Corporate & Investment Banking Company

In order to further strengthen our ability to meet the increasingly diverse and complex needs of our clients, we established the new Corporate & Investment Banking Company by integrating the Corporate & Institutional Company with the investment banking functions of the Global Products Unit. Increasing public interest in sustainability and other social issues is accelerating various structural shifts. By resolving social issues and supporting clients to enhance their corporate value, we will contribute to the sustainable growth and prosperity of industry, the economy, and society as a whole.

Business overview

As the in-house company in charge of large corporations, financial institutions, and public-sector entities in Japan, the company provides products (M&A, real estate, etc.) on a group-wide basis.

*Materiality areas:

- Industry development and innovation

- Sound economic growth

- Environment and society

Strengths

- Capacity to co-create value with clients through sector coverage structure, aligned among banking, trust banking, and securities

- Merged organization of sector coverage and product line to enhance capability to connect various functions within the Mizuho group and provide both financial and non-financial solutions

- Ability to provide sound risk capital for co-creating value with clients

Focuses

- In terms of sustainability including decarbonization, we aim to create businesses in a wide range of domains beyond finance by engaging deeply with clients and taking action to resolve their issues, as well as the issues affecting society and industry.

Optimization

- We will establish an appropriate balance of risk & return by reviewing our business portfolio. With regard to cross-shareholdings, we are continuing their steady reduction and effectively reallocating capital to highly profitable product areas, mezzanine financing, and the like.

Measures to achieve medium-term business plan

We will bolster our role as a partner that co-creates value with clients by accurately identifying the major trends of structural change in society and industry and providing a diverse range of financial and non-financial solutions to facilitate clients' sustainable growth and prosperity. By integrating coverage and products following the establishment of the new in-house company, we will ensure "market-in" approaches to clients (i.e., approaches informed by client needs), thereby enhancing our ability to provide solutions.

League tables

| FY2019 | FY2020 | FY2021 | FY2022 | |

|---|---|---|---|---|

| ECM1 | #4 | #4 | #4 | #4 |

| DCM2 | #1 | #1 | #1 | #1 |

| M&A3 | #3 | #15 | #5 | #5 |

| SDG bonds4 | #1 | #1 | #1 | #1 |

- Equity underwriting amount worldwide, bookrunner basis. Source: Refinitiv

- Including straight bonds, investment corporation bonds, zaito institution bonds, municipal bonds (lead manager method only), samurai bonds, and preferred securities and excluding bonds issued by Mizuho.

Source: Refinitiv. - Deals in which Japanese companies were publicly involved. Excluding real estate. Source: Refinitiv

- Source: Refinitiv

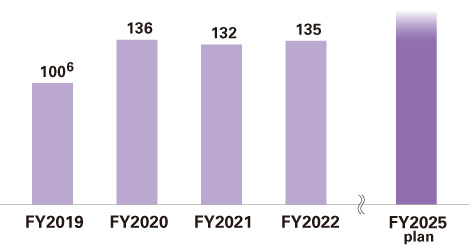

Strategic investment balance5

- Strategic Investment. Hybrid financing, Equity & Mezzanine, etc.

- With FY2019 results as 100