Message from the Group CFO

Looking back on the second year of the medium-term business plan

Since the Bank of Japan implemented its negative interest rate policy in 2016, we have strategically focused on strengthening profitability through diversification of our business portfolio, optimizing cost and capital efficiency with disciplined financial management, and reinforcing our capital adequacy to ensure our sustainable growth. In fiscal 2024, we truly began to see the tangible results of our efforts taking shape.

Looking back, fiscal 2024 was marked by historic events. In the US, the presidential election brought changes in the administration, while in Japan, the Bank of Japan initiated interest rate hikes, signaling the end of its negative interest rate policy and the beginning of a normalization of monetary policy after eight years. Meanwhile, financial institutions benefited from a favorable operating environment, underscoring the stability of broader market conditions, and active corporate investment also contributed to strong business growth.

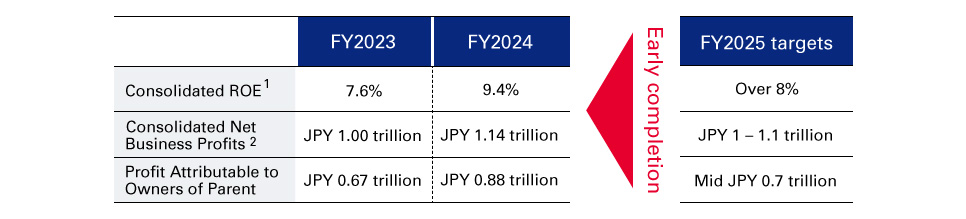

With such an operating environment, we achieved steady business growth in both customer and market divisions. Fiscal 2024 saw record-high Consolidated Net Business Profits and Profit Attributable to Owners of Parent, while we maintained credit-related costs at low levels by proactively preparing provisioning with a forward-looking perspective. Consolidated ROE improved to 9.4%, greatly exceeding the target of over 8.0% that we had set for the final year of the current medium-term business plan, and we achieved all of the financial targets in said plan one year ahead of our initial schedule of fiscal 2025.

Moreover, we invested in Rakuten Securities and Rakuten Card and acquired Greenhill. We also carried out growth investments contributing to Mizuho's unique competitive edge and enhanced shareholder returns through our first share buyback in 16 years. We believe the share buyback was received positively by the capital markets and has provided momentum for the next stage of our management.

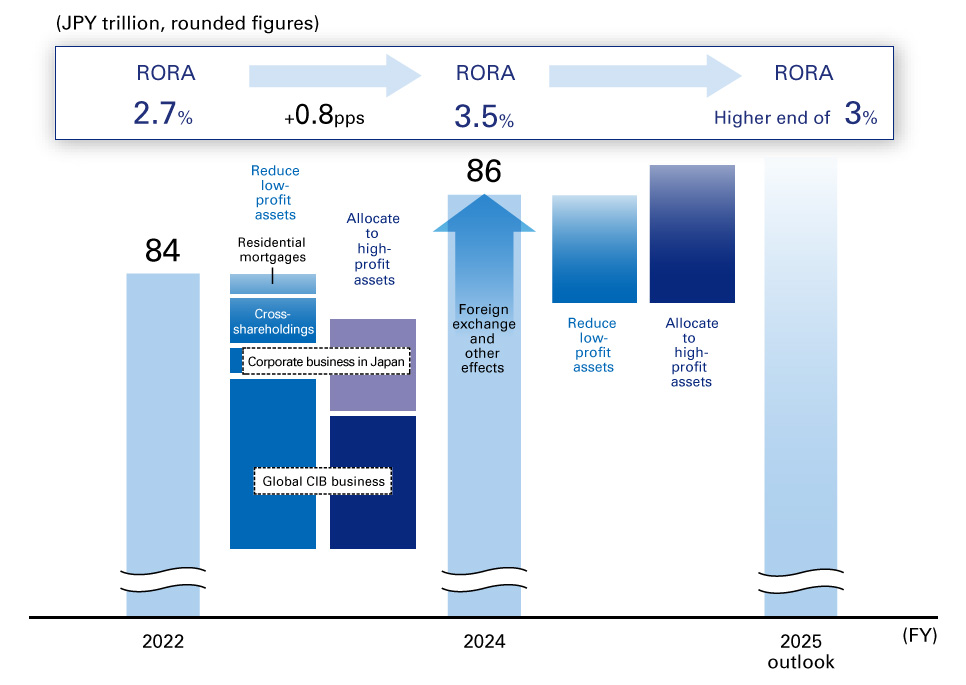

Progress on medium-term business plan targets (Figure 1)

- Excluding Net Unrealized Gains (Losses) on Other Securities.

