Credit Risk Management

Basic Approach

We define credit risk as the Mizuho group's exposure to the risk of losses that may be incurred due to a decline in, or total loss of, the value of assets (including off-balance-sheet instruments), as a result of deterioration in obligors' financial position.

Mizuho Financial Group manages credit risk for the group as a whole. Specifically, Mizuho Financial Group establishes the group's fundamental credit risk policy to manage major group companies, and monitors and manages the credit risks of the group as a whole.

Credit Risk Management Structure

Our Board of Directors determines the Mizuho group's basic matters pertaining to credit risk management. In addition, the Risk Management Committee broadly discusses and coordinates matters relating to basic policies and operations in connection with credit risk management and matters relating to credit risk monitoring for the Mizuho group. Under the control of the Group CRO, the Credit Risk Management Department and the Risk Management Department jointly monitor, analyze, and submit suggestions concerning credit risk and formulate and execute plans in connection with basic matters pertaining to credit risk management.

Our principal banking subsidiaries and other core group companies manage their credit risk according to the scale and nature of their exposures in line with basic policies set forth by Mizuho Financial Group. The board of directors of each company determines key matters pertaining to credit risk management.

The Balance Sheet & Risk Management Committee and the Credit Committee, each of which is a business policy committee of our principal banking subsidiaries, are responsible for discussing and coordinating overall management of their individual credit portfolios and transaction policies towards obligors. The respective Chief Risk Officers (CRO) of our principal banking subsidiaries are responsible for matters relating to planning and implementing credit risk management. The credit risk management departments of our principal banking subsidiaries are in charge of planning and administering credit risk management and conducting credit risk measuring and monitoring. Such departments regularly present reports regarding their risk management situation to Mizuho Financial Group. The credit departments of our principal banking subsidiaries determine policies and approve/disapprove individual transactions in terms of credit review, credit management and collection from obligors in accordance with the lines of authority set forth respectively by our principal banking subsidiaries. In addition, our principal banking subsidiaries have established internal audit groups that are independent of the business departments in order to ensure appropriate credit risk management.

Method of Credit Risk Management

We have adopted two different but mutually complementary approaches to credit risk management. The first approach is "individual credit management," in which we manage the process for each individual transaction and individual obligor from execution until collection, based on our assessment of the credit quality of the obligor. Through this process, we curb losses in the case of a credit event. The second is "credit portfolio management," in which we utilize statistical methods to assess the potential for losses related to credit risk. Through this process, we identify credit risks and respond appropriately.

Individual Credit Management

1. Credit Codes

The basic code of conduct for all of our executive officers and employees engaged in the credit business is set forth in our credit code. Seeking to fulfill the bank's mission and social responsibilities, our basic policy for credit business is determined in light of fundamental principles focusing on public welfare, safety, growth, and profitability.

2. Internal Rating System

One of the most important elements of the risk management infrastructure of our principal banking subsidiaries is the use of an internal rating system that consists of credit ratings and pool allocations. Credit ratings consist of obligor ratings which represent the level of credit risk of the obligor, and transaction ratings which represent the possibility of ultimately incurring losses related to each individual claim by taking into consideration the nature of any collateral or guarantee and the seniority of the claim.

