Transitioning to the Next Generation of Financial Services

Mizuho Financial Group, Inc. ("Mizuho") is pleased to announce a new business plan spanning a five–year period starting from fiscal 2019. The plan is titled 5–Year Business Plan: Transitioning to the Next Generation of Financial Services.

Our customers' needs and the financial industry are rapidly undergoing structural changes in reflection of the structural shifts occurring in the economy, industry, and society such as digitalization, an aging society with a low birthrate, and globalization. It is essential that we respond quickly to these structural changes, especially in light of increasing uncertainty in the business environment due to concerns regarding a global economic slowdown, signs of a turn in the credit cycle, and other factors.

In consideration of this environment and the issues we face, our new business plan is focused on transitioning to the next generation of financial services—building new forms of partnerships with our customers so that we can respond to their needs as the times change. Our objective is to build a stronger and more resilient financial group which our customers can depend on in the coming era.

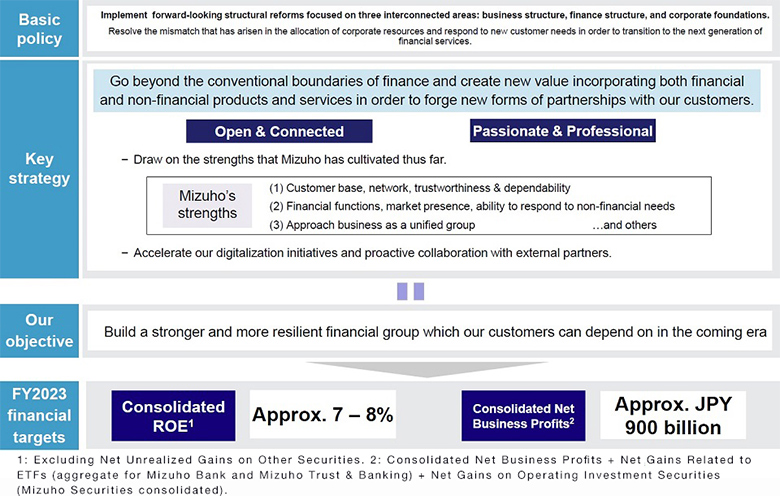

1. Basic policy

Implement forward–looking structural reforms focused on three interconnected areas:

business structure, finance structure, and corporate foundations.

Resolve the mismatch that has arisen in the allocation of corporate resources and respond to new customer needs in order to transition to the next generation of financial services.

The 5–Year Business Plan can be broadly divided into two phases:

- Phase 1 (3 years): Full implementation of the structural reforms, building the firm foundations for next generation financial services.

- Phase 2 (2 years): Achieve the effects of the structural reforms and accelerate further growth.

2. Key strategy

Go beyond the conventional boundaries of finance and create new value incorporating both financial and non–financial products and services in order to forge new forms of partnerships with our customers.

– Draw on the strengths that Mizuho has cultivated thus far.

Mizuho's strengths

(1)Customer base, network, trustworthiness & dependability

(2)Financial functions, market presence, ability to respond to non-financial needs

(3)Approach business as a unified group

...and others

– Accelerate our digitalization initiatives and proactive collaboration with external partners.

In order to transition to the next generation of financial services, we will implement the abovementioned strategy and aim to build new forms of partnerships with our customers.

Building new forms of partnerships with our customers

For individual customers: be a partner that helps customers design their lives in a changing society

For corporate & institutional clients: be a strategic partner for business development under a changing industrial structure

For market participants: be a partner with expert knowledge of market mechanisms and the ability to draw on a range of intermediary functions

In order to achieve this, we will adopt "Open & Connected" and "Passionate & Professional" as our action principles.

Open & Connected

- We will flexibly blend customer segments, regions, functions, and other aspects of our business to create new, more open value chains spanning both finance and adjacent fields.

- We will proactively collaborate not only within the Mizuho group but also with external partners.

Passionate & Professional

- Each member of the group will be encouraged to find a source of inspiration in the dreams and hopes of our customers and better connect with them.

- We will fully draw on Mizuho's strengths, backed by our high level of expertise, to anticipate customers' needs and then think, act, and deliver.

3. Financial targets

As financial targets, we will set a target for Consolidated ROE as an indicator of our earnings power compared to capital, and a target for Consolidated Net Business Profits as an indicator of fundamental earnings power.

| Consolidated ROE1 | Approx. 7 – 8% by fiscal 2023 |

| Consolidated Net Business Profits2 | Approx. JPY 900 billion by fiscal 2023 |

- 1:Excluding Net Unrealized Gains on Other Securities.

- 2:Consolidated Net Business Profits + Net Gains Related to ETFs (aggregate for Mizuho Bank and Mizuho Trust & Banking) + Net Gains on Operating Investment Securities (Mizuho Securities consolidated).

| Common Equity Tier 1 (CET1) capital ratio target level3 | Lower end of the 9 – 10% range |

| Reduction of cross–shareholdings4 | Reduction of JPY 300 billion by the end of fiscal 2021 |

- 3:Basel III (finalized requirements) fully–effective basis. Excluding Net Unrealized Gains on Other Securities.

- 4:Acquisition cost basis.

Shareholder Return Policy

We are maintaining the current level of dividends for the time being while aiming to strengthen our capital base further to enhance returns to shareholders at an early stage.