- Including Net Gains (Losses) related to ETFs and others.

Perspective on the economic and financial environment in fiscal 2025 and beyond

The second Trump administration, inaugurated in January 2025, has again pursued an "America First" agenda, aiming for private-sector-led economic growth and low inflation. Key policy initiatives include energy cost reductions, permanent income tax reductions, administrative and fiscal reforms to secure financial resources and curb long-term interest rates, and reciprocal tariffs to address trade imbalances and revive domestic manufacturing. These changes will have impacts across diplomacy, trade, and national security, and they are already having a considerable influence on the real economy and financial markets. In particular, if economic tension between the US and China escalates, there could be disruptions to the global supply chain and subsequent declines in economic growth rates. Also, concerns over diminished confidence in the US could destabilize credit markets, potentially leading to significant deterioration in the global economic and financial environment. Therefore, the outlook remains highly uncertain.

My role as CFO is to achieve stable profit growth even in the face of such a challenging business environment. In fiscal 2025, maintaining a robust balance sheet through flexible and disciplined financial management and responding to changes in the economic and financial environment will be even more crucial. At the same time, we will further strengthen our business portfolio through diversified and complementary revenue streams to minimize profit volatility.

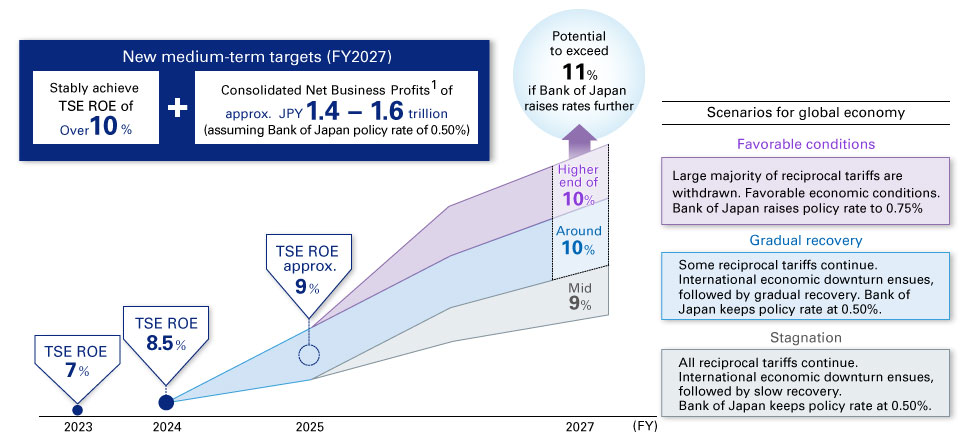

New medium-term financial targets and fiscal 2025 targets

Having achieved all fiscal 2025 financial targets one year ahead of schedule, we have set new medium-term financial targets to achieve by fiscal 2027. Given the diverse scenarios that could unfold due to the Trump administration's economic and trade policies and the responses taken by China and other countries, we have outlined three potential paths: favorable conditions, gradual recovery, and stagnation. Based on these scenarios, we have set new targets for Consolidated Net Business Profits and Tokyo Stock Exchange (TSE) ROE. The assumed scenarios and new medium-term targets will be revised as appropriate. As indicated in Figure 2, we are targeting TSE ROE of over 10% and Consolidated Net Business Profits of approximately JPY 1.4 – 1.6 trillion.

To that end, in fiscal 2025, we aim for record-high Consolidated Net Business Profits of JPY 1.28 trillion, Profit Attributable to Owners of Parent of JPY 940.0 billion, and TSE ROE of approximately 9%. While Profit Attributable to Owners of Parent amounted to JPY 885.4 billion in fiscal 2024 after taking into account financial measures such as realizing losses from the foreign bond portfolio and proactive provisioning, we firmly believe that Mizuho has a strong earnings base that could generate JPY 1.0 trillion under normalized conditions, excluding extraordinary factors. Based on this figure and factoring in expected growth in Net Business Profits, we aim to increase Profit Attributable to Owners of Parent to JPY 1.05 trillion in fiscal 2025. However, considering potential negative impacts on Net Business Profits, credit-related costs, and net gains related to stocks, we have conservatively set our fiscal 2025 guidance at JPY 940.0 billion. We intend to revise this guidance as necessary, based on changes in our external business environment.