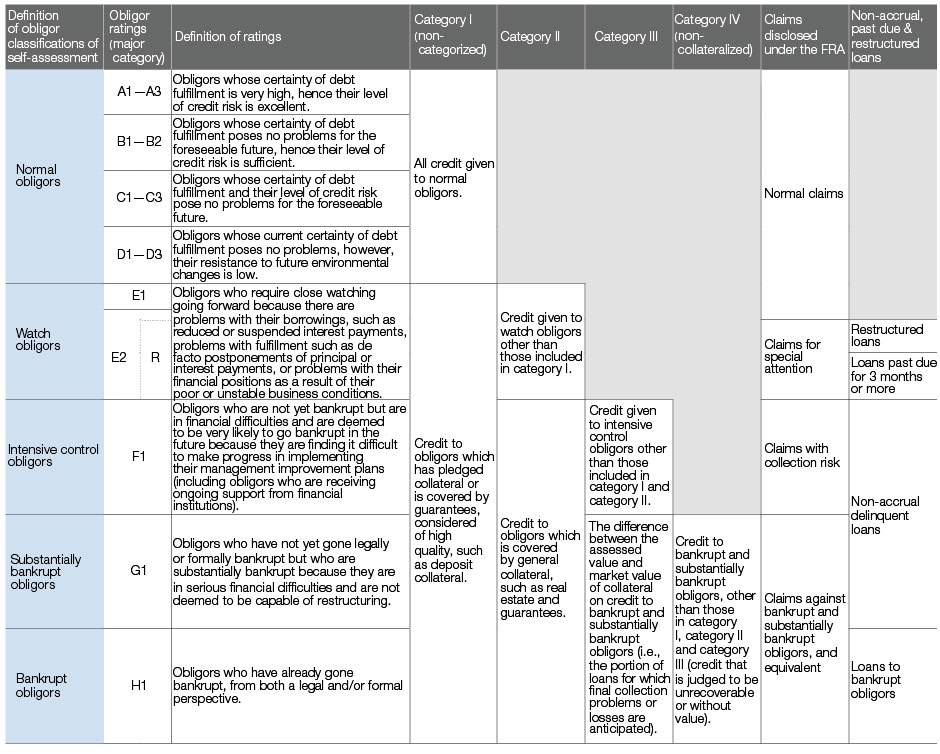

In principle, obligor ratings apply to all obligors and are subject to regular reviews at least once a year to reflect promptly the fiscal period end financial results of the obligors, as well as special reviews as required whenever an obligor’s credit standing changes. This enables our principal banking subsidiaries to monitor both individual obligors and the status of the overall portfolio in a timely fashion. Because we consider obligor ratings to be an initial phase of the self-assessment process regarding the quality of our loans and off-balance-sheet instruments, such obligor ratings are closely linked to the obligor classifications and are an integral part of the process for determining the provision for credit losses on loans and charge-offs in our self-assessment of loans and off-balance-sheet instruments. (Please refer to the chart on the next page regarding the connection between obligor ratings, definition of obligor classifications of self-assessments, non performing loans based on the Banking Act and the Financial Reconstruction Act).

To assign obligor ratings, we have a quantitative evaluation system (rating model) in place to enable proper assessment of an obligor's credit standing. The system gives a quantitative rating to an obligor based on obligor-specific characteristics such as type of business (corporation or individual) and geography (in Japan or outside Japan). We categorize our rating models for companies in Japan into those for large companies and those for small and medium-sized companies. The former consist of 13 models according to industry-specific factors, while the latter consist of three models. For companies outside Japan, we utilize nine models.

These were developed by the Credit Risk Management Department based on a statistical methodology and approved by the CRO.

Pool allocations are applied to small claims that are less than a specified amount by pooling obligors and claims with similar risk characteristics and assessing and managing the risk for each such pool. Our principal banking subsidiaries efficiently manage credit risk and credit screening by dispersing a sufficient number of small claims within each pool.

Our principal banking subsidiaries generally review the appropriateness and effectiveness of our approach to obligor ratings and pool allocations once a year in accordance with predetermined procedures, which is audited by the Internal Audit Group.

Connection between obligor ratings, definition of obligor classifications of self-assessments, non performing loans based on the Banking Act ("BA") and the Financial Reconstruction Act ("FRA")

Mizuho Financial Group defines a Restructured Loan as a loan extended to a Watch Obligor when the following conditions are met: an obligor is experiencing financial difficulties and lending conditions were amended favorably to the obligor such as allowing interest rate reduction, postponement of principal repayment/interest payment, debt forgiveness, etc.

An overdue loan is defined as a loan for a Watch Obligor of which the loan principal or interest is overdue for three months or more following the contractual payment date.

Methods for provision for credit losses on loans and off-balance-sheet instruments and charge-offs

| Normal obligors | Calculate the value of estimated loss based on the probability of failure over the coming year for loans by obligor rating and appropriate it for the general provision for credit losses on loans and off-balance-sheet instruments. |

| Watch obligors | Calculate the estimated loss on loans based on the probability of failure over the next three years and appropriate it for the general provision for credit losses on loans and off-balance-sheet instruments. Further, in regard to special attention obligors, for obligors with large claims more than a certain amount, if the cash flow from the return of principal and interest payments can reasonably be estimated, set up a provision for credit losses on loans and off-balance-sheet instruments under the DCF method. |

| Intensive control obligors |

Provide an amount for specific provision for credit losses on loans and off-balance-sheet instruments as calculated by one of the following methods after deducting amounts anticipated to be recoverable from the sale of collateral held against the claims and from guarantors of the claims: a) an amount calculated based on the overall ability of the obligor to pay, or b) the estimated loss calculated on the basis of the balance and the probability of failure over the next three years. Further, for obligors with large claims more than a certain amount, if the cash flow from the return of principal and interest payments can reasonably be estimated, set up a provision for credit losses on loans and off-balance-sheet instruments under the DCF method. |

