Responsible financing and investment

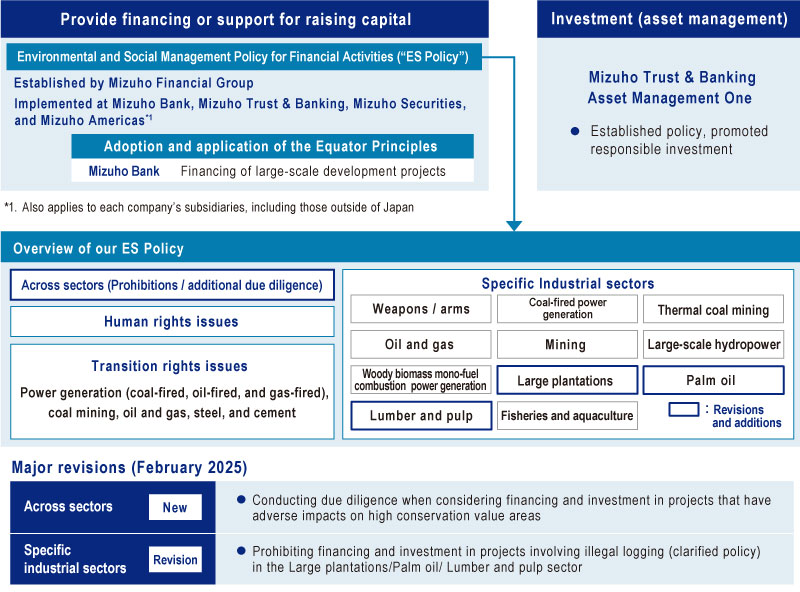

Mizuho has established a management framework for responsible financing and investment, and is working to ensure environmental consideration and respect for human rights in its financing and investment activities.

An overview of responsible financing and investment

Mizuho has established the Environmental and Social Management Policy for Financial Activities ("ES Policy"), which covers responses to climate change, conservation of biodiversity, and respect for human rights, to prevent and mitigate adverse impacts of financing and investment on the environment and society.

In February 2025, we revised the ES Policy to strengthen our responses to issues such as loss of nature.

Overview of our Environmental and Social Management Policy for Financial Activities (PDF/719KB)

Implementation of Environmental and Social Management Policy for Financial Activities

Verification process when screening a potential transaction

- To prevent or mitigate adverse impacts on the environment and society, Mizuho makes decisions on financing and investment transactions after performing due diligence on each core group company based on their business characteristics, which includes confirmation of the client’s risk management status based on the risks that Mizuho should recognize.

Verification process during the transaction term

- We engage (hold constructive dialogue) with clients in transition risk sectors and specific industrial sectors at least once yearly.

- Verify the degree to which clients have taken steps to avoid or mitigate environmental and social risks.

- With clients in transition risk sectors, discuss medium- to long-term issues and confirm the status of the client’s response in regard to climate change risks and opportunities.

- In the event that we identify any acts in violation of the policy during the term of a transaction, we determine whether or not to continue the transaction after responding to the discovery, such as by urging the client to take immediate remedial measures, based on the characteristics of the services we are providing.

Governance

- Our business execution and supervisory lines regularly review whether or not our measures related to risks, sectors, and other factors are appropriate and sufficient, with consideration to changes in the external business environment and the results of implementation. Following these reviews, we may revise or otherwise make changes to our policies to enhance their implementation.

Education and training

- To ensure effective risk management, employees and executive officers participate in education and training.

Stakeholder communication

- We place a strong emphasis on engagement with stakeholders to ensure that our initiatives are aligned with society's standards and expectations.

Providing financing or support for raising capital

As a global financial institution, Mizuho is committed to meeting the banking needs of the communities in Japan and around the world where we operate. To deliver on our responsibilities as a bank, and to contribute to the sound development of economies and societies, we draws on our sophisticated risk–taking capabilities structured within a firm risk management framework.

Additionally, Mizuho’s Credit Code, which stipulates our basic approach, guidelines, and lending criteria, emphasizes the importance of utilizing the provision of credit as a means of contributing to the sustainable development of the economy and society as well as solving social issues. In fact, one of the lending criteria in this Code is whether the extension of credit will contribute to the sound development of the economy and the communities we serve.

We make credit decisions after examining the recognized risks based on our Environmental and Social Management Policy for Financial Activities, and we also engage in dialogue with customers regarding medium– to long–term environmental and social issues.

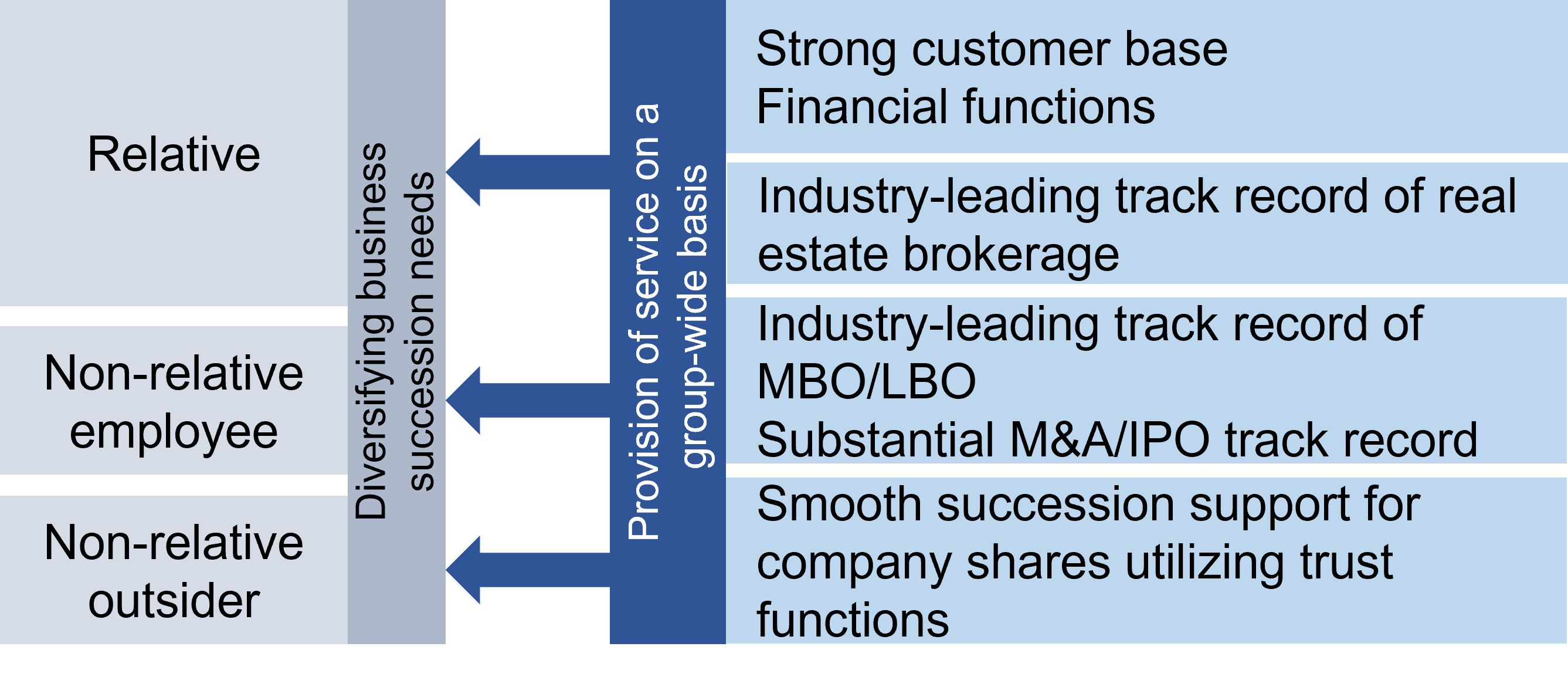

Similarly to our credit operations, in our trust operations as well we make decisions on securitization of real estate and other affairs after examining the recognized risks based on our Environmental and Social Management Policy for Financial Activities. In this way, we are ensuring thorough responses to environmental and social issues.

We also seek to take environmental and social impact into consideration and manage risk through the following initiatives.

The Equator Principles

We recognize that large–scale development projects may have adverse impacts on the environment and local communities. To minimize and/or mitigate the environmental and social risks associated with such large–scale developments, Mizuho Bank works together with the project proponents (clients) to conduct appropriate environmental and social risk assessment/due diligence as required under the Equator Principles*. The Equator Principles was most recently revised to the fourth version (EP4) following consultation with various stakeholders and financial institutions led by the Equator Principles Association of which Mizuho Bank was the Asia Oceania Regional Representative. Mizuho Bank started to apply the EP4 from July 2020.