Setting new medium-term financial targets (Figure 2)

- Including Net Gains (Losses) related to ETFs.

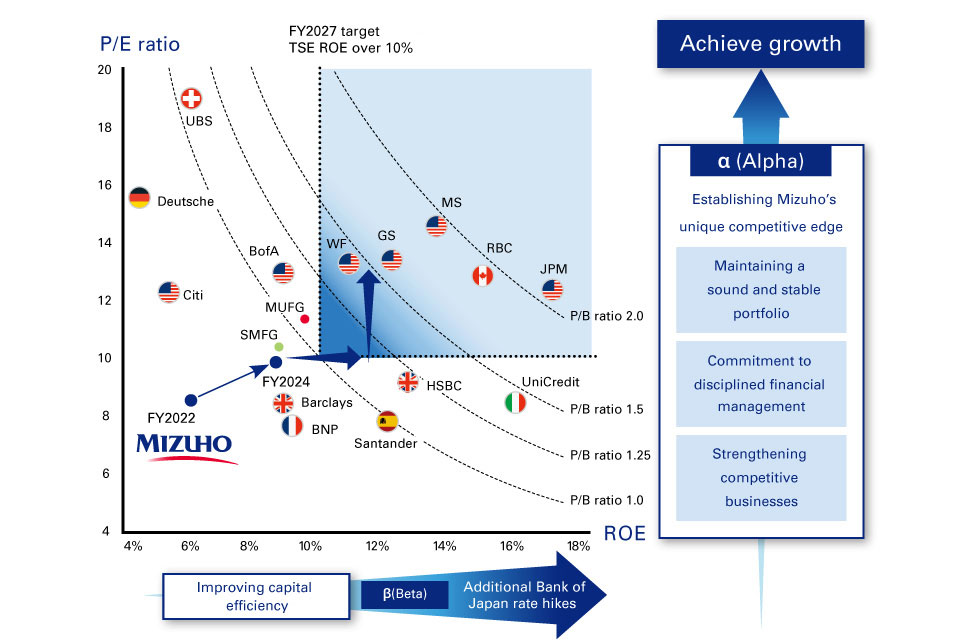

Progress of measures to improve the P/B ratio

Mizuho’s price-to-book (P/B) ratio has been improving, driven by increases in ROE and expectations for sustainable growth. However, compared to our global peers, there is still room for improvement, despite differences in policy interest rates across countries. Further improving our P/B ratio is a top management priority, and we will continue our efforts toward achieving this goal.

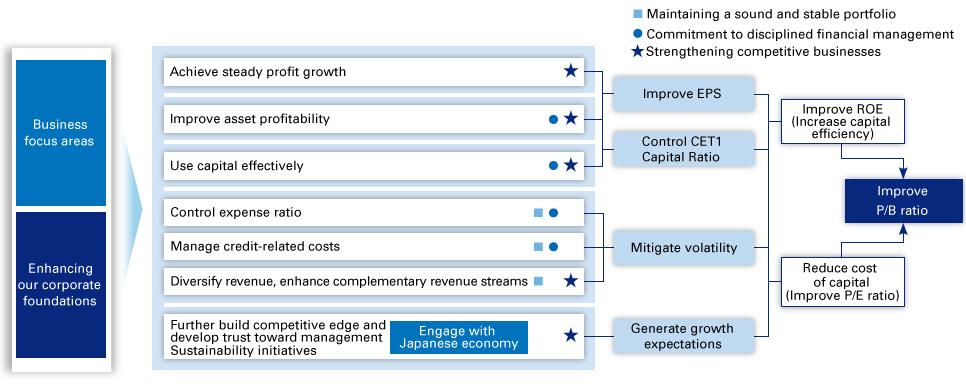

The path to an improved P/B ratio will be realized through increasing ROE and our price-to-earnings (P/E) ratio. As set forth in our medium-term financial targets, we aim to increase TSE ROE to over 10% by fiscal 2027, while solidifying Mizuho's unique competitive edge and enhancing the P/E ratio. To achieve this, we will maintain a sound and stable portfolio, committed to disciplined financial management. The business aspects of our approach are discussed in "Business model for value creation" on page 33, so here I will focus on the financial aspects.