4. Priority business domains

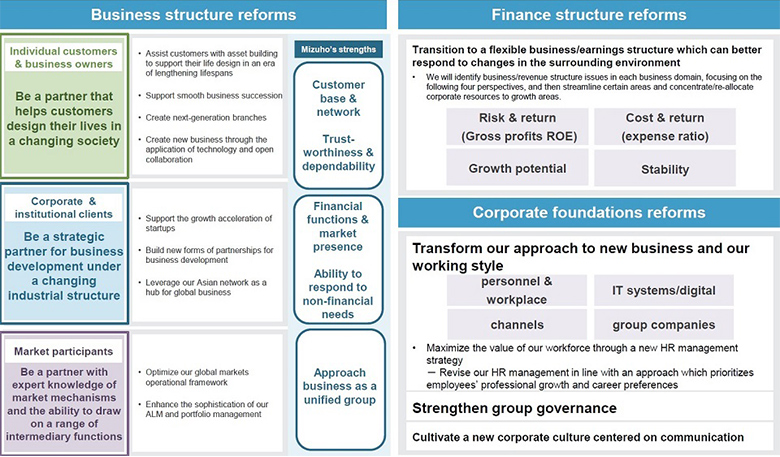

(1)Business structure reforms

We will implement business structure reforms focused on the following initiatives to better enable us to respond to structural shifts occurring in the economy, industry, and society while drawing on Mizuho's strengths.

- Be a partner that helps customers design their lives in a changing society

- Assist customers with asset building to support their life design in an era of lengthening lifespans, and develop professionals capable of providing this assistance.

- Provide sophisticated solutions for business succession needs and assist clients with needs regarding identifying candidates for senior management roles.

- Create next–generation branches focused on consulting which combine physical locations and digital channels.

- Appeal to new customer demographics and create new demand through the application of technology and open collaboration.

- Be a strategic partner for business development under a changing industrial structure

- Open collaboration for growth acceleration including financing the growth of startups and forming industry–government–academia partnerships.

- Utilize our industry knowledge and other insights to build new forms of partnerships, sharing business risks.

- Leveraging our Asian client base and network in order to support the business development of global clients.

- Be a partner with expert knowledge of market mechanisms and the ability to draw on a range of intermediary functions

- By optimizing our global network and products framework, draw on a broad range of intermediary functions to connect investors with other investors and connect issuers with investors.

- Enhance the sophistication of our ALM and portfolio management through flexible asset allocation while maintaining a focus on achieving a balance between realized gains and unrealized gains/losses.

(2)Finance structure reforms

We will implement finance structure reforms focused on the following initiatives to transition to a flexible business/earnings structure which can better respond to changes in the business environment and competitive environment.

- We will identify business/revenue structure issues in each business domain, focusing on the following four perspectives:

- (1) Risk & return (Gross profits ROE), (2) Cost & return (expense ratio), (3) Growth potential, (4) Stability

- Based on the above issues, streamline certain areas and concentrate/re–allocate corporate resources to growth areas.

- After establishing a stable earnings base, transition to a revenue structure centered on proactively pursuing revenue streams with upside potential.

(3)Corporate foundations reforms

We will implement the following initiatives in order to strengthen our corporate foundations as a means of supporting continued competitive advantage.

- Transform our approach to new business and our working style.

- Focus on the following areas: personnel & workplace, IT systems/digital, channels, and group companies.

- Revise our HR management in line with an approach which prioritizes employees' professional growth and career preferences and promote a new HR management strategy focused on maximizing our workforce value that is universally recognizable.

- Strengthen group governance.

- Expand the use of "dual–hat" appointments of executive officers between the holding company and group companies and other methods of strengthening unified management of the group, including group companies other than banking, trust banking, and securities entities. This will enhance our ability to implement key strategies and structural reforms.

- Cultivate a new corporate culture centered on communication.

5. Value created for stakeholders

Through the initiatives under the new business plan, we will create new value for our stakeholders.

- Customers: Create new value in adjacent business areas surrounding finance and achieve increased customer convenience and business growth.

- Shareholders: Increase corporate value by resolving structural issues and accelerating growth.

- Employees: Create workplaces that give employees a sense of purpose, linked to customer satisfaction.

With this in mind, we have defined sustainability for Mizuho as "achieving sustainable and stable growth for Mizuho, and through this growth, contributing to the sustainable development and prosperity of the economy, industry, and society around the world". Further, we will select "key sustainability areas" which reflect the expectations and demands of our stakeholders, in light of a materiality to and affinity with our strategies, and the medium– to long–term impact on our corporate value. This will form the basis of our efforts to contribute to the realization of the UN's Sustainable Development Goals (SDGs).

5–Year Business Plan: Transitioning to the Next Generation of Financial Services

Priority business domains

This immediate release contains statements that constitute forward–looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995, including estimates, forecasts, targets and plans. Such forward–looking statements do not represent any guarantee by management of future performance.

You can also identify forward–looking statements by discussions of strategy, plans or intentions. These statements reflect our current views with respect to future events and are subject to risks, uncertainties, and assumptions. Actual results may differ materially, for a wide range of possible reasons, including, but not limited to: incurrence of significant credit–related costs; declines in the value of our securities portfolio; changes in interest rates; foreign currency fluctuations; failure to comply with laws or regulations; the manifestation of operational risk or IT system risk; the effect of changes in general economic conditions in Japan and elsewhere

For information regarding Mizuho Financial Group's financial condition, business performance, and other matters which might materially affect the investment decisions of investors, please refer to the latest versions of the firm's short–form financial statements, securities reports, integrated reports, and other disclosure materials released in Japan, or Form 20–F and other SEC submissions and disclosure materials released in the United States.

Except when obligated by the Tokyo Stock Exchange's Securities Listing Regulations and other rules, Mizuho Financial Group does not always update or revise our business strategy or the forecasted figures and other forward–looking statements, regardless of the emergence of new information, the occurrence of events, or any other reason, nor are we obligated to do so.

These materials do not constitute an offer or solicitation of the purchase or sale of any security in the United States, Japan, or any other country or jurisdiction.