* The Equator Principles are a set of voluntary guidelines adopted by financial institutions to ensure that large–scale development or construction projects appropriately consider the associated potential impacts on the natural environment and the affected communities.

Assessments of environmental risk related to real estate collateral

To deal with environmental risk in real estate, including pollution of the soil, usage of asbestos, and other issues related to real estate collateral, we implement assessments of environmental risk when certain established conditions apply. When risks are judged to be above a specified level, the amount corresponding to the assessed risk is deducted.

Investment (asset management)

Mizuho believes that giving appropriate consideration to environmental, social, and corporate governance (ESG) issues and other aspects through responsible investment initiatives to improve and foster investee companies' sustainability and enterprise value will enhance the medium– to long–term investment return for our customers, and furthermore contribute to the flow of funds supporting the development of a sustainable society.

Mizuho's trust banking arm, Mizuho Trust & Banking, and Asset Management One have established the following policy and are working to promote responsible investment initiatives.

Asset Management One’s Sustainable Investment Policy (Japanese text only)

Mizuho Trust & Banking and Asset Management One are taking initiatives to implement stewardship responsibilities and promote ESG investing by adopting and setting policies to put into practice Japan's "Principles for Responsible Institutional Investors (Japan's Stewardship Code)." Mizuho believes these activities are important for fulfilling our proper role as a responsible institutional investor.

Asset Management One's Policies with Respect to Japan's Stewardship Code (Japanese text only)

In addition, these two entities have signed on to the UN Principles for Responsible Investment (PRI), which ensure that institutional investors and pension funds, etc., incorporate environmental, social, and corporate governance (ESG) considerations into their decision–making processes.

Mizuho Trust & Banking and Asset Management One are also strengthening their ESG investment initiatives by incorporating ESG–related issues and engagement into their investment strategies and giving consideration to ESG issues in exercising their proxy voting rights.

Initiatives for responsible investment

Details of Mizuho Trust & Banking's activities towards responsible investment. (Japanese text only)

Stewardship activities

2024 Asset Management One Sustainability Report

Details of Asset Management One's stewardship activity framework and its ESG investments.

The Equator Principles

Mizuho Bank adopted the Equator Principles as an initiative for responsible investment and financing. The Equator Principles is a risk management framework adopted voluntarily by financial institutions to determine, assess, and manage the environmental and social risks associated with financing of large scale development projects.

Mizuho Bank (former Mizuho Corporate Bank) was the first Asian bank to adopt the Equator Principles in 2003, and also became the first Asian bank to chair the Equator Principles Limited (May 2014 – May 2015).

We have actively engaged with the Equator Principles initiative as a member of the Equator Principles Limited's Steering Committee, which consists of 10 international financial institutions. Mizuho Bank has held the role of Asia Oceania Regional Representative from October 2017 to November 2021.

We deem ourselves socially responsible of our investment and financing. Therefore, by undertaking environmental and social due diligence in accordance with the Equator Principles, we believe that we could share the knowledge and risk management on environment and social impacts to our clients, and direct the "flow of funds" toward environmentally and socially responsible projects.

The Equator Principles Limited Official Website

What are the "Equator Principles"?

Launch of the "Equator Principles"

Large–scale development projects such as oil/gas development, mining, power plants, dams etc. often include significant adverse impacts on the natural environment and/or local communities.

For example, in 1980s the Sardar Sarovar Project, which involved construction of dam on the Narmada River in mid–western India, was severely criticized worldwide for its adverse environmental and social impacts. Built in order to provide electricity and irrigation water to downstream regions, the construction of this dam resulted in the forced dislocation of more than 200,000 indigenous people living along the upstream districts, without provision of sufficient compensation or means of livelihood restoration. To ensure justice to the people displaced, international NGOs undertook Narmada relief campaign, due to which financial assistance to the project, provided by the World Bank and Official Development Assistance (ODA) of the Japanese government was aborted.

Amidst such growing interests in the environmental and social impacts, by the late 1990s, multilateral development financial organizations such as the World Bank and Export Credit Agencies of OECD member countries came up with their respective environmental and social guidelines to appropriately manage environmental and social risks associated with such large–scale projects. However, only a handful of private financial institutions were implementing environmental and social reviews at that time. Therefore, environmental NGOs started demanding that the private financial institutions independently manage environmental and social risks as more attention was given to CSR in terms of environmental issues.

To address these demands and concerns, in October 2002, ABN AMRO and the International Finance Corporation (IFC) – organization in charge of private projects for the World Bank Group, invited major international financial institutions engaged in project finance activities, to assemble in London with the intention to come up with environmental and social risks management guidelines for private financial institutions. As a result of this meeting, Citigroup, ABN AMRO, Barclays, and West LB in collaboration with IFC, created a framework of managing environmental and social risks. The Equator Principles (EP) were thus formulated in June 2003.

The EP were first revised in July 2006 to align it with the IFC Performance Standards (April 2006). Further revision of IFC Performance Standards in 2012 and the need to strengthen environmental and social risks management, resulted in the launch of third iteration of the EP (EP III) in June 2013.

Most recently, EP4 was launched in November 2019 considering the international trends. EP4 newly apply to a broader range of transactions and requires further environmental and social assessments such as climate change and human rights.

Column: Origin of the name "Equator Principles"

The initial founders of the Equator Principles (EP) wanted the adoption of the EP to be globally applicable (to financial institutions in the northern and southern hemispheres) and the equator seemed to represent that balance perfectly – hence the name, became "Equator Principles".

Summary of the Equator Principles

The Equator Principles (EP) are a set of voluntary guidelines adopted by financial institutions to ensure that large scale development or construction projects appropriately consider the associated potential impacts on the natural environment and the affected communities.

The Equator Principles Financial Institutions (EPFIs) formulate their own environmental and social guidelines to comply with the Equator Principles framework, which in turn confirms compliance with the underlying IFC Performance Standards and World Bank Group EHS Guidelines. EPFIs also establish internal management systems to ensure that clients implement their projects in consideration with the environment and society. Under these management systems, EPFIs will assess the environmental and social impacts of large–scale projects and will incorporate compliance with the EP as a condition of lending.

Column: From the Preamble of the Equator Principles (excerpt)

- As financiers and advisors, we work in partnership with our clients to identify, assess and manage environmental and social risks and impacts in a structured way, and on an ongoing basis.

- We, the Equator Principles Financial Institutions (EPFIs), have adopted the Equator Principles in order to ensure that the Projects we finance and advise on are developed in a manner that is socially responsible and reflects sound environmental management practices.

- We will not provide Project Finance, Project–Related Corporate Loans to Projects or Project–Related Refinance and Project–Related Acquisition Finance to Projects which do not comply with the relevant Equator Principles requirements. As Bridge Loans and Project Finance Advisory Services are provided earlier in the Project timeline, we will request that the client communicates its intention to adhere to the requirements of the Equator Principles when subsequently seeking long term financing.

As mentioned above, the Equator Principles (EP) are aimed to direct the "flow of funds" towards environmentally and socially responsible projects. The EP benefit not only the local communities but also the clients and the financial institutions by promoting sustainable development.

For full text of the Equator Principles, refer to The Equator Principles and related documents (English/Japanese).

List of the Equator Principles Financial Institutions

Scope of the Equator Principles

The Equator Principles (EP) apply globally and to all industry sectors.

The EP apply to the following five financial products:

- Project Finance Advisory Services where total Project capital costs are USD 10 million or more.

- Project Finance with total Project capital costs of USD 10 million or more.

- Project–Related Corporate Loans (including Export Finance in the form of Buyer Credit) where all three of the following criteria are met:i. The majority of the loan is related to a Project over which the client has Effective Operational Control (either direct or indirect).

- ii. The total aggregate loan amount and the EPFI's individual commitment (before syndication or sell down) are each at least USD 50 million.

- iii. The loan tenor is at least two years.

- Bridge Loans with a tenor of less than two years that are intended to be refinanced by Project Finance or a Project–Related Corporate Loan that is anticipated to meet the relevant criteria described above.

- Project-Related Refinance and Project-Related Acquisition Finance, where all of the following three criteria are met:i. The underlying Project was financed in accordance with the Equator Principles framework.

- ii. There has been no material change in the scale or scope of the Project.

- iii. Project Completion has not yet occurred at the time of the signing of the facility or loan agreement.

The Equator Principles – applicable environmental and social standards

The Equator Principles Financial Institutions (EPFIs) will confirm that the project, if under the EP scope, complies with all the applicable host country environmental and social laws, as well as the IFC Performance Standards and the World Bank Group EHS Guidelines.

IFC Performance Standards

The IFC Performance Standards (IFC PS), which summarize the standards for pollution prevention, conservation of the natural environment and the protection of the human rights of local inhabitants and workers, consist of the following eight items.