P/B ratio comparison to global peers1 (Figure 3)

- Created by Mizuho based on Bloomberg data. Closing price as of April 30, 2025 used for P/B ratio.

To improve our P/B ratio, we will take the following four key financial measures: improve earnings per share (EPS), control the CET1 Capital Ratio, mitigate volatility, and generate growth expectations (see Figure 4). By continuing to firmly pursue our six initiatives, we will steadily produce results and gain trust from our shareholders and investors.

Approach to improving P/B ratio (Figure 4)

1. Achieve steady profit growth

In fiscal 2024, Consolidated Net Business Profits reached a record-high JPY 1,144.2 billion, an increase of approximately JPY 340.0 billion from fiscal 2022, and of which around JPY 200.0 billion was realized through strengthening our business focus areas.

We saw significant improvement in results particularly in our corporate business in Japan by providing tailored proposals and financial solutions to address the increasing corporate actions from large corporations and middle-market firms. Also, our global CIB business demonstrated strong performance, especially in the US, where we improved our position in the league tables.

In fiscal 2025, uncertainties over US policies may have a global impact by curbing investment and corporate actions, potentially leading to a decline in profits in the primary business of our corporate business in Japan and global CIB business. We will strive to increase profits in secondary business by capturing the opportunities that arise from increased demand for hedging of foreign exchange and interest rate risk, which stems from the expanding volatility of financial markets, as well as increased order flow from the asset reallocation decisions of institutional investors. We also expect higher demand for consultation and discussion from our corporate clients on strategy restructuring in response to major changes in the business environment. To address these needs, we will create business opportunities by leveraging Mizuho's strengths, such as the research capabilities of the Industry Research Department of Mizuho Bank and the advisory and consulting capabilities of Mizuho Trust & Banking and Mizuho Securities. Furthermore, in light of significantly volatile financial markets, we will strive to thoroughly respond to retail customers in accordance with our customer-oriented business conduct and build trusted relationships in the asset and wealth management business, which will lead to an increase in assets under management and growth in related revenue.

2. Improve asset profitability

To improve ROE, we will also continuously improve return on risk-weighted assets (RORA). In our clients' businesses, we will assess the profitability of all clients, transactions, and products, reallocating management resources to businesses with higher RORA. Specifically, we will reduce low-RORA segments such as housing loans subject to intense interest rate competition and long-standing customer loans that have shown limited RORA improvement. The management resources freed up as a result will be invested in high RORA businesses such as M&A-related finance, real estate finance, and other businesses with the potential to generate various ancillary revenue.

We also continue to work on reducing cross-shareholdings. The book value of our cross-shareholdings, which stood at approximately JPY 2.0 trillion at the beginning of fiscal 2015, has been reduced to approximately JPY 0.8 trillion over the past 10 years. Moving forward our plan of reducing the book value by JPY 300.0 billion over the three years from fiscal 2023, we have sold JPY 186.1 billion in cross-shareholdings as of the end of fiscal 2024. In recent years, our clients have become increasingly aware of the need to reduce cross-shareholdings due to growing demand for stronger corporate governance. Accordingly, we have drawn up a new plan to reduce the book value by JPY 350.0 billion or more over the three years from fiscal 2025 in order to accelerate reduction, while still intending to achieve our initial plan of reducing the book value by JPY 300.0 billion by fiscal 2025. In terms of deemed holdings of shares, we will proceed with measures to reduce these by JPY 200.0 billion over the three years from fiscal 2025. Based on our stock price at the end of March 2025, we aim to reduce the market value of cross-shareholdings, including deemed holdings of shares, to less than 20% of net assets within three years.

Risk-weighted assets (RWA) and RORA1 (Figure 5)

- RWAs calculated on a management accounting basis (figures for March 2025 preliminary). Includes interest rate risk in banking account. RORA: Gross Profit RORA. As of fiscal year-end.

