March 28, 2018

Company name: Mizuho Financial Group, Inc.

Representative: Yasuhiro Sato, President & Group CEO

Location of head office: 1–5–5, Otemachi, Chiyoda–ku, Tokyo

Code No.: 8411 (on the First Section of the Tokyo Stock Exchange)

Notice regarding Execution of Agreement concerning the Integration of Trust Banks Specializing in Asset Administration Services (Joint Share Transfer) and regarding Change of Subsidiary

Mizuho Financial Group, Inc. (President & Group CEO: Yasuhiro Sato) hereby announces that our consolidated subsidiary, Trust & Custody Services Bank, Ltd. (President & CEO: Akira Moriwaki, "TCSB"), at its board of directors meeting held today, has resolved to execute, and has executed, with Japan Trustee Services Bank, Ltd. (Representative Director and President: Yasuo Kuwana, "JTSB"), a management integration agreement (the "Integration Agreement") to carry out a management integration through incorporating a holding company by joint share transfer (the "Integration"); further, we announce that we expect a change of subsidiary as a result of the execution of the Integration Agreement.

The applications to and approvals from the regulatory authorities are conditions precedent to the Integration.

Ⅰ. Overview of the Integration

1. Purpose of the Integration

Since its establishment in 2001, TCSB, in addition to trust services, engages in a wide range of businesses, such as comprehensive securities management outsourcing services to life insurers, and custody services, and holds assets under custody and administration of JPY 384 trillion (as of December 31, 2017), which consist of entrusted assets and assets managed under custody agreements, etc..

Since its establishment in 2000, JTSB, operating primarily in trust services (acting as a trustee when tasked with re–entrustment from trust banks), has expanded its assets under custody and administration, and holds entrusted assets of JPY 276 trillion (as of December 31, 2017).

The purpose of the Integration is to contribute to further growth in the domestic securities settlement market and the enhancement of the domestic investment chain through realizing more stable and higher quality operations and strengthening its system development capabilities by concentrating TCSB's and JTSB's managerial resources and know–how in relation to their asset administration services and seeking the benefit of scale.

The integrated company will realize the enhancement of business operations by strengthening operational systems and developing human resources specializing in asset administration services and fulfill its social mission to support securities settlement infrastructure in Japan, applying its advanced expertise to a wide range of businesses, including trust services, information integration services, custody services, and comprehensive securities management outsourcing services to life insurers, and aims to be the top trust bank specializing in asset administration services in Japan to meet a wide variety of customer needs in asset administration services.

2. Integration Structure

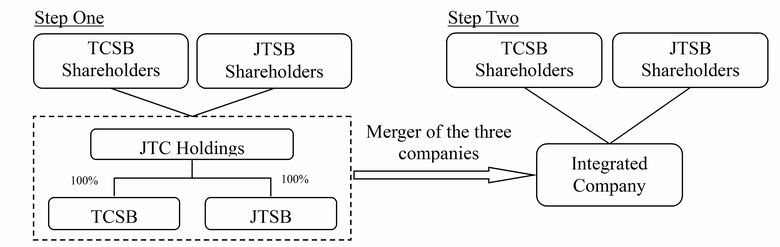

In the Integration, for step one, TCSB and JTSB will incorporate "JTC Holdings, Ltd." ("JTC Holdings"), a holding company whose shareholders are TCSB's and JTSB's existing shareholders, by implementing the joint share transfer (the "Share Transfer"), and TCSB and JTSB will become wholly–owned subsidiaries of JTC Holdings. For step two, around 2021, the integrated company will be launched by implementing an absorption–type merger of JTC Holdings, TCSB, and JTSB.

Allotment (share transfer ratio) in relation to the Share Transfer is as below.

| TCSB | JTSB | |

|---|---|---|

| Share transfer ratio | 1.02 | 1 |

As a result of the Share Transfer, for 1 share of TCSB's common stock, 1.02 shares of JTC Holdings' common stock; and for 1 share of JTSB's common stock, 1 share of JTC Holdings' common stock will be allotted and issued to the shareholders, respectively. The number of new shares issued by JTC Holdings as a result of the Share Transfer is 2,040,000 shares.

We will further discuss the integrated company's corporate name, the surviving company, and other details, and will make announcements once the details have been determined. In addition, the applications to and approvals from the regulatory authorities are conditions precedent to the establishment of the structure regarding the Integration.

3. Calculation Basis of the Allotment in Relation to the Share Transfer

When considering the number of allotted shares of JTC Holdings used as the consideration for the Share Transfer, TCSB calculated the share transfer ratio based on the respective future business plans and financial statements of TCSB and JTSB, and, as a result of the repeated serious discussions with JTSB referring to the calculation result, TCSB has found that the share transfer ratio stated in 2. above is reasonable and not detrimental to the shareholders' interests; and has subsequently agreed with JTSB as above.