PS1 – Assessment and Management of Environmental and Social Risks and Impacts

PS2 – Labor and Working Conditions

PS3 – Resource Efficiency and Pollution Prevention

PS4 – Community Health, Safety and Security

PS5 – Land Acquisition and Involuntary Resettlement

PS6 – Biodiversity Conservation and Sustainable Management of Living Natural Resources

PS7 – Indigenous Peoples

PS8 – Cultural Heritage

- For full text of the IFC Performance Standards, refer to IFC official website.

World Bank Group EHS Guidelines

The World Bank Group EHS Guidelines are Environment, Health and Safety guidelines for projects, designated by the World Bank Group. The Guidelines consist of the General EHS Guidelines, common to all industries, and 62 Industry–specific EHS Guidelines. The pollution control standards presented in these guidelines are utilized as standards not only by the IFC but also by the multilateral financial institutions and the Export Credit Agencies of the OECD member countries.

For full text of the World Bank Group EHS Guidelines, refer to IFC official website.

Launch of the Equator Principles 4 (November 2019)

Formerly only project finance and project finance advisory services were under the Equator Principles (EP) scope. In June 2013, the third iteration of the EP (EP III) was launched, which expanded the scope of the EP to include project–related corporate loans.

Furthermore, the fourth iteration of the EP (EP4) was launched in November 2019. The key points are;

- Expanded scope to include Project–Related Refinance and Acquisition Finance partially.

- Added emphasis on climate change, through Climate Change Risk Assessment requirements.

- Added emphasis on human rights, through additional due diligence requirements on Indigenous Peoples' rights in developed countries.

The Equator Principles Financial Institutions have expanded to more than 100 institutions. One may say that the EP have become the de facto standard for financial institutions.

Application for projects

Application process

Environmental and social risk management process under the Equator Principles

Mizuho Bank recognizes that large scale development projects may have adverse impacts on the environment and local communities. To minimize and/or mitigate the environmental and social risks and impacts associated with such large scale developments, Mizuho Bank works in partnership with our clients to identify, assess and manage such risks and impacts as required under the Equator Principles.

Overview of the environmental and social risk management process

Categorization and requirements

The Equator Principles Financial Institution (EPFI) categorizes the project into one of the following three categories, based on the magnitude of associated environmental and social impacts. The EPFI also ensures that the client undertake appropriate mitigation actions depending on the project category.

Projects with significant adverse impact on the environment and society need to satisfy all the relevant requirements of the Equator Principles. In addition to the Environmental and Social Impact Assessment (ESIA) prepared by the client, a report by an independent environmental and social consultant is also required.

Review by the EPFI

The EPFI reviews (a) the Environmental and Social Impact Assessment (ESIA) and (m) the assessment report by an independent expert and will determine whether the project complies with the requirements of the Equator Principles before deciding whether to provide loan to the project.

Reflection on the financing agreement

The Equator Principles require the client to include the following four covenants in the loan agreement:

a. Compliance with the applicable host country's environmental and social laws, regulations and permits;

b. Compliance with the Environmental and Social Management Plans (ESMPs) and the Equator Principles Action Plan;

c. Preparation of periodic reports regarding the compliance of items (a) and (b); and

d. Decommissioning plan of the facilities (where applicable).

An Action Plan is prepared, as a result of the EPFI's due diligence process, to describe and prioritize the actions needed to address any gaps in the assessment documentation, ESMPs, the Environmental and Social Management System (ESMS), or Stakeholder Engagement process documentation to bring the project in line with applicable standards of the Equator Principles. The Action Plan is typically tabular in form and lists distinct actions, mitigation measures, follow–up studies or plans to complement the assessment.

The impact of environmental and social risks of the project can be reduced and the project can be modified to qualify for financing by including the compliance of the Action Plan as a requirement for financing. Project expense may increase due to the implementation of the Action Plan.

In case of project finance, after the syndicate member banks providing funds to the project are officially determined, the lead arranger will initiate the negotiations between the client and the syndicate toward an accord on the Action Plan and the covenants.

Disclosure of the implementation process and the number of screened projects

Each Equator Principles Financial Institution is required to publicly report its internal Equator Principles implementation process and the number of projects to which the Equator Principles are applied each year by category, by industry and by region, etc.

Mizuho discloses relevant information in accordance with this requirement.

Mizuho and the Equator Principles

Mizuho Bank (formerly Mizuho Corporate Bank) recognized early that the Equator Principles would become a new global standard in international financing for environmental and social risk management of large–scale projects and therefore within six months of their inception in June 2003, Mizuho Bank became the first Asian bank to adopt the Equator Principles in October 2003. Since then, Mizuho Bank has been conducting environmental and social risk assessments based on the Equator Principles and has also been proactively undertaking initiatives to promote them and raise awareness regarding environmental and social risk impacts among businesses and other related parties, including the borrowers. Through these activities, Mizuho Bank has contributed to balanced economic development via financing and environmental preservation, and, thus, fulfilled its social responsibility as a financial institution.

Since the adoption of the Equator Principles in October 2003, Mizuho Bank has played a leadership role in the Equator Principles Limited (formerly the Equator Principles Association) as a member of the Steering Committee for many years. Mizuho Bank also led the Equator Principles Limited as its Chair, thus becoming the only Asian bank to chair the association. Mizuho Bank has also held the role of Asia Oceania Regional Representative for four consecutive years.

Chronicle: Initiatives for the Equator Principles

Implementation System for the Equator Principles

Mizuho Bank has created the Sustainable Development Office in its Sustainable Products Promotion Department. The Sustainable Development Office is responsible for the bank's overall implementation of the Equator Principles.

The Sustainable Development Office applies the Mizuho's in-house Equator Principles Implementation Manual to all its projects globally, which are under the scope of the Equator Principles. The Sustainable Development Office also endeavors to promote internal understanding of the Equator Principles through in–house training and via the distribution of in–house newsletters etc.

General Process and Internal Procedures for the Equator Principles Implementation

For a project that falls under the scope of the Equator Principles the business promotion division officer first prepares an "Equator Principles (EP) Screening Form", which is a simplified checklist. The Sustainable Development Office then reviews the EP Screening Form and categorizes the proposed project into A, B or C based on the magnitude of the potential environmental and social impacts. Also, the Sustainable Development Office prepares a recommendation in documents such as "EP Screening Report", to inform the business promotion division officer the necessary actions that the client shall take to comply with the environmental and social requirements. The business promotion division officer then supports the client as recommended by the Sustainable Development Office. In addition, the Sustainable Development Office ensures that the relevant environmental and social covenants are included in the loan documentation.

For a project in which Mizuho Bank acts as a financial advisor, the Sustainable Development Office supports the clients by advising them on identifying potential issues under environmental and social reviews by Equator Principles Financial Institutions.

Application of the Equator Principles at Each Stage of Finance (Image)

Internal Procedures

- The business promotion division officer prepares an "EP Screening Form", which is a simplified environmental and social risk assessment checklist and submits it to the Sustainable Development Office.

- The Sustainable Development Office reviews the "EP Screening Form", conducts the required due diligence and categorizes the project into A, B or C.

- The recommendation from the Sustainable Development Office (ex. "EP Screening Report", etc.) is submitted to the credit division together with the credit application prepared by the business promotion division. The credit division takes into account the potential environmental and social risks of the project to make a comprehensive determination of the risks specific to the project.

- After preliminary credit approval, the Sustainable Development Office confirms that the necessary Action Plan is in place and the covenants are set out in relevant financing documents. If additional action is required to make the project compliant with the Equator Principles, the Sustainable Development Office addresses to the Client through the business promotion division to conduct necessary actions.

- After confirming that the necessary steps have been taken by the Client, the business promotion division prepares an "EP Review Form" and submits to the Sustainable Development Office.

- The Sustainable Development Office confirms that the project is compliant with the Equator Principles and prepares an "EP Review Report".

Internal Equator Principles implementation flow

Disclosure subject to the Equator Principles 4

Closed Transactions screened for EP Compliance

Project Finance

(Note)

- The figures above represent the number of projects Mizuho Bank applied the Equator Principles which reached Financial Close in FY2022, CY2023 and CY2024.

- Due to the consolidation of the reporting period by the Equator Principles Limited, the figures for CY2023 represent the number of projects which reached Financial Close from April 1, 2023 to December 31, 2023.

- The figures above with the "✓" have been assured by Ernst & Young ShinNihon LLC.

FY2022 CY2023 CY2024

By Sector (number of projects)

(Note)

- The figures above represent the number of projects Mizuho Bank applied the Equator Principles which reached Financial Close in FY2022, CY2023 and CY2024.

