Global Corporate & Investment Banking Company

As a strategic partner supporting our clients' global businesses, we will leverage our firm presence in the US capital markets and our extensive network in Asian economic zones to provide comprehensive financial solutions to clients in each region. In addition, we will use engagement as a means of supporting their business development and transition to decarbonization, while also helping to resolve social issues.

Business overview

Providing solutions on a unified group basis to clients including both Japanese companies operating outside Japan and non-Japanese companies.

*Materiality areas:

- Industry development and innovation

- Sound economic growth

- Environment and society

Strengths

- Corporate & Investment Banking (CIB) business model that offers both balance sheet and capital markets / investment banking functions such as DCM, ECM, and M&A, and a firm presence in US capital markets

- Extensive international network centered on Asia where the economy is growing

- Robust client base and strong loan portfolio

Focuses

- The growth drivers in our business outside Japan are the US, which has the largest fee pool, and Asia, which has strong economic fundamentals. We are working toward further growth by prioritizing allocation of corporate resources in these regions.

Optimization

- We will consolidate administrative operations outside Japan into Mizuho Global Services India and deploy best practices and digital transformation to standardize work processes. At the same time, we will strategically reallocate corporate resources throughout each region, replacing underperforming assets with highly profitable assets.

Measures to achieve medium-term business plan

We will take bold steps to improve asset profitability through further enhancement of CIB capabilities in the US, and through expanding non-interest income and revising our portfolio by extending the CIB model to Asia-Pacific and EMEA. We will also take steps to enhance our framework of internal controls and business expansion to ensure its alignment with increasingly demanding supervisory perspectives and tightened regulations. Towards further business growth and stable operations, we will enhance and diversify our human capital portfolio by employing professional human resources well-acquainted with each local market and developing the core personnel who can work internationally in the future.

League tables

| FY2019 | FY2020 | FY2021 | FY2022 | |

|---|---|---|---|---|

| Americas DCM1 | #9 | #9 | #8 | #8 |

| excl. US banks | #3 | #3 | #2 | #2 |

| Share | 3.3% | 3.4% | 3.5% | 4.2% |

| Americas Non-IG LCM/DCM2 |

#25 | #17 | #21 | #16 |

| excl. US banks | #11 | #8 | #10 | #6 |

| Share | 1.0% | 1.4% | 1.4% | 1.7% |

- Bonds issued by investment grade corporations, fee basis. Source: Dealogic.

- Bonds and loans issued by non-investment grade corporations, fee basis. Source: Dealogic.

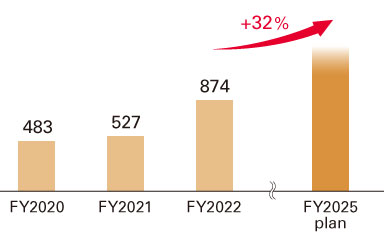

Transaction banking

(Asia-Pacific (USD million))