4. Integration Timetable (scheduled)

March 28, 2018

Execution of the Integration Agreement

by May 31, 2018

Resolution of the Share Transfer plan at the respective board of directors meetings of TCSB and JTSB (scheduled)

by June 30, 2018

Resolution of the Share Transfer plan at the respective shareholders meetings of TCSB and JTSB (scheduled)

October 1, 2018

Incorporation date of JTC Holdings (effective date) (scheduled)

around 2021

Launch of the integrated company through the merger of JTC Holdings, TCSB, and JTSB (scheduled)

5. Overview of the Companies Involved in the Share Transfer (as of December 31, 2017)

| (1) Name | Shisan Kanri Service Shintaku Ginko Kabushiki Kaisha (English) Trust & Custody Services Bank, Ltd. |

||||

|---|---|---|---|---|---|

| (2) Address | 8–12, Harumi 1–chome, Chuo–ku, Tokyo | ||||

| (3) Representative | President & CEO Akira Moriwaki |

||||

| (4) Scope of Operations | Securities processing services, trust services and bank businesses related to asset administration services, and businesses related to Japanese master trusts | ||||

| (5) Capital Stock | JPY 50 billion | ||||

| (6) Establishment Date | January 22, 2001 | ||||

| (7) Number of Issued Shares | 1,000,000 shares | ||||

| (8) Fiscal Year–End | March 31 | ||||

| (9) Number of Employees | 675 | ||||

| (10) Shareholding ratio | Mizuho Financial Group, Inc. | 54.0% | |||

| The Dai–ichi Life Insurance Company, Limited | 16.0% | ||||

| Asahi Mutual Life Insurance Company | 10.0% | ||||

| Meiji Yasuda Life Insurance Company | 9.0% | ||||

| Japan Post Insurance Co., Ltd. | 7.0% | ||||

| Fukoku Mutual Life Insurance Company | 4.0% | ||||

| (11) Relationship with Our Company | Capital Relationship | Our company holds 540,000 shares in the company. The company does not hold our company's shares. | |||

| Human Resources Relationship | An executive officer as defined in the Companies Act, and an executive officer as defined in the internal regulations of our company, are inaugurated as part–time directors of the company. | ||||

| Business Relationship | Our company administrates the business of the company. The company is commissioned to administrate the securities with our company. Mizuho Trust & Banking Co., Ltd. ("MHTB"), our affiliated company, commissions the company for re–entrustment of its assets entrusted with MHTB by MHTB's clients. Mizuho Trust Systems Company, Limited, our affiliated company, is commissioned to operate the systems and to develop the software by the company. | ||||

| Related Party Status | The company is our consolidated subsidiary, and our related party. | ||||

| (12) Assets under Custody and Administration | JPY 384 trillion Entrusted assets are JPY 141 trillion, and assets managed under custody agreements, etc., are JPY 243 trillion. |

||||

| (13) Financial Status, and Business Performance for the Past Three Years | FY Ended March 2015 | FY Ended March 2016 | FY Ended March 2017 | ||

| Net Assets | JPY 59,419 million | JPY 60,385 million | JPY 60,771 million | ||

| Total Assets | JPY 1,993,528 million | JPY 5,473,232 million | JPY 11,424,703 million | ||

| Net Assets per Share | JPY 59,419.42 | JPY 60,385.55 | JPY 60,771.91 | ||

| Ordinary Revenue | JPY 23,785 million | JPY 24,500 million | JPY 23,462 million | ||

| Ordinary Profit | JPY 1,792 million | JPY 1,721 million | JPY 990 million | ||

| Net Profit | JPY 1,129 million | JPY 1,129 million | JPY 674 million | ||

| Net Profit per Share | JPY 1,129.20 | JPY 1,129.27 | JPY 674.44 | ||

| Dividend per Share | JPY 230 | JPY 230 | JPY 135 | ||

| (1) Name | Nihon Trustee Service Shintaku Ginko Kabushiki Kaisha (English) Japan Trustee Services Bank, Ltd. |

||||

|---|---|---|---|---|---|

| (2) Address | 8–11, Harumi 1–chome, Chuo–ku, Tokyo | ||||

| (3) Representative | Representative Director and President Yasuo Kuwana |

||||

| (4) Scope of Operations | Securities processing services, trust services and bank businesses related to asset administration services, and businesses related to Japanese master trusts | ||||