- Due to the consolidation of the reporting period by the Equator Principles Limited, the figures for CY2023 represent the number of projects which reached Financial Close from April 1, 2023 to December 31, 2023.

- The figures above with the "✓" have been assured by Ernst & Young ShinNihon LLC.

FY2022 CY2023 CY2024

By Region, Country (Designated/ Non–designated), and Implementation of Independent Review by an Environmental and Social Consultant (Number of projects)

(Note)

- The figures above represent the number of projects Mizuho Bank applied the Equator Principles which reached Financial Close in FY2022, CY2023 and CY2024.

- Due to the consolidation of the reporting period by the Equator Principles Limited, the figures for CY2023 represent the number of projects which reached Financial Close from April 1, 2023 to December 31, 2023.

- List of Designated Countries as defined by the Equator Principles Limited is published on the Equator Principles Limited website.

The Equator Principles Limited Designated Countries list - The figures above with the "✓" have been assured by Ernst & Young ShinNihon LLC.

FY2022 CY2023 CY2024

Project–Related Corporate Loan

(Note)

- The figures above represent the number of projects Mizuho Bank applied the Equator Principles which reached Financial Close in FY2022, CY2023 and CY2024.

- Due to the consolidation of the reporting period by the Equator Principles Limited, the figures for CY2023 represent the number of projects which reached Financial Close from April 1, 2023 to December 31, 2023.

- The figures above with the "✓" have been assured by Ernst & Young ShinNihon LLC.

FY2022 CY2023 CY2024

By Sector (Number of projects)

(Note)

- The figures above represent the number of projects Mizuho Bank applied the Equator Principles which reached Financial Close in FY2022, CY2023 and CY2024.

- Due to the consolidation of the reporting period by the Equator Principles Limited, the figures for CY2023 represent the number of projects which reached Financial Close from April 1, 2023 to December 31, 2023.

- The figures above with the "✓" have been assured by Ernst & Young ShinNihon LLC.

FY2022 CY2023 CY2024

By Region, Country (Designated/ Non–designated), and Implementation of Independent Review by an Environmental and Social Consultant (Number of projects)

(Note)

- The figures above represent the number of projects Mizuho Bank applied the Equator Principles which reached Financial Close in FY2022, CY2023 and CY2024.

- Due to the consolidation of the reporting period by the Equator Principles Limited, the figures for CY2023 represent the number of projects which reached Financial Close from April 1, 2023 to December 31, 2023.

- List of Designated Countries as defined by the Equator Principles Limited is published on the Equator Principles Limited website.

The Equator Principles Limited Designated Countries list - The figures above with the "✓" have been assured by Ernst & Young ShinNihon LLC.

FY2022 CY2023 CY2024

Project-Related Refinance and Project-Related Acquisition Finance

By Sector (Number of projects)

(Note)

- The figures above represent the number of projects Mizuho Bank applied the Equator Principles which reached Financial Close in FY2022, CY2023 and CY2024.

- Due to the consolidation of the reporting period by the Equator Principles Limited, the figures for CY2023 represent the number of projects which reached Financial Close from April 1, 2023 to December 31, 2023.

- The figures above with the "✓" have been assured by Ernst & Young ShinNihon LLC.

FY2022 CY2023 CY2024

By Region and Country (Designated/ Non–designated) (Number of projects)

(Note)

- The figures above represent the number of projects Mizuho Bank applied the Equator Principles which reached Financial Close in FY2022, CY2023 and CY2024.

- Due to the consolidation of the reporting period by the Equator Principles Limited, the figures for CY2023 represent the number of projects which reached Financial Close from April 1, 2023 to December 31, 2023.

- List of Designated Countries as defined by the Equator Principles Limited is published on the Equator Principles Limited website.

The Equator Principles Limited Designated Countries list - The figures above with the "✓" have been assured by Ernst & Young ShinNihon LLC.

FY2022 CY2023 CY2024

Project Finance Advisory Services

(Note)

- The figures above represent the number of projects for which Mizuho Bank had entered Project Finance Advisory Service contract in FY2022, CY2023 and CY2024.

- Due to the consolidation of the reporting period by the Equator Principles Limited, the figures for CY2023 represent the number of projects which Mizuho Bank had entered Project Finance Advisory Service contract from April 1, 2023 to December 31, 2023.

- The figures above with the "✓" have been assured by Ernst & Young ShinNihon LLC.

FY2022 CY2023 CY2024

(Note)

- The figures above represent the number of projects for which Mizuho Bank had entered Project Finance Advisory Service contract in FY2022, CY2023 and CY2024.

- Due to the consolidation of the reporting period by the Equator Principles Limited, the figures for CY2023 represent the number of projects which Mizuho Bank had entered Project Finance Advisory Service contract from April 1, 2023 to December 31 2023.

- The figures above with the "✓" have been assured by Ernst & Young ShinNihon LLC.

FY2022 CY2023 CY2024

CY2024 Ernst & Young ShinNihon LLC Independent Assurance Report (PDF/176KB)

CY2023 Ernst & Young ShinNihon LLC Independent Assurance Report (PDF/43KB)

FY2022 Ernst & Young ShinNihon LLC Independent Assurance Report (PDF/84KB)

Project Name Reporting Sample - Project Finance

Project Name Reporting Sample – Project-Related Corporate Loan

Initiatives for the Equator Principles

Leadership as a Member of the Steering Committee

During the revision of the Equator Principles in 2013 and 2020, Mizuho Bank as a member of the Equator Principles Limited Steering Committee, took part in various Task Forces such as scope expansion, information disclosure, and climate change, and contributed to finalizing the revised Equator Principles.

Mizuho Bank also participates together with other Equator Principles members in various working groups to help define policies and guidance for the larger group in these important areas of interest.

Management and Future Development of the Equator Principles Limited

Mizuho as the Chair Bank (2014 to 2015)

From May 2014, Mizuho Bank assumed the role of the Chair of the Equator Principles Limited and played a leadership role by leading the discussions and decisions affecting the operational policies and organizational management of the Limited. At the annual meeting of the Limited on October 28, 2014, Mizuho Bank led the other member institutions in discussions regarding climate change, biodiversity, the protection of human rights, capacity building and training among the Limited members.

Accepting Trainees

With many years of experience as the Chair and as the Regional Representative of the Equator Principles Limited in the Asia-Oceania region, Mizuho Bank has also worked proactively to enhance the understanding of the Equator Principles by accepting trainees from financial institutions in Asia.

- June 2009: China / Industrial Bank Co., Ltd.

- May 2015: Taiwan / Cathay United Bank Co.

- December 2016, January 2017: Japan / The Norinchukin Bank

- May 2017: South Korea / Korea Development Bank

- February 2019: Japan / Nippon Life Insurance Company

- August 2019: South Korea / Shinhan Bank

During the training, the trainees received an opportunity to learn about the implementation of the Equator Principles together with practical case studies.

Publication of "Implementation Guidelines for the Equator Principles"

Mizuho Bank together with MUFG Bank (formerly Bank of Tokyo Mitsubishi UFJ) and Sumitomo Mitsui Banking Corporation published a book on implementation guidelines for the Equator Principles on March 15, 2016. This book not only covers the details of all the ten constituent principles of the Equator Principles framework and their practical implementation by the author banks, but it also provides details on some of the prominent environmental and social risk management guidelines other than the Equator Principles that are commonly referred by the financial institutions. Mizuho Bank believes that the publication of this book will help promote awareness regarding the Equator Principles and other significant environmental and social risk management guidelines and frameworks and will enhance knowledge sharing among the various industries and financial institutions in Japan.

Seminar for Japan Society for Impact Assessment (JSIA)

On March 26, 2021, Mizuho Bank organized a seminar about the Equator Principles 4, at the Japan Society for Impact Assessment (JSIA)'s regular meeting.

Seminars held for Stakeholders

Mizuho Bank has been promoting the understanding of the Equator Principles by holding seminars not only for private financial institutions but also for other stakeholders, including government organizations and private businesses.

(Note)

- The number of participants above include approximate numbers.

Internal Training Sessions for Employees

Mizuho Bank conducts regular training sessions for its employees on environmental and social risk assessments and Equator Principles requirements involved in large–scale project financing. During fiscal years from 2020 to 2024, these training sessions were attended by approximately 7,200 employees.

(Note)

- The number of participants above include approximate numbers.

Case studies on the Equator Principles

Case study 1: Tangguh LNG Project

Project summary

Tangguh LNG is a major development project involving construction and operation of a plant capable of supplying 7.6 million tons of LNG a year from gas fields in Bintuni Bay in Papua Barat, Indonesia. The gas fields have proven reserves of 14.4 trillion cubic feet.

