Mizuho Financial Group, Inc. (the "Company") hereby announces that the Compensation Committee resolved, at the meeting held on June 14, 2018, to revise the compensation system for directors, executive officers as defined in the Companies Act, executive officers as defined in our internal regulations and specialist officers of the Company as well as the directors, executive officers as defined in the our internal regulations and specialist officers of Mizuho Bank Co., Ltd., Mizuho Trust & Banking Co., Ltd. and Mizuho Securities Co., Ltd. (the "Three Core Companies") and to revise the stock compensation program introduced in the fiscal year ended March 31, 2016 (the "Program," and the trust established based on a trust agreement executed with Mizuho Trust & Banking Co., Ltd., the "Trust"). The Mizuho Financial Group Compensation Policy was revised as set forth in the Appendix hereto.

In addition, the Compensation Committee has resolved that the Company will make an additional cash contribution to the Trust in order for the trustee to acquire shares of the Company.

1. Revisions to the Program

The following revisions will apply to stock compensation for the fiscal year ending March 31, 2019. Except as described below, the contents of the Program introduced in the fiscal year ended March 31, 2016 will remain unchanged.

- (1)Those subject to the Program

Those subject to the Program are the the directors, executive officers as defined in the Companies Act, executive officers as defined in our internal regulations and specialist officers of the Company, as well as the directors, executive officers as defined in the our internal regulations and specialist officers of the Three Core Companies (collectively the "Company Group Officers").

- (2)Overview of the Program

The Program adopts the Board Benefit Trust framework. In addition to the performance-based stock compensation program introduced in the fiscal year ended March 31, 2016 ("Stock Compensation Ⅱ"), the Company will establish a new stock compensation program based on the Company Group Officer's position in their respective company ("Stock Compensation Ⅰ").

Stock Compensation Ⅰ, in principle, will be paid at the time of retirement of subject Company Group Officers in the form of shares of the Company calculated based on their position. A system shall be adopted which enables a decrease or forfeiture of the amount by resolution of the Compensation Committee, etc., depending on the performance of the company or the individual.

Stock Compensation Ⅱ, as was previously introduced, is paid to subject Company Group Officers (excluding non-executive officers responsible for management supervision) to reflect the Group's performance, the performance of organizations (in-house companies and units, etc.) that each Company Group Officer is in charge of and the performance of each Company Group Officer. A system has been adopted which enables the entire amount of deferred payments over three years, as well as a decrease or forfeiture of the deferred amount by resolution of the Compensation Committee, etc., depending on performance of the company or the individual.

- (3)Method of payment of the Company stock

Upon the payment of stock compensation under the Program, if the Company Group Officer meets the benefit requirements pursuant to the Rules on the Distribution of Officer Shares, the Company may, for a certain portion, pay a monetary amount equivalent to the market value of its stock in lieu of stock compensation. The Company may sell its shares in the Trust in order to make such cash payments.

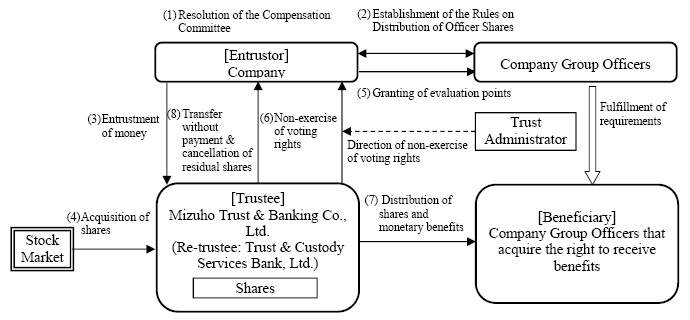

2. Structure of the Program after revision

- (1)The Company resolved to introduce the Program at the Compensation Committee meeting. Further, the Three Core Companies will obtain the approval of directors' compensation by a resolution of the shareholders' meeting with regard to the introduction of the Program.

- (2)The Company and the Three Core Companies will establish the Rules on Distribution of Officer Shares pertaining to the compensation with regard to the introduction of the Program.

- (3)The Company will entrust money based on the Compensation Committee's resolution described in (1) above. The Three Core Companies will reimburse the Company according to the distribution of the Company's shares to their respective Company Group Officers.

- (4)The Trust will acquire shares of the Company from the stock market using the money entrusted in (3) above.

- (5)The Company and the Three Core Companies will grant evaluation points to the Company Group Officers in accordance with the Rules on Distribution of Officer Shares.

- (6)The Trust will, in accordance with the directions of the trust administrator who is independent from the Company, not exercise voting rights with regard to the Company's shares in the Trust.

- (7)The Trust will distribute shares in the Company and monetary benefit to the beneficiaries, who are Company Group Officers that have satisfied the requirements for benefits set forth in the Rules on Distribution of Officer Shares.

- (8)Should any shares remain when the Trust expires, the remaining shares will be transferred without payment from the Trust to the Company and cancelled in accordance with a board of directors' resolution. It is intended when the Trust expires the monies remaining (limited to amounts exceeding the cash reserves that were contributed separately from the funds to acquire shares for the purpose of covering expenses, etc., during the term of the Program) are to be donated to an organization that has no conflicts of interest with the Company, the Three Core Companies or Company Group Officers.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Mi bibendum neque egestas congue quisque egestas. Fermentum dui.

3. Reason for the Additional Contribution

The Company plans to continue the Program after revising it and has decided to make an additional cash contribution to the Trust to provide funds (the "Additional Trust") to acquire necessary shares in the future.

4. Summary of the Additional Trust

(1) Type of Trust:

Money held in trust other than in the form of a monetary trust (third party beneficiary trust)

(2) Entrustor:

The Company

(3) Trustee:

Mizuho Trust & Banking Co., Ltd.

(Re-trustee: Trust & Custody Services Bank, Ltd.)

(4) Beneficiaries:

Directors, executive officers as defined in the Companies Act, executive officers as defined in our internal regulations and specialist officers of the Company, as well as directors, executive officers as defined in the our internal regulations and specialist officers of the Three Core Companies who have satisfied the requirements for benefits set forth in the Rules of Distribution of Officer Shares.

(5) Date of Additional Trust: July 23, 2018 (planned)

5. Details regarding the acquisition of shares of the Company through the Additional Trust

- (1)Type of shares to be acquired: Common stock of the Company

- (2)Amount of the Additional Trust to acquire the shares: JPY 2,100,000,000 (planned)

- (3)Maximum number of shares to be acquired: 10,820,000 shares

- (4)Method of acquiring shares: From the stock market

- (5)Period of acquiring shares: From July 23, 2018 to July 27, 2018 (planned)

End