Customer-oriented Approach

Basic approach

Mizuho regards adhering to integrity—or, in other words, acting as a trusted partner by always upholding solid moral principles—as one of the values we pursue in realizing our stated Purpose, which is to "Proactively innovate together with our clients for a prosperous and sustainable future". We believe that garnering customers' trust through our customer-oriented approach will lead to garnering trust from all of our stakeholders and this will underpin our sustainable growth.

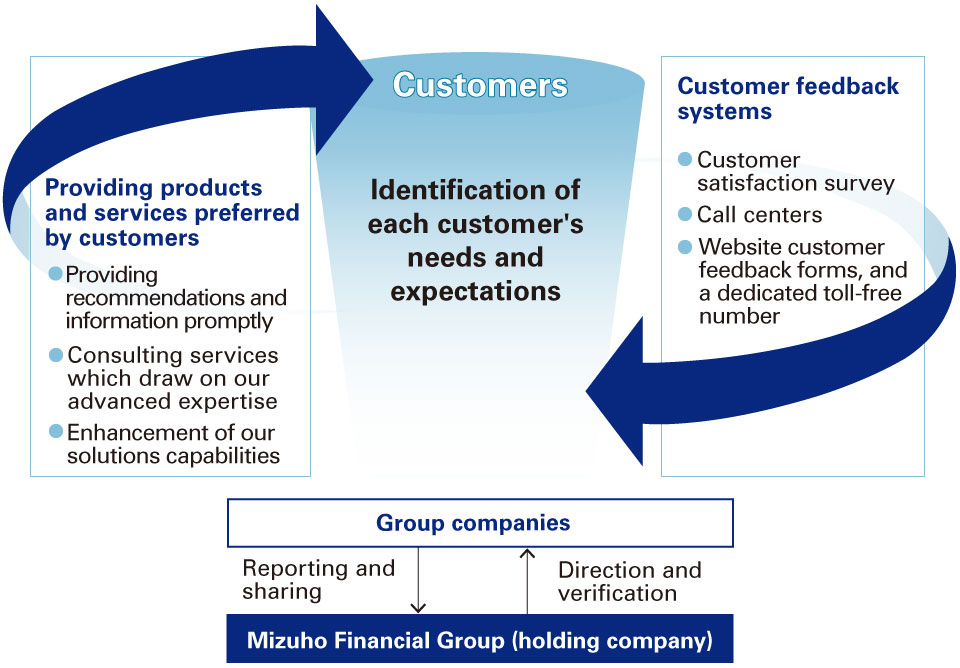

Identifying customer needs and expectations and utilizing them in our corporate activities

Mizuho regards the customer comments that we receive through various channels as a valuable asset in our corporate activities. We work to identify customers' diverse and constantly changing needs and expectations, improving our service quality accordingly so that we can continue to provide products and services preferred by customers. We have created a cycle whereby the current status of group companies' efforts is reported to Mizuho Financial Group for verification and consultation, leading to further improvements.

Customer feedback channels

Mizuho Bank, Mizuho Trust & Banking, and Mizuho Securities garner customer feedback through multiple channels:

- Regular customer satisfaction surveys seeking customer views on our products, services, recommendations, etc.

- Call centers responding to customer opinions and requests

- Website feedback forms and a dedicated toll-free number to gather customer opinions and requests

Asset management-related business

We have released our Policies Regarding Mizuho's Fiduciary Duties* as a set of group-wide policies to ensure we continue offering products and services that genuinely serve the best interests of our customers. In addition, at our holding company and at relevant group companies, we have established, made public, and executed action plans based on these policies.

* Fiduciary duties is a general term for the broad range of roles and responsibilities that fiduciaries are expected to fulfill when engaging in certain business activities in order to live up to the trust that is placed in them by their customers.

For more information on Policies Regarding Mizuho’s Customer-oriented Business Conduct, please click on the link below:

https://www.mizuhogroup.com/binaries/content/assets/pdf/mizuhoglobal/who-we-are/governance/customer/fiduciary.pdf (PDF/132KB)

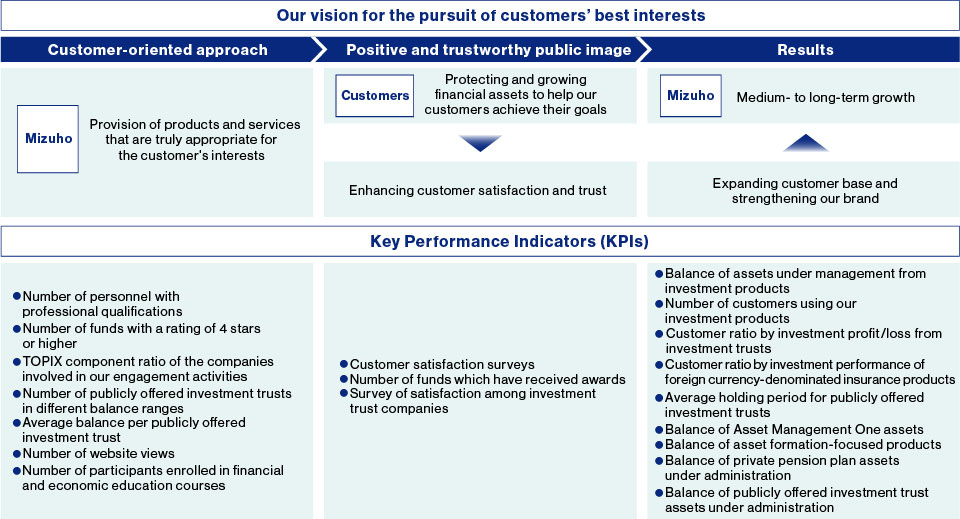

Our vision for the pursuit of customers' best interests

We believe that protecting and growing financial assets and helping our customers achieve their goals by providing products and services that are truly appropriate for the customer's interests will lead to the achievement of the customer's best interests.

At the same time, we aim to utilize the medium- to long-term growth of Mizuho to further enhance our level of customer service by expanding our business base and establishing a brand based on customer satisfaction and trust.

Key Performance Indicators (KPIs)

We have established KPIs to confirm our level of performance in customer-oriented business conduct. We publicize progress on these KPIs periodically, along with the status of initiatives under our Action Plan.

In addition to the KPIs listed above, the following common KPIs have also been released.

Common KPIs

(1) Customer ratio by investment profit/loss from investment trust funds/fund wraps, (2) Cost vs. return of the best-selling investment products in terms of the balance of investment trust assets under management, (3) Risk vs. return of the best-selling investment products in terms of the balance of investment trust assets under management, (4) Customer ratio by investment performance of foreign currency-denominated insurance products, (5) Cost vs. return of foreign currency-denominated insurance products.

Common KPIs are indicators based on the "Common Key Performance Indicators (KPIs) Comparable Across Investment Trust Distributors" published by Japan's Financial Services Agency in June 2018 and the “Common Key Performance Indicators (KPIs) Comparable Across Foreign Currency-denominated Insurance Distributors" by Japan’s Financial Services Agency in January 2022.