the framework of the corporate governance system, including the roles, composition, and governing policies regarding the Board of Directors, executive officers, Nominating Committee, Compensation Committee, and Audit Committee for Mizuho Financial Group as a Company with Three Committees.

Overview of Independence Standards for Independent Directors

Overview of Independence Standards for Independent Directors (PDF/341KB)The standards, which MHFG set out concerning Independence for Outside Directors.

Basic Policy for Executive Compensation, etc.

Basic Policy for Executive Compensation (PDF/305KB)The policy, which MHFG set out concerning the determination of compensation for each individual director and executive officer ("Officers") of MHFG as well as MHBK, MHTB and MHSC ("Core Subsidiaries").

Outline of Compensation System and Compensation Determination Process.

Corporate Governance Report

Corporate Governance Report (As of December 23, 2025) (PDF/ 1,128KB)The report, submitted to the Tokyo Stock Exchange, sets out the status of corporate governance system.

Risk Governance

Basic approach

To fulfill our responsibility as a global financial institution, the Mizuho group integrates the implementation of risk management with the execution of business strategy and financial strategy through our risk appetite framework, and we advance appropriate risk-taking and risk control in order to grow and develop sustainably together with customers, economies, and society as a whole.

When selecting our top risks for fiscal 2024, in addition to our risk perception with regard to the macro-environment and monetary policy direction in Japan and globally, we discussed the increased focus of society on environmental and social issues such as climate change, loss of nature, and human rights violations, as well as the risks posed by generative AI. We have addressed each top risk with a variety of controls, three of which we will focus on here as they relate to the core topics of the medium-term business plan.

First, our readiness for an increasingly unpredictable global financial and economic environment. With regard to credit risk, we simulate and examine the impact of rising interest rates on the macroeconomy and corporate earnings, and take risks based on an appropriate risk-return calculation. In addition, despite the volatile market environment, with the yen at historic lows against the dollar, we are monitoring trends in different countries’ financial policies and working to control market and liquidity risks with a forward-looking approach, drawing on lessons learned from the market volatility caused by rapid interest rate hikes in the US and Europe in recent years.

Second is global risk management. The acquisition of Greenhill in the Americas is an example of our group's expansion of the global CIB business. We are also strengthening our risk management systems in the Americas, EMEA, and APAC to provide banking and securities functions globally.

Finally, we are strengthening our corporate foundations. We must improve readiness in areas of growing risk, such as cybersecurity, and also be vigilant against new risks due to the rapid spread of AI. In order to provide stable financial services, we will strive to improve risk management also from the perspective of operational resilience.

In the context of unprecedented uncertainty around the globe, this will be an important year for us to assess the global environment in a forward-looking manner under our risk appetite framework, and to execute our strategy through flexible and appropriate risk-taking and risk control. We will comprehensively assess and evaluate risks and opportunities in order to proceed with appropriate risk management on a group and global basis.

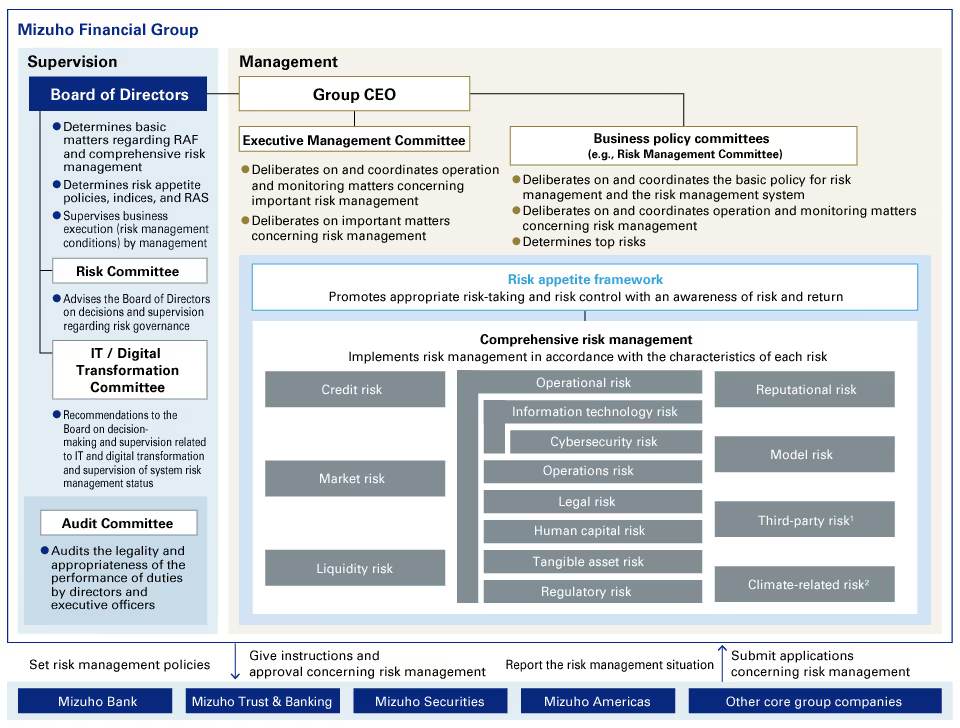

Risk appetite framework (RAF)