3. Control expense ratio

Through disciplined cost management, Mizuho has maintained its expense ratio around 60% which is comparable to that of major European and US banks despite the large difference in policy interest rates. With the increasing uncertainty of our business environment and the heightening risks associated with its severity, we will reduce fixed costs to strengthen the downward resilience of earnings. Under the strong commitment of management, we will improve the efficiency and productivity of our business processes by dynamically scaling back products, services, and businesses in which we have less of a competitive advantage. At the same time, we will actively invest in the necessary areas to ensure stable business operations as a financial institution and reinforce our competitive edge.

4. Manage credit-related costs

Due to changing economic and trade policies, including the introduction of reciprocal tariffs in the US, the business environment will likely become more severe, especially in sectors that are highly dependent on exports to the US. We need to be aware of the possibility that our clients' financial conditions may deteriorate and credit-related costs may increase. Accordingly, in fiscal 2024, we proactively allocated JPY 92.4 billion for provisions targeting sectors expected to experience adverse effects, ensuring readiness for future risks. By closely monitoring customers’ business and financial conditions and offering restructuring and improvement proposals before difficulties arise, we will continuously work to control credit costs.

5. Diversify revenue and enhance complementary revenue streams

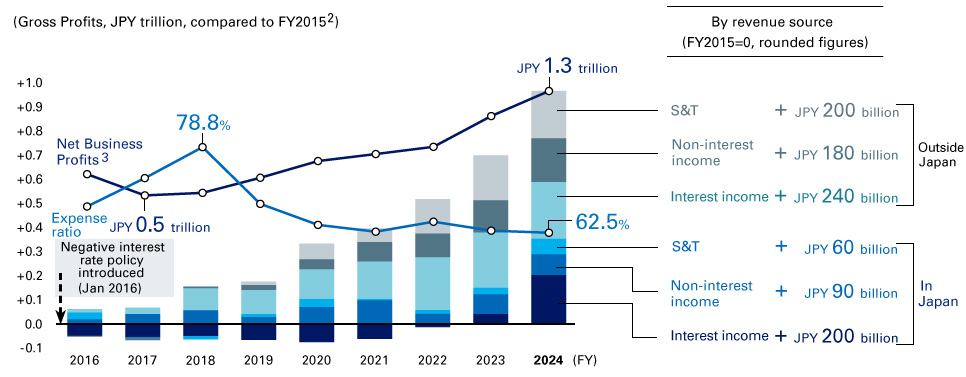

Having been faced with a difficult situation where interest income in Japan was significantly reduced due to the Bank of Japan's negative interest rate policy, we have diversified our business portfolio in and outside Japan, expanded non-interest income, and achieved earnings stability and growth. Particularly, we have achieved strong earnings growth for the global CIB business centered on the US by pursuing synergies between commercial banking, investment banking, and sales and trading (S&T) businesses with highly credit-worthy blue-chip companies and institutional investors as main clients. Compared to other peers in Europe and the US, Mizuho's global CIB business model is characterized by a low percentage of trading revenue, which fluctuates greatly in response to financial market conditions. Because of that low percentage, our global CIB business model produces extremely stable earnings.

The Japanese economy continues to gradually achieve nominal growth, and since the negative interest rate policy was lifted in March 2024 policy rates have remained positive. As a result, interest income in Japan will likely continue to increase. However, we remain prepared in case of any potential declines in policy rates, which could significantly impact deposit and loan profitability in customer divisions. We are flexibly controlling our Japanese yen and foreign currency bond portfolio in markets divisions while anticipating this possibility. This approach will mitigate fluctuations in our overall revenue from changes in policy interest rates and ensure that the revenue streams from our customer and markets divisions complement one another to an even greater extent.

Breakdown of revenue1 and expense ratio (Figure 6)

- Customer divisions + S&T

- For S&T, FY2016 – 2018: compared to FY2015, total of in and outside Japan.

FY2019 – 2024: compared to FY2018. - Consolidated, including Net Gains (Losses) related to ETFs and others. Excluding the realization of losses in securities portfolio.