The Project, operated by oil major BP, has drawn substantial attention worldwide against a backdrop of mounting demand for LNG in recent years. Japan, the world's largest importer of LNG, has shown considerable interest in the Project with a number of Japanese companies participating as sponsors.

Mizuho Bank (former Mizuho Corporate Bank) provided financing for the Project in collaboration with international financial institutions including the Japan Bank for International Cooperation (JBIC) and Asian Development Bank (ADB). Two rounds of financing were conducted, in August 2006 and November 2007. Also, in June 2016, another financing was executed for construction and operation of Train 3 of the Project.

In financing the Project as an Equator Bank, Mizuho Bank conducted assessments to determine the Project's environmental and social impacts.

Preserving and protecting the natural environment

As part of the bank's environmental assessment, it was confirmed that pollution control conducted at plant site and gas fields is in accordance with local laws and environmental standards established by the International Finance Corporation (IFC).*1 It was also confirmed that appropriate action plans were in place to preserve and protect the local natural environment.

A particular point of emphasis was protecting mangrove forests along the shoreline. Mangroves create an environment that is highly suitable for cultivating shrimp, which is done in nearby coastal waters. So, protection of these mangroves was important not only to protect biodiversity but also to support the local community which relied on shrimp cultivation as a source of income.

BP, the Project operator, established a Biodiversity Action Plan to ensure protection of the environment. Scrupulous protection measures are implemented to protect the natural habitats. For example, in laying the pipeline, connecting offshore gas fields with the LNG plant on land, cutting–edge construction methods were used to minimize the impact on the surrounding environment. Underground tunnels were dug horizontally in both directions, one from the offshore fields and the other from the plant construction site. The pipe was pushed in from the offshore fields and pulled from the plant construction site. This avoided digging ground in the mangrove forests to lay the pipe, thereby preserving the mangroves.

*1 IFC (International Finance Corporation): One of members in the World Bank Group that implements investment and lending to private projects, especially in developing countries.

Initiatives for local autonomy

The area around Bintuni Bay is home to a multitude of villages across a wide area populated with ethnic groups with different languages and sets of values. From a social perspective, location of the plant required relocating one whole village (127 households in total*2). Therefore, a major issue was how to ensure harmony between local communities and to share the benefits of the Project.

The assessment found that according to locally held values the benefits reaped by the products from the Bintuni Bay should be shared by all villages in the vicinity of the Bintuni Bay area. Therefore, the operators concluded that it would not only be necessary to compensate a village that had to be relocated to build the planned LNG plant but also support other surrounding villages.

Specifically, Land Acquisition and Resettlement Action Plan (LARAP) was prepared and appropriate compensation was provided for building houses and infrastructure. In accordance with the requirements of IFC standards calling for relocation compensation, the standard of living of residents has been improved above and beyond prior levels. Moreover, a comprehensive social program was established to support sustained social development. This program aims to provide support in generating employment, by providing technical guidance in various fields such as agriculture and food processing. Additional support is also provided in a number of areas such as health, hygiene and education.

*2 Reference:"Land Acquisition and Resettlement Action Plan" July 2006, ADB, p6

Case study 2: Laos' Nam Ngiep 1 Hydropower Project

Project summary

Nam Ngiep 1 Hydropower Project constructs and operates a 289MW Hydropower Plant on the Nam Ngiep River in Laos.

This Project not only aims to contribute to the electricity demand in Laos, but also have a purpose to obtain it's developing finances by selling the electricity to the neighboring country, Thailand. As a result of its large project scale, Asian Development Bank (ADB), Japan Bank for International Corporation (JBIC) and many commercial banks joined in its finance.

Initiatives for local autonomy

As a result of a large project site, the big impact to the local community during construction and operation phase was the top concern.

Based on the findings of prior survey, the Project noticed that they had to acquire the land from approximately 800 households (more than 5,000 people). In addition, there were more than 400 households (approximately 3,000 people) who have to resettle since their house and plowland was in the planned submerging area.

In line with the findings, the Project Company undertook consultations with the identified/affected households to determine the relocation site. Also, they designed their new housing based on their social backgrounds. Furthermore, it was found that 99% of the resettling households belonged to the Mons tribe and, 99% of the accepting communities were from Laos. Therefore, the Project Company hired the specialists and anthropologists who had a good understanding of the Mons culture and traditions, as care persons to manage the resettlement and assimilation process.

After the resettlement, the Project Company provided replacement farmlands which were of either equal or greater value. The affected farmers were also provided working machines and agricultural supports for the households. Furthermore, they constructed some educational facility and medical centers which existing landowners could use. The Project has provided numerous supports for both resettled and existing households to improve and restore their livelihoods.

Reference: "Resettlement and Ethnic Development Plan" June 2014, ADB

Case study 3: Muara Laboh IPP Project

Project summary

The Muara Laboh IPP Project involves construction and operation of an 80MW geothermal power plant in Indonesia. The Project contributes to meet the sharp electricity demand in Sumatra Islands and concurrently helps Indonesia to explore the environmentally friendly geothermal resource. The Project has been under operation since 2019. Mizuho Bank acted as Financial Advisor and financed the project in collaboration with Japan Bank for International Cooperation (JBIC), Nippon Export and Investment Insurance (NEXI) and Asian Development Bank (ADB).

Preserving and protecting the natural environment

As per the environmental and social due diligence of the project, the lender group hired an external environmental consultant and their site survey found some species classified as endangered (IUCN Red List) within the Project site. The relevant stakeholders engaged in the further critical habitat assessment with the consultant and developed a proper Biodiversity Action Plan to mitigate the potential risks based on IFC Performance Standards and ADB Safeguard Policy Statement (SPS) and ADB SPS Requirements.

In addition, the Project Company and the lender group jointly developed and agreed on an Environmental and Social Action Plan (ESAP) including, for example, a Stakeholder Engagement Plan and a Grievance Mechanism in order to preserve the environmental and social circumstance.

Reference: "Indonesia: Muara Laboh Geothermal Power Project" ADB

Management and future development of the Equator Principles Limited

Management of the Equator Principles Limited

Organizational management of the Equator Principles Limited

Equator Principles Financial Institutions (EPFIs) adopted the Governance Rules and established the Equator Principles (EP) Association in July 2010. EP Association was the unincorporated association of member EPFIs whose object was the management, administration and development of the Equator Principles.

As of January 2024, the EP Association was replaced by a new legal structure and the Equator Principles are now legally represented by Equator Principles Limited.

However, the Equator Principles are still governed by the Steering Committee, supported by the Office of the Equator Principles which consists of the CEO and the Secretariat.

The Equator Principles Limited management structure*

* Links to the Equator Principles Limited official website

Steering Committee

The Steering Committee co-ordinates management and development of the Equator Principles on behalf of the Signatories to the Equator Principles. The Steering Committee is elected by the Signatories to the Equator Principles. The Steering Committee consists of 8 EPFIs as from November 2023.

Office of the EP - CEO

In May 2023, the EP Limited appointed its first CEO. The CEO is responsible for the day to day leadership and management of the EPA, on behalf of the Steering Committee, and will deliver key initiatives set in the annual work plan.

Office of the EP - Secretariat

The Secretariat is responsible for the day to day management and administration of the Equator Principles (e.g. managing internal and external communications (including the official website), organization and facilitation of EP events). The Secretariat is provided by a third party entity.

Exchange of opinions with international NGOs

As key stakeholders, the international NGOs play an important role in the implementation of the Equator Principles. The EP Limited exchanges opinions, from time to time, on the progress of issues such as climate change, social risks, human rights and reporting and transparency with NGOs.

Revision of IFC Performance Standards

The IFC revised its Performance Standards (PS) in January 2012.

To reflect changes in the IFC PS, EPFIs revised the Equator Principles to focus on a number of themes, such as Biodiversity, Climate Change, and Social Risks, and launched the third iteration of the Equator Principles (EP III) in 2013. The current fourth iteration of the Equator Principles (EP4) has further strengthened these themes. Mizuho has started to apply EP4 from July 2020.

Accomplishments of the Equator Principles

Three changes to project finance

The Equator Principles have resulted in three major changes to project finance

- With the Equator Principles, environmental and social risks are now widely recognized by society as significant risk factors, in assessing the projects. In addition, the implementation of risk–responsive measures via an Action Plan, is now embedded in the financing agreement. As a result, consideration of environmental and social risks and the mitigation of risks have been prioritized, benefitting the global environment and local communities.

- The application of the Equator Principles to a project has become an important competitive factor for financial institutions in obtaining the position of lead arranger in project syndication. In addition, collaboration in coping with environmental and social risks has been encouraged among syndicate members. The establishment and dissemination of these Principles have given financial institutions focused initiatives when addressing environmental and social risks.