We have positioned our RAF as the corporate management framework to execute risk-taking in a manner that is consistent with our risk appetite. Risk appetite refers to the types and levels of risk that we will accept in order to implement our business and financial strategies. Through our RAF, we manage strategy and risk in an integrated manner and aim to achieve the optimal risk and return through appropriate risk-taking and risk control.

In the actual implementation of our RAF, the Board of Directors determines basic matters concerning the RAF and also decides on a risk appetite statement (RAS), which documents the RAF's management system and Mizuho's risk appetite. Operations are supervised based on the Board’s decisions. In addition, the Risk Committee, which advises the Board of Directors, provides advice to the Board on matters concerning the RAF and related topics. In business operations, the Group CRO, Group CFO, and Group CSO provide assistance overseen by the Group CEO, and implement business strategy, financial strategy, and risk management from an overall perspective.

Risk appetite is determined through management discussions on top risks and other potential risk events, which are then incorporated into baseline scenarios and risk scenarios that are shared internally. Based on our awareness of these internal and external environments, we then formulate a risk appetite policy consistent with the medium-term and fiscal year business plans. Also, regarding capital adequacy, profitability, and liquidity, we set the quantitative risk appetite indices and their levels. The risk appetite policy as well as the risk appetite indices and their levels are determined by the Board of Directors. The risk appetite operating conditions are regularly monitored and reported to the Board of Directors. The risk appetite is also revised as necessary when there are changes in the environment or strategies.

Mizuho's risk management system

- Complex risk spanning other risks.

- Risk that could amplify other risks.

Stress testing

At Mizuho, we assess the suitability of our risk appetite and the validity of our business plans through stress testing, calculating and assessing the financial effect on our capital adequacy ratio and on our performance.

We carry out stress testing based on scenarios formulated taking into account current economic conditions and future outlooks, vulnerabilities in Mizuho's business and finance structures, and other factors. We can confirm whether our capital adequacy ratio, performance, and other indicators are sufficient in the case that stress events actually materialize. If such indicators fall below the necessary level, we reconsider and revise our risk appetite and business plans. In addition, we calculate the impact on risk levels, including interest rate risk in the banking book, and confirm the balance between this risk capital and owned capital at the post-stress stage to assess the adequacy of the capital level.

In addition, to structure robust risk management systems, stress testing is also used to manage risk in various risk categories, such as liquidity risk and market risk.

Mizuho's capital adequacy stress testing

Management of Top Risks

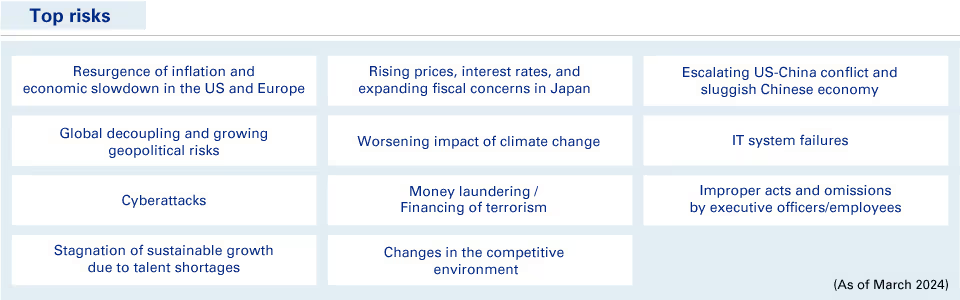

We have identified "top risks" (i.e., risks that are recognized to have a major potential impact on the Mizuho group) as follows, while taking into consideration factors such as changes in the internal and external business environment, and risks with the potential to manifest in the future (emerging risks).

In fiscal 2024, we face the prospect of an acceleration in global decoupling due to election results in various countries and heightened geopolitical risks, as well as lingering uncertainty regarding global inflation and the direction of monetary policy. In this context, we have carried out a revision of our risk scenarios, changing "continuation of high inflation and spillover to credit risk" and "a shift in monetary policy and growing fiscal concerns" to "resurgence of inflation and economic slowdown in the US and Europe" and "rising prices, interest rates, and expanding fiscal concerns in Japan" respectively, as well as revising the scenarios for "escalating US–China conflict and sluggish Chinese economy" and "global decoupling and growing geopolitical risks". We are also revising risk scenarios for related top risks in light of the potential medium to long–term emergence of risks associated with elevated demands and expectations for financial institutions with regard to loss of nature, and risks arising from the expanding use of AI.