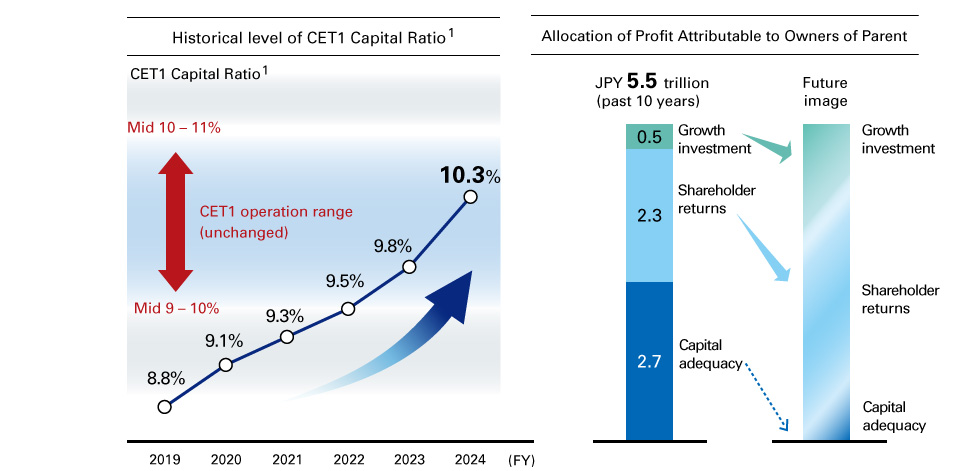

6. Use capital effectively

We will maintain our capital management policy of achieving an optimal balance between capital adequacy, growth investments, and enhancement of shareholder returns. While capital adequacy has long been a financial challenge for Mizuho, we have retained approximately half or JPY 2.7 trillion of the JPY 5.5 trillion in Profit Attributable to Owners of Parent recorded over the past 10 years as capital. As a result, our CET1 Capital Ratio (excluding Net Unrealized Gains (Losses) on Other Securities), a regulatory ratio, improved significantly and has reached a sufficient level of 10.3%, close to the upper limit of the operation range. In light of this, we will place greater emphasis on allocating future Profit Attributable to Owners of Parent to enhancing shareholder returns and making strategic growth investments.

Historical level of CET1 Capital Ratio and allocation of Profit Attributable to Owners of Parent (Figure 7)

- Basel III finalization fully effective basis. Excluding Net Unrealized Gains (Losses) on Other Securities. As of fiscal year-end.