| (5) Capital Stock | JPY 51 billion | ||||

| (6) Establishment Date | June 20, 2000 | ||||

| (7) Number of Issued Shares | 1,020,000 shares | ||||

| (8) Fiscal Year–End | March 31 | ||||

| (9) Number of Employees | 1072 | ||||

| (10) Shareholding ratio | Sumitomo Mitsui Trust Holdings, Inc. | 66.6% | |||

| Resona Bank, Limited. | 33.3% | ||||

| (11) Relationship with Our Company | Capital Relationship | Not applicable. | |||

| Human Resources Relationship | Not applicable. | ||||

| Business Relationship | Not applicable. | ||||

| Related Party Status | Not applicable. | ||||

| (12) Assets under Custody and Administration | JPY 309 trillion Entrusted assets are JPY 276 trillion, and assets managed under custody agreements, etc., are JPY 33 trillion. |

||||

| (13) Financial Status, and Business Performance for the Past Three Years | FY Ended March 2015 | FY Ended March 2016 | FY Ended March 2017 | ||

| Net Assets | JPY 58,700 million | JPY 58,981 million | JPY 59,156 million | ||

| Total Assets | JPY 2,468,835 million | JPY 6,901,302 million | JPY 13,201,888 million | ||

| Net Assets per Share | JPY 57,549.99 | JPY 57,825.09 | JPY 57,996.58 | ||

| Ordinary Revenue | JPY 27,602 million | JPY 27,891 million | JPY 26,559 million | ||

| Ordinary Profit | JPY 788 million | JPY 570 million | JPY 576 million | ||

| Net Profit | JPY 460 million | JPY 348 million | JPY 390 million | ||

| Net Profit per Share | JPY 451.25 | JPY 341.87 | JPY 383.24 | ||

| Dividend per Share | JPY 180 | JPY 140 | JPY 155 | ||

6. Overview of the Holding Company to be Newly Established through the Share Transfer

| (1) Name | JTC Holdings Kabushiki Kaisha (English) JTC Holdings, Ltd. |

|

|---|---|---|

| (2) Address | 8–11, Harumi 1–chome, Chuo–ku, Tokyo | |

| (3) Representative | To be determined | |

| (4) Scope of Operations | The purpose of the company is to engage in the following businesses as a bank holding company:

|

|

| (5) Capital Stock | JPY 500 million | |

| (6) Fiscal Year–End | March 31 | |

| (7) Number of Issued Shares | 2,040,000 shares | |

| (8) Establishment Date | October 1, 2018 (scheduled) | |

| (9) Shareholding (ratio) | Sumitomo Mitsui Trust Holdings, Inc. | 33.3% |

| Mizuho Financial Group, Inc. | 27.0% | |

| Resona Bank, Limited. | 16.7% | |

| The Dai–ichi Life Insurance Company, Limited | 8.0% | |

| Asahi Mutual Life Insurance Company | 5.0% | |

| Meiji Yasuda Life Insurance Company | 4.5% | |

| Japan Post Insurance Co., Ltd. | 3.5% | |

| Fukoku Mutual Life Insurance Company | 2.0% | |

Ⅱ. Change of Subsidiary

1. Reason for the Change

TCSB and JTSB have entered into the Integration Agreement to implement the Share Transfer as set forth in "I. Overview of the Integration, 2. Integration Structure" above, and to incorporate JTC Holdings, whose shareholders are existing shareholders of TCSB and JTSB, which companies will each become a wholly–owned subsidiary of JTC Holdings. As a result, JTC Holdings will be our equity–method affiliate, and TCSB will no longer be our subsidiary.

2. Method of Change

A holding company will be incorporated through joint share transfer.

3. Overview of the Subsidiary Subject to Change, and the Counterparty to the Share Transfer

An overview of TCSB, the subsidiary subject to the change, and JTSB, the counterparty to the Share Transfer, is as set forth in "I. Overview of the Integration, 5. Overview of the Companies Involved in the Share Transfer (as of December 31, 2017)" above.

4. Timetable of the Change

March 28, 2018

Execution of the Integration Agreement

by May 31, 2018

Resolution of the Share Transfer plan at the respective board of directors meetings of TCSB and JTSB (scheduled)

by June 30, 2018

Resolution of the Share Transfer plan at the respective shareholders meetings of TCSB and JTSB (scheduled)

October 1, 2018

Incorporation date of JTC Holdings (date of change) (scheduled)

Ⅲ. Future Outlook

As a result of the Integration, TCSB will no longer be our consolidated subsidiary, and JTC Holdings, the holding company, will be our equity–method affiliate. The impact of the Integration on our performance is currently being examined carefully, and will be disclosed as necessary once the examination is completed.

End