| Substantially bankrupt obligors | Provide the entire balance after deducting amounts anticipated to be recoverable from the sale of collateral held against the claims and from guarantors of the claims for specific provision for credit losses on loans and off-balance-sheet instruments, or charge-off the entire balance. |

| Bankrupt obligors |

3. Self-assessment, Provision for Credit Losses on Loans and Off-Balance-Sheet Instruments and Charge-Offs

We conduct self-assessment of assets to ascertain the status of assets both as an integral part of credit risk management and in preparation for appropriate accounting treatment, including provision for credit losses on loans and off-balance-sheet instruments and charge-offs. During the process of self-assessment, obligors are categorized into certain groups taking into consideration their financial condition and their ability to make payments, and credit ratings are assigned to all obligors, in principle, to reflect the extent of their credit risks. The related assets are then categorized into certain classes based on the risk of impairment. This process allows us to identify and control the actual quality of assets and determine the appropriate accounting treatment, including provision for credit losses on loans and off-balance-sheet instruments and charge-offs. Specifically, the credit risk management department of each of our principal subsidiaries is responsible for the overall control of the self-assessment of assets of the respective banking subsidiaries, cooperating with the administrative departments specified for each type of asset, including loan portfolios and securities, in executing and managing self-assessments. In our assessment of the probability of obligor bankruptcy, we deem an obligor that is rated as being insolvent or lower as being bankrupt.

4. Credit Review

Prevention of new impaired loans through routine credit management is important in maintaining the quality of our overall loan assets.

Credit review involves analysis and screening of each potential transaction within the relevant business department. In case the screening exceeds the authority of the department, the credit department in charge at headquarters carries out the review. We have specialist departments for different industries, business sizes, and regions, carries out timely and specialized examinations based on the characteristics of the client and its market, and provides appropriate advice to the business department.

In addition, in the case of obligors with low credit ratings and high downside risks, the business department and credit department jointly clarify their credit policy and in appropriate cases assist the obligors at an early stage in working towards credit soundness.

Credit Portfolio Management

1. Risk Measurement

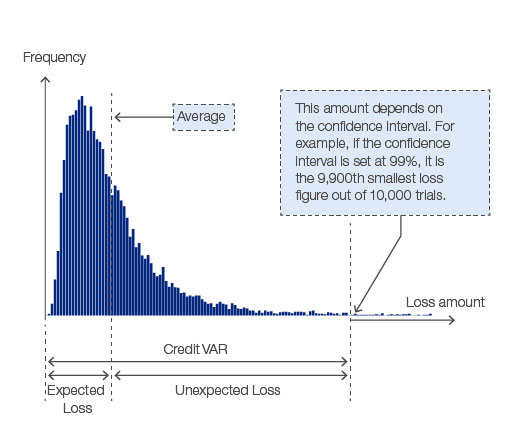

We use statistical methodologies that involve a risk measurement system (enterprise value corporate valuation model, holding period of one year) to manage the possibility of losses by measuring the expected average loss for a one-year risk horizon ("Expected Loss") and the maximum loss within a certain confidence interval ("Credit VAR"). The difference between Expected Loss and Credit VAR is measured as the credit risk amount ("Unexpected Loss").

The risk measurement system covers the following account items reported by each Mizuho Financial Group company: credit transactions including loans and discounts; securities; obligors' liabilities for acceptances and guarantees; deposits and foreign exchange; derivatives including swaps and options; off-balance- sheet items including commitments; and other assets involving credit risk.

In establishing transaction spread guidelines for credit transactions, we aim to ensure an appropriate return from the transaction in light of the level of risk by utilizing credit cost data as a reference.

Also, we monitor our credit portfolio from various perspectives and set guidelines noted below so that losses incurred through a hypothetical realization of the full Credit VAR would be within the amount of risk capital and loan loss reserves.

Loss distribution

2. Risk Control Methods

Our principal banking subsidiaries have established guidelines to manage "credit concentration risk," which stems from granting excessive credit to certain corporate groups. Our principal banking subsidiaries also set the credit limit based on a verification of the status of capital adequacy. In cases where the limit is exceeded, our principal banking subsidiaries will formulate a handling policy and/or action plan.

In addition to the above, our principal banking subsidiaries monitor total credit exposure, credit exposure per rating, credit concentration per corporate group, geographic area, and business sector to make a periodical report to the Balance Sheet & Risk Management Committee and the Credit Committee.