Materiality

Mizuho is advancing sustainability initiatives as a unified group by identifying and including key sustainability areas in its 5–year Business Plan and business plans for specific areas.

Risks and opportunities/KPI/Performance/Outcome

Significance of materiality areas and Identification Process

Efforts Related to the Sustainable Development Goals

Materiality

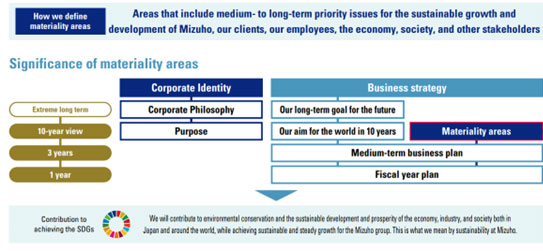

How we define materiality areas

Areas that include medium-to long-term priority issues for the sustainable growth and development of Mizuho, our clients, our employees, the economy, society, and other stakeholders

Risks and opportunities/KPI/Performance/Outcome

| Materiality | Stakeholders | Risks and opportunities | Main initiatives | KPIs | KPI Performance | Outcome |

| Declining birthrate and aging population, plus good health and lengthening lifespans | Customers (Retail) |

【Risk】 Demographic changes such as the declining birthrate and aging population imply potentially detrimental changes to our retail customer base, which is the foundation of our business. 【Opportunity】 By providing retail asset formation, management, and succession and improving customer experience, we will have an opportunity to address social issues and enhance our corporate value through our business expansion. |

|

|

|

|

| Industry development and innovation | Customers (Corporate) |

【Risk】 Any delay in changes in industrial and business structure poses a risk of damaging the sustainability of our corporate client base and of society overall.【Opportunity】 By anticipating changes and contributing to the sustainable development of our clients and society, we will have an opportunity to address social issues and demonstrate our superiority in a changing competitive environment. |

|

|

|

|

| Sound economic growth | Markets | 【Risk】 Changes in the economic and financial market environment affect our business operations. 【Opportunity】 By contributing to sound economic growth and playing a role in that process, Mizuho can both directly secure business opportunities and indirectly contribute to a more stable business environment. |

|

|

|

|

| Environment and society | Environment | 【Risk】 Our sustainability relies completely on the sustainability of society, including the economy and the environment, which are the foundation for our business operations. 【Opportunity】 Supporting the realization of environmental and social sustainability may itself prove to be a business opportunity for Mizuho. |

|

|

|

|

| Personnel | Employees・Foundations for contribution | 【Risk】 Lack of personnel is a risk to Mizuho's business continuity. 【Opportunity】 Creating a corporate culture that encourages a diverse range of people to act on their own initiative and grow will provide opportunities to create social value and enhance Mizuho's corporate value. |

|

|

|

|

| Governance | Foundations for contribution | 【Risk】 Administrative penalties and damage to social credibility due to poor governance are risks to our sustainability, business continuity, and strategy implementation. 【Opportunity】 Stable business operations underpinned by strong corporate governance are the cornerstone of our growth strategy, corporate foundations, and everything else at Mizuho. |

|

Significance of materiality areas

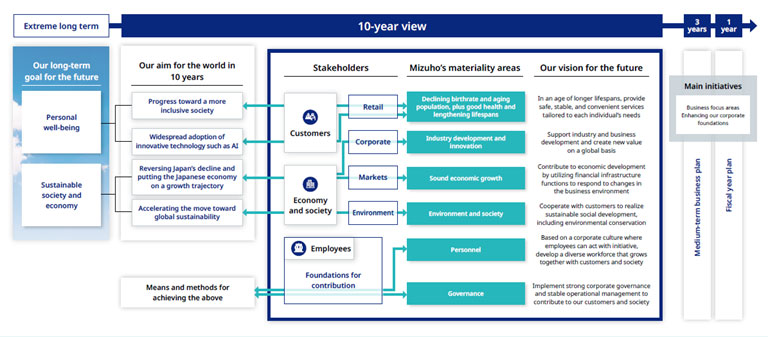

We devised Mizuho's growth strategy by backcasting from our aim for the world in 10 years, which was itself devised by backcasting from our long-term goal for the future. Our materiality areas link to our aim for the world in 10 years through categories comprising our stakeholders—customers, economy and society, and employees—along with our foundations for contribution.