- The vigorous exchange of opinions on the environmental and social risks of a project has been encouraged among financial institutions, clients and environmental NGOs through the management of the Equator Principles and their application to project finance.

As described above, the Equator Principles have brought a variety of advantages to stakeholders including project–affected communities, financial institutions, clients and environmental NGOs.

Perspective

The EP Limited's Strategy

In October 2020, the Equator Principles (EP) Limited launched its first ever Strategy. This high-level statement sets out the directions for the EP Limited over the next few years and demonstrates the collective willingness of the EP Limited to continually improve.

20 years of the EP

June 2023 was the 20-year anniversary of the Equator Principles (EP). The EP remains a market proven risk framework and well recognized brand. Areas that may require further consideration to ensure that the EP remain the 'gold standard' in E&S risk management are being discussed among members.

As of August 2025, 130 financial institutions have adopted the Equator Principles.

Increasing the number of adopting financial institutions enhances the influence and leverage of the Equator Principles, which further leads to a decrease in environmental and social risks. Therefore, it is paramount for the EP Limited to continue outreaching to those financial institutions that have not yet adopted the Equator Principles and to increase the number of members.

Glossary for the Equator Principles

– IFC Performance Standards (PS)

IFC Performance Standards (January 2012) summarize the standards for pollution prevention, conservation of the natural environment and the protection of human rights of local inhabitants and workers and consist of the following eight items:

PS1 – Assessment and Management of Environmental and Social Risks and Impacts

PS2 – Labor and Working Conditions

PS3 – Resource Efficiency and Pollution Prevention

PS4 – Community Health, Safety and Security

PS5 – Land Acquisition and Involuntary Resettlement

PS6 – Biodiversity Conservation and Sustainable Management of Living Natural Resources

PS7 – Indigenous Peoples

PS8 – Cultural Heritage

These Standards are published on IFC official website.

– Action Plan*

The Action Plan (defined as "Equator Principles Action Plan" in Exhibit I of The Equator Principles (July 2020)) is prepared, as a result of the EPFI's due diligence process, to describe and prioritize the actions needed to address any gaps in the assessment documentation, ESMPs, the ESMS, or Stakeholder Engagement process documentation to bring the project in line with applicable standards as defined in the Equator Principles. The Action Plan is typically tabular in form and lists distinct actions, mitigation measures, follow–up studies or plans that complement the assessment.

* Source:The Equator Principles Limited, The Equator Principles (July 2020), Exhibit I.

– Information Memorandum

Materials distributed to potential lenders in syndication. It is prepared by the lead arranger to provide the potential lenders with information on project specifics, such as loan conditions, summary of the project, and significance of the project.

– Environmental and Social Impact Assessment

The Environmental and Social Impact Assessment refers to the procedure of forecasting and assessing the environmental and social impacts of a proposed project in its area of influence through preliminary investigations. Used mainly for large–scale development projects.

– Environmental and social review

To confirm the potential adverse environmental and social impacts of the project.

– Syndicate

A group of financial institutions that finance a project.

– IFC (International Finance Corporation)

One of members in the World Bank Group that implements investment and lending to private projects, especially in developing countries.

– Lead Arranger

Lead financial institution that plays a leading role in arranging the syndication for project finance.

– Syndication

The process by which several different lenders provides various portions of the loan to finance the same project.

– Stakeholders

The stakeholders represent interested parties who have direct or indirect stakes in the interests and actions of corporations, public administration and/or NGOs. As for a large–scale development project, the stakeholders include not only the client and the project–affected communities, which are directly involved in the development project, but also third parties such as citizen–based NGOs because of the potential environmental and/or social impact of the proposed project.

– World Bank

The World Bank is made up of the IBRD (International Bank for Reconstruction and Development) and IDA (International Development Association). Its original purpose was to provide for the reconstruction of countries destroyed by World War II. Its current purpose is to provide for international development. IBRD, IDA, IFC (International Finance Corporation), MIGA (Multilateral Investment Guarantee Agency), and ICSID (International Centre for Settlement of Investment Disputes) collectively make up the World Bank Group.

– World Bank Group EHS (Environmental, Health, and Safety) Guidelines

The EHS Guidelines are technical reference documents that describe the performance levels and measures that are deemed achievable with existing technologies at reasonable costs in managing relevant issues in the environment, health and safety fields. The World Bank Group applies EHS Guidelines to its environmental and social assessments of projects. Industry sector guidelines for 62 sectors, such as offshore oil and gas development, thermal power, mining and more, are designed to be used together with the General EHS Guidelines, which provide guidance on common EHS issues potentially applicable to all industry sectors. These Guidelines are published on IFC official website.

– Documentation

Preparation of the loan agreement.

– Basel II Accord

The Basel II Accord, which defined new rules on capital adequacy requirements for banks, was made public by the Basel Committee on Banking Supervision and came into effect at the end of 2006. Therefore, banks are required to appropriately assess risk–exposed assets, monitor and manage various risks and disclose relevant information. Banks operating internationally need to maintain a capital adequacy ratio of 8% or more.

– Acquisition Finance*

Acquisition Finance is provision of financing for the acquisition of a Project or a Project company which exclusively owns, or has a majority shareholding in a Project, and over which the client has Effective Operational Control.

* Source: The Equator Principles Limited, The Equator Principles (July 2020), Exhibit I.

– Financial Advisor

Person or company that advises on financial issues including methods of financing.

– Project Finance Advisory Services (FA)

Provision of advice on the potential financing of a development where one of the options may be project finance.

– Bridge Loan*

An interim loan given to a business until the longer term stage of financing can be obtained.

* Source:The Equator Principles Limited, The Equator Principles (July 2020), Exhibit I.

– Project Finance (PF)

A method of financing in which cash flows generated by the project are expected to be the source of repayment. Project finance differs from corporate finance, in which financing is made by drawing on the corporate credibility of the borrower. PF is often used for large–scale projects including power plant and oil and gas development. Also, it often involves a loan to a new entity formed specifically to own the project. The Equator Principles are applied to project finance as defined in the Basel II Accord.

Project finance is "a method of funding in which the lender looks primarily to the revenues generated by a single project, both as the source of repayment and as security for the exposure. This type of financing is usually for large, complex and expensive installations that might include, for example, power plants, chemical processing plants, mines, transportation infrastructure, environment, and telecommunications infrastructure. Project finance may take the form of financing of the construction of a new capital installation, or refinancing of an existing installation, with or without improvements. In such transactions, the lender is usually paid solely or almost exclusively out of the money by funds generated by the contracts for the facility's output, such as the electricity sold by a power plant. The borrower is usually an SPE (Special Purpose Entity) that is not permitted to perform any function other than developing, owning, and operating the installation. The consequence is that repayment depends primarily on the project's cash flow and on the collateral value of the project's assets." Source: Basel Committee on Banking Supervision, International Convergence of Capital Measurement and Capital Standards ("Basel II"), November 2005.

– Project–Related Corporate Loans (PRCL)*

Corporate loans, made to business entities (either privately, publicly, or state–owned or controlled) related to a project, either a new development or expansion (e.g. where there is an expanded footprint), where the Known Use of Proceeds is related to a project in one of the following ways:

- The lender looks primarily to the revenues generated by the project as the source of repayment (as in Project Finance) and where security exists in the form of a corporate or parent company guarantee;

- Documentation for the loan indicates that the majority of the proceeds of the total loan are directed to the project. Such documentation may include the term sheet, information memorandum, credit agreement, or other representations provided by the client into its intended use of proceeds for the loan.

It includes loans to government–owned corporations and other legal entities created by a government to undertake commercial activities on behalf of the government, For all Category A and, as appropriate, Category B Projects, Project–Related Corporate Loans shall include loans to national, regional or local governments, governmental ministries and agencies.

* Source:The Equator Principles Limited, The Equator Principles (July 2020), Exhibit I.

– Export Credit Agency

A national institution that promotes private international business by investment, financing, guarantees, and insurance. Such an agency is often called an export–and–import bank or an ECA (Export Credit Agency). Well known ECAs include NEXI (Nippon Export and Investment Insurance), JBIC (Japan Bank for International Cooperation), and US–EXIM (Export–Import Bank of the United States).

– Refinance*

Refinance is the process of replacing an existing loan with a new loan, where the new loan will be used to pay out (retire) an existing loan, and that loan is not near or in default.

* Source: The Equator Principles Limited, The Equator Principles (July 2020), Exhibit I.

The Equator Principles and related documents (English/Japanese)

Environmental and social policies and guidelines with which the Equator Principles comply

The Equator Principles comply with the IFC Performance Standards and the World Bank Group EHS Guidelines.