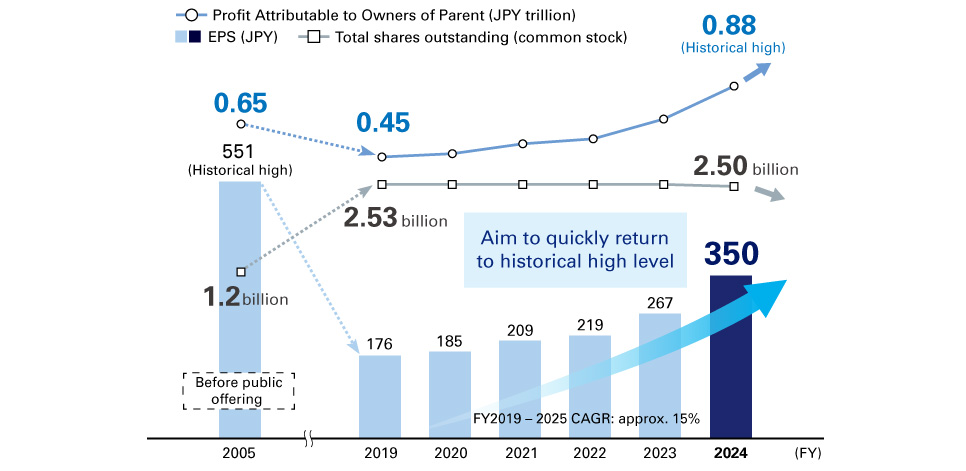

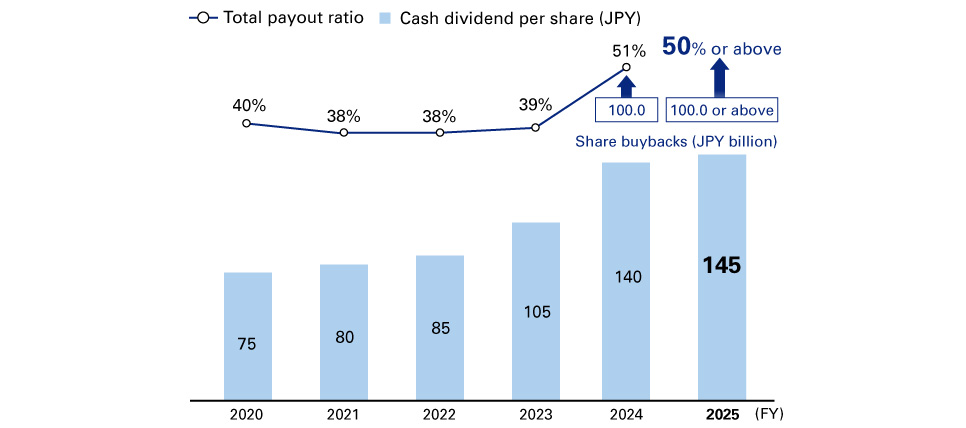

Given these gradual changes in our capital policy, we revised our shareholder return policy, which now calls for progressive increases in dividends per share and the execution of flexible and intermittent share buybacks. In accordance with this new policy, we will increase dividends per share by approximately JPY 5 each fiscal year based on the steady growth of our stable earnings base and decide on share buybacks based on business results, capital adequacy, our stock price, and opportunities for growth investment, using a total payout ratio of 50% or more as a guide.

The key principles underlining this approach are as follows: (1) the scale of shareholder returns, a combination of dividends and share buybacks, should be indicated as the total payout ratio, given that it is now possible to continuously repurchase shares; (2) dividends, which are the basis of shareholder returns, should be steadily increased even in the face of downward pressure on earnings from the increasingly uncertain business environment and rapidly changing macro-environment; and (3) management's intention to steadily increase EPS should be demonstrated by reducing the number of outstanding shares through flexible share buybacks.

Improve EPS (Figure 8)

Based on our new shareholder return policy, we have established our shareholder return forecast for fiscal 2025: cash dividend per share of JPY 145 (a JPY 5 increase from fiscal 2024 and the fifth consecutive year of increases) and share buybacks of JPY 100.0 billion. Accordingly, the total payout ratio is expected to be approximately 50% based on our Profit Attributable to Owners of Parent forecast of JPY 940.0 billion, which will be revised as necessary. We will also consider further shareholder returns based on our capital adequacy ratio, stock price, and growth investment opportunities.

Shareholder returns and fiscal 2025 forecast (Figure 9)

Our approach to growth investment will also remain unchanged. We will determine growth investments in a careful and disciplined manner by conducting multifaceted and in-depth examination of consistency with Mizuho's strategies, adequacy of investment returns, effectiveness of governance, and compatibility of corporate cultures.

Since fiscal 2023, we have acquired Greenhill to strengthen our global M&A advisory function in our global CIB business and corporate business in Japan, and we have strategically invested in Rakuten Card and Rakuten Securities, both of which belong to the Rakuten Group, one of Japan's leading e-commerce platform companies, to strengthen the mass-market retail and asset and wealth management businesses. In the mass-market retail business in Southeast Asia, where there is potential for future growth, we are making limited amounts of experimental investments to accumulate knowledge from a fintech and digital finance point of view on the business and competitive environment and the penetration of new digital services, as well as to consider our next growth strategy. We will continue to make growth investments by carefully selecting and exploring investment opportunities that will strengthen Mizuho's unique competitive edge.

In making growth investments, we work closely with investee companies, drive business to realize the strategic intent of our strategy, monitor the progress of profit plans, and promote organizational integration through personnel exchanges and the strengthening of governance so that we can quickly realize the benefits of these investments. We will manage experimental investments in particular with discipline and will quickly exit if it is deemed that expected returns will not be realized.

To our investors

During a business trip to Europe at the end of 2024, I had the opportunity to sit down with an institutional investor who has made significant investments in Mizuho. I explained how we have reinforced profitability by diversifying our business portfolio, improved cost and capital efficiency through disciplined financial management, and enhanced our capital adequacy, especially during the challenging business environment following the negative interest rate policy. One remark stood out to me: "We are satisfied with the financial results achieved through your disciplined management. However, investors' expectations lie beyond your current trajectory. We would like to see Mizuho transform from a Japanese financial institution that operates globally to a truly global financial institution rooted in Japan." Together with our management team, we are committed to driving Mizuho forward into its next stage of growth.

We sincerely appreciate and welcome your candid feedback and continued support in the future.

Takefumi Yonezawa