Sumitomo Mitsui Trust Holdings, Inc. (President: Kunitaro Kitamura), Mizuho Financial Group, Inc. (President and Group CEO: Yasuhiro Sato), Resona Bank, Limited as a subsidiary of Resona Holdings, Inc. (Director, President and Representative Executive Officer: Kazuhiro Higashi), and The Dai–ichi Life Insurance Company, Limited as a subsidiary of Dai–ichi Life Holdings, Inc. (President and Representative Director: Koichiro Watanabe) have executed a memorandum of understanding to commence detailed analysis and negotiations in preparation for the management integration (the "Integration") of Japan Trustee Services Bank, Ltd. (Representative Director and President: Yasuo Kuwana, "JTSB") and Trust & Custody Services Bank, Ltd. (President & CEO: Akira Moriwaki, "TCSB").

The applications to and approvals from domestic and foreign regulatory authorities are conditions precedent to the Integration.

- 1.Purpose of the Integration

Since its establishment in 2000, JTSB, operating primarily in trust services (acting as trustee when tasked with re–entrustment from trust banks), has expanded its assets under custody and administration and holds entrusted assets of JPY 244 trillion (as of September 30, 2016).

Since its establishment in 2001, TCSB, in addition to trust services, engages in a wide range of businesses such as comprehensive securities management outsourcing services to life insurers and custody services, and holds assets under custody and administration of JPY 375 trillion (as of September 30, 2016).

The concentration of both companies' managerial resources and expertise will have the benefit of scale, will realize more stable and higher quality operations, and aims for further growth in the domestic securities settlement market and contribute to the enhancement of the domestic investment chain.

- 2.What the Integrated Company Aims to Be

In addition to the integrated company having the benefit of scale by being the largest asset administration service provider in Japan, the integrated company will strengthen operation systems with the application of new technologies, will develop human resources specializing in asset administration services, and will have enhanced operations including securities processing services related to investment trusts and pension trusts and comprehensive securities management outsourcing services. By meeting a wide variety of customer needs, the integrated company will aim to be the top trust bank specializing in asset administration services in Japan.

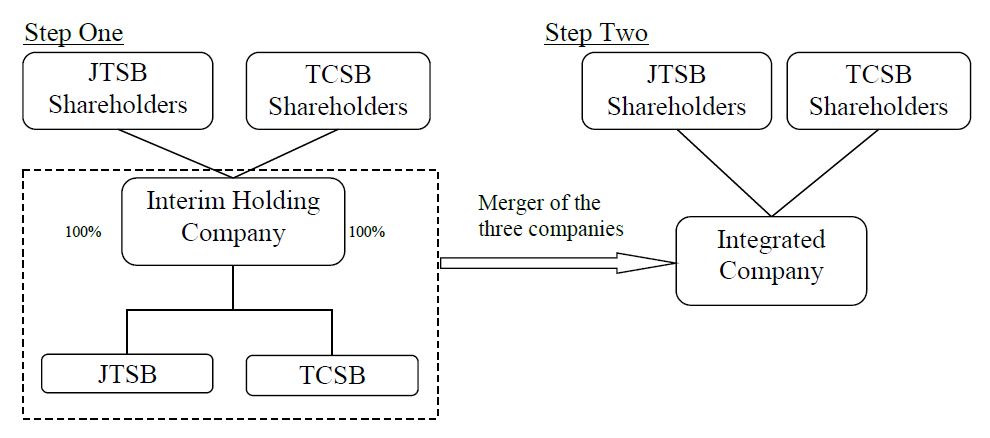

- 3.Integration Structure

For step one of the Integration, an interim holding company will be established as a wholly–owning parent company of JTSB and TCSB, and both companies' corporate functions will be unified. Following the completion of preparations for integration of system operations, step two will commence, in which the three companies – the interim holding company, JTSB and TCSB – will merge and undergo final management integration.

The applications to and approvals from domestic and foreign regulatory authorities are conditions precedent to the establishment of this Integration Structure.

4.Integration Schedule

Regarding the Integration, following detailed analysis and negotiations, we aim to execute a final agreement in the latter half of fiscal year 2017. After executing the definitive agreement, we intend to realize the effects of Integration as soon as possible, while taking into consideration the schedule for system construction, for which the acquisition of necessary board of directors resolutions and shareholder meeting resolutions as well as the applications to and approvals from domestic and foreign regulatory authorities are conditions precedent.

We will further discuss the integration structure, and details regarding the integrated company, including the corporate name, the location of the head office, and the prospective representative, and will make announcements once such details have been determined.

[Reference] Summary of Banks Specializing in Asset Administration Services (As of December 31, 2016)

| (1) Name | Japan Trustee Services Bank, Ltd. (JTSB) | Trust & Custody Services Bank, Ltd. (TCSB) | ||

| (2) Main Office Address | Harumi Island Triton Square Tower Y 8–11, Harumi 1–Chome, Chuo–ku, Tokyo | Harumi Island Triton Square Tower Z 8–12, Harumi 1–Chome, Chuo–ku, Tokyo | ||

| (3) Representative | Representative Director and President Yasuo Kuwana | President & CEO Akira Moriwaki | ||

| (4) Scope of Operations | Securities processing services, trust services and bank businesses related to asset administration services, and businesses related to Japanese master trusts | Securities processing services, trust services and bank businesses related to asset administration services, and businesses related to Japanese master trusts | ||

| (5) Capital Stock | JPY 51 billion | JPY 50 billion | ||

| (6) Establishment Date | June 20, 2000 | January 22, 2001 | ||

| (7) Number of Employees | 975 (as of September 30, 2016) | 653 (as of September 30, 2016) | ||

| (8) Shareholding (ratio) | Sumitomo Mitsui Trust Holdings | 66.6% | Mizuho Financial Group | 54.0% |

| Resona Bank | 33.3% | Dai–ichi Life Insurance | 16.0% | |

| Asahi Mutual Life Insurance | 10.0% | |||

| Meiji Yasuda Life Insurance | 9.0% | |||

| Japan Post Insurance | 7.0% | |||

| Fukoku Mutual Life Insurance | 4.0% | |||

| (9) Assets under Custody and Administration | JPY 294 trillion Entrusted assets are JPY 244 trillion (as of September 30, 2016). | JPY 375 trillion Entrusted assets are JPY 135 trillion (as of September 30, 2016). | ||

| (10) Recent Earnings (2015 Fiscal Year) | Ordinary Revenue | JPY 27.8 billion | Ordinary Revenue | JPY 24.5 billion |

| Ordinary Profits | JPY 500 million | Ordinary Profits | JPY 1.7 billion | |

| Net Profit | JPY 300 million | Net Profit | JPY 1.1 billion | |