Support for SMEs and regional revitalization

Support for small and medium–sized enterprises (SMEs)

By drawing on our consulting capabilities to provide proposals and solutions that address the issues SMEs face, we ensure that clients' perspectives are prioritized when providing support for business expansion, succession, reorganization, and other client needs. We also believe that proactively supporting SMEs is a key part of fulfilling our social responsibility as a financial institution.

In particular, by providing consulting and support for SMEs' growth strategies, we can introduce clients to potential M&A opportunities from the standpoint of business expansion and succession, and support the growth of innovative companies with exceptional technologies or ideas.

Furthermore, a specialized business reorganization section within our Head Office provides support for SMEs' business improvement and reorganization needs. In addition, our Head Office collaborates with frontline offices to provide consultations and support for clients through partnerships with external organizations, external specialists, and other financial institutions.

Regional revitalization initiatives

In Japan, as a result of the trend toward concentration of businesses and other economic activity solely in Tokyo, rural populations are expected to decline and regional economies are expected to shrink in the future. As a nation, Japan must look for ways to revitalize regional areas through a virtuous cycle in which jobs draw people back to local areas and population growth creates more jobs.

Utilizing our office network in Japan, we are striving to promote the revitalization of regional economies by providing our clients with funding, supporting the operations of local businesses, and collaborating with regional governments.

Case study: Efforts to revitalize local economies through business revitalization support

At Mizuho Bank, we are drawing on our strengths as a group with offices in all 47 prefectures of Japan to support regional industry revitalization.

This involves co-creation with startups and local companies, business matching and business succession between local companies, assistance to companies seeing declining performance, and other efforts. The main organizational body driving our support is our Regional Revitalization Desk, which houses our headquarters functions for planning and promoting initiatives towards resolving issues faced by local communities.

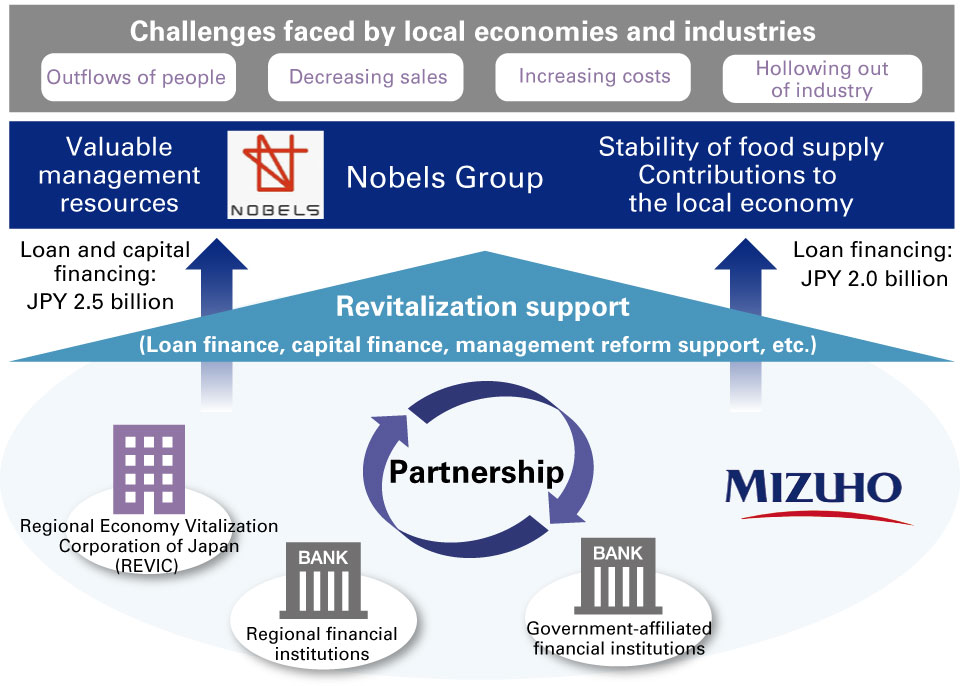

For example, in May 2024 we provided support including loan and capital financing of JPY 4.5 billion to the Nobels Group, a large agricultural corporation in Hokkaido's Tokachi region, in collaboration with the Regional Economy Vitalization Corporation of Japan, government-affiliated financial institutions, regional financial institutions, and others. The Nobels Group faced a challenging business environment due to rising feed prices, falling beef prices, and other factors, but has significant business resources as one of the largest agricultural businesses in Japan, with advanced technological capabilities and a circular business model. Our support for its revitalization has profound significance in contributing to the maintenance and development of the regional economy and supporting local employment.

Going forward, we will help to revitalize regional economies through targeted support for companies that are of importance to local communities.