Global Markets Company

Regarding our sales and trading business, we will enhance our ability to respond to diversifying client needs by further acceleration of integrated banking and securities operations in each region, and boost our capacity to provide market solutions, and to pursue digitalization.

With respect to our banking operations, under the situation in which highly uncertain market conditions are expected to continue, we will realize stable earnings by controlling risks through flexible operations by early warning signals management and close market analyses.

Business overview

The company engages in sales and trading (S&T) business offering market products, and banking operations comprising asset and liability management (ALM) and investment.

*Materiality areas:

- Sound economic growth

Strengths

- S&T business integrated across banking and securities, aligned to regional characteristics in the US, EMEA, Asia (ex-Japan) and Japan respectively

- Stable S&T business underpinned by various clients under the Corporate & Investment Banking (CIB) business model

- Global ALM management and flexible portfolio management by capturing early warning signals, etc. in our banking operations

Focuses

- In our S&T business, we will focus on expanding product lines that contribute to growth of the CIB business model around the world, and ensure earnings stability through business diversification and transaction flows. In our banking operations, we will improve our Japanese yen- and foreign currency-based ALM to ensure it is responsive to changes in the market environment and focus on flexible portfolio management integrating investment and ALM.

Measures to achieve medium-term business plan

We will focus on expanding equities business in Japan and the US, and derivatives business in Asia (ex-Japan), while in the EMEA region we will focus on products consistent with our CIB business model. This will enable us to further accelerate integrated banking and securities operations within the S&T business in each region. To manage increasing foreign-currency assets on our balance sheet, we will increase the stability of our capacity to procure foreign currency funding, including by effectively using yen-dominated assets. In investment product sales in Japan, we will aim to increase earning opportunities from corporate clients by furthering acceleration of integrated banking and securities operations through reinforcement of our capacity to provide financial product intermediary services.

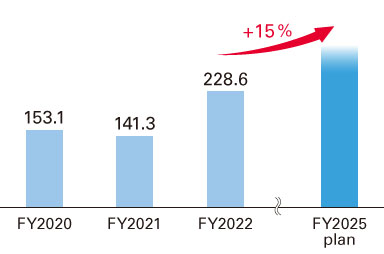

Ex-Japan S&T Revenues (JPY billion)

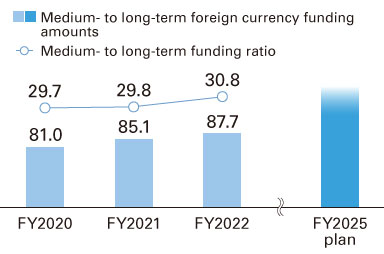

Medium- to long-term foreign currency funding amounts (USD billion, %)