The Equator Principles

The Equator Principles (July 2020) (original text in English) (PDF/493KB)

The Equator Principles (July 2020) (Japanese translation) (PDF/372KB)

Environmental and social policies and guidelines with which the Equator Principles comply

IFC official website

Stewardship responsibilities and ESG investment

Initiatives at Asset Management One

At the same time that Asset Management One, which is the Mizuho group company responsible for asset management, began operations in October 2016, we newly established our Responsible Investing Department (currently Research and Engagement Group) and proceeded with initiatives for active engagement in discussions with our investee companies regarding environmental, social, and corporate governance (ESG) issues and exercise of proxy voting rights.

Asset Management One's corporate message "Creating a sustainable future through the power of investment" clearly states that it will "incorporate sustainability into management" as an asset management company contributing to customers and society. Asset Management One created a materiality map that dynamically captures global environmental and social issues based on two axes (double materiality) of sustainable materiality, which indicates the level of civil society and investor interest, and financial materiality, indicating the economic impact. Management also identified nine core materiality items of climate change, biodiversity, business and human rights, water resources, circular economy, diversity equity and inclusion, sustainable food systems, air, water and land pollution, and health and wellbeing. Of these, business and human rights, diversity and inclusion, and health and wellbeing were set as focus areas, that the company will use to guide its engagement and voting related to its materiality items.

Approach to engagement activity

Asset Management One’s Engagement Approach (PDF/54KB)

Actual engagement activities

Engagement Activities with Japanese Companies (PDF/124KB)

Engagement Activities with Overseas Companies (PDF/47KB)

Examples of engagement

Our engagement activity – examples for Japanese equity passive strategies (PDF/293KB)

Engagement Case Study with an Overseas Company (PDF/62KB)

Development of products with a view to ESG

In recent years, institutional investors have been showing greater interest in ESG investment, which considers environmental, social, and corporate governance (ESG) issues, as a type of non–financial information. To continue to be an asset management institution that contributes to the development of our customers and society as a whole, Asset Management One recognizes the importance of ESG information as a foundation for financial information in the medium to long term, and we are working to integrate ESG into our investment strategies.

ESG Japan Equity Strategy

The domestic ESG Focus Fund is an ESG investment product that reflects our vision of sustainable investment products.

Conceptually, it aims to achieve sustainable financial returns and contribute to social returns including in the form of the planet or society passed onto the next generation, by investing in companies serving as drivers of a sustainable society. To that end, we have built an investment strategy integrating the following three features.

①Evaluation of promising industries based on a double materiality approach

Based on our proprietary Materiality Map, we identify and evaluate promising industries with growth potential, and leverage ESG Rating, our proprietary tool for business evaluation, to select companies with business practices capable of rapidly responding to societal demand for sustainability.

②Identification of business opportunities and evaluation of management quality by ESG experts

Building on the industrial evaluation based on the Materiality Map, the ESG Macro-Research and ESG Quantitative Analysis Teams, both composed of specialists in ESG, conduct research to identify "companies involved in business to help solve environmental and social issues" and "companies with high ESG potential" as candidates for investment. Those companies are subsequently assessed for suitability as investment targets in terms of profit sustainability and valuation, among others. Only those companies that are expected to produce substantial returns on capital over the years are retained in the portfolio.

③Engagement with investment targets leveraging our strong presence

Our sector analysts and ESG analysts work together to engage with the target companies in order to ensure that the latter continue to improve their ESG potential.

Strengthening support for sustainable businesses

The social and economic challenges that need to be resolved in order to achieve a sustainable society are becoming increasingly diverse and complex. The needs and actions of stakeholders have changed, and expectations and demands for companies to create value for society are on the rise. Against this backdrop, initiatives to improve sustainability are becoming an ever more critical aspect of business strategy.

Mizuho believes that achieving both the resolution of social issues and economic growth will lead to the growth of our customers and, ultimately, to an increase in Mizuho's corporate value. Mizuho is supporting our clients' SX =realize a sustainable society and enhance corporate value.

Mizuho has established materiality in business as well as long-term goals, which serve as KPIs (monitoring indicators), for sustainable finance, and for environmental and climate change response finance, and has formulated a sustainable business strategy. To capture expanding business opportunities, we are strengthening our promotion framework and promoting sustainable business by providing solutions from both financial and non-financial perspectives.

Mizuho's sustainable business strategy (PDF/5,920KB)

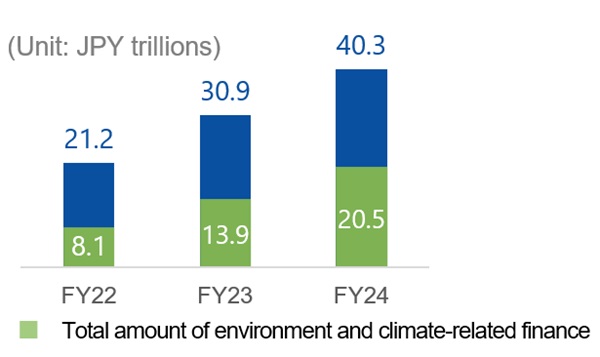

Targets and Results of Sustainable finance

Targets (Sustainable finance): Total cumulated amount FY2019-2030 JPY 100 trillion, Environment and climate-related finance JPY 50 trillion

Our definition of sustainable finance and environmental finance

Training and Awareness

Capability building (PDF/4,063KB)

Training sessions on the Equator Principles

Mizuho Bank conducts regular training sessions for its employees on environmental and social risk assessments and Equator Principles requirements involved in large–scale project financing.

Training sessions on the Equator Principles

Main initiatives

Finance

Financing support for renewable energy projects

Sustainability–linked bonds/loans

Supporting the issuance of SDG bonds

SME-tailored sustainable finance

Sustainable finance performance

Sustainability–linked bonds/loans

We are supporting our clients' sustainability strategies by providing sustainability–linked bonds and loans which link preferential terms to the borrower's achievement of sustainability performance targets. Mizuho arranged Japan's first sustainability–linked bond (SLB), and we are also issuing sustainability–linked loans (SLL) both inside and outside Japan.

SME-tailored sustainable finance

Mizuho Bank offers proprietary sustainable finance products for SME clients to support environmental and social actions intended to achieve CO2 emissions reduction targets or improve the working environment, for example. Mizuho's SME-tailored sustainable finance totaled JPY 64.0 million in FY2024.

Investment and products: ESG investment

In the Asset Management Company, we are engaging in constructive, purposeful dialogue (engagement) with the companies in which we invest. In addition to supporting improvements in these companies' corporate value and supporting sustainable growth for society, we are also pursuing ESG investment, making investment decisions with not only financial information but also ESG factors and other types of non–financial information. For example, we are offering ESG investment products, such as those using our ESG Low Volatility High Dividend Payment Strategy in which we select stocks from an ESG perspective with a focus on dividend yields and low volatility and aim to produce stable returns, our Sustainability Research Strategy in which we consider positive contributions to solving social issues as revenue opportunities and employ selective investment. Our Future Works (ESG) in which we actively select stocks with high ESG evaluations based on the management philosophy and investment process of our Future World series. Going forward, we will continue to practice ESG investment, with the goal of creating a positive cycle for society's sustainable development.

Stewardship responsibilities and ESG investment

Results

Sustainable finance results (trillion JPY)

Category

Sustainable finance

Description

FY23

(single year)

FY24

(single year)

FY19-24

(Cumulative)

Social

0.5

0.6

Social loans

Arrangement of loans compliant with ICMA’s social bond principles and LMA’s social loan principles

0.02

0.15

Social loans

Underwriting of bonds compliant with ICMA’s social bond principles

0.5

0.5

2.7

Sustainable

1.7

1.4

Sustainability loans and sustainability-linked loans

Arrangement of loans compliant with LMA's sustainability-linked loan principles and Ministry of Environment’s Green Loan and Sustainability-linked Loan Guidelines

1.4

1.3

Sustainability bonds and sustainability-linked bonds

Underwriting of bonds compliant with ICMA's Sustainability Bond Guidelines, Social Bond Principles, Green Bond Principles, and LMA’s Sustainability-linked Bond Principles

0.4

0.2

8.8

Project finance for infrastructure

Arrangement of project finance for public transportation, public facilities, and other infrastructure

0.1

0.4

1.9

Proprietary Mizuho products

(excluding Environmental and Climate-related Finance)

Mizuho Human Capital Management Impact Financing

SDGs promotion support loans / private placement bond

Sustainable Supply Chain Finance

Mizuho Sustainability Link Loan PRO /Mizuho Sustainability Link Private Placement Bond PRO