This interconnects our growth strategy and materiality areas across the same 10-year time span. The key pillars of our growth strategy—our business focus areas and enhancing our corporate foundations—include plans for addressing our materiality areas.

Materiality Positioning and Identification Process

When designating "Materiality" at Mizuho, we consider the expectations of society: expectations various stakeholders maintain towards Mizuho in regard to the social impact and importance for Mizuho: medium– to long–term impact on our corporate value and compatibility with Mizuho's strategies and business areas.

In general, the company shall confirm the necessity of revising the Materiality on a yearly basis.

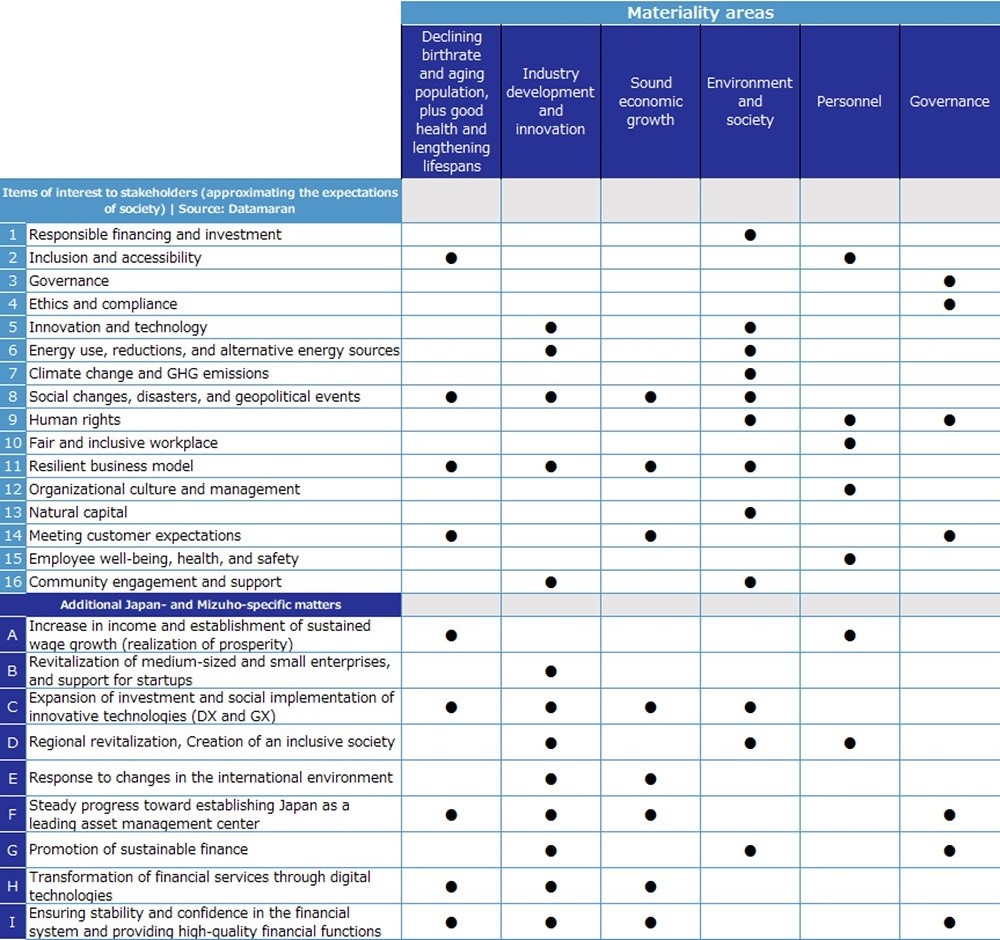

| STEP1 | Check alignment with the expectations of society ● Shortlisted 16 items that are of interest for a full-service financial institution on a global basis, using external data based on financial institutions' disclosures for investors, regulatory trends, media sources, and similar. ● Added nine further items (A to I), consisting of matters for consideration and Mizuho-specific matters, based on the Japan Financial Services Agency's Strategic Directions and Priorities, meetings with institutional investors, customer surveys, and similar Confirmed that Mizuho's materiality areas cover the latest expectations of society. |

| STEP2 | Check alignment with importance for Mizuho

● Confirmed how materiality areas and our business strategy (key topics in our growth strategy and medium-term business plan) relate to one another. |

| STEP3 | Confirm and decide on risks and opportunities and main initiatives

● Confirmed risks and opportunities—which are the reasons for selecting materiality areas—and the main initiatives to address materiality areas. |