For designated top risks, we have decided on additional risk control measures, including measures for preventing the designated top risks and follow-up responses, and we are monitoring the status of risk control throughout the fiscal year and reporting to the Risk Committee and Board of Directors.

(Please see Risk Governance for more on our management of top risks.)

Note: The risks described here are only some of the possible risks we are aware of. For more comprehensive information on the Mizuho group's risks, please refer to the annual securities report, Form 20-F, and other related documents.

Comprehensive Risk Management

Comprehensive Risk Management Systems

At Mizuho, under the basic approach to the implementation of our RAF, we maintain a comprehensive risk management structure ascertaining and assessing overall risk and restricting risk to within a range that is permissible for business.

Under the comprehensive risk management structure, we classify and manage the risks that arise in our businesses according to the various kinds of risk, including credit risk, market risk, liquidity risk, and operational risk. Moreover, our group companies manage risk appropriately according to the nature of their risk, such as settlement risk, trust banking operations risk, and similar. When considering the adoption of new products and services, we check predetermined specific criteria relating to the characteristics of each risk, and institute countermeasures as required.

We have also put in place a system whereby each Mizuho Financial Group company conducts risk management appropriate for the company's business operations and scope and status of risk, and Mizuho Financial Group, as the holding company, oversees risk management across the whole group.

The Risk Management Committee chaired by the Group Chief Risk Officer (Group CRO), which meets monthly, provides integrated monitoring and management of the overall risk for the Mizuho group. The Group CRO reports the risk management situation to the Board of Directors, the Risk Committee, and the Executive Management Committee regularly and as necessary. In addition, Mizuho Financial Group receives reports and applications for approval concerning the risk management situation from our core group companies* and gives them appropriate instructions concerning risk management as necessary.

* Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, Mizuho Research & Technologies, Asset Management One, Mizuho Innovation Frontier, Mizuho Americas, Custody Bank of Japan, MI Digital Services, and Mizuho Leasing.

Risk Capital Allocation

At Mizuho, under the risk capital allocation framework, we endeavor to obtain a clear grasp of the group’s overall risk exposure and implement measures to make sure this exposure is within limits that are acceptable.

More specifically, we allocate risk capital to our core group companies (including their subsidiaries) to control risk within the limits set for each company. We also control risk within acceptable limits by working to ensure that the overall risk on a consolidated basis does not exceed our financial capacity. To ensure the ongoing financial soundness of Mizuho Financial Group and our core group companies we regularly monitor as necessary the manner in which risk capital is being used in order to obtain an accurate grasp of the risk profile within this framework. Reports are also submitted to the board of directors and other committees of each company. Risk capital is allocated to Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, and Mizuho Americas by risk category, and is further allocated within their respective business units.

Framework for allocating risk capital

*Includes the risk exposure of group companies that are managed by core group companies

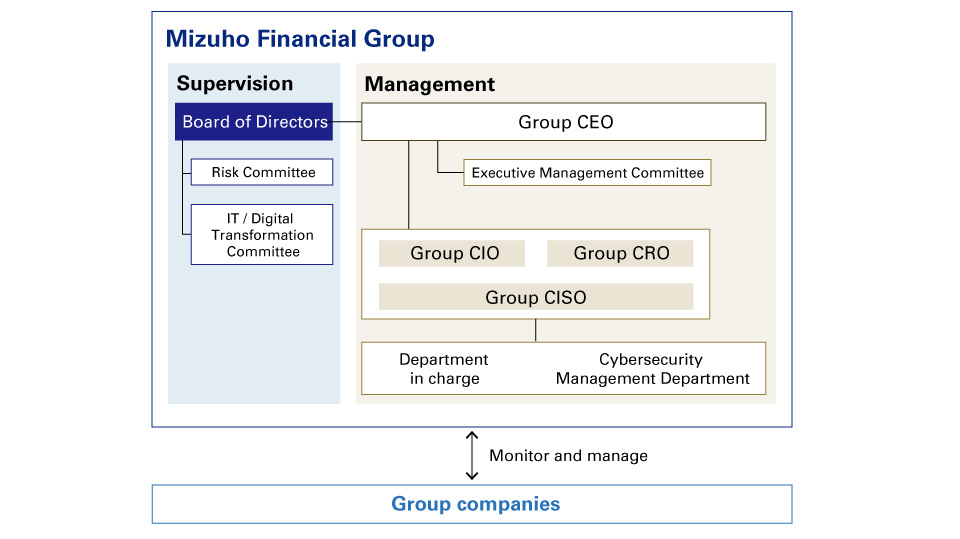

Cybersecurity

Basic approach