Mizuho Positive Impact Finance

Mizuho Positive Impact Finance PRO

Value Co-creation investment

0.2

0.2

1.0

Other

Loans for innovation businesses

Net increase in ESG / SDGs investment under management

Other

1.4

0.2

4.7

Environmental and Climate-related finance

10.5

Green bonds

Underwriting of bonds compliant with ICMA green bond principles

1.2

0.9

8.0

Financing for qualified green projects / businesses

Arrangement of finance targeting use of funds specified in the Mizuho's green bond frameworks

0.4

0.6

2.5

Transition (outside of coverage of Environmental and climate-related finance until FY2022 results)

0.3

0.2

Transition loans and transition-linked loans

Arrangement of loans compliant with the ICMA's Climate Transition Handbook, the basic policies on climate transition finance, and other principles

0.2

0.1

Transition bonds and transition-linked bonds

Underwriting of bonds compliant with the ICMA's Climate Transition Handbook, the basic policies on climate transition finance, and other principles

0.1

0.1

1.2

Sustainable (environmental and climate-related finance)

0.8

0.8

Sustainability loans and sustainability-linked loans

Arrangement of loans compliant with LMA’s sustainability-linked loan principles

0.6

0.5

Sustainability bonds and sustainability-linked bonds

Underwriting of bonds compliant with the ICMA's Climate Transition Handbook, the basic policies on climate transition finance, and other principles

0.1

0.3

1.5

Proprietary Mizuho products

Mizuho Eco Finance

Mizuho Sustainable Real Estate NRL

Mizuho Sustainability Link Loan PRO /Mizuho Sustainability Link Private Placement/ Bond PRO

Mizuho Positive Impact Finance

Mizuho Positive Impact Finance PRO

Sustainable Shipping Impact Finance

Mizuho Natural Capital Impact Finance

Transition Investment Facility / Value Co-creation Investment

1.9

2.9

Other

Other environmental and climate-related finance

0.3

0.1

8.0

20.5

40.3

*1. Revised based on the refinement of aggregated figures.

*2. FY24 Environment and climate-related finance:Mizuho Bank accounts for JPY 5.2 trillion and Mizuho Trust & Banking (Financing and investment balance) accounts for JPY 57.8 billion.

Sustainable finance results (trillion JPY)

Research and Consulting

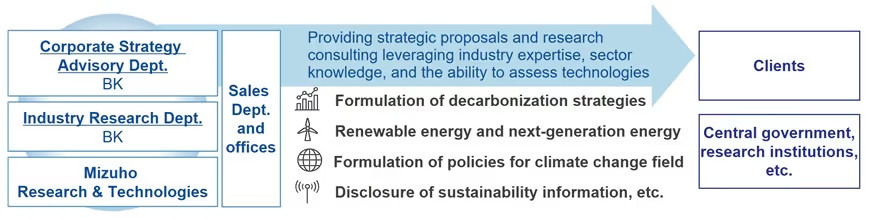

Solving Issues through Collaboration between RCU Functions and Financial Functions

The Research & Consulting Unit (RCU) is responsible for research related to industries, companies, the economy, and financial markets, as well as consulting related to management strategy, sustainability, digital transformation, and similar areas. We have accumulated specialized expertise in sustainability over the years, and by integrating the broad research and consulting knowledge of the entities that make up RCU we are promoting initiatives to bring together all of Mizuho to meet the sustainable business needs of our clients.

Specifically, with Mizuho Financial Group (the holding company) serving as the hub, we are working with relevant departments within and outside RCU, including the Mizuho Bank Industry Research Department and the Consulting Sector of Mizuho Research & Technologies, to respond to the diverse and increasingly complex sustainability business needs of our clients. We are doing this by disseminating our expert knowledge on sustainability, supporting of the development of new ideas and solutions based on such expert knowledge, and assisting in the provision of advice on how to address challenges.

The strength of Mizuho lies in our ability to solve the challenges facing our clients and society through cooperation and collaboration across RCU, which possesses a high level of expertise in both financial and non-financial areas, and banking, trust banking, securities, and other financial functions within our group.

Sustainability consulting

We are supporting our clients' development and implementation of sustainability strategies by applying our in–depth insight into industry, the economy, and society and our high–level expertise in sustainability.

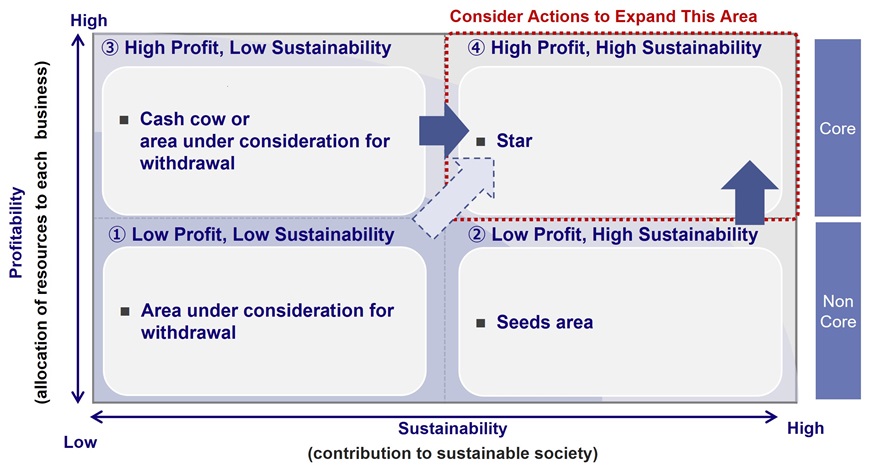

【Case Study ①】We support our clients to review sustainability-centered business portfolios.

- Formulate strategy by adding sustainability as a new decision-making criterion

- Support clients closely across upstream discussions, downstream consulting, and financial business

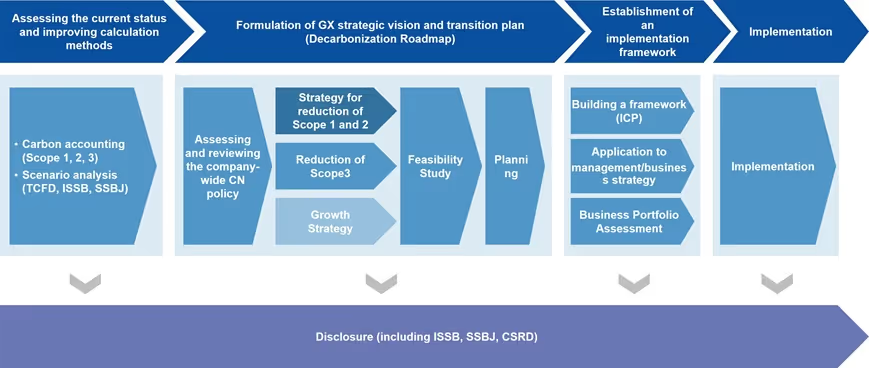

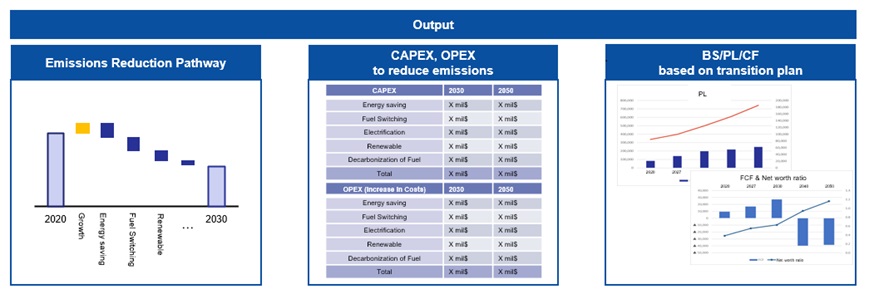

【Case Study ②】We offers "Carbon Neutral Planning" to support companies in formulating transition plans toward carbon neutrality.

- This service leverages our extensive expertise accumulated over many years in carbon accounting and decarbonization technologies to assist in the development of concrete strategies and plans, including financial aspects.

- In addition, we can propose the establishment of organizational structures to ensure smooth implementation of the formulated strategies and plans, as well as provide hands-on advice and coordination with external partners during the execution phase.

Business initiatives based on materiality

Mizuho has identified the following as materiality, and is working to make positive contributions in these areas: Declining birthrate and aging population, plus good health and lengthening lifespans; Industrial development & innovation; Sound economic growth; and Environmental and social considerations.

Environmental and social considerations

- Addressing Climate Change (Initiatives based on TCFD Recommendations)

- Environmental business initiatives

- Environmental and human rights considerations

Declining birthrate and aging population, plus good health and lengthening lifespans

Asset formation support initiatives

With many people now living to 100 years old, post-retirement life is inevitably longer. Given the continued low interest rates, asset formation to prepare for the future will become increasingly important.